Revolut Hits $75B Valuation in Landmark Milestone

Revolut has achieved a staggering $75 billion valuation, marking one of the largest valuations ever for a privately held fintech. The jump underscores strong revenue performance, expansion into new markets, and increased traction in banking, payments, and wealth products. This valuation puts Revolut closer to big-bank territory and signals investor confidence at a time when many fintechs are struggling. It also reinforces Revolut’s ambition to become a full global financial super-app. For the fintech industry, the deal signals a renewed appetite for mega-valuations and late-stage capital. The milestone may prompt renewed competition among digital banks globally.

Video of the Day

Insight of the Day

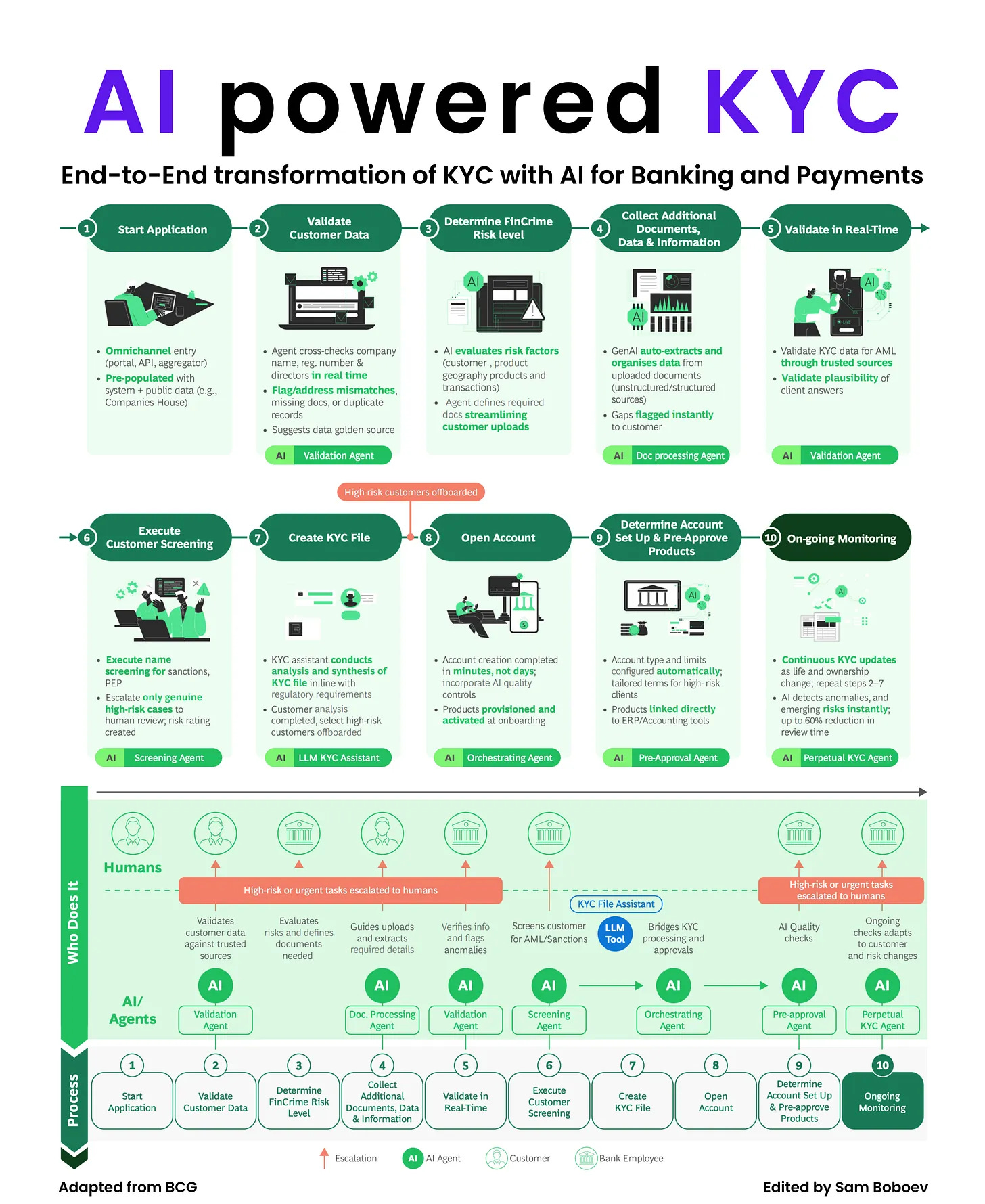

𝐄𝐱𝐩𝐥𝐨𝐫𝐢𝐧𝐠 𝐇𝐨𝐰 𝐀𝐈 𝐈𝐬 𝐓𝐫𝐚𝐧𝐬𝐟𝐨𝐫𝐦𝐢𝐧𝐠 𝐊𝐘𝐂 𝐢𝐧 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐛𝐲 𝐁𝐂𝐆

Financial crime operations cost banks up to 5% of total expenses.Despite billions invested in KYC, screening, and transaction monitoring — half of client refreshes at leading banks still rely on manual work.

After a decade of compliance-driven expansion, the shift is clear: banks are now redesigning KYC to balance risk coverage, efficiency, and sustainability.

𝐀𝐈 𝐦𝐨𝐝𝐞𝐥 — 𝐚𝐬 𝐚 𝐥𝐚𝐲𝐞𝐫𝐞𝐝 𝐭𝐫𝐚𝐧𝐬𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧 𝐚𝐜𝐫𝐨𝐬𝐬 𝐭𝐡𝐫𝐞𝐞 𝐰𝐚𝐯𝐞𝐬:

1️⃣ Predictive AI – analyzes patterns and behaviors to generate risk insights faster.

2️⃣ Generative AI – processes both structured and unstructured data to accelerate due diligence.

3️⃣ Agentic AI – goes further, enabling autonomous decision-making and orchestration across systems.

Together, they move KYC from isolated automation to end-to-end transformation. But here’s the catch — success isn’t about the tools, it’s about execution.

𝐖𝐢𝐧𝐧𝐢𝐧𝐠 𝐛𝐚𝐧𝐤𝐬 𝐚𝐫𝐞 𝐟𝐨𝐜𝐮𝐬𝐢𝐧𝐠 𝐨𝐧 𝐟𝐨𝐮𝐫 𝐟𝐮𝐧𝐝𝐚𝐦𝐞𝐧𝐭𝐚𝐥𝐬:

🔹 Reimagine processes around data and intelligence — not retrofit old workflows.

🔹 Prioritize for impact — balance ambition and complexity.

🔹 Build for scale — modular components, shared data products, common delivery lifecycles.

🔹 Embed trust & governance — ensure explainability and compliance by design.

At its core, AI in KYC is a human–machine partnership.

Manual repetition gives way to human judgment amplified by digital agents.

KYC teams evolve into hybrid intelligence models — leaner, smarter, and focused on exceptions where expertise truly adds value.

👉 AI developers design and train the digital agents.

👉 Analysts and supervisors validate AI outputs, manage exceptions, and ensure compliance.

Over time, both humans and machines learn together — adapting as new risks and behaviors emerge.

𝐓𝐡𝐚𝐭’𝐬 𝐭𝐡𝐞 𝐫𝐞𝐚𝐥 𝐩𝐫𝐨𝐦𝐢𝐬𝐞 𝐨𝐟 𝐀𝐈 𝐢𝐧 𝐊𝐘𝐂:

Curated News

💳 Payments

Pay.com.au Raises AUD $53M for Global Expansion

The Australian payments platform has secured AUD $53 million to accelerate international expansion and strengthen product capabilities. The fresh capital will support scaling infrastructure and capturing more of the corporate payments market.

Source

KuCoin Pay Adds Crypto Payments via Brazil’s Pix

KuCoin Pay has integrated with Brazil’s Pix network, enabling merchants to accept crypto payments instantly through the country’s most widely used real-time payment system. The move deepens crypto-to-fiat interoperability in one of Latin America’s most active fintech markets.

Source

Mollie Prepares Merchants for Agentic Commerce

Mollie is rolling out tools to help European merchants adopt agentic commerce—AI-driven automated purchasing. The initiative signals growing demand for next-gen checkout and payment automation.

Source

Alipay+ to Connect with Bahrain’s National QR Scheme

Alipay+ will integrate with Bahrain’s national QR payment network, improving cross-border payment acceptance for Asian digital wallets. The move strengthens Bahrain’s position as a digital payments hub in the Gulf region.

Source

TerraPay Launches Xend Global Interoperability Network

TerraPay has introduced Xend, a global interoperability platform designed to connect billions of wallet users for seamless cross-border payments. The network aims to reduce fragmentation and simplify international transfers.

Source

VALR Adds Multi-Currency Fiat Options Through OpenPayd

Crypto exchange VALR is enabling multi-currency fiat deposits and withdrawals via OpenPayd, giving users more flexibility when moving funds across markets. This expansion strengthens VALR’s bridge between traditional finance and digital assets.

Source

🏦 Banking

DNB Extends Partnership with Tietoevry to Modernize Payments Infrastructure

Norway’s DNB is deepening its collaboration with Tietoevry Banking to overhaul its payment infrastructure. The upgrade aims to boost speed, resilience, and compliance across domestic and cross-border transactions.

Source

Wio Bank Launches UAE’s First Shared Family Banking Experience

Wio Bank has launched “Wio Family,” a shared banking platform enabling families to collaboratively manage accounts, spending, and savings. The innovation targets modern households seeking transparency and financial control.

Source

Top US Banks Hit by Cyber Breach at Mortgage Tech Supplier

A major cybersecurity breach at a mortgage technology provider has affected several leading US banks. The incident raises concerns about third-party vulnerabilities in financial supply chains.

Source

Techcombank Offers Up to $1M in AI Competition Scholarships

Vietnam’s Techcombank is funding up to $1 million in scholarships for an AI innovation competition, supporting the country’s push toward advanced digital technologies in finance. The initiative aligns with the bank’s broader digital transformation strategy.

Source

💡 Fintech

GFT and FICO Form Global Smart-Finance Partnership

GFT and FICO have launched a global partnership focused on intelligent decisioning, risk analytics, and AI-driven finance automation. The collaboration aims to help banks accelerate digital transformation and improve credit decision accuracy.

Source

Tidalwave Raises $22M, Targets 4% of US Mortgage Market

Mortgage startup Tidalwave has raised a $22M Series A round to scale its AI-powered underwriting platform. The company is aiming to capture 4% of the US mortgage market through faster, more transparent loan approvals.

Source

iwoca Findings: 75% of Brokers Say Policies Hurt SMEs

iwoca’s SME Expert Index shows that three-quarters of finance brokers believe current government policies are negatively impacting small businesses. Many expect upcoming budget measures to further weaken SME confidence.

Source

AI-Driven Scams Surge as 75% of Shoppers Sense Rising Fraud Risk

A new report finds most consumers believe AI-powered scams are increasingly realistic, raising risks during peak shopping periods like Black Friday. The findings highlight the urgent need for stronger fraud-prevention tools.

Source

🪙 Crypto

JPMorgan Cuts Ties With Strike CEO, Reviving Debanking Debate

JPMorgan has reportedly ended its banking relationship with the CEO of Strike, prompting renewed concerns about crypto-related debanking practices. The case highlights ongoing friction between major banks and crypto-native companies.

Source

Bitwise CIO: Most DATs Likely to Trade at Discounts

Bitwise’s CIO predicts that most Digital Asset Trusts (DATs) will soon shift from premiums to discounts due to market structure changes and increased competition. This could reshape retail investor behavior in crypto-linked products.

Source

Solana Sell-Off Puts Holders Under Pressure

Solana’s price has faced intensified selling pressure amid broader market volatility. Investors are watching closely as the ecosystem’s liquidity and DeFi activity show signs of stress.

Source

💼 WealthTech

Wealthy Raises $14.5M Led by Bertelsmann

Wealth management platform Wealthy has secured $14.5 million to expand its digital advisory and investment tools. The new funding will support product enhancements and regional growth.

Source

⚖️ Regulation

AFME Welcomes FCA’s Streamlined Reporting Rules

The Association for Financial Markets in Europe (AFME) has endorsed new FCA measures to simplify transaction reporting requirements. The updates aim to reduce compliance burden while maintaining market transparency.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.