PayPal Moves Toward Becoming a Bank for Small Businesses

PayPal has submitted applications to establish an industrial bank in the US, a move that would significantly expand its ability to serve small businesses. If approved, the license would allow PayPal to hold deposits directly and offer more integrated lending and financial products. This marks a strategic shift from being primarily a payments provider to a more full-stack financial services platform. For SMBs, this could mean faster access to credit and simplified money management within PayPal’s ecosystem. The move also signals growing convergence between fintechs and traditional banking. For the wider fintech sector, it underscores how scale players are pushing deeper into regulated financial infrastructure.

Video of the Day

Insight of the Day

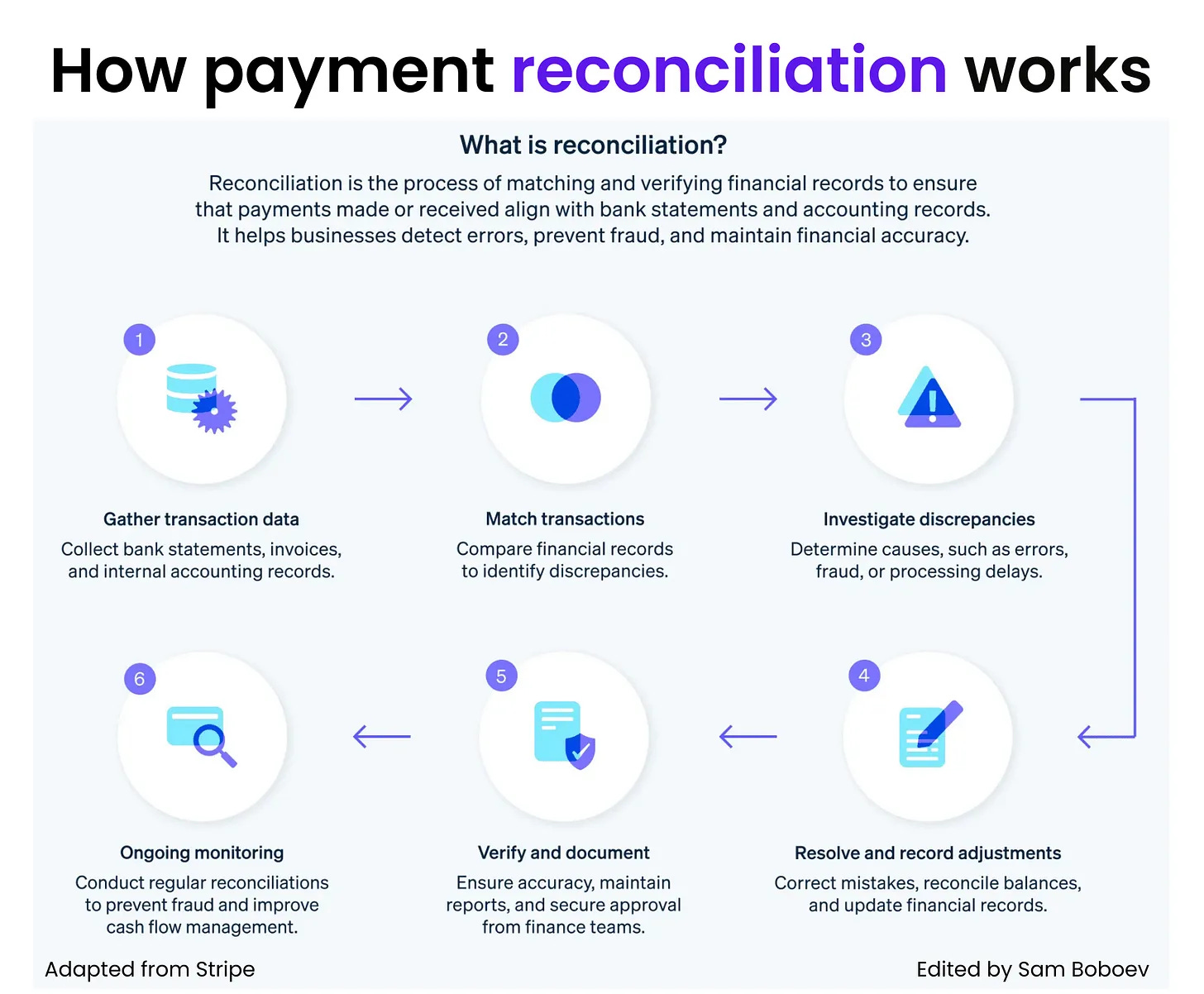

𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐡𝐨𝐰 𝐩𝐚𝐲𝐦𝐞𝐧𝐭 𝐫𝐞𝐜𝐨𝐧𝐜𝐢𝐥𝐢𝐚𝐭𝐢𝐨𝐧 𝐰𝐨𝐫𝐤𝐬 𝐛𝐲 𝐒𝐭𝐫𝐢𝐩𝐞

Payment reconciliation involves several steps that help ensure the payments recorded in the financial statements are consistent with the payments made or received. The exact process varies from business to business, but generally includes the following steps:

🔹 Gather data

Collect all the relevant financial documents and records, such as bank statements, invoices, receipts, and the records in the accounting system. You will use this data to verify the accuracy of the payments.

🔹 Match transactions

Compare the records from the bank statements with the entries in the accounting system. Ensure that the dates, amounts, and descriptions of the transactions match.

🔹 Identify discrepancies

During the matching process, you might find transactions that don’t align. These discrepancies might come from differences in timing, errors, or fraud. Make a list of these discrepancies for further investigation.

🔹 Resolve discrepancies

Investigate the discrepancies to determine their causes. This could involve contacting the issuing bank, checking the original transaction documents, or reviewing the accounting entries. Once you have identified the reasons for the discrepancies, make the necessary corrections or adjustments in the accounting records.

🔹 Record adjustments

Sometimes, you may find that certain transactions are recorded incorrectly in the accounting system or are missing entirely. Record any adjustments needed to reconcile the account, such as bank fees, interest earned, or correcting errors.

🔹 Verify balances

After you have made all the adjustments, verify that the adjusted balance in the accounting records matches the ending balance on the bank statement.

🔹 Document the process

Curated News

💳 Payments

Stripe Unveils Agentic Commerce Suite for AI-Driven Sales

Stripe has launched a new Agentic Commerce Suite designed to let AI agents discover products, negotiate, and complete transactions autonomously. The move positions Stripe at the center of emerging AI-native commerce workflows.

Source

Ottu and Mastercard Partner to Accelerate Digital Commerce in the GCC

Ottu has signed a strategic partnership with Mastercard to support digital commerce growth across the GCC. The collaboration focuses on improving payment orchestration and merchant acceptance in the region.

Source

Square Tests Cash Rounding as Penny Production Ends

Square is piloting cash-rounding functionality in response to the end of penny production. The update aims to help merchants handle cash transactions smoothly without operational disruption.

Source

🏦 Banking

Monzo Acquires Habito to Strengthen Mortgage Offering

Monzo has acquired mortgage broker Habito, deepening its push into home finance. The deal supports Monzo’s ambition to become a primary bank for its customers.

Source

Starling Bank Expands SaaS Unit Engine With New HQ

Starling is embarking on a hiring spree as its SaaS arm, Engine, moves into a new headquarters. The expansion highlights growing demand for banking-as-a-service platforms.

Source

🧠 Fintech

Klarna Launches Open Standard for Agentic Commerce

Klarna has introduced an open standard to make products discoverable by AI agents. This positions Klarna at the forefront of AI-led shopping and next-generation commerce.

Source

Informed.IQ Raises $63M to Scale AI Loan Verification

Informed.IQ has secured $63 million to expand its AI-powered loan verification tools. The funding reflects rising demand for automation in credit and mortgage processes.

Source

CapRelease Secures $36M to Expand Home Equity Solutions

CapRelease has raised $36 million in combined debt and equity financing. The capital will support growth in alternative home equity products.

Source

🪙 Crypto

RedotPay Raises $107M in Series B to Scale Crypto Payments

Hong Kong-based RedotPay has closed a $107 million Series B round. The funding will support global expansion of its crypto payments platform.

Source

Exodus Joins PayPal in Launching USD Stablecoin

Crypto wallet Exodus has launched a USD-backed stablecoin, following PayPal’s move into the space. The development highlights growing competition in regulated stablecoins.

Source

Tether Backs Stablecoin Payments Firm Speed in $8M Round

Tether has invested in Speed, a stablecoin payments startup. The deal reinforces Tether’s push into real-world payment use cases.

Source

Visa Launches Stablecoin Settlement for US Banks

Visa has introduced stablecoin settlement capabilities for US banks, marking a major step toward blockchain-based payments. The move signals increasing institutional adoption of stablecoins.

Source

FTC Orders Nomad Operator to Repay Users After $186M Hack

The FTC has compelled the operator of Nomad to repay users following a $186 million crypto bridge hack in 2022. The case sets a precedent for consumer protection in crypto.

Source

Bitcoin Treasury Firm KindlyMD Faces Nasdaq Delisting

KindlyMD is at risk of Nasdaq delisting after its stock fell 99%. The situation underscores volatility and governance risks in crypto-linked public companies.

Source

📈 WealthTech

Duco and Phoenix Group Modernise Asset Management Data

Duco has partnered with Phoenix Group to modernise data reconciliation across asset management operations. The collaboration aims to improve efficiency and data accuracy.

Source

📜 Regulation

FCA Confirms Commercial VRP Scheme for 2025

The UK’s FCA has announced that a commercial Variable Recurring Payments scheme will launch in 2025. This is a major milestone for open banking-powered payments.

Source

Aspire Hits Key Regulatory Milestones Across Australia, EU and US

Aspire has announced major regulatory approvals supporting its global expansion. The milestones strengthen its position as a cross-border fintech platform.

Source

🧩 Other

AMINA Bank Launches Web3-Native Partnership Programme

AMINA Bank has unveiled a Web3-focused partnership programme connecting startups with 17 specialist partners. The initiative aims to accelerate institutional adoption of digital assets.

Source

Sutherland and ComplyAdvantage Launch AI-Native FinCrime Platform

Sutherland and ComplyAdvantage have introduced a unified, AI-native financial crime compliance solution. The platform targets increasingly sophisticated fraud and AML threats.

Source

Equifax Launches Tools to Support Motor Finance Redress

Equifax has introduced new solutions to help lenders manage motor finance redress requirements. The tools aim to reduce compliance risk and operational complexity.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.