Polygon Labs Launches $250M Stablecoin Payments Push with Coinme and Sequence Acquisitions

Polygon Labs announced plans to acquire Coinme and Sequence as part of a $250 million strategy to accelerate stablecoin-based payments. The move significantly strengthens Polygon’s payments stack by improving fiat on- and off-ramps alongside developer infrastructure. It signals growing confidence in stablecoins as a mainstream payments rail rather than a niche crypto use case. The acquisitions also position Polygon to compete more directly with traditional payment networks and fintechs. For enterprises, the push lowers barriers to integrating blockchain-based payments at scale. Overall, the deal highlights how infrastructure players are consolidating to capture the next phase of digital payments growth.

Video of the Day

Insight of the Day

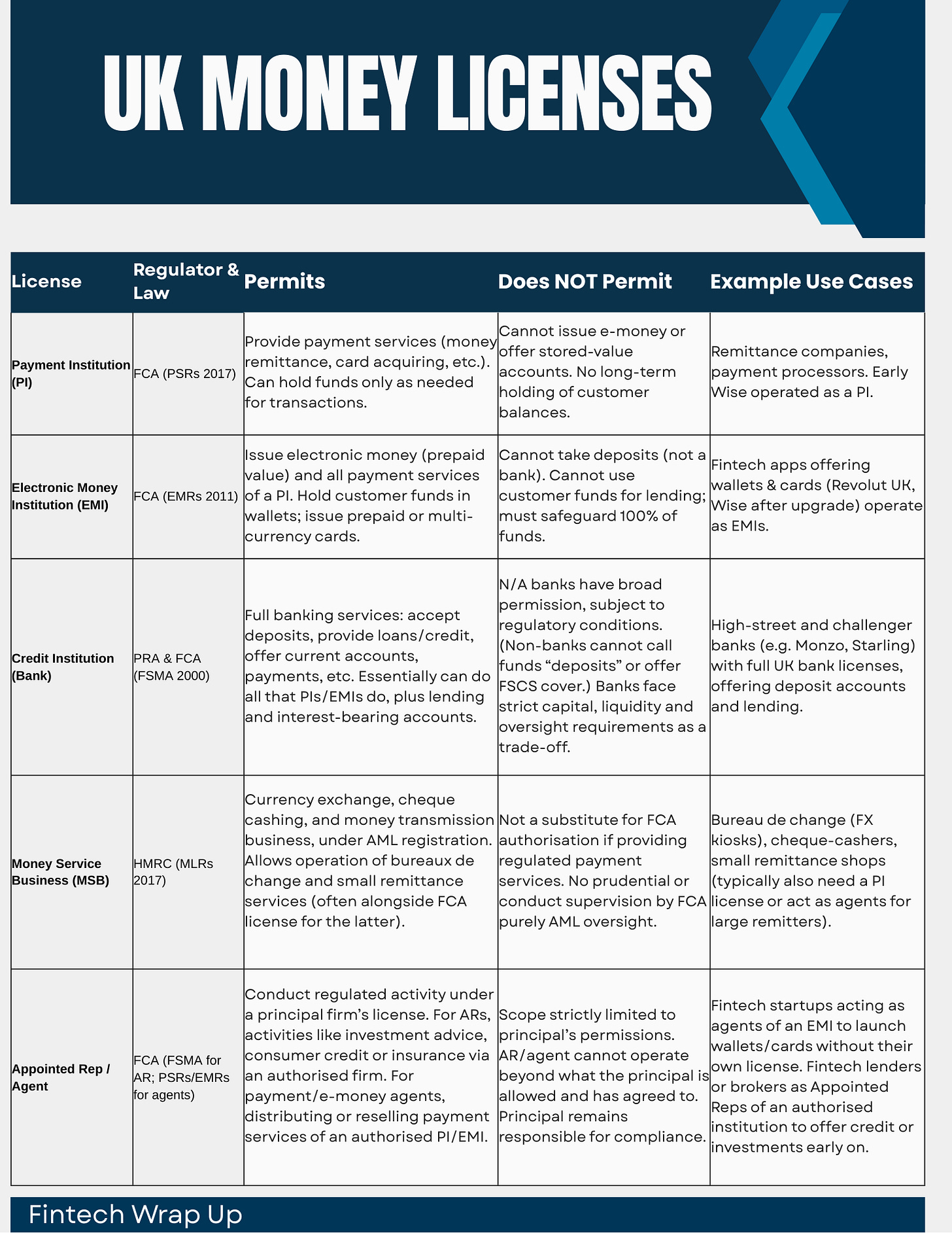

𝐒𝐭𝐫𝐮𝐜𝐭𝐮𝐫𝐢𝐧𝐠 𝐘𝐨𝐮𝐫 𝐔𝐊 𝐋𝐢𝐜𝐞𝐧𝐬𝐞 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐲

Choosing the right license in the UK comes down to the scope of services you want to offer and the stage of your company. I think of it in layers of increasing capability (and complexity):

____

If you just need to move money A-to-B (payments, transfers) and not store value, a Payment Institution license is often sufficient and more attainable. It’s the lightweight option for pure payments players.

____

If you want to hold customer funds (wallets, prepaid accounts) but not do lending, an Electronic Money Institution gives you that power, bridging some of the gap with banking while staying asset-light. This has become the sweet spot for many fintech startups offering “bank-like” apps without being banks.

____

If you require full financial intermediation (taking deposits, lending, full banking services), only a Banking license truly unlocks that. It’s a longer journey with heavy compliance, but necessary for traditional banking models and for customer trust at scale (FSCS protection, etc.).

____

For niche or small-scale money services (currency exchange, etc.): MSB registration covers the AML duties, but often you’ll pair it with a PI license if you’re also transmitting money. It’s a narrower consideration, mostly about compliance if your business handles physical or FX cash transactions.

____

For crypto ventures, the cryptoasset registration is now a gatekeeper for UK market entry. It doesn’t give consumer-facing regulatory imprimatur, but it’s non-negotiable for legality. I’d treat it as one piece of the puzzle. Many crypto firms also end up getting an e-money or investment license down the line as their offerings expand, but AML registration is step one.

____

When in doubt or early on, the Appointed Rep/agent model can be a lifesaver. It allows you to operate and learn under another’s wing. Use this to test the waters or launch faster, but plan your longer-term move to direct authorization if you succeed. It’s essentially renting a license versus owning one.

____

Ultimately, regulatory strategy in fintech is about aligning your license with your product roadmap. Starting simple and upgrading as needed is a common approach, just as Wise and Revolut did (from PI to EMI to, potentially, bank). But skipping necessary licensing can kill a business (operating without the right permissions can lead to shutdowns or customer distrust). So you focus on the structural capabilities each regime offers and pick the one that covers my needs with the least overhead, while keeping an eye on future requirements as you scale. Clarity on these UK license types helps me make confident, first-principles decisions about how to build and grow a compliant fintech product.

Curated News

💳 Payments

Klearly Secures €12M to Modernize Restaurant Payments

Klearly raised €12 million to expand its payments platform tailored for the restaurant industry. The funding will support product development and international expansion as hospitality businesses seek more integrated payment and reconciliation tools.

Source

Noah and NALA Partner on Stablecoin Cross-Border Payments

Noah and NALA have partnered to enable stablecoin-based cross-border payments focused on emerging markets. The collaboration aims to reduce transaction costs and settlement times compared with traditional remittance rails.

Source

Ant International Hits 2 Billion Payments in Emerging Markets

Ant International processed two billion payments across emerging markets, driven by AI-enabled risk and fraud tools. The milestone highlights the scale and maturity of digital payments infrastructure in developing economies.

Source

Paysecure Reports Five-Fold Merchant Growth Ahead of 2026 Push

Paysecure announced a five-fold increase in merchants and outlined aggressive growth plans for 2026. The company is capitalizing on rising demand for secure, scalable payment solutions among SMEs.

Source

🏦 Banking

Indian Banks Plan Large-Scale ATM Expansion

Indian banks are preparing a major expansion of ATM networks to improve nationwide cash access. The initiative reflects the continued importance of physical banking infrastructure alongside rapid digital adoption.

Source

Nationwide Launches AI Platform for Granular Spending Insights

Nationwide unveiled an AI-driven platform offering detailed customer spending insights. The tool is designed to improve personalization, financial wellbeing services, and internal analytics.

Source

Revolut Adds Call Identification to Fight Impersonation Scams

Revolut introduced call identification features to help customers verify legitimate bank communications. The move targets rising impersonation and social engineering fraud risks.

Source

📈 WealthTech

iAltA Expands Wealth Infrastructure with BridgeFT Acquisition

iAltA acquired BridgeFT to enhance its wealth management infrastructure capabilities. The deal strengthens portfolio reporting and data connectivity for advisers and institutions.

Source

🪙 Crypto

ClearBank Partners with Taurus for Stablecoin Custody

ClearBank selected crypto custody firm Taurus to support upcoming stablecoin services. The partnership signals deeper integration of digital assets within regulated banking frameworks.

Source

Coincheck to Buy Digital Asset Manager 3iQ

Japanese crypto exchange Coincheck announced plans to acquire digital asset manager 3iQ. The move reflects ongoing consolidation as exchanges expand into regulated asset management.

Source

Kraken-Linked SPAC Eyes $250M US IPO

A SPAC linked to Kraken is targeting a $250 million US public listing. The deal highlights renewed momentum for crypto-related capital markets activity.

Source

BNB Chain to Gain 40% Speed Boost with Fermi Upgrade

BNB Chain announced its upcoming Fermi upgrade, promising a 40% performance improvement. The upgrade aims to support higher throughput for DeFi and on-chain applications.

Source

⚖️ Regulation

Payments Association Urges Bank of England to Ease Stablecoin Stance

The Payments Association has urged the Bank of England to reconsider its approach to stablecoins. Industry leaders warn restrictive policies could push innovation offshore.

Source

Korbit Fined $2M for AML Violations

South Korean crypto exchange Korbit accepted a $2 million fine for anti-money laundering failures. The case highlights intensifying regulatory scrutiny of crypto platforms.

Source

South Korean Crypto Exchanges Push Back on Ownership Caps

Major South Korean exchanges are opposing proposed ownership cap regulations. They argue the measures could restrict competitiveness and foreign investment.

Source

EMEA Accounts for Half of Global AML Fines

Regulatory findings show EMEA accounted for 50% of global AML fines as long-running probes concluded. The data underscores sustained enforcement pressure across the region.

Source

🧩 Other

LSEG Launches Trade Surveillance to Detect Financial Crime

LSEG introduced a new trade surveillance solution to help firms identify market abuse and financial crime. The tool applies advanced analytics across multiple asset classes.

Source

martini.ai Enhances Credit Research with Unified AI Assistant

martini.ai expanded its AI assistant to unify document upload and credit research workflows. The update streamlines analysis for credit and risk teams.

Source

Rimes Expands Data and Analytics via Strategic Partnerships

Rimes announced partnerships with PANTA, BMLL, and Ortec Finance to strengthen its end-to-end analytics offering. The move broadens coverage across benchmarks, risk, and performance data.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.