PayPal Wallet Comes to ChatGPT

PayPal has integrated its digital wallet directly into ChatGPT, allowing users to manage payments, check balances, and complete transactions without leaving the chatbot interface. This marks a major milestone in blending conversational AI with fintech, making financial interactions more seamless and intuitive. Users can now use ChatGPT for real-time payment actions through PayPal, reflecting the deepening partnership between AI platforms and financial services. The move positions ChatGPT as an emerging fintech assistant capable of managing personal finances. It also opens new possibilities for embedded finance and conversational commerce.

Video of the Day

Insight of the Day

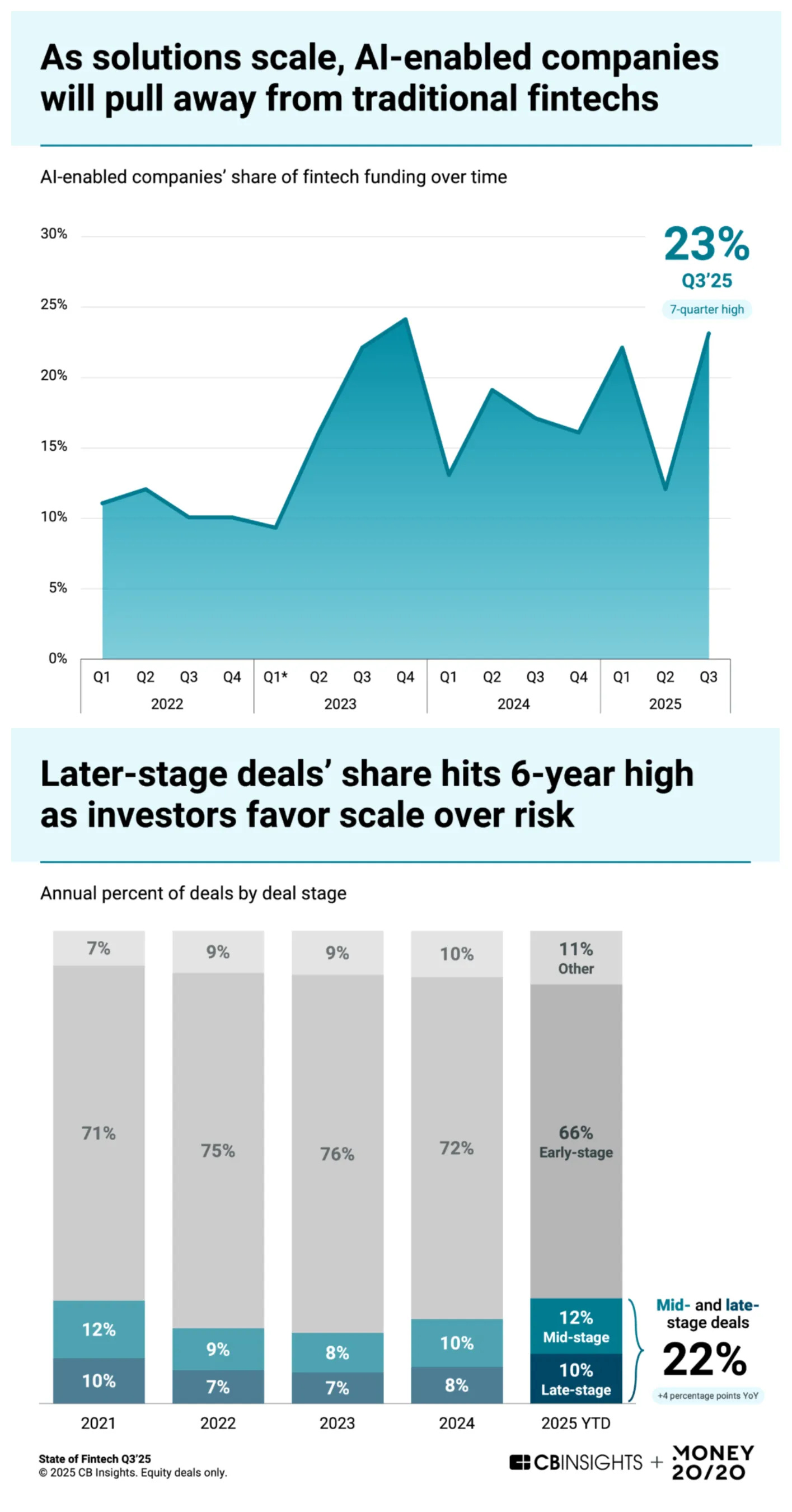

AI-powered fintechs on the rise in Q3 25 funding rounds

✅ AI captures nearly one-quarter of fintech funding as agentic solutions gain market traction

Among the largest deals in Q3’25 were rounds for AI-powered fintechs, highlighting the growing role of autonomous solutions in finance and creating a new competitive tier in fintech. AI-enabled fintechs captured 23% of Q3’25 fintech funding, the highest share since Q4’23.

Five of the 10 largest fintech equity deals went to companies heavily deploying AI in their solutions. Ramp raised a $500M Series E-II just 45 days after its initial Series E in June 2025, as it launched hundreds of AI-powered tools and its first AI agents. AppZen, which builds AI agents for financial operations with its proprietary LLM, also raised a $180M Series D round.

AI-enabled companies’ share of fintech deals remained steady at 17% in both Q2 and Q3’25, reflecting investors’ focus on proven autonomous capabilities.

✅ Investors shift to more established fintechs

Investors are also prioritizing investments in more mature fintechs in 2025, signaling a structural reset in risk appetite.

Mid- and late-stage companies have captured 22% of all deals YTD, the highest concentration since 2021. Median deal sizes YTD for mid- and late-stage deals have also increased vs. 2024, by 16% and 50%, respectively.

In contrast, early-stage deals now make up less than two-thirds (66%) of total activity, the first dip below 70% since 2020. The shift reflects a strategic pivot toward companies with established business models and clearer paths to scale.

The largest mid- and late-stage rounds went to companies with proven scale, predictable growth, and measurable efficiency gains. In addition to the large late-stage rounds for Ramp and AppZen, investors concentrated on financial operations solutions, including automated accounts payable (Xelix), small business financial management (Hala, Uzum), and ERP solutions (Omie).

Curated News

💳 Payments

Venmo & Bilt Redefine Rent and Mortgage Payments

Venmo and Bilt have announced a first-of-its-kind partnership enabling users to pay rent and mortgage directly through Venmo. The collaboration bridges social payments with housing finance, expanding Venmo’s role in major recurring transactions.

Source

Unlimit Adds Apple Pay Disbursements to Its Platform

Unlimit now supports Apple Pay for disbursements, allowing faster, more secure digital payouts to users. This integration enhances user convenience and supports fintechs offering streamlined, mobile-first payment experiences.

Source

BBVA Expands Cash Deposit Feature with Paysafe

BBVA customers can now deposit and withdraw cash while shopping, thanks to a partnership with Paysafe. The initiative bridges online banking and physical retail, making banking services more accessible in everyday settings.

Source

NMI Unveils Developer-First Payments Environment

NMI has launched a new developer-focused environment for embedding payments into SaaS platforms. This tool simplifies integration for software providers, promoting innovation in embedded payments.

Source

Citi & Coinbase Partner to Expand Digital Asset Payments

Citi and Coinbase are joining forces to enhance cross-border and institutional digital asset payments. The collaboration aims to merge traditional banking infrastructure with crypto capabilities for global clients.

Source

Paytently Secures EU Payment Licence

Paytently has received its Payment Institution (PI) licence from the Malta Financial Services Authority, enabling it to expand regulated operations across Europe. This milestone strengthens its compliance and cross-border service offerings.

Source

🏦 Banking

Barclays to Acquire Best Egg for $800M

Barclays announced plans to acquire Best Egg, a leading digital lending platform, for $800 million. The deal underscores traditional banks’ growing interest in fintech-driven consumer finance solutions.

Source

Starling Bank Launches AI Tool to Fight Scams

Starling Bank has rolled out the UK’s first AI-powered scam detection tool, designed to identify fraudulent transactions in real time. The technology strengthens consumer protection and enhances digital trust in banking.

Source

Regulator Warns Australian Banks on Tech Risks

Australian regulators have cautioned banks to strengthen oversight of technology and cybersecurity risks. The warning follows increased reliance on digital infrastructure across financial institutions.

Source

💡Fintech

Tabby Completes Secondary Share Sale

Middle East fintech Tabby completed a secondary share sale, giving early investors an exit opportunity while reaffirming the company’s strong valuation. The move signals continued confidence in regional fintech growth.

Source

FundPark Raises $71M for AI-Powered Lending Platform

Hong Kong-based FundPark secured $71 million in fresh funding to expand its AI-driven lending services for SMEs. The financing will accelerate its mission to automate risk assessment and working capital solutions.

Source

Thredd Partners with LoanPro to Enter Credit Market

Payment processor Thredd is entering the credit space via a partnership with LoanPro. The collaboration will enable Thredd to offer embedded credit products and expand its product suite.

Source

Flagright Powers Webull’s Real-Time AML Compliance

Flagright has been chosen by Webull to enhance transaction monitoring and AML compliance through real-time AI-driven analytics. The partnership reinforces Webull’s regulatory and fraud prevention capabilities.

Source

Bottomline Introduces Embedded AI for Treasury Management

Bottomline announced an embedded AI agent designed to optimize treasury and cash management. The innovation helps finance teams automate workflows and improve decision-making across global enterprises.

Source

🪙 Crypto

Western Union to Launch USDPT Stablecoin on Solana

Western Union revealed plans to issue its own stablecoin, USDPT, on the Solana blockchain by mid-2026. The move signals a major shift by a global remittance leader toward blockchain-based payments.

Source

ClearBank & Circle Partner on Regulated Stablecoin Payments

ClearBank and Circle are teaming up to enable regulated stablecoin payments in the UK. The collaboration aims to bridge the gap between traditional finance and blockchain infrastructure.

Source

KR1 Eyes Public Listing on London Stock Exchange

UK crypto investment firm KR1 is exploring a public listing on the London Stock Exchange. A successful IPO would mark a milestone for digital asset firms seeking mainstream capital market access.

Source

DeepSeek and Qwen Triumph in AI Crypto Trading Challenge

AI firms DeepSeek and Qwen outperformed U.S. rivals in a global crypto trading competition, highlighting Asia’s growing dominance in AI-driven digital asset trading strategies.

Source

📱 Other

ChatGPT Go Launches in Brazil with Nubank Partnership

OpenAI has launched ChatGPT Go in Brazil through a partnership with Nubank, offering exclusive AI-driven benefits to the bank’s customers. The collaboration deepens ties between AI services and digital banking ecosystems.

Source

UK Payments Industry Criticizes Regulatory Overhaul

Industry leaders in the UK payments sector have expressed concern that the government’s latest regulatory reforms are more of a reshuffle than substantive change. They warn that the update may not adequately support innovation or competition.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.