PayPal Backs Stable Layer 1 Blockchain

PayPal has made a strategic investment in a new stable-focused layer 1 blockchain, marking a bold step in its ongoing Web3 expansion. The move signals PayPal’s deepening interest in blockchain infrastructure beyond payments, aiming to support faster, more secure, and programmable financial transactions. By backing a base layer network rather than just applications, PayPal positions itself closer to the backbone of future digital finance. This could pave the way for new on-chain payment solutions, cross-border efficiencies, and stablecoin-powered commerce. The investment also underscores PayPal’s intention to remain a leader in the convergence of traditional payments and crypto infrastructure. As regulators worldwide tighten scrutiny, PayPal’s blockchain bets may also shape industry standards.

Insight of the Day

What Are Contextual Commerce Payments?

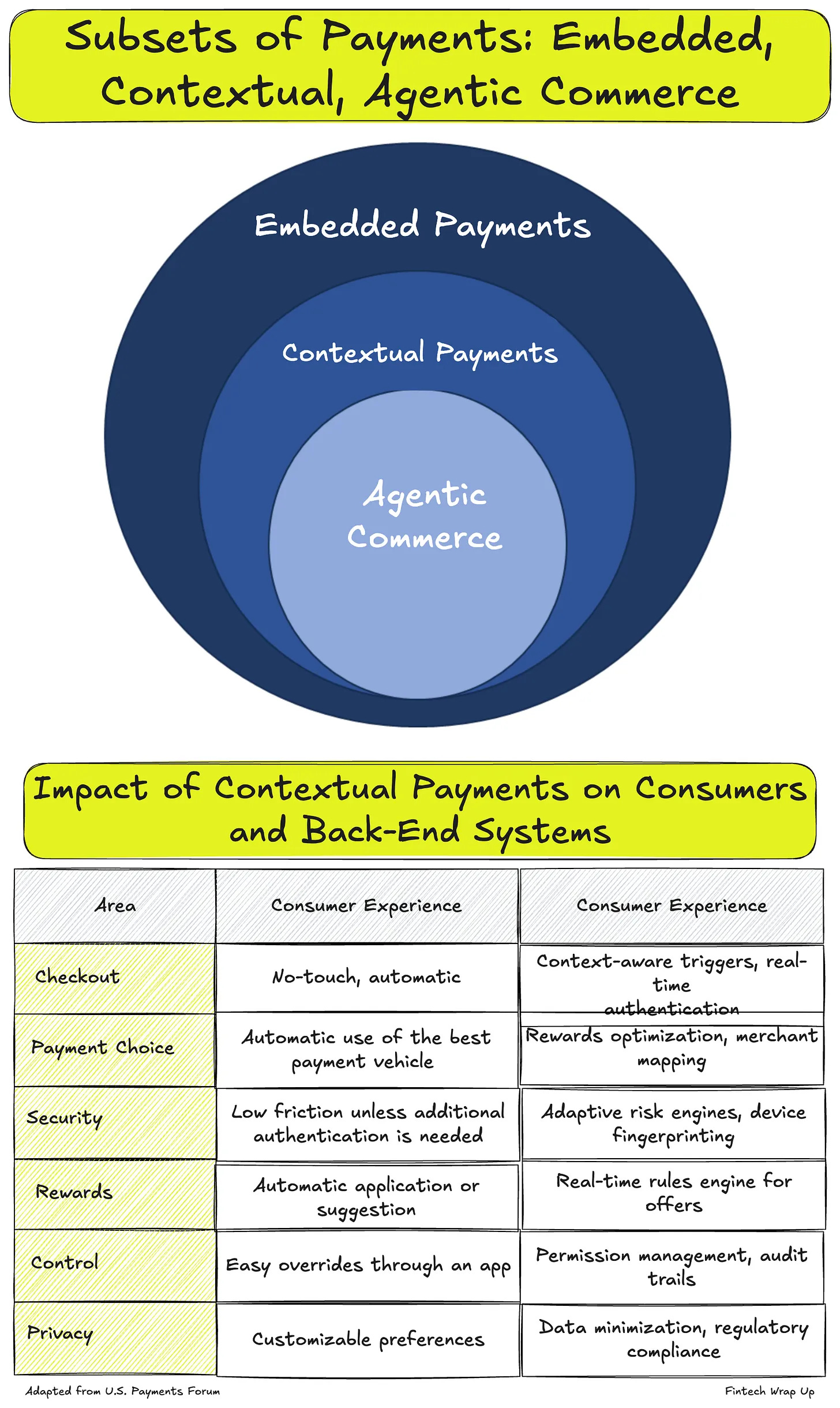

Contextual commerce is a type of eCommerce where customers can make purchases within the context of an activity—without being explicitly directed to a checkout page. Contextual payments are the transactions that occur in this environment, happening seamlessly in the background. No direct checkout interaction is needed; instead, payments are triggered by processing logic that uses prior customer consent and contextual data.

This data can include geolocation, biometrics, sensors, or computer vision to determine when and how much to charge, which merchant account to use, and which payment instrument to apply.

Contextual payments are a subset of embedded payments. While embedded payments integrate payment capabilities directly into an app or site, contextual payments go further—making the experience user-centric by fitting naturally into what the consumer is already doing.

👉 Examples:

🔹 Walk-out retail technology: Sensors, AI, and computer vision track items a consumer takes from shelves. When the customer leaves, the system automatically charges a pre-enrolled payment method.

🔹 Smart appliances: A refrigerator detects when groceries are low and reorders them automatically using stored payment details.

In both cases, payments occur in the background, leveraging pre-approved credentials. Consumers don’t pull out a card, open an app, or manually authorize a transaction. Instead, contextual triggers initiate seamless payments using stored credentials, ensuring convenience and reducing friction.

These payments thrive in IoT ecosystems—smart devices across homes, vehicles, and wearables. A smart home, for example, might order groceries or adjust services automatically, routing the payment from device → merchant → processor → issuer for approval, with no user intervention required.

A step beyond this is agentic commerce. Here, AI “agents” manage contextual payments with predictive intelligence. These agents apply learned preferences—such as loyalty points, transport choices, or habitual purchases—without the consumer needing to take action.

Curated News

💳 Payments

WhatsApp Expands QR Code Payments in India

Meta is pushing WhatsApp deeper into commerce by enabling QR code-based payments in India. This move leverages UPI’s popularity and could make WhatsApp a powerful driver of digital transactions across one of the world’s fastest-growing payments markets.

Source

Adyen Partners with LVMH on Luxury Payments

Adyen has secured a major deal with luxury group LVMH to streamline global payments. The partnership strengthens Adyen’s position as a premium payments provider for high-value retail transactions.

Source

Checkout.com Boosts Rail Europe Acceptance Rates

Checkout.com’s tech has helped Rail Europe increase acceptance rates by 8% while reducing fraud. The deal highlights the value of optimized payments infrastructure in global travel commerce.

Source

EBANX Expands with AI and Stablecoin Solutions

At the Payments Summit, EBANX announced new AI-powered services, stablecoin integrations, and expansion into the Philippines. The company aims to support global firms entering emerging markets with more flexible payout solutions.

Source

Agentic AI and Real-Time Payments Reshape Market

A new industry analysis highlights how agentic AI, digital currencies, and real-time payments are transforming global payments. The shift points toward more intelligent, autonomous, and seamless transaction systems.

Source

UK Cash Access Improves Post-FCA Rules

Nearly half of Britons say access to cash has improved a year after FCA’s new regulations. The findings suggest regulatory intervention is helping maintain financial inclusion amid declining cash use.

Source

CMC Markets Adds Paysafe Wallets Skrill & Neteller

CMC Markets will integrate Skrill and Neteller wallets to expand payment options for clients. The partnership enhances convenience and flexibility for retail traders.

Source

🏦 Banking

HSBC Launches Tokenized Deposit Service

HSBC has introduced a cross-border tokenized deposit product, marking another major bank step into digital assets. The service promises faster settlements and new liquidity management tools for institutional clients.

Source

VersaBank Rolls Out AI-Powered Core Tech

Canada’s VersaBank has integrated new internally developed AI into its core banking systems. The update aims to improve efficiency, enhance security, and future-proof its banking operations.

Source

Zand Bank Teams Up with Chainlink

UAE-based Zand Bank has formed a strategic partnership with Chainlink to enhance smart contract-based financial services. The collaboration could accelerate the use of blockchain in regulated banking.

Source

💸 Fintech

Tide Hits Unicorn Status with $120M Raise

UK fintech Tide has become a unicorn after securing $120 million in new funding. The capital will fuel its SME-focused banking and payments expansion.

Source

TPG Backs Tide at $1.5B Valuation

TPG has led a major investment round in Tide, valuing the UK fintech at $1.5 billion. This underscores investor confidence in SME-focused neobanking platforms.

Source

Guavapay Suspends UK Operations

London-based fintech Guavapay has temporarily halted UK services. The suspension raises questions about compliance and operational resilience in the paytech sector.

Source

Mastercard Welcomes New Start Path Cohort

Mastercard has announced the latest participants in its Start Path program for emerging fintechs. The initiative offers startups global access, mentorship, and growth opportunities.

Source

Predicti Raises $4.2M for AI in Finance

Spanish startup Predicti has secured $4.2M to expand its predictive AI solutions for financial services. The technology aims to help banks and fintechs better manage risk and customer insights.

Source

Rekord Raises $2.1M for Smarter Credit Decisions

Rekord has raised $2.1M to build AI-driven credit decisioning tools. Its platform promises more inclusive and accurate lending assessments.

Source

🪙 Crypto

U.S. and U.K. Form Joint Crypto Task Force

The U.S. and U.K. have launched a task force to align policies on crypto and capital markets. The move highlights growing international coordination on digital asset regulation.

Source

Ripple Reveals Institutional DeFi Roadmap

Ripple has unveiled a DeFi strategy aimed at institutional finance and real-world asset tokenization. The roadmap reflects Ripple’s ambition to expand beyond payments into broader crypto-financial services.

Source

Kaia and LINE NEXT Launch Stablecoin Superapp

Kaia and LINE NEXT are collaborating on “Project Unify,” a stablecoin-powered financial superapp. The product will integrate payments, lending, and DeFi features under one platform.

Source

Cardless Raises $60M with Coinbase Partnership

Cardless, in partnership with Coinbase and Bilt, has raised $60M to expand its credit card offerings. The funding strengthens its positioning in crypto-linked consumer finance.

Source

📜 Regulation

EU Bars Big Tech from Financial Data Sharing Scheme

The EU is set to exclude Big Tech firms from its upcoming financial data-sharing system. Regulators argue the move will prevent market dominance and ensure fair access for smaller players.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a "Source: [Name]" attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.