PayPal Introduces 5% Cashback on BNPL Purchases and Expands to In-Store Payments

PayPal has launched a new cashback program offering U.S. customers 5% back on all Buy Now, Pay Later (BNPL) purchases through the end of 2025, while also expanding its “Pay Monthly” option to in-store checkouts. The move aims to boost BNPL adoption during the holiday season and strengthen PayPal’s position in the competitive short-term financing market. By adding cashback rewards and extending BNPL availability to physical stores, PayPal bridges digital and offline shopping experiences. This initiative enhances customer loyalty, drives merchant engagement, and underscores PayPal’s strategy to blend rewards with flexible financing. The program could pressure rivals like Affirm and Klarna to match incentives as competition intensifies.

Insight of the Day

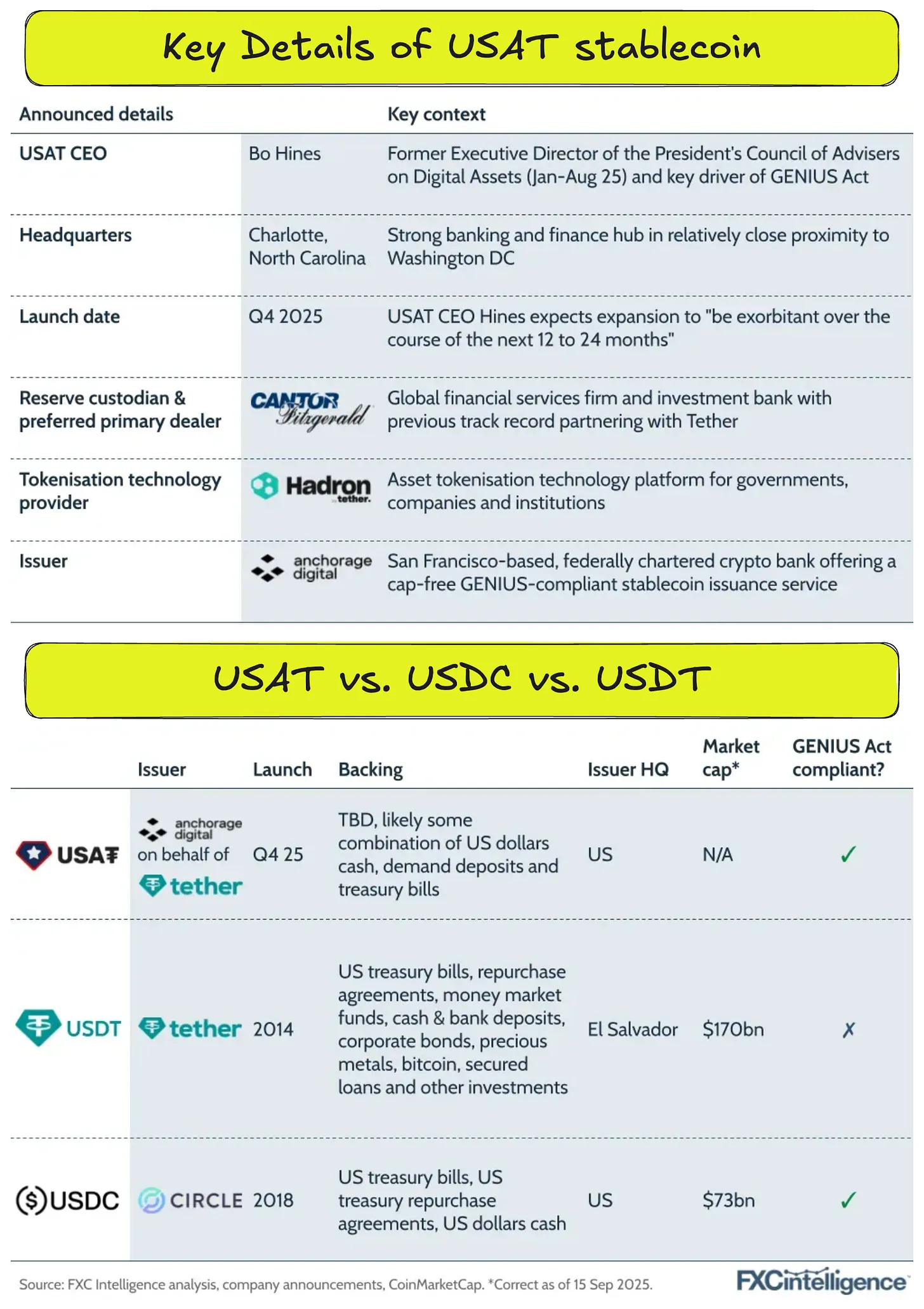

USAT: Tether’s stablecoin for the US market

From its all-American branding to its structural and operational set-up, USAT is a stablecoin expressly designed for the US market. And much of this is in service of GENIUS Act compliance.

Rather than create an issuing entity in the US, Tether has employed Anchorage Digital, a crypto bank that offers a host of Web3-related services, including a stablecoin issuance service. Designed to fully comply with GENIUS at a federal level, meaning it supports the issuance of stablecoins without the state-level cap of $10bn, Anchorage supports the deployment of stablecoins across multiple blockchain platforms, meaning that like USDT and its wider competitors, USAT will be able to be deployed for a variety of use cases.

From a reserve perspective, this means it is likely to be backed by an asset mix much closer to USDC than USDT, and Tether has also brought in a third party to handle the compliant custody of its reserves, in the form of global financial services player Cantor Fitzgerald.

However, Tether will also be harnessing its own stablecoin expertise in the form of its tokenisation technology platform Hadron, which allows organisations, including governments and companies, to tokenise digital and real-world assets. It is likely this is one of the few areas it can immediately handle with GENIUS compliance without needing to gain additional time-consuming regulatory approvals, yet it also serves as something of a marketing tool for Hadron – particularly in the US where it has a strong potential market given the flurry of current activity around stablecoins.

Beyond the infrastructure, Tether’s appointment of Bo Hines, former Executive Director of the President’s Council of Advisers on Digital Assets and a key player in delivering the GENIUS Act’s passing, also speaks to a strong desire to make USAT a part of the US’s stablecoin establishment, rather than USDT, which can be regarded as a foreign outsider.

Curated News

💳 Payments

EBANX Integrates Colombia’s Bre-B Instant Payments for Global Businesses

EBANX is enabling global companies to access Colombia’s new Bre-B instant payment system from day one, improving real-time transaction capabilities in the region. This expansion supports faster digital commerce and enhances payment infrastructure for Latin America’s growing fintech ecosystem.

Source

Workday Launches Pay Transparency Solution for EU Compliance

Workday has introduced a new pay transparency tool designed to help companies comply with upcoming EU rules on salary equity. The platform streamlines reporting and helps organizations meet regulatory requirements while promoting fairness in compensation practices.

Source

NCR Atleos and Moto Partner to Expand Self-Service Cash Access

NCR Atleos is teaming up with Moto to broaden access to self-service cash withdrawal and deposit solutions. The collaboration aims to improve financial inclusion by making physical cash services more widely available in underserved areas.

Source

🏦 Banking

Monzo Revives Push for U.S. Banking License

UK-based digital bank Monzo is renewing efforts to secure a U.S. banking license, according to the Financial Times. If successful, Monzo would join the small group of European neobanks expanding regulated operations into the American market.

Source

Bud Financial Launches MCP Server for AI-Powered Banking

Bud Financial has unveiled its MCP Server, a platform designed to accelerate the development of AI agents using bank-grade financial data intelligence. The innovation promises to enhance financial automation and data-driven insights across the banking industry.

Source

Lloyds’ Barcode Deposit Feature Hits £3M Milestone

Lloyds Bank’s app feature allowing barcode-based cash deposits has surpassed £3 million in transactions via PayPoint. The success highlights the continued demand for hybrid digital-physical banking solutions.

Source

💡 Fintech

Ukrainian Fintech Achieves Unicorn Status Amid Growth Surge

A Ukrainian fintech firm has reached a $1 billion valuation, reflecting the resilience and innovation of Eastern Europe’s startup scene. The milestone underscores growing investor interest in regional fintech solutions despite geopolitical challenges.

Source

India’s Raise Financial Becomes Unicorn After $120M Series B

India’s Raise Financial has joined the unicorn club following a $120 million Series B funding round. The capital will fuel expansion into wealth and retail investment products amid rising competition in India’s fintech space.

Source

Digital Credit Platform Yup Raises $32M for Profitability Push

Yup, a digital lending startup, has secured $32 million in new funding as it aims to reach profitability. The investment will support technology improvements and regional market expansion.

Source

BGC Group Acquires Macro Hive to Strengthen Analytics Capabilities

BGC Group has acquired Macro Hive, a financial analytics firm, to enhance its data-driven insights and research offerings. The deal bolsters BGC’s strategic expansion in financial technology and research services.

Source

G2 Risk Solutions Completes EverC Acquisition

G2 Risk Solutions has finalized its acquisition of EverC, integrating advanced fraud and risk analytics into its fintech offerings. The merger strengthens its capabilities in compliance and merchant monitoring.

Source

🪙 Crypto

EU Plans Unified Crypto Oversight Under ESMA

The EU is proposing to centralize crypto supervision under the European Securities and Markets Authority (ESMA) to replace fragmented national oversight. The move would bring more consistency and transparency to the region’s digital asset markets.

Source

Agio Ratings Raises $6M to Expand Digital Asset Risk Tools

Agio Ratings has secured $6 million in funding to enhance its risk management solutions for digital assets. The company aims to provide better transparency and security insights to institutional crypto investors.

Source

📊 WealthTech

Prometeia and FinCredible Form Risk Management Partnership

Prometeia and FinCredible have entered a strategic partnership to strengthen risk management in Central and Eastern Europe. Their collaboration focuses on improving analytics and compliance solutions for financial institutions.

Source

🛡️ Regulation

U.S. Faster Payments Council and ASC X9 Form Standards Alliance

The U.S. Faster Payments Council and Accredited Standards Committee X9 have formed an alliance to develop and promote consistent standards for faster payments. The collaboration aims to ensure interoperability and safety across the U.S. payments ecosystem.

Source

💻 Other

Index Engines and Hitachi Vantara Advance AI-Driven Data Recovery

Index Engines and Hitachi Vantara have announced an AI-powered clean data recovery solution designed to improve enterprise cyber resilience. The partnership introduces service-level agreement (SLA)-backed recovery guarantees for critical systems.

Source

Cybersecurity Concerns Rise Among Consumers

A new report highlights growing consumer anxiety about cybersecurity and data protection. The findings signal a need for stronger digital safeguards and transparency in financial services.

Source

OpenDialog and Durell Partner on AI-Driven Insurance Quotes

OpenDialog and Durell have partnered to bring AI-powered quote journeys to digital insurance platforms. The collaboration aims to streamline underwriting and improve customer engagement in e-trade channels. Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.