Monzo Adds Built-In Tax Filing Feature

Monzo has launched a new in-app tax filing tool, empowering freelancers and small business owners to manage taxes directly from the bank’s platform. This marks a major step in Monzo’s evolution from a digital bank into a full-service financial companion. By integrating tax filing into its app, Monzo aims to simplify complex administrative tasks that typically require third-party software. The tool leverages automation to pre-fill data and ensure compliance with HMRC requirements. Analysts see this as a strategic move to deepen user engagement and boost retention among self-employed customers. It also positions Monzo competitively against both challenger and traditional banks expanding into financial management services.

Insight of the Day

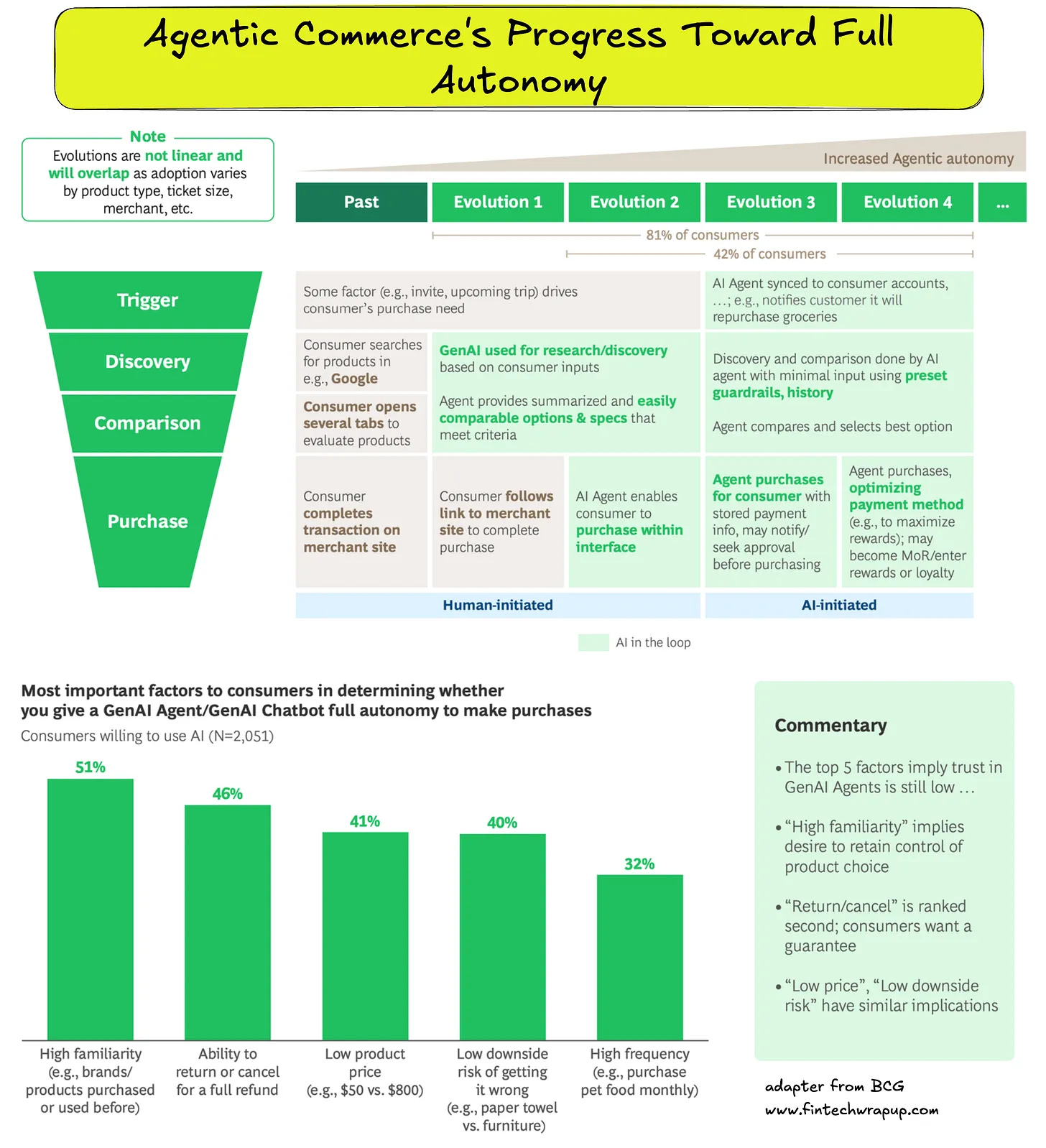

Agentic Commerce Functionality and Adoption Will Progress Toward Full Autonomy Over Time

The e-commerce shopping journey typically consists of four major steps:

1. Trigger: The consumer decides they have a need for a product or service.

2. Discovery: They undertake research to discover the options that meet their needs.

3. Comparison: They compare potential options across product specs, reviews, price, and other factors.

4. Purchase: They make their selection and check out on the merchant website. Agentic commerce will disrupt each step as it progresses toward full autonomy. BCG expects the evolutions to overlap as adoption varies by product category, ticket size, merchant, and other factors.

Evolution 1: Consumers trigger the process and embark on discovery and comparison within a large language model (LLM) or AI chat interface such as ChatGPT, rather than the traditional path of using a search engine like Google. From there, they click on a link, often jumping straight to the product or checkout page on the merchant website to complete the purchase.

Evolution 2: As offered by AI-powered answer engine Perplexity Pro, consumers can now select their desired product and check out within the AI interface with a wallet or a stored payment method, never visiting the merchant’s website.

Curated News

💳 Payments

Adyen Partners with SAP to Simplify Retail Payment Setup

Adyen became the first to launch SAP’s new Open Payment Framework, enabling retailers to streamline payment configurations across multiple systems. The collaboration reduces integration complexity and accelerates global rollout for merchants.

Source

Visa Launches AI ‘Trusted Agent Protocol’ for Smarter Shopping

Visa introduced its Trusted Agent Protocol, designed to authenticate AI shopping assistants and safeguard consumer transactions. The move addresses rising concerns around AI-powered e-commerce fraud.

Source

Wise Wins UAE Central Bank Approval for Payment Licenses

Wise secured final authorization for Stored Value Facilities and Retail Payment Services from the Central Bank of the UAE, solidifying its regional presence. This marks a major milestone in expanding cross-border financial infrastructure in the Middle East.

Source

HK Fintech Reap Secures MAS Payment License

Reap, a Hong Kong–based fintech firm, received a payment license from Singapore’s Monetary Authority, paving the way for regional expansion. The approval reinforces Singapore’s status as a fintech innovation hub in Asia.

Source

HitPay and Triple-A Partner to Enable Stablecoin Payments

HitPay and Triple-A are collaborating to allow merchants to accept stablecoins, bridging traditional payments with crypto infrastructure. The integration aims to enhance transaction efficiency and lower costs for global SMEs.

Source

🏦 Banking

Glia Unveils Next-Gen Voice AI for Banks and Credit Unions

Glia introduced a new Voice AI platform delivering human-like speed and accuracy, allowing banks to boost customer service capacity. The system blends automation with real-time conversational intelligence.

Source

Midwest Community FCU Chooses Mahalo Banking for Digital Upgrade

Midwest Community Federal Credit Union selected Mahalo Banking to advance its digital platform and member experience. The partnership reflects growing adoption of modern core banking technologies in community finance.

Source

bunq Expands Globally with Premium Rewards Powered by Ascenda

Dutch neobank bunq is accelerating its global growth by launching a premium rewards program with loyalty specialist Ascenda. The offering enhances user engagement and retention in competitive digital banking markets.

Source

JP Morgan Crosses $40 Trillion in Assets Under Custody

JP Morgan has surpassed $40 trillion in assets under custody, setting a new industry record. The milestone underscores the bank’s dominance in institutional services and its expanding role in global asset flows.

Source

💡 Fintech

UK Venture Funding Reaches Multi-Year High

UK fintech and tech startups are experiencing a surge in venture funding, marking the highest levels seen in several years. The rebound signals renewed investor confidence and could reignite London’s position as Europe’s fintech hub.

Source

Plaid Updates ML Model to Combat Fraud

Plaid enhanced its machine learning–powered fraud detection system, improving accuracy and adaptability against evolving financial scams. The update strengthens protection for fintechs and their users.

Source

Vertice AI Launches Copilot to Accelerate FI Growth

Vertice AI released “Vertice AGENT,” an interactive AI copilot helping community financial institutions scale personalized growth strategies. The tool integrates predictive analytics with customer engagement automation.

Source

Revolut Acquires AI Travel Agent Swifty

Revolut acquired Swifty, an AI travel assistant incubated at Lufthansa Innovation Hub, signaling a deeper push into lifestyle services. The move enhances Revolut’s ecosystem beyond finance and into travel tech.

Source

Form3 Secures Strategic Investment from Nationwide

Payment infrastructure firm Form3 announced a strategic investment from Nationwide Building Society to bolster real-time payments innovation. The partnership reflects continued collaboration between fintechs and traditional institutions.

Source

🪙 Crypto

Coinbase to Invest in India’s CoinDCX

Coinbase is investing in CoinDCX, India’s largest crypto exchange, to strengthen regional collaboration and expand Web3 adoption. The move aligns with Coinbase’s broader push to diversify its international footprint.

Source

Scintilla Selects Flagright for Real-Time AML Compliance

Crypto platform Scintilla partnered with Flagright to deploy real-time transaction monitoring and AML compliance solutions in the UAE. The collaboration highlights the increasing regulatory emphasis in crypto finance.

Source

💰 WealthTech

SS&C Completes $1B Acquisition of Calastone

SS&C Technologies finalized its $1 billion acquisition of Calastone, enhancing its fund distribution network and data-driven wealth infrastructure. The deal strengthens SS&C’s position in digital investment operations.

Source

⚖️ Regulation

FCA Endorses Tokenisation in Asset Management

The UK’s Financial Conduct Authority announced support for tokenisation initiatives to drive efficiency and innovation in asset management. The move signals a regulatory green light for blockchain integration in traditional finance.

Source

💼 Other

Nova Credit Raises $35M to Advance Cash Flow Underwriting

Nova Credit secured $35 million in Series D funding to accelerate development of cash flow–based credit assessments. The company aims to expand access to fairer credit through alternative data analytics.

Source

Klarna Partners with Qatar Airways to Expand Travel Services

Klarna announced a new partnership with Qatar Airways to expand its “Pay Later” offering into travel bookings. The collaboration blends flexible financing with premium travel experiences.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.