Monzo mirrors Revolut and Klarna with plan to launch mobile service

Monzo is looking to diversify its revenue streams.

Monzo is planning to launch a mobile phone offering, mirroring similar moves by challenger financial startups Revolut, Klarna, and N26. The UK challenger bank is planning to launch a digital sim and offer monthly contracts in the UK, according to the Financial Times, which first reported the move and which has been confirmed by Monzo.

A spokesperson for Monzo said: "When we heard from our customers that mobile contracts can be a pain point, we set out to explore how we could do this the Monzo way, and we are in the early stages of developing this idea." Monzo’s move into mobile is in its early stages, so it does not yet have a launch date, sources said.

According to the report, Monzo would not build its own infrastructure but would act as a so-called mobile virtual network operator (MVNO). Instead of the high cost of establishing infrastructure of masts and systems, MVNOs licence parts of other operators’ networks. MVNOs then typically try and offer their customers cheaper prices.

Monzo, which has over 12m customers, will hope to be able to cross-sell its mobile proposition to its customers. It will put Monzo up against the likes of EE and the recently-merged VodafoneThree, as well as new challenger financial operators moving into this area.

Challenger banks like Monzo and its rivals are increasingly looking to branch out into new areas and new markets. Along with its core digital banking services, Monzo, for example, also offers insurance and BNPL services. The digital bank is looking to launch across the EU.

In June this year, Klarna said it was launching a mobile offering, first in the US, followed by the UK, Germany and other markets. Earlier this year, N26 said it was planning to offer mobile phone contracts while Revolut also announced plans to launch mobile plans in the UK and Germany.

Insight of the Day

Understanding Value Creation in Financial Services

How do financial services create value?

Very interesting article by Mason Reeves

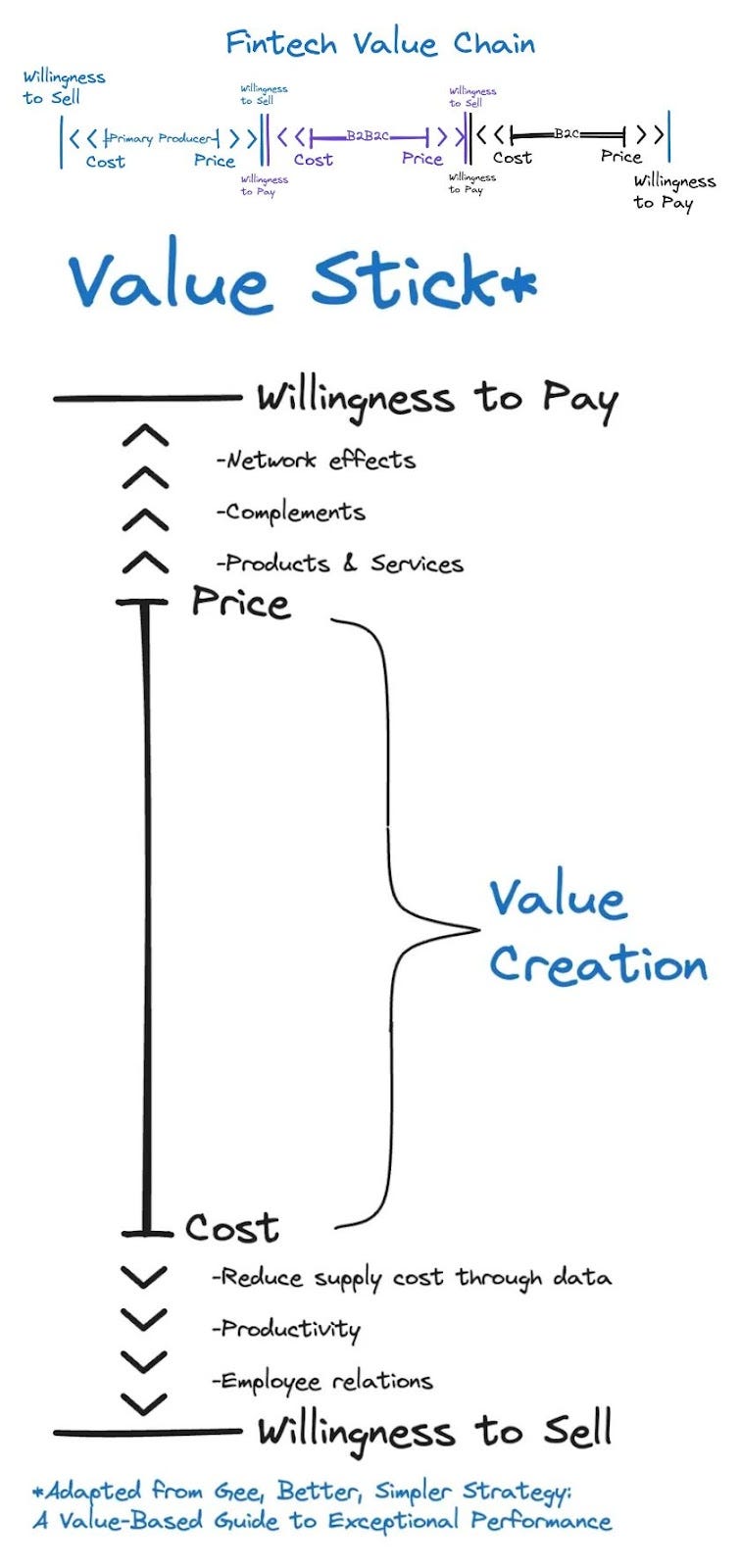

👉 The Value Stick Framework

At the top of the stick is the user’s willingness to pay (WTP) — the maximum amount they’re willing to spend on a product or service. At the bottom is the willingness to sell (WTS) of suppliers, employees, and investors — essentially, the costs of providing that service.

Value creation occurs in the space between these two points. Specifically, when you can:

🔹 Sell your product at a price that exceeds all of your costs

🔹 Increase users’ willingness to pay

🔹 Lower the price at which suppliers and employees are willing to sell to you

👉 Value Chains in Financial Services

In fintech, value sticks rarely exist in isolation. Instead, they form links in broader value chains, particularly in ‘business-to-business-to-consumer’ (B2B2C) settings. The ultimate consumer’s willingness to pay cascades through the entire chain, influencing the business models and value creation potential at each link.

The more links in the chain, the more margins that need to be accounted for (or ‘mouths to feed’). If a link in the chain isn’t covering its costs (ie, net profit that exceeds its cost of capital), it is basically transferring value to other links in the chain.

Minimizing inefficiencies can increase the value creation across the chain, versus value transfer within the chain.

For example, a B2B2C fintech company often has to work with:

🔹 The willingness to pay of their direct business customers (B2C companies)

🔹 The willingness to sell of primary producers (like bank sponsors providing BIN sponsorships or other financial services to the fintech)

🔹 Various intermediaries (such as card networks)

👉 The Fintech Value Creation Challenge

For fintech companies, this creates an interesting dynamic. The more links in the chain, the more margins need to be accounted for. This can create both opportunities and challenges:

🔹 Opportunities: Finding efficiencies (like internalizing offsetting FX flows to reduce transaction costs, risks and capital)

🔹 Challenges: Managing ongoing variable costs (particularly costs that are harder to monitor using SaaS-style performance metrics) and having diverse revenue streams, ensuring enough margin remains at each step so that value is created, not transferred

👉 Hidden Costs and Revenue Streams

An often-overlooked aspect of fintech business models is that stakeholders might be both paying you for one thing while “selling you” something else — particularly financial risks.

🔹 Credit and fraud costs: These are often unavoidable in payment processing and need to be carefully managed to minimize the risk of large, lumpy losses that reduce profit and cash flows

🔹 Interest (float) and foreign exchange: These can be either costs or benefits, depending on the timing and direction of money flows

Curated News

📈 FINTECH NEWS

Blueacorn co-founder pleads guilty to PPP fraud scheme

Since the CARES Act was enacted in March 2020, 200 defendants in more than 130 criminal cases have been prosecuted and over $78 million in cash proceeds derived from fraudulently obtained PPP funds have been seized, in addition to several real estate properties and luxury items purchased with the proceeds.

Court allows CFPB cuts amid regulatory confusion

As the CFPB faces major staff cuts and scaled-back oversight, consumers and financial firms are left navigating a period of uncertainty.

When ‘invest like the 1%’ fails: How Yieldstreet’s real estate bets left customers with massive losses

Yieldstreet is one of the best-known examples of American startups with the stated mission of democratizing access to assets such as real estate, litigation proceeds and private credit. But some Yieldstreet customers who participated in its real estate deals face huge losses on investments that they say turned out to be far riskier than they thought.

Mongolian fintech AND Global raises $21.4m in Series B funding

The round, led by the International Finance Corporation and Japan's AEON Financial Service, builds on AND Global's 2021 $15.3 million Series A round.

💳 PAYMENTS

Monzo mirrors Revolut and Klarna with plan to launch mobile service

Monzo is planning to launch a mobile phone offering, mirroring similar moves by challenger financial startups Revolut, Klarna, and N26.

SoftBank preps US listing for payments app subsidiary PayPay

Reuters reports that its sources say the listing could happen as soon as Q4 2025 and could potentially raise more than $2 billion.

Payoneer and Stripe Partner to Deliver Enhanced Online Checkout Experience for SMBs from Around the Globe

Payoneer, the global financial technology company powering business growth across borders, today announced a strategic partnership with programmable financial services company Stripe.

Tap. PIN. Approved: Bringing card-present security to Ecommerce

If you’re running an online business, fraud (and the chargebacks that come with it) is probably high on your radar. And for good reason, it’s a big problem that cost merchants $43 billion last year.

Indonesian QR code payment system now works in Japan

Indonesia’s QRIS payment system is now accepted in Japan as of August 17, 2025, marking its first expansion outside ASEAN.

🏦 BANKING & Embedded Finance

Inspector General Warns FDIC Oversight Failures Endanger Banks

PYMNTS Intelligence has found that a majority of traditional financial services firms have inked pacts with third-party providers, including FinTechs.

AMINA Bank Taps Banking Leader Michael Benz to Lead APAC Expansion

AMINA Bank AG, a Swiss Financial Market Supervisory Authority (FINMA)-regulated crypto bank with global reach, has appointed Michael Benz as Head of AMINA Hong Kong and the wider APAC region.

Fibank Successfully Places €50 Million Bond Issue

Fibank (First Investment Bank) has successfully placed a private bond issue with a total value of €50 million, fully compliant with MREL requirements.

British Business Bank and Close Brothers agree ENABLE Guarantee worth up to £300m

The British Business Bank has agreed a transaction of up to £300m with Close Brothers under its ENABLE Guarantees programme, in a move designed to increase lending capacity for UK smaller businesses.

💰 WEALTH TECH

Infinity Loop Raises $5M; Empowers Enterprises to Save Millions on Vendor Contracts

Infinity Loop, the AI-native contract intelligence platform built to help enterprises save money on vendor contracts, today announced it has raised a $5M Seed Round, led by Glasswing Ventures and TIAA Ventures, with participation from Plug and Play, Restive Ventures, and angel investors.

💰 Funding & M&A

Klarna Secures Scalable Funding in $26bn Deal to Drive U.S. Pay in 4 Growth

Klarna, the global digital bank and flexible payments provider, announced the execution of a multi-year forward flow agreement with Nelnet, a U.S.-based financial services and investment firm, to support the continued expansion of Klarna’s Pay in 4 product in the United States.

🧠 AI & Infrastructure

IVIX Raises $60 Million Series B to Fight Financial Crime with AI

IVIX, the first AI-powered platform designed to help governments around the world combat financial crime at scale using LLMs, advanced graph analytics and publicly available data, today announced the close of its $60 million Series B funding round, bringing the total amount raised to $85 million.

Payments and AI Deals Push Tencent, Mastercard Stocks Higher

The CE 100 Index outpaced all benchmarks, with a big boost from the Be Well segment, where a key component got a thumbs up from famed value investor Warren Buffett.

🧾 Crypto & Blockchain

Metaplanet's Bitcoin Treasury Hits 18,888 BTC with Latest Buy

Metaplanet disclosed Monday that it bought another 775 BTC for about $93 million, bringing its total holdings to 18,888 BTC.

Dutch crypto firm Amdax aims to launch Bitcoin treasury company on Euronext Amsterdam-based cryptocurrency service provider Amdax plans to launch a bitcoin treasury company called AMBTS (Amsterdam Bitcoin Treasury Strategy) on the Dutch stock exchange, Amdax said on Monday.

Bullish shares more than double in NYSE debut Investor confidence in the cryptocurrency sector was punctuated after Bullish was valued at $13.16 billion last week, setting the pace for other digital asset firms looking to list in the US.

Japan to approve country’s first yen-pegged stablecoin Japan’s Financial Services Agency is expected to approve JPYC, a Tokyo-based fintech firm, to issue a yen-pegged stablecoin as early as this fall, according to Nikkei.

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a "Source: [Name]" attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.