N26 CEO Valentin Stalf Steps Down Amid Investor Tensions

N26, one of Europe’s top neobanks, is facing leadership upheaval as co-founder Valentin Stalf steps down from his role as CEO following a dispute with investors. The departure comes at a critical moment for the bank as it navigates profitability challenges and heightened competition in the digital banking sector. Stalf’s exit raises questions about the future direction of N26 and whether a new leader will accelerate or slow its strategic push for growth. For investors and fintech watchers, this marks a pivotal moment in the neobank’s journey. N26 has long been seen as a European challenger bank success story, but leadership changes may test its resilience. The move also highlights ongoing tensions between founders and backers in scaling fintech firms.

Insight of the Day

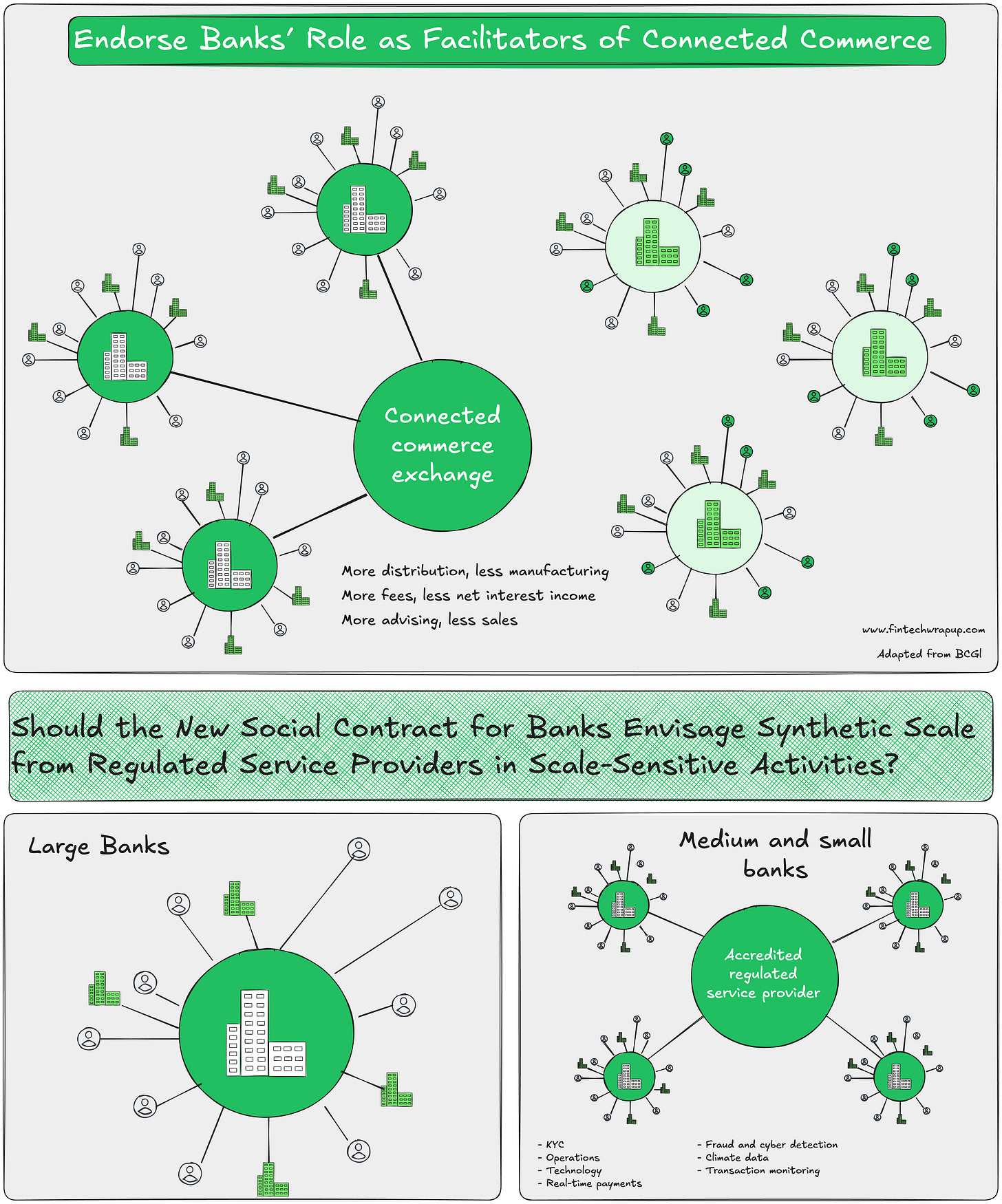

Renegotiating the Social Contract Between Banks and Society

Banks and society have had an unspoken “grand bargain” for centuries: banks get to take deposits and move money, and in return, they’re expected to fuel economic growth, maintain stability, and operate under tight regulatory supervision.

But here’s the catch—this deal is starting to feel outdated.

Today, many banks are trading below book value, signaling weak profitability and reduced capacity to lend. If banks can’t generate returns above their cost of capital, they’ll pull back capital rather than inject it into the economy. That’s a problem not just for banks—but for everyone who relies on credit to keep the economy moving.

Curated News

💳 Payments

Nuvei & Zuora Launch Global Recurring Payments Platform

Nuvei and Zuora have partnered to offer enterprises an integrated solution for recurring payments, aiming to simplify global subscription management. This move strengthens recurring revenue models and supports businesses expanding internationally.

Source

Workday & DailyPay Bring On-Demand Pay to Workers

Workday has teamed up with DailyPay to give employees faster access to their earnings. The partnership reflects rising demand for flexible payroll solutions as financial wellness tools gain traction.

Source

dLocal Partners with Tiendamia for Cross-Border eCommerce

Payments giant dLocal has joined forces with Tiendamia to drive cross-border eCommerce growth in Latin America. The partnership aims to make regional online shopping more seamless for international buyers.

Source

Andaria & tell.money Expand Payee Verification Across Europe

Andaria and tell.money are extending Verification of Payee (VoP) services across Europe, building on successful UK implementation. This effort aims to boost trust and reduce fraud in cross-border payments.

Source

Electronic Payments Acquires Handpoint to Enter Europe

US-based Electronic Payments has acquired Handpoint, expanding its footprint into the European payments market. The deal strengthens its global reach and merchant services offering.

Source

DBS Cashback Boosts Heartland Sales

DBS’ PayLah! cashback campaign has driven a 50% rise in weekend sales for local merchants. The initiative highlights the power of targeted digital incentives in supporting SMEs.

Source

🏦 Banking

Starling Bank Acquires Ember for SME Tax Integration

Starling Bank has acquired Ember to integrate automated tax tools directly into SME accounts. The move strengthens Starling’s offering to business customers and streamlines financial admin.

Source

Citi Rolls Out AI Automation in Commercial Banking

Citi has introduced AI-powered automation across its commercial banking operations. The upgrade is designed to enhance efficiency and improve customer experiences.

Source

💡 Fintech

Eltropy Expands Integrations to 50+ Core Systems

Eltropy has expanded its platform to integrate with over 50 core banking and fintech systems. The move enhances its ecosystem connectivity and value for financial institutions.

Source

Midas Raises $80M in Turkey’s Largest Fintech Deal

Turkish fintech Midas has secured $80 million in Series B funding, the country’s largest fintech investment to date. The raise underscores growing investor confidence in Turkey’s digital finance market.

Source

Casca Raises $29M for AI Lending Platform

Casca has secured $29 million to grow its AI-driven loan origination platform. The funding highlights the momentum behind AI-powered credit solutions.

Source

Juspay & Outpayce Simplify Travel Payments

Indian fintech Juspay has partnered with Outpayce to streamline payments for the travel industry. The collaboration aims to reduce friction in online booking transactions.

Source

🪙 Crypto

Figure Files for IPO as Blockchain Lending Grows

Blockchain lender Figure has filed for an IPO, signaling growing investor appetite for blockchain-powered finance. The move could mark one of the largest public listings in crypto lending.

Source

HK Stablecoins Could Connect Digital Yuan Globally

Hong Kong’s stablecoin projects may serve as a bridge between China’s digital yuan and global markets. This could accelerate cross-border adoption of central bank digital currencies (CBDCs).

Source

Wyoming Officially Launches State-Backed Stablecoin

Wyoming has launched its own state-backed stablecoin, positioning itself as a US pioneer in crypto regulation and adoption. The move could influence wider state-level adoption.

Source

SharpLink Adds 143,593 ETH to Holdings

SharpLink has acquired an additional 143,593 ETH, strengthening its crypto reserves. The move signals growing corporate confidence in Ethereum as a strategic asset.

Source

Fed’s Banking Regulator Considers Allowing Staff Crypto Holdings

The Fed’s top banking regulator is weighing a policy change to let staff hold crypto. This reflects shifting regulatory attitudes as digital assets move closer to mainstream finance.

Source

MoonPay & Trust Wallet Form Strategic Partnership

MoonPay has entered a multi-year partnership with Trust Wallet to expand Web3 payment infrastructure. The collaboration aims to enhance user access to crypto services.

Source

📈 WealthTech

Aspire Launches Yield Solution for Singapore SMEs

Aspire has rolled out a yield product that enables SMEs in Singapore to earn returns on idle cash. The move supports cash management and boosts competitiveness.

Source

Bank of Singapore Introduces ‘Catalyst’ for Ultra-Rich

Bank of Singapore has launched a new family office platform, “Catalyst,” designed for ultra-wealthy clients. The offering strengthens its position in Asia’s wealth management market.

Source

⚖️ Regulation

Switzerland Eyes Joining UK’s Anti-Dirty Money Task Force

Switzerland is considering joining the UK’s financial crime task force to combat dirty money. The move would mark deeper cross-border collaboration in financial regulation.

Source

📊 Other

Palantir Stock Drops for Fifth Straight Day

Palantir shares fell 9%, marking a fifth consecutive decline amid investor concerns. The slump highlights growing volatility in tech stocks.

Source

Latin America’s SaaS Sector on Track to Double by 2027

EBANX reports that Latin America’s SaaS sector is set to nearly double by 2027. Strong digital adoption and cross-border growth are fueling the expansion.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a "Source: [Name]" attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.