PayOS and Mastercard complete milestone agentic payment transaction

PayOS and Mastercard have successfully executed the first agentic payment transaction, marking a major step toward autonomous financial operations. The pilot showcases how AI-powered payments can handle end-to-end decision-making without human input, potentially transforming transaction efficiency and reducing errors. This milestone reflects growing industry momentum in embedding AI directly into payments infrastructure. Experts suggest it could pave the way for a new era of real-time, adaptive financial services. Mastercard’s involvement further validates the commercial potential of agentic finance, signaling upcoming industry adoption. The move sets the stage for deeper AI integrations across global payment ecosystems.

Insight of the Day

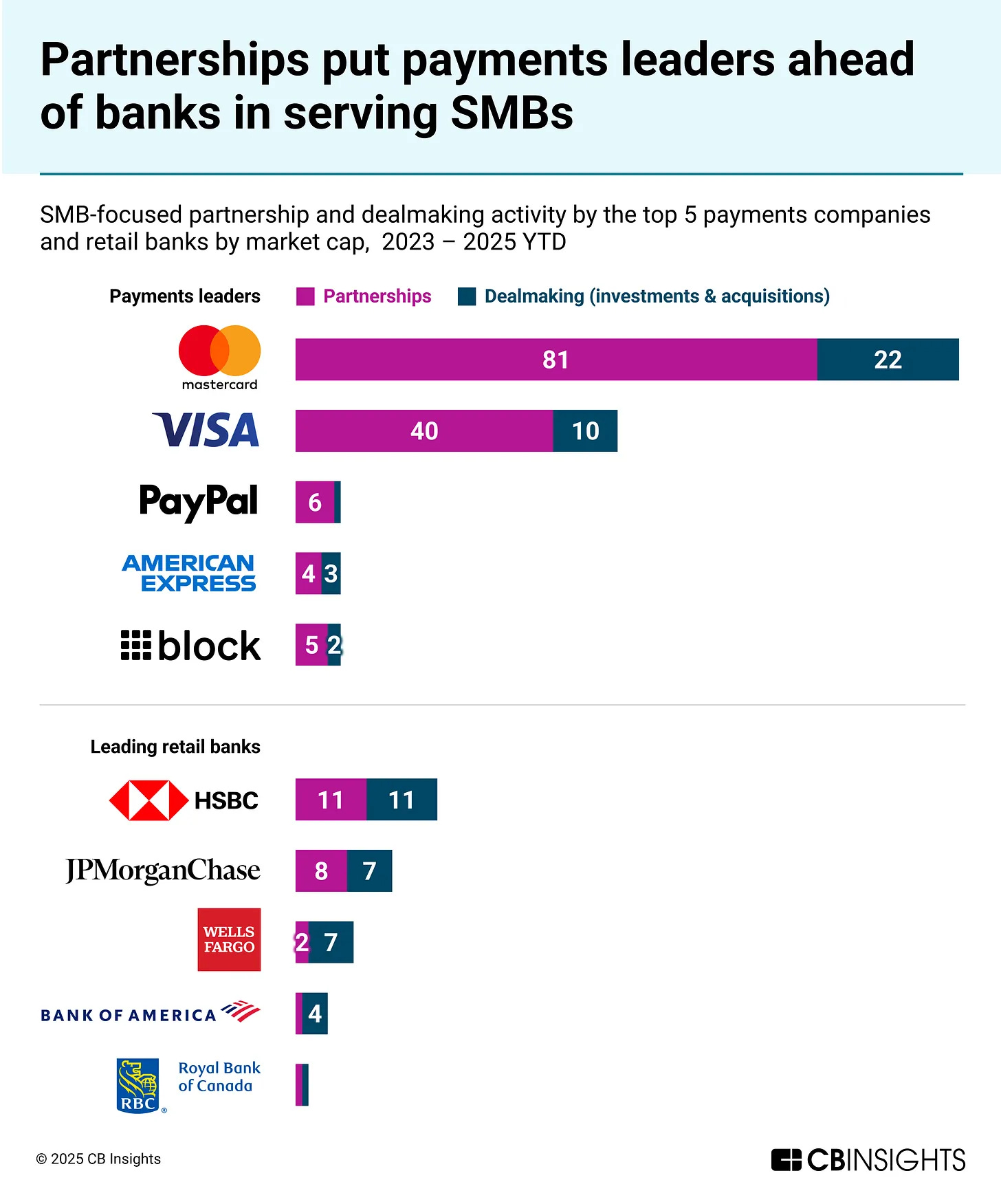

Partnerships Put Payments Leaders Ahead of Banks in Serving SMBs

As small businesses (SMBs) rapidly digitize, they are creating a critical window for financial institutions to capture market share. SMBs represent 90% of businesses worldwide and are demanding faster, more flexible financial tools to manage cash flow, access capital, and accept payments. Yet, among incumbent financial services providers, it is the payments companies—not the big banks—that are pulling ahead in meeting these demands.

New data from CB Insights highlights just how wide the gap has become. Between 2023 and 2025 YTD, payments giants like Mastercard, Visa, PayPal, American Express, and Block (Square) have been far more active in striking partnerships and deals focused on SMBs than their banking counterparts.

Mastercard leads the field with a staggering 81 partnerships and 22 investments and acquisitions targeting SMB solutions. Visa follows with 40 partnerships and 10 deals, underscoring the aggressive role networks are playing in building ecosystems around small businesses. Even PayPal, American Express, and Block—though smaller in absolute numbers—are consistently engaging in SMB-focused collaboration, with activities ranging from embedded finance integrations to new credit offerings.

By contrast, leading retail banks are lagging. HSBC, the most active bank in this space, posted 11 partnerships and 11 deals, while JPMorgan Chase logged 8 partnerships and 7 deals. Wells Fargo, Bank of America, and RBC trail even further behind. The disparity illustrates a fundamental difference in strategy: while banks often focus on lending or treasury products, payments companies are embedding themselves deeper into SMB operations through technology, partnerships, and platform plays.

Curated News

💳 Payments

More than half of Brits now use mobile wallets

Mobile wallet adoption has crossed 50% in the UK, driven by convenience and security benefits. This marks a shift in consumer behavior that could accelerate the decline of physical cards and cash usage.

Source

DNA Payments launches new PAX A6650 POS device in the UK

DNA Payments has introduced the PAX A6650 handheld POS device, offering merchants advanced mobility and payment flexibility. The rollout strengthens options for businesses adapting to cashless and omnichannel commerce.

Source

Bluefin and Alacriti team up to enhance POS payment security

Bluefin and Alacriti are partnering to bolster POS payment security with advanced encryption solutions. The move aims to reduce fraud risks as retail payment channels face rising cyber threats.

Source

German startup FLIZPay raises $1M pre-seed funding

Berlin-based FLIZPay secured $1M to grow its mobile payments platform. The funding will help scale operations and expand services in Europe’s competitive fintech ecosystem.

Source

Unlimit expands in Peru with Mastercard and Visa membership

Unlimit has obtained principal membership with Mastercard and Visa in Peru, boosting its Latin American presence. The expansion strengthens its ability to provide cross-border and local payment solutions.

Source

UnionPay pushes cross-border interoperability with new gateway

UnionPay International has launched China’s Cross-Border Interconnection Payment Gateway to drive seamless global interoperability. The initiative enhances connectivity across payment ecosystems in Asia and beyond.

Source

EPAA warns of quantum risks to payments industry

The EPAA released a report urging the payments industry to prepare for quantum computing threats. Without proactive measures, encryption and security standards could be at risk within the decade.

Source

Visa Direct embraces stablecoins for faster business funding

Visa Direct will leverage stablecoins to speed up settlement and working capital flows for businesses. The initiative signals growing mainstream adoption of digital assets within payments infrastructure.

Source

🏦 Banking

Bank of America launches GenAI assistant for customers

Bank of America has introduced a GenAI-powered assistant to provide instant answers for customer queries. The tool reflects banks’ increasing reliance on AI to improve customer experience and efficiency.

Source

BofA’s GenAI transforms payments solutions

In a separate move, Bank of America announced its GenAI assistant will be integrated into global payments services. This aims to streamline cross-border transactions and enhance treasury operations.

Source

Barclays partners CGI for multi-bank trade finance

Barclays has teamed up with CGI to integrate a multi-bank trade finance platform. The collaboration supports more efficient, transparent cross-border trade processes for corporate clients.

Source

Türk Ekonomi Bankası to deploy Provenir’s AI decisioning

Türkiye’s Türk Ekonomi Bankası will roll out Provenir’s AI-driven decisioning platform to enhance risk management. The move underscores banks’ increasing use of AI to boost efficiency and compliance.

Source

💰 Fintech

Bite Investments raises $25M for private markets tech

Bite Investments secured $25M in funding to accelerate its private markets investment platform. The company aims to democratize access to alternative investments with digital infrastructure.

Source

Finova and Escode launch Escrow-as-a-Service

Finova and Escode introduced Escrow-as-a-Service, enabling businesses to streamline escrow processes via API. The solution targets fintechs, marketplaces, and high-value transaction platforms.

Source

Fruitful unveils automated Money Map system

Wealth platform Fruitful launched Money Map, an automated money management tool that turns financial advice into one-click actions. The innovation aims to simplify personal finance decision-making.

Source

DailyPay appoints Poulomi Damany as Chief Product Officer

DailyPay named Poulomi Damany as its new Chief Product Officer to lead product strategy and innovation. The appointment highlights the firm’s focus on scaling earned wage access solutions.

Source

Global Payments adds new board members

Global Payments announced board additions aimed at boosting shareholder value creation. The changes reflect a strategic push to strengthen governance and long-term growth.

Source

🪙 Crypto

Brex to accept stablecoins for payments

Brex will allow businesses to settle payments using stablecoins, expanding its payment options. This move shows corporate credit providers increasingly embracing digital assets.

Source

Chainlink and UBS collaborate on tokenized fund workflows

Chainlink partnered with UBS to integrate Swift messaging into tokenized fund workflows. The collaboration strengthens institutional infrastructure for blockchain-based investment products.

Source

📈 WealthTech

Sibos 2025: Europe urged to integrate capital markets

At Sibos 2025, experts called for greater integration of Europe’s capital markets to boost efficiency and competitiveness. Harmonization is seen as crucial for attracting investment and driving growth.

Source

⚖️ Regulation & Legal

Start-up founder Charlie Javice sentenced for JPMorgan fraud

Charlie Javice, founder of a fintech startup, has been sentenced for defrauding JPMorgan. The high-profile case highlights ongoing regulatory scrutiny of fintech founders and investor protection.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.