Monzo Secures EU Banking Licence, Unlocking European Expansion

Monzo has secured a full EU banking licence, a pivotal milestone that enables the UK challenger bank to operate across the European Union without relying on partnerships or intermediaries. The move significantly strengthens Monzo’s long-term growth strategy as competition among digital banks intensifies. Ireland has been selected as the first expansion market, with an early waitlist already open to customers. This licence provides Monzo with regulatory credibility and operational flexibility in a post-Brexit landscape. For the broader fintech sector, it signals that well-capitalised neobanks are transitioning from domestic success stories to pan-European players. The development also raises the competitive bar for other challengers still operating under limited or passporting arrangements.

Video of the Day

Insight of the Day

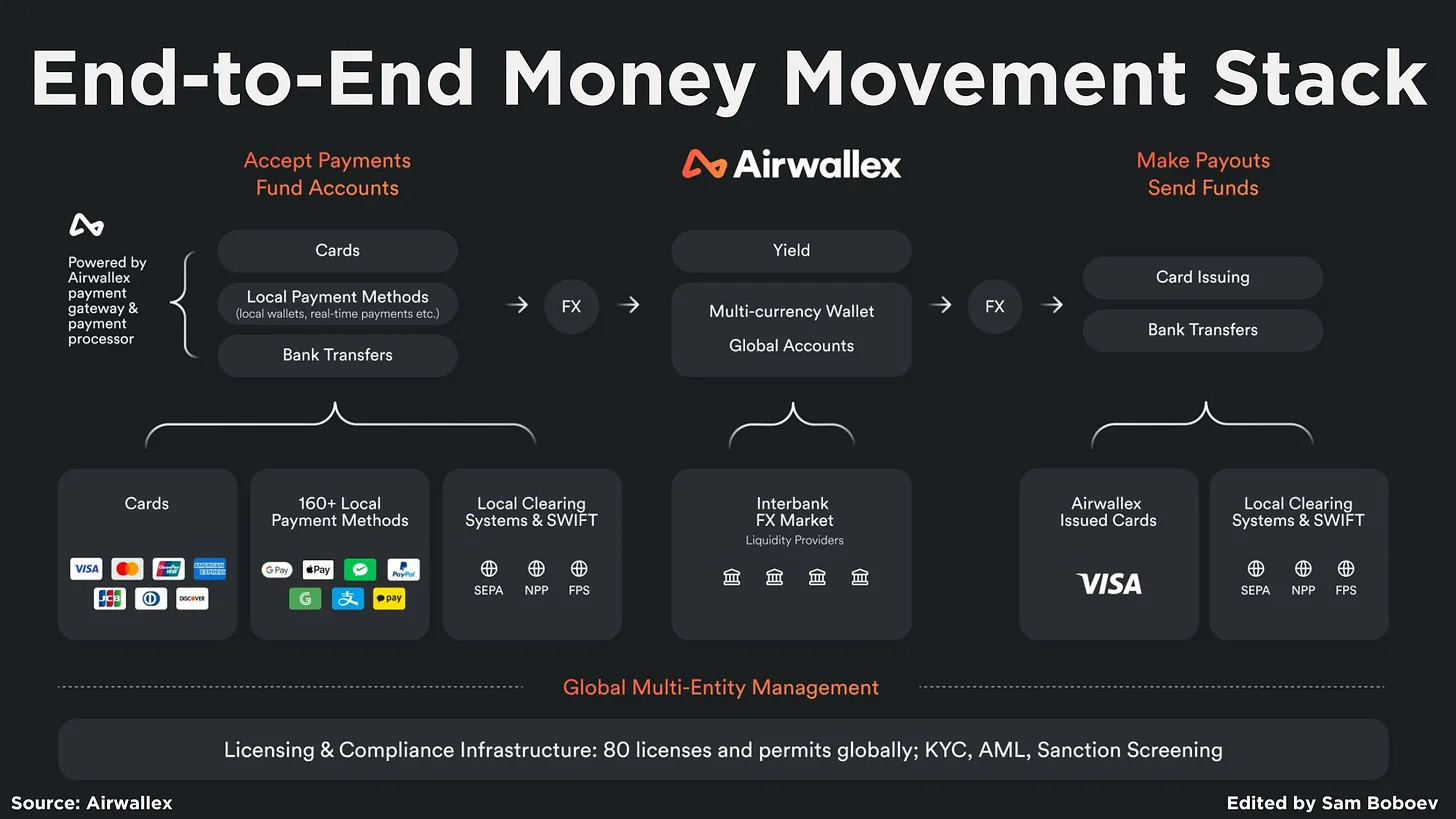

𝐄𝐧𝐝-𝐭𝐨-𝐄𝐧𝐝 𝐦𝐨𝐧𝐞𝐲 𝐦𝐨𝐯𝐞𝐦𝐞𝐧𝐭 𝐬𝐭𝐚𝐜𝐤

I have been studying how global financial platforms stitch together payments, FX, accounts and payouts under one infrastructure. What Airwallex built is a good example of what an end to end money movement stack looks like in practice. Here is a simple breakdown of how the system works and how companies can use it.

____

🔹 𝐀𝐜𝐜𝐞𝐩𝐭𝐢𝐧𝐠 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐚𝐧𝐝 𝐟𝐮𝐧𝐝𝐢𝐧𝐠 𝐚𝐜𝐜𝐨𝐮𝐧𝐭𝐬

Airwallex starts at the entry point. Businesses can accept money through cards, 160 plus local payment methods and bank transfers. Everything feeds into a single balance.

This is useful if you operate in multiple markets and want one operator to handle the processing and local acquiring.

____

🔹 𝐌𝐨𝐯𝐢𝐧𝐠 𝐛𝐞𝐭𝐰𝐞𝐞𝐧 𝐜𝐮𝐫𝐫𝐞𝐧𝐜𝐢𝐞𝐬

Once the money is in, the next step is FX. Airwallex routes conversions through its interbank liquidity partners and gives you the ability to convert inside the platform.

For multi market teams, the main advantage is predictable conversion logic and fewer external hops.

____

🔹 𝐇𝐨𝐥𝐝𝐢𝐧𝐠 𝐚𝐧𝐝 𝐦𝐚𝐧𝐚𝐠𝐢𝐧𝐠 𝐟𝐮𝐧𝐝𝐬

You get a multi currency wallet and global accounts. This allows you to collect, convert and hold funds in the currencies where you operate. Yield options are built on top of this layer.

If you are expanding into new regions, this reduces the need for local banking relationships in the early stage.

____

🔹 𝐌𝐚𝐤𝐢𝐧𝐠 𝐩𝐚𝐲𝐨𝐮𝐭𝐬

From there, funds can move out through two channels. Card issuing or bank transfers.

This makes the platform suitable for marketplaces, gig platforms, SaaS companies and any business that needs to pay out customers or suppliers across borders.

____

🔹 𝐓𝐡𝐞 𝐢𝐧𝐟𝐫𝐚𝐬𝐭𝐫𝐮𝐜𝐭𝐮𝐫𝐞 𝐮𝐧𝐝𝐞𝐫𝐧𝐞𝐚𝐭𝐡

The stack is supported by local clearing systems like SEPA, NPP and FPS, global card networks and a compliance engine that sits behind everything. Airwallex holds 80 licences and permits globally which allows them to run multi entity operations in many regions without handing off processes to third parties.

Curated News

💳 Payments

Square Tests Cash Rounding as Penny Production Ends

Square is piloting a cash-rounding feature to help merchants manage transactions as the U.S. phases out penny production. The update aims to simplify cash handling while minimizing disruption for small businesses.

Source

Unipaas and Nayax Launch Integrated Card-Present Payments for UK SaaS

Unipaas has partnered with Nayax to deliver a fully embedded, card-present payments solution tailored for UK SaaS platforms. The collaboration enables software providers to offer seamless in-person payments alongside existing digital capabilities.

Source

Ottu and Mastercard Expand Local Payment Access Across the GCC

Ottu has teamed up with Mastercard to help enterprises scale across the GCC using localized payment methods. The partnership reduces friction for regional expansion while supporting global payment standards.

Source

Juspay Brings Visa Click to Pay to Brazil

Juspay has integrated Visa Click to Pay in Brazil, enabling faster and more secure online checkout experiences. The launch supports higher conversion rates while reducing cart abandonment.

Source

Xsolla Integrates Spenn in Rwanda and Zambia

Xsolla has integrated Spenn’s payment ecosystem in Rwanda and Zambia to support developers and merchants. The move expands access to local digital wallets and strengthens regional payment infrastructure.

Source

🏦 Banking

HSBC Commits to Keeping Branches Open Until 2027

HSBC has pledged to keep all UK bank branches open until at least 2027. The move responds to political and customer pressure over access to in-person banking services.

Source

Zand Achieves ISO 27001 and 27701 Certifications

Digital lender Zand has become the first bank in the Middle East to achieve both ISO 27001 and 27701 certifications. The milestone underscores growing regulatory and security maturity in regional digital banking.

Source

📊 Fintech

Informed.IQ Raises $63M to Scale AI Loan Verification

Informed.IQ has secured $63 million in funding from Invictus to expand its AI-driven loan verification platform. The capital will support growth as lenders seek faster, more accurate underwriting.

Source

Fintech Hiring Surges Despite Rising UK Unemployment

UK fintech hiring has reached new highs even as overall unemployment rises. The trend highlights continued demand for digital finance talent amid industry transformation.

Source

Tyro Acquires Thriday to Expand SME Offerings

Australian payments firm Tyro has acquired fintech startup Thriday. The deal strengthens Tyro’s position in serving small and medium-sized businesses with integrated financial tools.

Source

GIC and Baillie Gifford Back South Korea’s Toss

Global investors GIC and Baillie Gifford are reportedly backing South Korean fintech super-app Toss. The investment highlights continued confidence in large-scale consumer fintech platforms in Asia.

Source

🪙 Crypto

SBI Plans Yen-Based Stablecoin Launch in 2026

Japan’s SBI Group is preparing to launch a yen-denominated stablecoin in 2026. The initiative reflects growing institutional interest in regulated digital currencies.

Source

Tencent and Bitkub Partner on Digital Asset Services

Tencent has partnered with Thailand’s Bitkub to develop digital asset services. The collaboration signals increasing big-tech involvement in Southeast Asia’s crypto ecosystem.

Source

Bitcoin Traders React to Potential Bank of Japan Rate Hike

Bitcoin markets saw renewed volatility as traders braced for a possible Bank of Japan rate hike. The sell-off underscores crypto’s sensitivity to global macroeconomic signals.

Source

📈 WealthTech

Trading Technologies Acquires OpenGamma

Trading Technologies has acquired OpenGamma, a specialist in margin and capital optimization analytics. The deal strengthens its institutional risk and portfolio management capabilities.

Source

📜 Regulation & Compliance

Sardine and Helix Partner on Real-Time Fraud and Compliance

Sardine and Helix have partnered to deliver real-time fraud monitoring and compliance tools to sponsor banks. The collaboration addresses growing regulatory and risk management demands.

Source

🧩 Other

Starling’s SaaS Arm Opens New London HQ

Starling Bank’s SaaS business has opened a new London headquarters alongside a major hiring push. The move reflects growing momentum in banking-as-a-service models.

Source

bunq Upgrades Its GenAI Financial Assistant

bunq has launched a more powerful version of its GenAI financial assistant. The upgrade enhances personalization and positions AI as a core feature of digital banking experiences.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.