Prove launches ProveX, the Internet’s First Digital Trust Exchange

Prove has debuted ProveX, a new digital trust exchange that aims to standardize identity verification and authentication across the internet. The platform is positioned to reduce fraud and streamline onboarding by allowing entities to validate users through shared trust signals rather than redundant checks. This launch is significant amid rising fraud costs and emerging regulatory scrutiny in digital identity. For fintechs, ProveX could accelerate KYC/AML workflows while enhancing customer experience. Its exchange model suggests a shift toward cooperative identity infrastructure versus siloed systems. If successful, ProveX may become a foundational layer for digital identity in banking, payments, and Web3 ecosystems.

Video of the Day

Insight of the Day

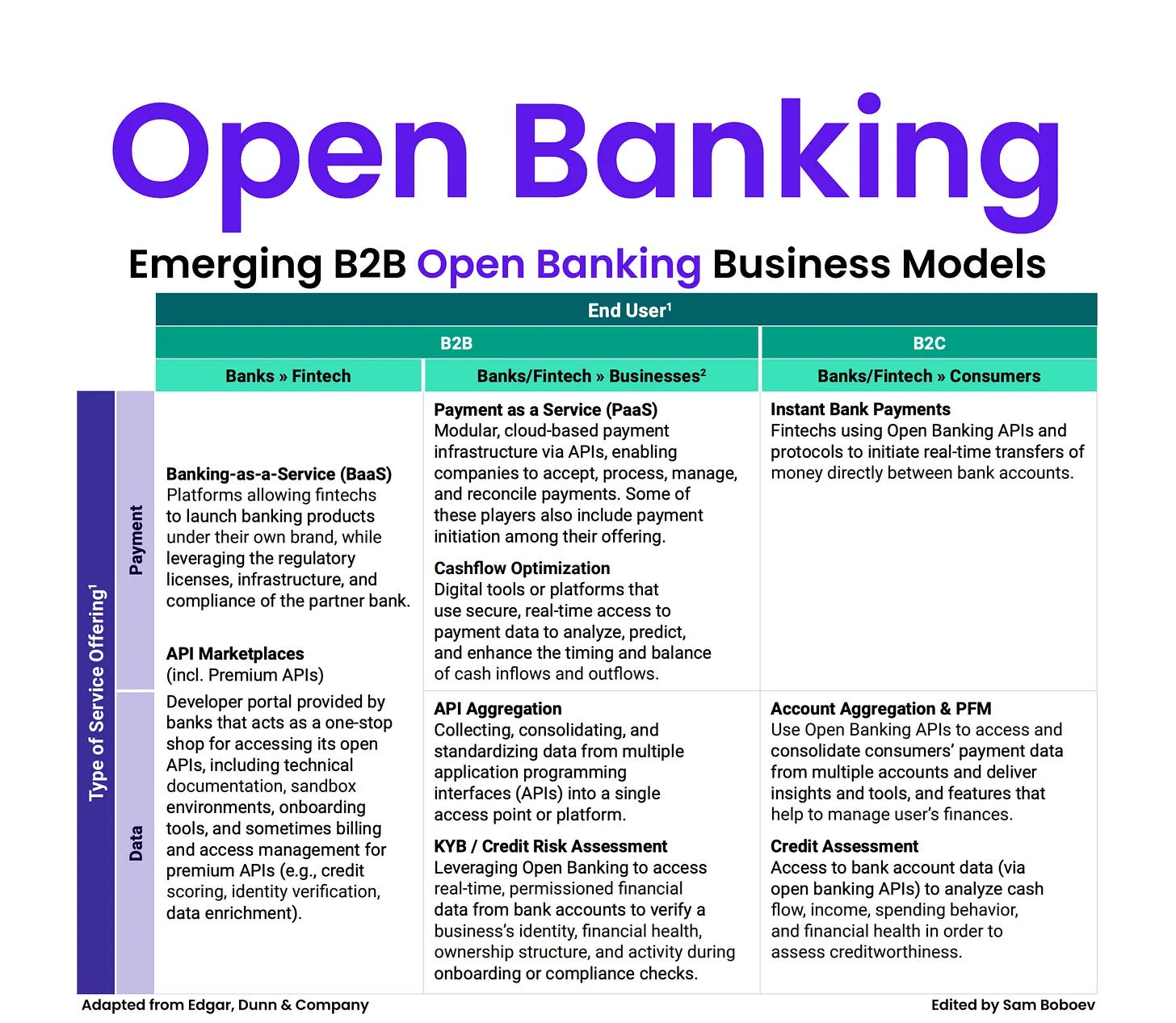

𝐄𝐦𝐞𝐫𝐠𝐢𝐧𝐠 𝐎𝐩𝐞𝐧 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐌𝐨𝐧𝐞𝐭𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐌𝐨𝐝𝐞𝐥𝐬

The B2C side is still a tough market. Consumers do not want to pay for services powered by Open Banking, and that makes it difficult for providers to build sustainable revenue models.

The momentum is happening in B2B. Businesses value better data, faster onboarding, and improved risk intelligence. They are willing to pay for tools that solve operational problems. This is why we are seeing a rise in new Agents beyond traditional TPPs and why banks are expanding their API catalog far beyond what regulation requires.

____

Here is the shift I am seeing.

🔹 𝐁𝐚𝐧𝐤𝐬 𝐚𝐫𝐞 𝐭𝐮𝐫𝐧𝐢𝐧𝐠 𝐀𝐏𝐈𝐬 𝐢𝐧𝐭𝐨 𝐫𝐞𝐯𝐞𝐧𝐮𝐞 𝐥𝐢𝐧𝐞𝐬

Banks are opening up premium APIs that go beyond simple account access. Credit scoring, identity verification, data enrichment and other value-added streams are becoming commercial products. The logic is simple. Banks already hold rich consumer data. The question now is how to package it in a way that businesses will pay for.

____

🔹 𝐁𝟐𝐁 𝐮𝐬𝐞 𝐜𝐚𝐬𝐞𝐬 𝐚𝐫𝐞 𝐬𝐜𝐚𝐥𝐢𝐧𝐠 𝐟𝐚𝐬𝐭𝐞𝐫 𝐭𝐡𝐚𝐧 𝐁𝟐𝐂

This is where the real commercial opportunity sits. Business customers adopt Open Banking tools when these tools reduce cost, reduce fraud or increase revenue. Some of the strongest traction is in:

• KYB and credit risk assessment

• API marketplaces and premium data access

• Payment as a Service platforms

• Cashflow analytics and optimization

• Real time account to account payments

🔹 𝐀𝐠𝐠𝐫𝐞𝐠𝐚𝐭𝐨𝐫𝐬 𝐚𝐧𝐝 𝐢𝐧𝐟𝐫𝐚𝐬𝐭𝐫𝐮𝐜𝐭𝐮𝐫𝐞 𝐩𝐥𝐚𝐲𝐞𝐫𝐬 𝐚𝐫𝐞 𝐛𝐞𝐜𝐨𝐦𝐢𝐧𝐠 𝐭𝐡𝐞 𝐧𝐞𝐰 𝐫𝐚𝐢𝐥𝐬

Aggregation platforms that standardize access to hundreds of bank APIs are positioning themselves as the foundational layer for fintechs. This makes it easier to build products that leverage payment data, identity data and transaction insights.

The takeaway for me. Open Banking is moving out of its early experimental phase and into a period where monetization is driven by real business outcomes. The winners will be the companies that build on top of bank grade data to solve onboarding, payments, and risk problems for businesses at scale.

If you are building in this space, this is a good moment to rethink where your revenue engine actually sits.

Curated News

💳 Payments

Equals Money and Okta Partner on AI-Secure Payments

Equals Money has partnered with Okta to embed identity and AI threat protection directly into payments authentication flows. The collaboration aims to reduce payment fraud and elevate security standards for enterprise clients.

Source

Vroozi Named to Q4 2025 AP Invoice Automation Landscape

Vroozi has been recognized for its accounts payable automation capabilities, signaling momentum in B2B payments and procurement tech. The listing highlights expanding enterprise adoption of invoice automation tools.

Source

iDenfy Rolls Out Shopify App for E-Commerce KYC

iDenfy has launched a Shopify App Store product designed to simplify merchant identity checks and compliance for online sellers. This integration caters to rising fraud pressures in retail payments.

Source

🏦 Banking

ING Finances £170m Green Upgrade at 40 Holborn Viaduct

ING is backing a major sustainability-focused transformation of a central London commercial asset, marking another step in green lending. The funding aligns with institutional ESG mandates shaping European credit markets.

Source

BankUnited Declares Quarterly Dividend

BankUnited confirmed its latest dividend distribution to shareholders, reinforcing its capital position and returning value amid stable operating performance.

Source

Westaim Corporation Launches Share Buyback Program

Westaim has initiated a normal course issuer bid to repurchase outstanding shares, signaling management confidence and a capital return strategy.

Source

🧠 Fintech

Pendo Launches Agent Analytics for Customer Experience Optimization

Pendo’s new GA release offers analytics on how users engage with support agents, blending product telemetry with service insights. This reflects growing convergence between CX tooling and core revenue operations.

Source

LexisNexis IDVerse Updates for Deepfake Detection

The latest IDVerse upgrade includes enhanced document checks and emerging threat detection, specifically deepfake identification. This is timely given AI-driven fraud escalation across onboarding pipelines.

Source

Credas and Dezrez Execute First Property Compliance Wallet Deal

A new compliance wallet process has been tested in the property market, demonstrating faster, shared KYC for real estate transactions. The milestone suggests potential for broader adoption in regulated sectors.

Source

🪙 Crypto

CoinJar Enters U.S. with AI-Enabled Regulated Exchange

CoinJar has expanded into the U.S. market, debuting compliance-first digital asset services supported by AI tooling. This reflects renewed appetite for institutional-grade crypto infrastructure.

Source

TRON Integrates with Base, Expanding TRX Access via Coinbase

TRON’s integration with Base enables direct access to TRX on Coinbase, broadening liquidity and user access. This could catalyze transactional use of TRX through a mainstream on-ramp.

Source

BVNK Debuts Smart Treasury for Automated Stablecoin Workflows

The new treasury product automates real-time stablecoin settlements and treasury operations, targeting corporates with cross-border needs. It positions BVNK to compete in institutional digital asset finance.

Source

Crypto.com Hires Sports Market Maker for Prediction Market

Crypto.com is building out its prediction market capabilities with specialized trading expertise from the sports sector. The move signals ambition to converge sports analytics and crypto liquidity.

Source

💼 WealthTech

Coinbase Ventures Leads $35m Series A in U.S. Trading Firm

Coinbase Ventures is backing a trading platform in a sizable Series A round, demonstrating continuing deal flow into capital markets infrastructure despite volatility.

Source

🌍 Other

Heirs Energies Secures $750m Afreximbank Financing

The financing package is intended to drive long-term growth initiatives, reinforcing Afreximbank’s role in large-scale regional investment.

Source

Paytm Expands Offshore with New Units in Indonesia and Luxembourg

Paytm is broadening its international footprint as it seeks revenue diversification beyond India. This expansion reinforces the company’s long-term ambition to operate as a global fintech platform.

Source

Y Combinator Backs $10.5m Seed for AI Avatar Startup Lemon Slice

Lemon Slice has raised a seed round to develop AI avatar technology, with YC support highlighting growing investor conviction in synthetic media.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.