Mastercard Unveils Platform to Boost Payment Approval Rates

Mastercard has launched a new global platform designed to significantly improve payment approval rates by leveraging AI, network insights, and real-time data sharing between banks and merchants. The technology helps reduce false declines and ensures more legitimate transactions go through, directly addressing one of the biggest pain points in digital payments. It enables issuers and acquirers to collaborate through shared intelligence, improving trust and efficiency across the network. This innovation represents a major stride in balancing fraud prevention with customer experience. By optimizing approvals, Mastercard aims to drive higher merchant revenues and smoother checkout experiences worldwide. The platform further strengthens Mastercard’s position as a leader in intelligent payment processing innovation.

Insight of the Day

Revolut’s Crypto Bet: From Customer Magnet to Core Payments Utility

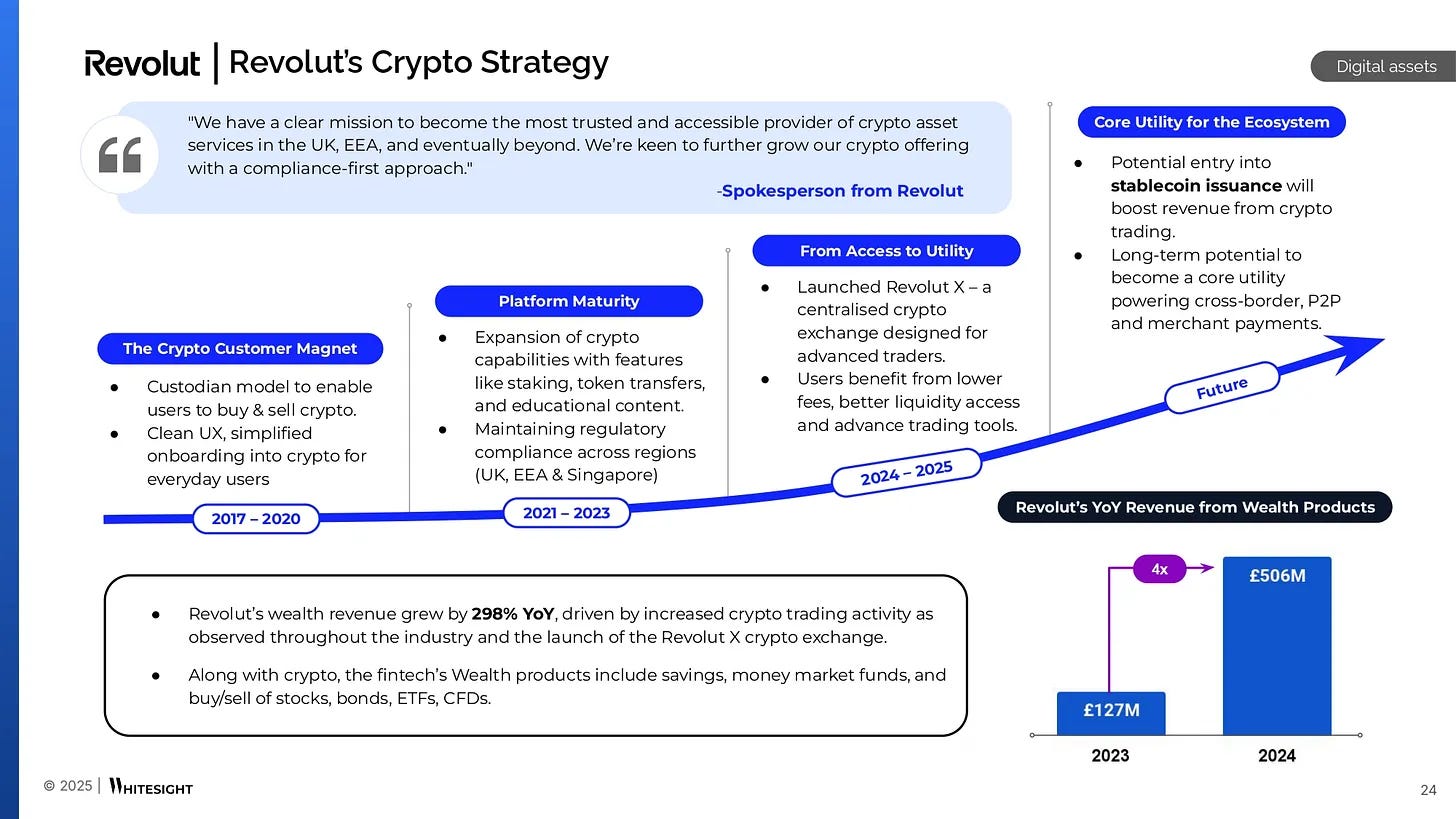

Revolut has always been a company that plays the long game, and nowhere is that clearer than in its approach to crypto. Since 2017, the fintech has steadily expanded from a simple custodian model into a potential ecosystem player that could shape the future of stablecoin payments.

Back in 2017–2020, Revolut’s first priority was accessibility. Crypto was still intimidating for most retail users, and Revolut spotted an opportunity: become the “on-ramp.” With a clean UX, simplified onboarding, and custody handled in-app, Revolut turned digital assets into something as easy as buying a coffee. This wasn’t about competing with Coinbase or Binance; it was about removing friction for the everyday customer.

Between 2021 and 2023, the company doubled down on capabilities. It added staking, token transfers, and educational content while carefully threading the needle of regulatory compliance across the UK, EEA, and Singapore. The strategy was clear: broaden the utility without losing credibility.

Now, in 2024–2025, Revolut is taking a leap into infrastructure with the launch of Revolut X, a centralized exchange built for advanced traders. Revolut X promises lower fees, deeper liquidity, and more sophisticated trading tools. In effect, Revolut is moving up the stack—from providing access to becoming part of the rails on which crypto trading runs. This is a critical transition: once customers begin relying on Revolut not just to hold or buy crypto, but to trade with better execution, Revolut locks in a much stickier relationship.

Curated News

💳 Payments

Visa and KNEX Bring Virtual Cards to Oracle ERP

Visa has partnered with KNEX to integrate virtual card solutions into Oracle’s ERP systems, streamlining corporate payments. The integration improves cash flow visibility and automates reconciliation for large enterprises.

Source

Flagright Powers Keyrails’ Transaction Monitoring

Regtech firm Flagright has partnered with Keyrails to deliver AI-driven transaction monitoring. The collaboration enhances fraud detection and strengthens compliance infrastructure for financial institutions.

Source

🏦 Banking

Shawbrook Confirms £50m London IPO Plans

Challenger bank Shawbrook has confirmed a £50 million IPO on the London Stock Exchange this November. The move will fuel growth in SME and property lending as it seeks to expand its footprint in the UK banking sector.

Source

NatWest Strengthens Innovation Economy Focus with New Hires

NatWest has made key strategic hires to accelerate its innovation-focused banking services. The appointments underscore its commitment to supporting UK startups and high-growth businesses.

Source

Lloyds Banking Group Pioneers AI Leadership Training

Lloyds Bank has partnered with the University of Cambridge to deliver AI leadership training for senior executives. The initiative aims to embed responsible AI use and enhance digital transformation capabilities across the bank.

Source

💡 Fintech

PicPay Eyes Wall Street Listing

Brazilian fintech PicPay plans a Wall Street IPO as part of its international growth strategy. The listing reflects rising global investor confidence in Latin America’s digital financial ecosystem.

Source

AmFi and Helix Connect Asia to Brazil’s Credit Market

Singapore-based AmFi and Brazil’s Helix are teaming up to link Asia’s investors to Brazil’s credit markets. The partnership will open new cross-border lending channels and expand liquidity in emerging markets.

Source

Peak XV Leads $13M Round for Indian Fintech GoodScore

Peak XV Partners led a $13 million Series A for GoodScore, a fintech developing credit scoring solutions for underserved populations. The funding will accelerate product innovation and expansion across India.

Source

Novidea Appoints Matt Foster as Executive Chairman

Novidea, a global insurtech platform, has appointed Matt Foster as Executive Chairman to drive its next phase of growth. Foster brings experience in scaling SaaS operations across financial technology sectors.

Source

Tabby Launches Saudi AI Factory with NVIDIA Systems

BNPL platform Tabby has launched a new AI Factory in Saudi Arabia equipped with NVIDIA HGX systems. The initiative will fuel AI innovation across retail and finance, reinforcing the region’s digital transformation goals.

Source

🪙 Crypto

Citi to Launch Crypto Custody Services in 2026

Citi is preparing to introduce crypto custody services by 2026, marking a major move by a global bank into digital asset management. The initiative will cater to institutional clients seeking secure crypto storage and compliance-ready solutions.

Source

MQube Tokenises £1.3bn Mortgage Debt in European First

UK proptech MQube has tokenised £1.3 billion in mortgage debt, a first-of-its-kind innovation in Europe. The move enables blockchain-based liquidity for traditional mortgage assets, unlocking new opportunities for investors.

Source

💰 WealthTech

Bankjoy and InvestiFi Bring Investing to Community Banks

Bankjoy has partnered with InvestiFi to give community banks and credit unions access to digital investing tools. This helps smaller institutions compete with major players by offering modern wealth management options.

Source

RLAM Doubles Down on Data Clarity with Aiviq’s TermsCloud

Royal London Asset Management has adopted Aiviq’s TermsCloud to enhance data transparency and streamline investment reporting. The move supports more accurate client communication and regulatory compliance.

Source

⚖️ Regulation

UK Expands Open Finance Framework

The UK is advancing its Open Finance framework to expand data-sharing rights for consumers and SMEs. The update aims to drive competition, innovation, and financial inclusion across the market.

Source

🤖 Other / AI & Innovation

Resistant AI Raises $25M to Fight Fraud

Resistant AI has raised $25 million to develop AI-powered systems that detect and prevent financial fraud. The technology will enhance security and trust across digital financial services.

Source

Algebrik AI Partners with Scienaptic for Inclusive Lending

Algebrik AI has partnered with Scienaptic AI to deliver inclusive loan decisioning systems. The collaboration enhances fairness and reduces bias in credit origination processes.

Source

Traders Gain Faster AI Insights via TS Imagine and Gentek.ai

TS Imagine and Gentek.ai have teamed up to deliver faster AI-driven analytics for traders and risk managers. The integration enables real-time decision-making and improved trading performance.

Source

XS.com Joins UAE’s Expanding Broker Network

Trading platform XS.com has obtained a new UAE license, joining the region’s growing roster of regulated brokers. The expansion reinforces the UAE’s status as a fintech and trading hub.

Source

Half of UK Gen Alpha Teens Already Hold £1,000+ in Savings

Research shows that 50% of UK Gen Alpha teens already have more than £1,000 saved, highlighting a new wave of financially aware youth. The findings point to rising demand for youth-oriented fintech solutions.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.