Mastercard Unveils On-Demand Decisioning Tool

Mastercard has launched an On-Demand Decisioning tool that enables banks and fintechs to dynamically adjust authorization decisions in real-time. The solution allows issuers to integrate custom logic and external data sources into the approval process, giving them more control over fraud prevention and transaction outcomes. This innovation supports more personalized, risk-sensitive payments while improving customer experience. With fraud levels on the rise, real-time flexibility in decision-making can significantly reduce false declines and operational inefficiencies. Mastercard positions this as part of its broader strategy to make payments more secure and intelligent. The tool is expected to strengthen partnerships with financial institutions by offering them advanced customization.

Insight of the Day

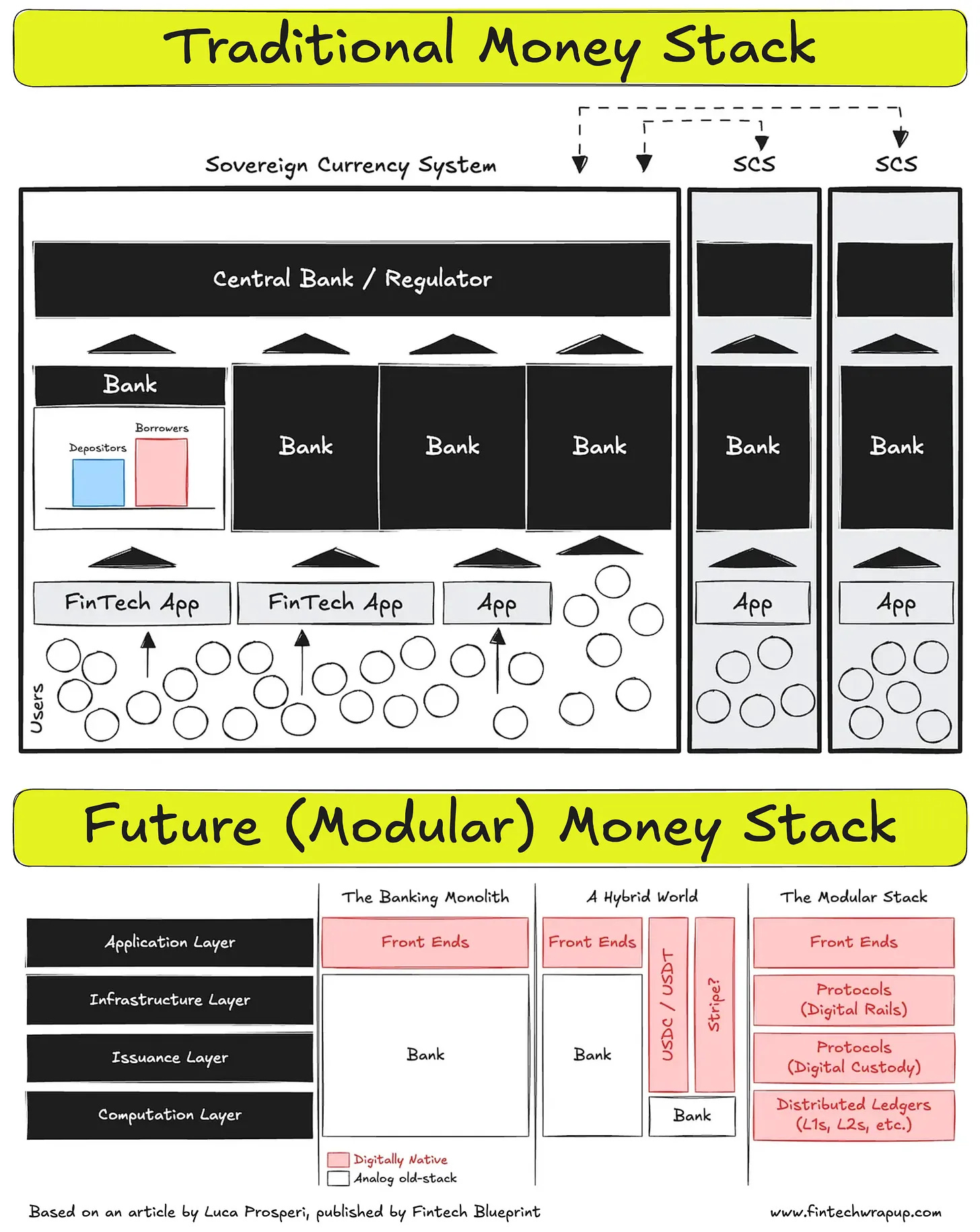

Rewiring The Money Stack

Based on an article by Luca Prosperi, published by Fintech Blueprint

Money is arguably the most complex mass-adopted product in existence. Everyone uses it, yet very few understand the machinery behind it. The balance shown on a bank statement, or in apps like Venmo, Revolut, or a stablecoin wallet, is not a tangible certainty but a system of checks and balances designed to ensure that value is usually — though not always — available when requested.

This multilayered system links the creditworthiness of banks, the storage of deposits, and the ability for digital applications to build countless features on top. In practice, money functions less as a product and more as infrastructure.

The current monetary system was shaped after the collapse of Bretton Woods in 1971, built on the relationship between treasuries, central banks, and commercial banks. While effective for decades, it has revealed critical limitations: geographical silos, inefficient governance, weak risk management, and an inability to meet the demands of a digital-first economy.

Curated News

💳 Payments

Rainforest Raises $29M for Embedded Payments Growth

Rainforest secured $29 million in Series B funding to expand its embedded payments platform. The company plans to scale integrations for SaaS providers and marketplaces, reinforcing the trend toward frictionless, built-in payment experiences.

Source

Hibernian FC Extends IFX Payments Deal

Scottish football club Hibernian FC renewed its partnership with IFX Payments to enhance digital payment solutions for fans and operations. The collaboration highlights the growing role of fintech in sports commerce.

Source

Thunes Expands Real-Time Payments to Morocco

Thunes launched real-time cross-border payments into Morocco, extending its network in the Middle East and Africa. This development supports financial inclusion and strengthens the country’s global remittance ecosystem.

Source

Nuvei Partners with EWS on Paze℠ Checkout

Nuvei joined forces with Early Warning Services to enable the Paze℠ digital wallet at checkout. The collaboration brings more convenience and security to online transactions, challenging existing payment players.

Source

TrueLayer Introduces Verified Payouts

TrueLayer rolled out Verified Payouts, enabling instant and compliant bank withdrawals for merchants and platforms. The service aims to reduce fraud while speeding up settlement processes.

Source

Green Dot and Stripe Partner on Cash Access

Green Dot teamed up with Stripe to provide better cash-to-digital services for underbanked consumers. The partnership is designed to bridge the gap between cash usage and online commerce.

Source

🏦 Banking

Float Launches Hybrid Business Accounts

Float introduced hybrid accounts that combine chequing-like spending with savings rates up to 4%. The product is designed to help businesses optimize liquidity without sacrificing yield.

Source

Narmi and Ninth Wave Bring Open Finance to Community Banks

Narmi partnered with Ninth Wave to deliver open finance capabilities to smaller financial institutions. This move helps community banks and credit unions offer modern digital services and compete with larger players.

Source

Ozone API and Plumery Collaborate on Open Banking Tech

Ozone API and Plumery announced a partnership to deliver advanced digital banking solutions powered by open banking. The collaboration aims to accelerate innovation for financial institutions across Europe.

Source

bunq Hits 20 Million Users

Dutch challenger bank bunq surpassed 20 million users as it celebrates its 10th anniversary. The milestone underscores growing consumer demand for digital-first banking alternatives.

Source

💡 Fintech

finmid Unlocks €400B SME Financing Market

finmid introduced a cross-border finance platform operating in 30 countries, addressing Europe’s €400 billion SME funding gap. The solution simplifies access to capital for businesses across fragmented markets.

Source

Temenos Wins IDC FinTech Real Results 2025 Award

Temenos was named the overall winner at IDC’s FinTech Real Results Awards 2025, recognizing its impact on digital transformation in banking. The accolade highlights Temenos’ leadership in core banking technology.

Source

NZ-based Marloo Secures $2.8M Pre-Seed

AI-powered fintech startup Marloo, based in New Zealand, raised $2.8 million in pre-seed funding. The firm aims to enhance financial decision-making with AI-driven tools.

Source

9fin Expands Debt Intelligence Platform to LATAM

Debt intelligence provider 9fin expanded its coverage to Latin America, aiming to bring more transparency and data access to regional debt markets. The move reflects growing global demand for debt market insights.

Source

🪙 Crypto

EasyJet Founder Launches Bitcoin Trading App

EasyJet founder Stelios Haji-Ioannou launched a new Bitcoin trading app focused on financial empowerment. The platform emphasizes accessibility and aims to attract retail users into crypto investing.

Source

BNP Paribas and HSBC Join Canton Blockchain

BNP Paribas and HSBC have joined Canton, a privacy-focused blockchain network for capital markets. Their participation signals growing institutional interest in secure blockchain solutions.

Source

BBVA Partners with Ripple on Crypto Custody

BBVA will leverage Ripple’s technology to provide Bitcoin and Ether custody for European institutions under MiCA regulations. The move strengthens Ripple’s foothold in the institutional crypto space.

Source

SwissBorg Suffers $41M Solana Loss

Crypto platform SwissBorg reported a $41 million loss tied to Solana assets. The incident underscores the volatility and operational risks facing crypto investment firms.

Source

GameStop Narrows Losses with Bitcoin Boost

GameStop’s Q2 results showed narrower losses, aided by Bitcoin holdings on its balance sheet. The move highlights the growing role of crypto in corporate treasury strategies.

Source

QMMM Stock Surges on Crypto Treasury Plan

QMMM stock soared nearly 1,750% after announcing plans to hold $100 million in Bitcoin, Ethereum, and Solana as treasury assets. The surge reflects market enthusiasm for corporate crypto adoption.

Source

📊 WealthTech

Plum Launches AI Money Co-Pilot

Plum introduced a financial management co-pilot built with Google’s Gemini AI. The tool offers users personalized savings and investment insights, reflecting the growing adoption of AI in personal finance.

Source

Altruist Unveils Hazel AI for Wealth Advisors

Altruist launched Hazel, an AI-powered platform designed to help financial advisors deliver tailored investment strategies. The solution enhances efficiency and client engagement in wealth management.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a "Source: [Name]" attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.