Nuvei Secures EU MiCAR License, Strengthening Its Crypto Payments Position

Nuvei has received authorization under the European Union’s Markets in Crypto-Assets Regulation (MiCAR), marking a significant regulatory milestone for the global payments provider. The license allows Nuvei to offer regulated crypto-related payment services across all EU member states under a unified framework. This approval positions Nuvei as an early mover among payment firms adapting to MiCAR, which is expected to reshape Europe’s digital asset landscape. It also enhances trust with enterprise clients seeking compliant crypto on- and off-ramp solutions. Strategically, the license supports Nuvei’s expansion across institutional crypto, Web3, and stablecoin-based payments. More broadly, it underscores how regulatory clarity in Europe is accelerating mainstream crypto adoption.

Video of the Day

Insight of the Day

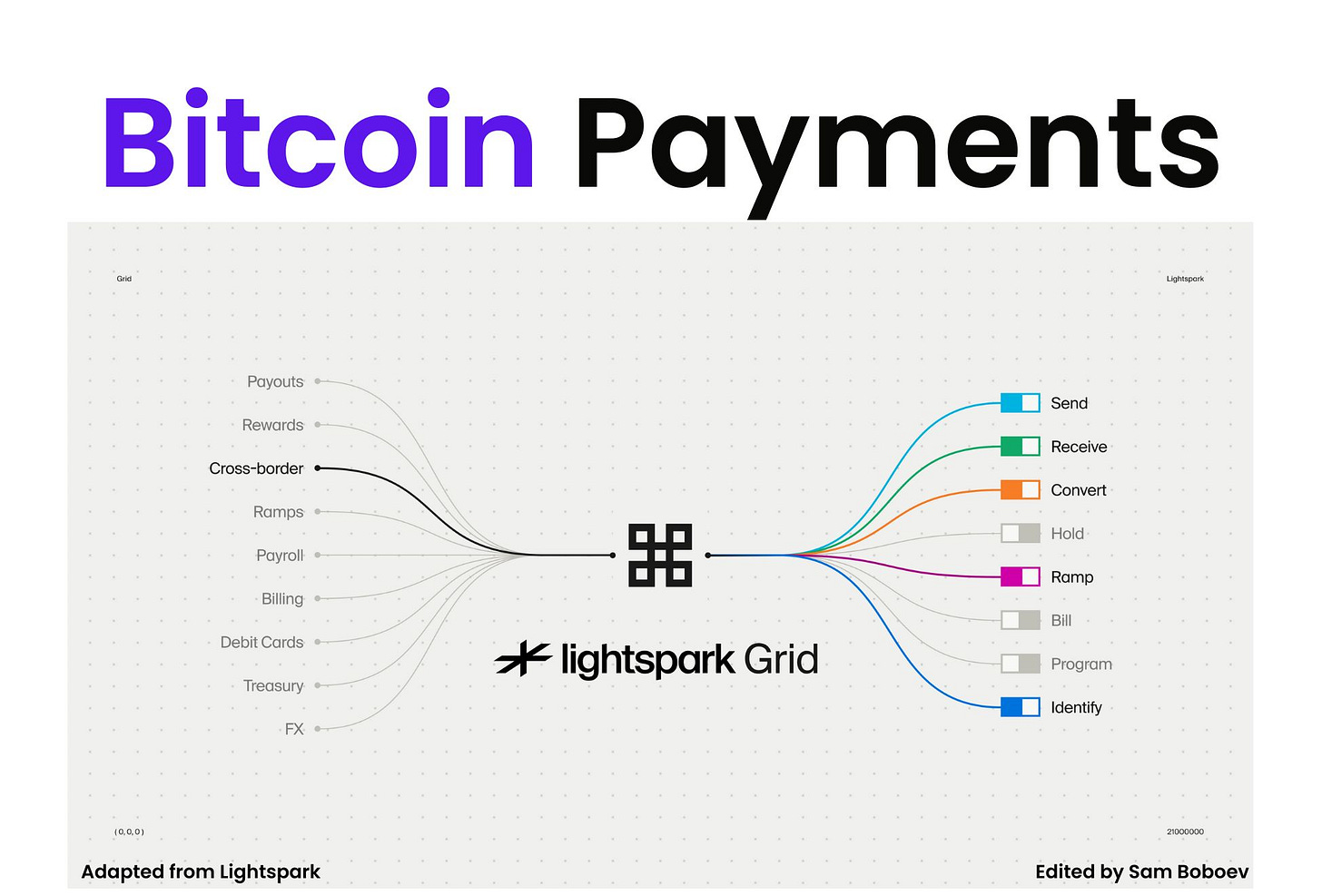

𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐇𝐨𝐰 𝐋𝐢𝐠𝐡𝐭𝐬𝐩𝐚𝐫𝐤 𝐆𝐫𝐢𝐝 𝐈𝐬 𝐑𝐞𝐝𝐞𝐟𝐢𝐧𝐢𝐧𝐠 𝐁𝐢𝐭𝐜𝐨𝐢𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬

Over the past few months, I have seen more founders and product teams realize the same thing. Our current payment rails were never designed for internet-native money movement. They work, but only with layers of patches and intermediaries. The result is slow settlement, expensive fees, unpredictable FX paths, and compliance friction that increases with every new geography.

Lightspark Grid is one of the clearest attempts I have seen to simplify this stack from the ground up.

Grid is a modular developer platform built on open networks and Bitcoin infrastructure. Instead of bundling everything into one black box, Grid exposes primitives that fintechs can mix and match to build programmable money flows - it’s one API to send, receive, and settle value globally across fiat, stablecoins or BTC. This idea of unbundled payments infrastructure is what makes it interesting.

👉 𝐖𝐡𝐲 𝐝𝐨𝐞𝐬 𝐭𝐡𝐢𝐬 𝐦𝐚𝐭𝐭𝐞𝐫?

Because founders want global reach without global complexity. They want low fees without hidden spreads. They want instant settlement without dealing with dozens of local processors. And they want an open, neutral network rather than a closed ecosystem controlled by a single platform.

Lightspark’s angle is simple. Use open networks. Use Bitcoin as the routing layer. Push fees as close to zero as possible. Build an API that abstracts away the messy parts so developers can focus on the experience. Their work with SoFi and Nubank shows that large institutions are already exploring this path.

👉 𝐒𝐨 𝐰𝐡𝐞𝐫𝐞 𝐝𝐨𝐞𝐬 𝐆𝐫𝐢𝐝 𝐬𝐢𝐭 𝐢𝐧 𝐭𝐡𝐞 𝐦𝐨𝐝𝐞𝐫𝐧 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐬𝐭𝐚𝐜𝐤?

It acts as the connectivity layer between your product and the global internet of value. You plug into Grid, and Grid plugs you into instant transfers, global liquidity, stablecoins, and Bitcoin rails. Then you compose what you need through five core primitives (with more to come).

→ Payouts

→ Ramps

→ Rewards

→ Global P2P

→ Treasury and liquidity capabilities

This shift from traditional rails to programmable, internet-native money movement is getting faster. And Grid is positioning itself as the toolkit that lets companies and developers build on top of it.

If you are building a fintech product today, understanding Grid is essential to understanding where the industry is heading.

Curated News

💳 Payments

Deutsche Bank Launches Wero to Boost European Digital Payments Sovereignty

Deutsche Bank has introduced Wero, a new digital payments solution designed to support simpler and more sovereign payments across Europe. The launch aligns with broader European efforts to reduce reliance on non-European payment schemes and strengthen regional infrastructure.

Source

Mastercard Expands Silver Logo Benefits With WhatsApp Chatbot in Azerbaijan

Mastercard has launched a WhatsApp chatbot in Azerbaijan to enhance engagement for Silver logo cardholders. The initiative highlights how card networks are using conversational commerce to improve customer experience and brand value.

Source

Interchecks and Mastercard Partner on Open Finance A2A Payments

Interchecks and Mastercard are collaborating to advance account-to-account payments through Open Finance. The partnership aims to reduce friction and costs in digital payments while expanding real-time transfer use cases.

Source

Yowpay and Akurateco Partner to Expand SEPA Payment Capabilities

Yowpay and Akurateco have formed a strategic partnership to broaden SEPA payment access for merchants and PSPs across Europe. The deal strengthens cross-border payment infrastructure and supports scalable merchant growth.

Source

🏦 Banking

Aspire Enters Europe With EMI License and Netherlands Hub

Aspire has secured an EU Electronic Money Institution license and established a new hub in the Netherlands. This move enables the fintech to expand banking services for SMEs across Europe under a regulated framework.

Source

Belgium’s itsme Acquires Dutch Digital ID Service iDIN

Bank-owned digital identity provider itsme has acquired iDIN from Dutch banks. The acquisition strengthens itsme’s position as a leading cross-border digital ID platform in Europe.

Source

U.S. Bank Avvance Expands Embedded Finance Network

U.S. Bank Avvance has added three new partners to its embedded financing ecosystem. The expansion highlights growing demand for integrated lending solutions within non-bank platforms.

Source

🪙 Crypto

CoinJar Brings Australian Crypto Exchange to the U.S.

CoinJar is expanding into the U.S. market, marking a major international move for Australia’s leading cryptocurrency exchange. The launch reflects increasing competition among global crypto platforms for U.S. users.

Source

SoFi Launches Bank-Issued Stablecoin SoFiUSD on Ethereum

SoFi has introduced SoFiUSD, a bank-issued stablecoin deployed on Ethereum. The launch signals deeper integration of stablecoins into regulated financial institutions.

Source

Intuit to Integrate USDC Across TurboTax and QuickBooks

Intuit plans to integrate USDC stablecoin functionality into TurboTax and QuickBooks. This move could accelerate mainstream adoption of stablecoins in consumer and SMB financial workflows.

Source

Taiwan Discloses $18M in Bitcoin Seized From Criminal Cases

Taiwanese authorities revealed they hold 210 Bitcoin seized from criminal investigations. The disclosure highlights how governments are increasingly managing and accounting for digital asset confiscations.

Source

Crypto.com Partners With DBS to Expand Payments in Singapore

Crypto.com has partnered with DBS to enhance crypto-linked payment services in Singapore. The collaboration reflects growing bank–crypto exchange cooperation in regulated Asian markets.

Source

📈 WealthTech

Lumera Acquires Acuity to Strengthen UK Life and Pensions Presence

Lumera has acquired Acuity to expand its footprint in the UK life and pensions market. The deal supports Lumera’s growth strategy and enhances its product capabilities in long-term savings.

Source

⚖️ Regulation

ECB Shifts Focus to Digital Euro After Holding Rates

ECB President Christine Lagarde signaled increased focus on the digital euro following a decision to hold interest rates. The move highlights the central bank’s growing emphasis on retail CBDC deployment.

Source

🚀 Fintech

Standard Chartered and Ant International Launch Tokenized Deposits

Standard Chartered has partnered with Ant International to roll out a tokenized deposit solution. The initiative demonstrates how banks are using blockchain to modernize corporate liquidity management.

Source

TD Securities Joins Capital Markets Gateway Network

TD Securities has joined Capital Markets Gateway as both an investor and client. The move expands the platform’s global underwriting and data-sharing ecosystem.

Source

Barclays and ExpectAI Partner to Help SMEs Monetize Sustainability Data

Barclays has teamed up with ExpectAI to help SMEs leverage sustainability data for profit growth. The partnership reflects rising demand for data-driven ESG tools in commercial banking.

Source

Google Expands Consumer Credit Push in India With UPI-Linked Card

Google is deepening its consumer credit strategy in India by launching a UPI-linked card. The move strengthens Google’s role in India’s rapidly evolving digital finance ecosystem.

Source

Plata Secures Up to $500M Financing Led by Nomura

Mexican fintech Plata has arranged up to $500 million in financing from Nomura. The deal represents the largest funding round for a Mexican fintech platform to date.

Source

Octane Raises $100M in Series F Funding

Octane has secured $100 million in Series F equity funding. The raise underscores continued investor appetite for high-growth fintech platforms despite a tighter capital environment.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.