PayPal’s Crypto Partner Accidentally Mints $300 Trillion in Stablecoins

PayPal’s crypto partner mistakenly minted $300 trillion worth of stablecoins due to a “technical error,” temporarily flooding the blockchain with excessive tokens before being swiftly corrected. The incident sparked widespread debate over the security and auditability of automated minting systems, especially for large financial platforms like PayPal. While no customer funds were impacted, the event underscores the fragile balance between innovation and oversight in digital payments. Experts note it may prompt stricter controls for fintechs issuing or managing digital assets. PayPal and its partner have pledged to enhance transparency and operational safeguards.

Insight of the Day

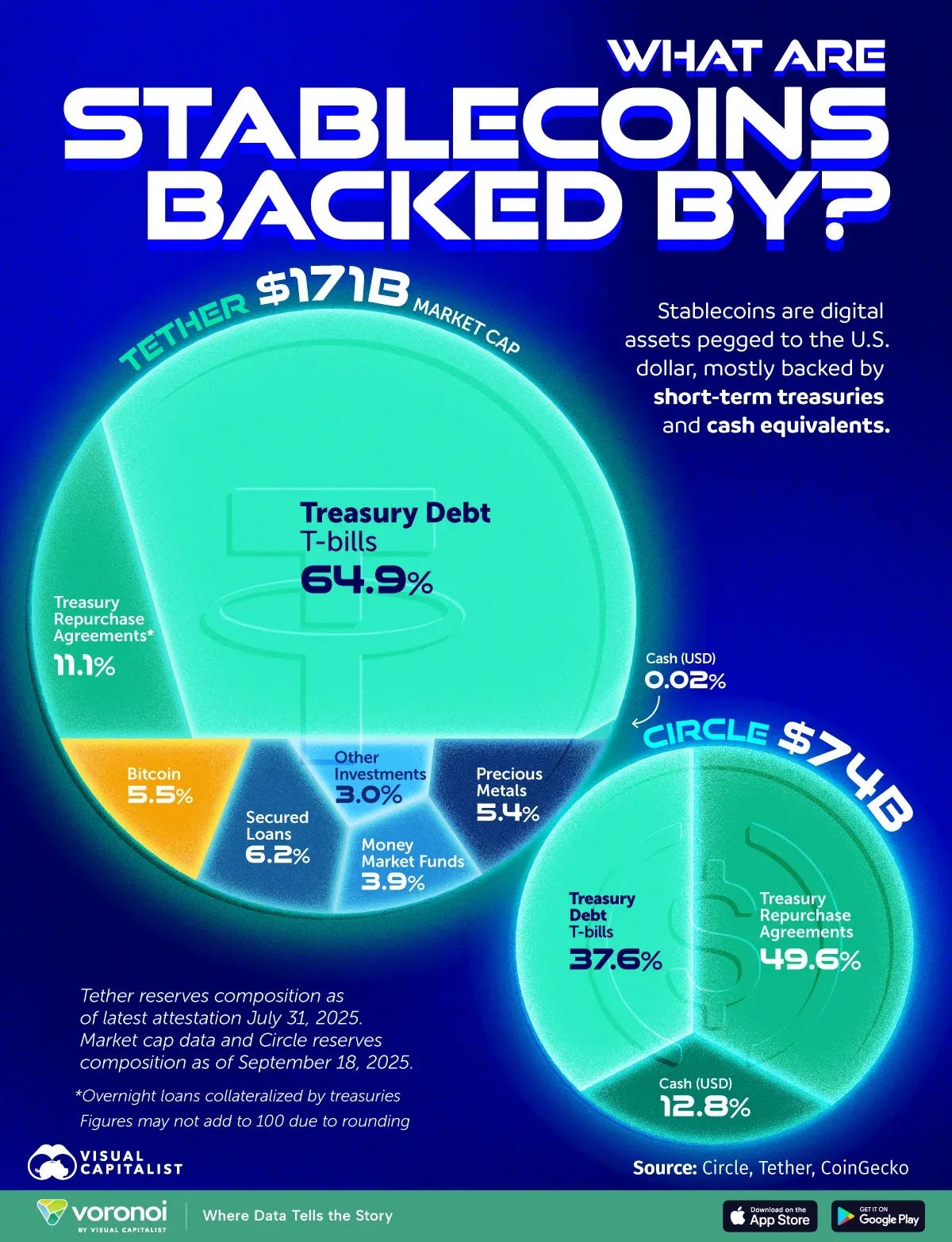

What Are Stablecoins Backed By?

Stablecoins have quietly become one of the most important pillars of digital finance. They promise the best of both worlds — the stability of fiat money and the efficiency of blockchain. But have you ever wondered what actually backs those billions of “stable” tokens moving across crypto markets every day?

Let’s take a look behind the curtain.

👉 The Big Two: Tether and Circle

Today, two issuers dominate the stablecoin landscape: Tether (USDT) and Circle (USDC). Together, they hold over $240 billion in market value, representing the backbone of most on-chain liquidity.

Tether leads with a $171B market cap, while Circle’s USDC follows at $74B. Both are pegged 1:1 to the U.S. dollar — but their backing structures tell two different stories about how “stability” is managed in crypto.

💼 What’s Behind the Peg?

According to Visual Capitalist’s latest data, most stablecoins today are backed by short-term U.S. Treasury bills (T-bills) and cash equivalents, which are highly liquid and low-risk.

Here’s the breakdown:

✅ Tether (USDT)

🔹 64.9% Treasury Debt (T-bills)

🔹 11.1% Treasury Repurchase Agreements

🔹 6.2% Secured Loans

🔹 5.5% Bitcoin

🔹 5.4% Precious Metals

🔹 3.9% Money Market Funds

🔹 3.0% Other Investments

🔹 0.02% Cash

Curated News

💳 Payments

Mesh Expands into Canada with Peoples Trust Partnership

Mesh has partnered with Peoples Trust to offer seamless digital payment services in Canada. The move enhances Mesh’s reach and aligns with growing demand for efficient B2B and travel payment solutions in North America.

Source

TCPB Pay Launches New App to Streamline Digital Payments

TCPB Pay has introduced a new mobile app aimed at simplifying transactions and enhancing customer experience through improved interface and security features. The app marks a key step in the company’s push to modernize its payments ecosystem.

Source

UATP and Burbank Bring Card-Present Payments to Airline Merchants

UATP has partnered with Burbank to roll out its innovative “Card-Present Over Internet®” solution, enabling airlines to accept in-person payments remotely. This technology aims to reduce fraud while expanding flexible payment options for the travel sector.

Source

🏦 Banking

First Internet Bank Adopts AI Loan System from Parlay Finance

First Internet Bank has integrated Parlay Finance’s AI-native loan intelligence system to optimize lending operations and risk management. The partnership exemplifies banks’ growing embrace of AI to streamline decision-making and enhance underwriting accuracy.

Source

Nymbus Recognized for Innovation in Core Banking Technology

Nymbus has been named a finalist for four major awards celebrating its next-gen core banking platform. The recognition highlights its role in driving digital transformation among regional and community banks.

Source

NCR Atleos Publishes White Paper on Utility ATM Networks

NCR Atleos released a white paper exploring the concept of utility ATM networks and their potential to improve efficiency and resilience across financial institutions. The report advocates for shared infrastructure as a cost-effective strategy for banks.

Source

💰 Fintech

Mexican Fintech Plata Raises $250M, Hits $3.1B Valuation

Plata secured $250 million in funding, pushing its valuation to $3.1 billion. The capital will fuel product expansion and regional growth, cementing its position as a leading Latin American fintech innovator.

Source

Bees & Bears Raises €5M to Expand Embedded Finance Platform

Berlin-based Bees & Bears raised €5 million to scale its embedded finance infrastructure, helping non-financial companies integrate financial products directly into their platforms. The startup targets SMEs looking to streamline financial services delivery.

Source

Crescent Enterprises Commits $68M to Grow Venture Arm

UAE-based Crescent Enterprises is investing $68 million to expand its venture arm focused on tech and sustainability-driven startups. The move reinforces the Gulf’s growing appetite for fintech and digital economy investments.

Source

$1.8B Raised Across 32 Fintech Investment Rounds

This week saw $1.8 billion raised across 32 funding rounds, signaling strong investor confidence in the fintech sector. The diverse funding spread underscores continued momentum in digital finance innovation worldwide.

Source

🪙 Crypto

Coinbase Launches Stablecoin Payments Platform for B2B

Coinbase has introduced a B2B payments platform powered by stablecoins, enabling faster, cheaper cross-border transactions for businesses. The move strengthens Coinbase’s presence in corporate crypto payments and challenges traditional rails.

Source

Stripe’s Tempo Blockchain Raises $500M, Recruits Ethereum Developer

Stripe’s blockchain spinoff Tempo secured $500 million in funding and hired a prominent Ethereum developer to boost its infrastructure. The move signals Stripe’s ambition to become a major player in blockchain-based payments.

Source

BingX Earns ISO 27001 Certification for Web3 Security

Crypto exchange BingX achieved ISO 27001 certification, marking a milestone in Web3 security standards. The certification reinforces its commitment to data protection and user trust amid tightening global regulations.

Source

💼 WealthTech

Aboon Raises $17.5M to Launch AI-Powered 401(k) Platform

Aboon secured $17.5 million in funding to launch an AI-driven 401(k) platform for financial advisors. The tool aims to enhance retirement planning efficiency through automation and personalized investment strategies.

Source

RedBlack Unveils New Cash Management Features

Wealth management firm RedBlack launched advanced cash management tools designed to improve liquidity and portfolio efficiency. The new capabilities target institutional clients seeking more sophisticated financial oversight.

Source

⚖️ Regulation

Romance Scams Cost UK Victims £108M in 2024

A new report revealed UK residents lost £108 million to romance scams in 2024, underscoring the ongoing need for stronger consumer protection and fraud prevention frameworks in digital finance.

Source

📈 Other

Ripple Acquires GTreasury for $1B to Enter Corporate Treasury Sector

Ripple is acquiring GTreasury for $1 billion, marking its entry into the corporate treasury space. The deal highlights Ripple’s strategy to expand beyond crypto payments and become a comprehensive financial technology provider.

Source

Hong Kong IPO Market Poised for Surge with 200+ Listings Planned

Over 200 companies are preparing to list in Hong Kong, signaling renewed investor confidence and regional capital market recovery. Analysts expect fintechs and digital firms to be among the most active sectors.

Source

Socure and DocuSign Partner to Secure Digital Signatures

Socure has teamed up with DocuSign to enhance identity verification for e-signatures, offering a more secure and frictionless signing process. The integration aims to reduce fraud while improving compliance for enterprises.

Source

Resilience Expands E&O Coverage for Tech Firms

Cyber insurance provider Resilience has expanded its Errors & Omissions coverage for technology companies with over $25 million in annual revenue. The new coverage reflects rising demand for robust digital risk protection.

Source

Creditstar Secures $10M Funding Agreement to Expand in Europe

Creditstar Group signed a $10 million funding limit agreement with Kilde to fuel its European expansion. The partnership supports the company’s growth in consumer lending and alternative finance markets.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.