Onafriq and Visa Drive Financial Interoperability in the DRC

Onafriq has partnered with Visa to launch Visa Pay in the Democratic Republic of Congo, aiming to bridge the gap between card payments and mobile money. This initiative will allow greater interoperability, helping users move money seamlessly between digital wallets and bank-issued cards. The collaboration is particularly significant in a market where mobile money adoption far outpaces traditional banking penetration. By linking the two ecosystems, Visa and Onafriq are positioning themselves at the heart of Africa’s financial inclusion strategy. For consumers, this means more convenience and choice in how they transact daily. For businesses, it represents improved reach and opportunities in digital commerce. Ultimately, this partnership reflects Visa’s broader push to deepen financial access in emerging markets.

Insight of the Day

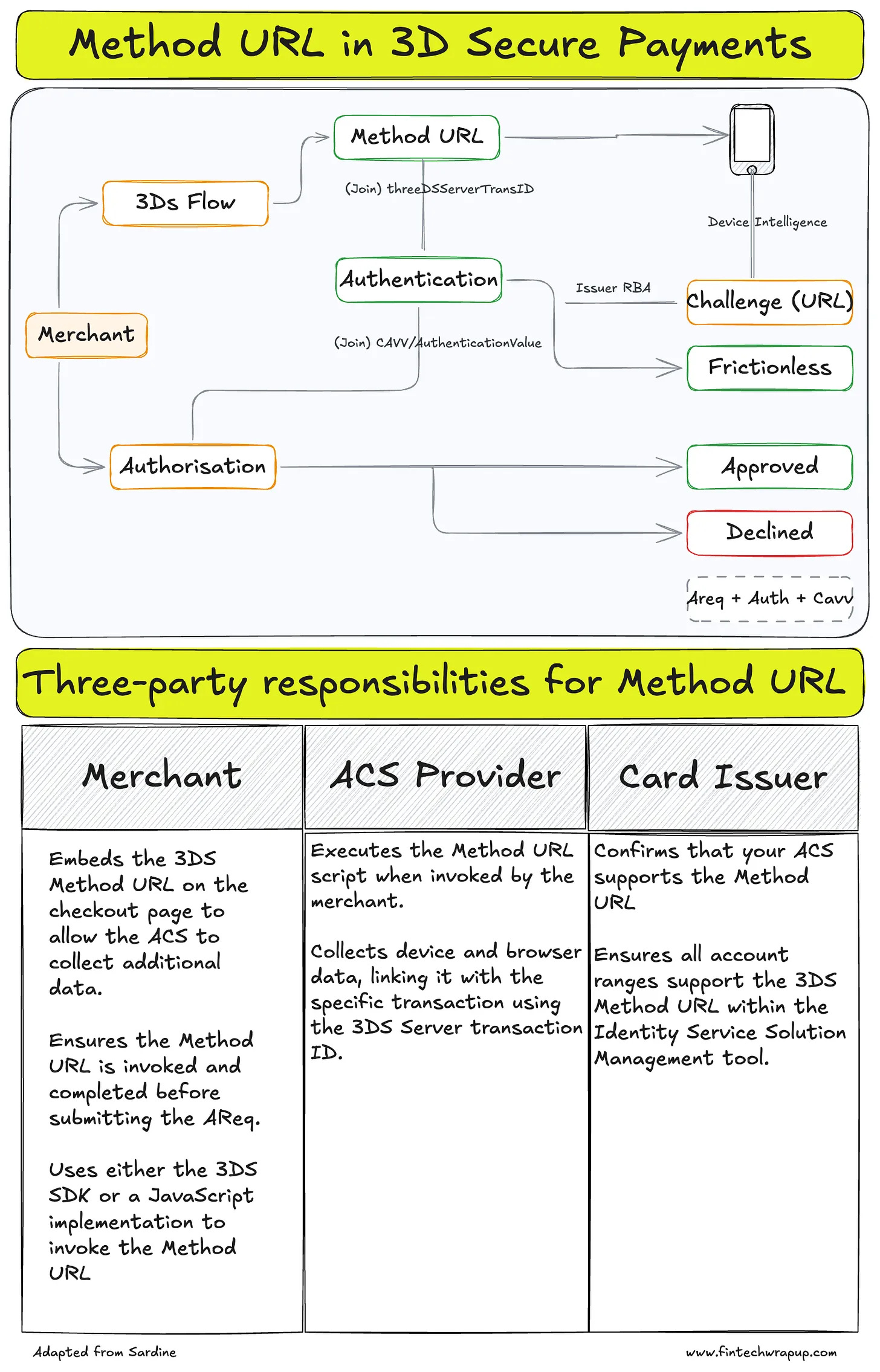

What is a Method URL in 3D Secure Payments?

In the 3D Secure (3DS) protocol, the Access Control Server (ACS) is responsible for authenticating transactions. The ACS uses the authentication request (AReq) to decide whether to proceed with a frictionless flow or introduce a challenge, such as an OTP.

One key component that influences this decision is the Method URL, which enables the ACS to collect device intelligence before the AReq is initiated. For merchants, invoking this Method URL prior to sending the AReq is essential for maximizing the chances of a frictionless approval. As of March 2025, MasterCard has made it mandatory to have a Method URL in the EU region.

Importantly, platforms like PayPal and other major payment processors won’t offer fraud or seller protection without device intelligence collected via their SDKs. For issuers, this means that approving frictionless flows, especially for small merchants without robust fraud defenses, without Method URL data significantly increases liability. In these cases, issuers will likely fall back to a challenge-based (friction) flow.

Curated News

💳 Payments

Paytently and Mastercard Roll Out Open Banking Payments

Paytently has teamed up with Mastercard to launch an open banking-powered payment solution, offering faster and more secure alternatives to card transactions. The move highlights the growing push toward frictionless account-to-account payments.

Source

EBANX Expands Cross-Border Payments with Capitec Pay

EBANX has integrated with Capitec Pay, bringing open banking-powered payments to international merchants serving South African customers. The partnership supports easier e-commerce transactions and strengthens financial access in emerging markets.

Source

Upwork and Wise Boost Freelancer Payments

Upwork has partnered with Wise Platform to enhance payment infrastructure for freelancers worldwide, enabling faster and cheaper cross-border transactions. The integration is set to benefit millions of global gig workers.

Source

Botim and CBE Strengthen UAE-Ethiopia Remittances

Messaging app Botim has partnered with the Commercial Bank of Ethiopia to expand remittance and payment corridors between the UAE and Ethiopia. The deal enhances cross-border financial connectivity for diaspora communities.

Source

Ant International and AlipayHK Unveil Wallet Partnership

Ant International and AlipayHK have launched a joint digital wallet initiative, boosting payment interoperability in Hong Kong. The move underscores Ant’s ongoing push to grow its international financial ecosystem.

Source

Stripe Brings Business Financing to Australia

Stripe is launching Stripe Capital in Australia, offering small businesses quick access to financing through its payments platform. The move strengthens Stripe’s role as both a payments and lending partner for SMEs.

Source

DailyPay and APS Team Up on Employee Financial Wellness

DailyPay has partnered with APS to integrate financial wellness tools across thousands of employers in the U.S. The collaboration helps employees access earned wages more flexibly.

Source

Payment Errors Threaten Business Growth

A recent analysis shows how frequent payment processing errors can halt expansion for businesses, creating costly inefficiencies. Companies are urged to upgrade payment infrastructure to avoid revenue leakage.

Source

🏦 Banking

Bank of England Forms Retail Payments Infrastructure Board

The Bank of England is seeking industry stakeholders to join its new Retail Payments Infrastructure Board, aimed at shaping the future of payment rails in the UK. The initiative reflects growing regulatory oversight of payment systems.

Source

Aven Raises $110M to Build ‘Machine Banking’ Platform

Aven has secured $110M in Series E funding, valuing the company at $2.2B, to scale its AI-driven “machine banking” service for homeowners. The platform automates key aspects of financial management, redefining mortgage-related banking.

Source

💻 Fintech

Rippling Secures UK E-Money License

Rippling has obtained FCA authorization as an Electronic Money Institution, paving the way for its expansion in the UK and Europe. This milestone strengthens its offering in HR and payroll-linked financial services.

Source

Personetics Launches AI-Powered MCP Server

Personetics has introduced its MCP Server, enabling banks to build agentic AI applications using customer financial intelligence data. The solution helps banks personalize customer engagement and innovate faster.

Source

Eloquent AI Secures $7.4M Seed Round

Conversational AI startup Eloquent AI has raised $7.4M in seed funding to expand its platform that enhances customer interactions for financial institutions. The funding will accelerate product development and market reach.

Source

🪙 Crypto

Binance and Franklin Templeton Collaborate on Digital Assets

Binance has joined forces with Franklin Templeton to develop new digital asset initiatives and investment products. The collaboration reflects growing institutional interest in blockchain-powered financial services.

Source

BingX Debuts AI Crypto Trading Strategist

BingX has launched AI Master, the first AI-powered trading strategist for crypto markets. The tool aims to give traders smarter, automated insights in a highly volatile sector.

Source

Dogecoin Surges 20% as ETF Nears

Dogecoin rallied 20% after a treasury firm disclosed large DOGE holdings and speculation grew around an upcoming DOGE ETF. The move highlights continued meme-coin momentum in mainstream finance.

Source

Bitcoin Briefly Hits $116K on Macro Optimism

Bitcoin spiked to $116K, buoyed by macroeconomic conditions favoring risk assets and heightened investor sentiment. The surge underscores BTC’s ongoing role as a barometer of global liquidity cycles.

Source

Gemini Offers 30% of IPO to Retail Investors

U.S.-based exchange Gemini announced that 30% of its upcoming IPO allocation will be reserved for retail investors. This approach sets a precedent for greater retail participation in crypto company listings.

Source

📊 WealthTech

WFE Hesitates on 24/7 Trading

The World Federation of Exchanges, which previously criticized tokenized equities, is now showing caution on adopting 24/7 trading. The hesitation highlights the tension between innovation and regulatory comfort in capital markets.

Source

⚖️ Regulation

UK Public Sector Lags in Blockchain Familiarity

A new report reveals that the UK public sector is “not at all familiar” with blockchain, highlighting a knowledge gap compared to private sector adoption. The findings may slow down potential government use cases.

Source

📚 Other

Eruditus Raises $150M for Global Edtech Growth

Edtech firm Eruditus has secured $150M to accelerate its international expansion. The funding will support scaling its online programs and partnerships with leading universities.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a "Source: [Name]" attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.