Revolut Launches $75B Secondary Share Sale

Revolut has kicked off a secondary share sale valuing the UK-based fintech giant at $75 billion, making it one of the most valuable private financial technology companies globally. The move allows early employees and investors to cash out, a significant milestone given ongoing speculation about the company’s IPO plans. The valuation puts Revolut in direct competition with major European banks, underscoring fintech’s growing weight in global finance. Analysts note the deal reflects strong investor confidence despite broader market volatility. Revolut has been aggressively expanding across banking, wealth management, and payments, and this sale provides liquidity while keeping growth momentum. However, it also raises questions about whether a public listing could soon follow.

Insight of the Day

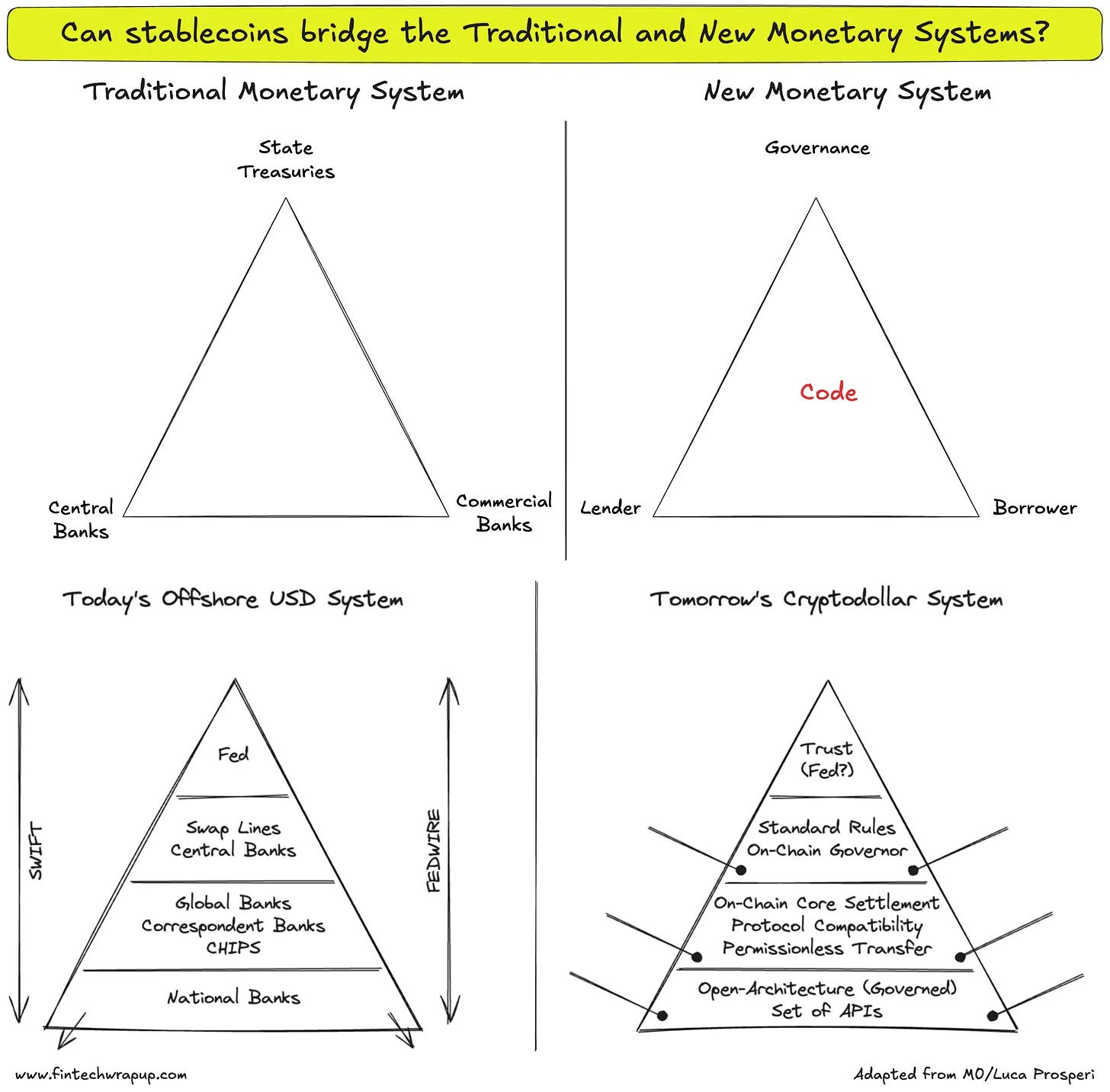

Can stablecoins bridge the Traditional and New Monetary Systems?

The monetary system we know today is relatively new. It emerged after the collapse of Bretton Woods, built on a tightly interdependent relationship between commercial banks, central banks, and state treasuries.

👉 How the traditional system works

Commercial banks supply liquidity by issuing loans in fiat, while central banks set rules and ensure all banks’ money is interchangeable. Treasuries benefit by borrowing cheaply in exchange for maintaining fiscal stability. The system works because roles are clearly divided: banks handle deposits, lending, and risk; central banks provide oversight and backstops; treasuries fund themselves. Banks, in return, enjoy oligopoly protection and profit spreads.

🚨 Where it fails

🔹 Credit underwriting - Shadow banking emerged as banks struggled with complex credit.

🔹 Risk management - Counterparty risks often spill over to taxpayers through bailouts.

🔹 Distribution/storage - Legacy ledger systems look outdated next to CBDCs and self-custody.

🔹 Returns - Low profitability has depressed bank valuations.

🔹 Tech integration - Banks lag in a world where commerce, data, and machine-to-machine interactions move faster than they can adapt.

Curated News

💳 Payments

Obita Raises $10M to Bridge Web2 and Web3 Payments

Former Ant Group executives have launched Obita, securing $10 million to build solutions that connect traditional Web2 infrastructure with emerging Web3 payment systems. The funding highlights growing investor interest in seamless cross-era financial transactions.

Source

Zyxel Networks Launches Pay-as-You-Go Billing

Zyxel Networks introduced flexible billing via its Circle platform, enabling businesses to adopt “pay as you go” models. This move reflects broader demand for adaptive pricing in enterprise technology and SaaS-based financial ecosystems.

Source

🏦 Banking

UK Open Banking Hits 15 Million Users

Open banking adoption in the UK has surged past 15 million users, showing accelerating demand for data-driven financial services. The milestone demonstrates how regulation and innovation are reshaping consumer finance.

Source

Warba Bank Launches Youth Account in Kuwait

Kuwait’s Warba Bank unveiled a new account designed specifically for younger customers, aiming to boost financial inclusion and digital adoption among Gen Z. The initiative underscores regional banks’ focus on customer segmentation.

Source

Net Zero Banking Alliance Pauses Amid Defections

The Net Zero Banking Alliance has halted its activities after multiple member banks exited, triggering a rethink of its role and strategy. The move highlights tensions between sustainability goals and practical business pressures in banking.

Source

Middle East Banking Innovation Summit Returns

The 2025 edition of the Middle East Banking Innovation Summit is set to return with record participation, reflecting the region’s fast-growing fintech and banking ecosystems. The event promises new product showcases and strategic partnerships.

Source

💡 Fintech

Fintech Pioneers Launch Bank for the Wealthy

Founders behind Monzo, Starling, and Nutmeg are teaming up to launch a new bank targeting high-net-worth individuals. The project highlights how fintech entrepreneurs are moving upmarket to tap premium banking services.

Source

Agentic AI in Banking: Handle with Care

A personalization expert has warned that banks should approach agentic AI adoption cautiously. While AI promises efficiency and personalization, it also raises ethical and customer trust challenges.

Source

Tenity Expands as Leading European Fintech Investor

Tenity has reinforced its role as a major fintech investor by onboarding a new European startup cohort. The expansion positions the firm as a key growth engine for early-stage financial technology companies.

Source

🪙 Crypto

Bitcoin Drops Below $108K on Inflation Fears

Bitcoin fell sharply to under $108,000 as new inflation data rattled markets. The drop underscores the continued sensitivity of digital assets to macroeconomic conditions.

Source

Crypto Groups Lobby Senate for Developer Protections

A coalition of crypto organizations is pushing U.S. lawmakers to safeguard developers in upcoming market structure legislation. Advocates argue that protecting coders is crucial for innovation and the broader blockchain ecosystem.

Source

Former Cred Executives Jailed for $150M Fraud

Two former executives from Cred have been sentenced to federal prison for orchestrating a $150 million crypto fraud. The case underscores ongoing risks and regulatory pressures in the digital asset space.

Source

Myriad Hits $10M USDC in Prediction Markets

DeFi platform Myriad has surpassed $10 million in USDC trading volume, positioning prediction markets as an emerging niche within decentralized finance. The milestone reflects growing user engagement with alternative crypto use cases.

Source

YouHodler Extends Sponsorship with Torino FC

Swiss-based crypto firm YouHodler renewed its partnership with Italian football club Torino FC, strengthening its European brand presence. The deal highlights the ongoing convergence of sports marketing and digital assets.

Source

📊 WealthTech

Allasso Raises $3M for AI-Driven Options Analytics

Allasso secured $3 million in funding to scale its AI-powered options analytics platform. The solution aims to make sophisticated derivatives strategies more accessible to institutional and retail investors alike.

Source

⚖️ Regulation

BNPL Data Shows Repeat Spenders Drive Growth

New research reveals that repeat users account for the bulk of Buy Now, Pay Later activity, challenging assumptions about first-time customer risks. The findings could shape upcoming regulatory debates around lending practices.

Source

📌 Other

Falcon Finance Creates $10M Onchain Insurance Fund

Falcon Finance has launched a blockchain-based insurance fund with an initial $10 million commitment. The initiative reflects growing experimentation at the intersection of DeFi and risk management.

Source

Allianz Trade Reshuffles Northern Europe Leadership

Allianz Trade has appointed new senior executives to lead its Northern Europe operations. The leadership refresh signals a strategic push to strengthen its regional presence.

Source

Ultima Markets Partners with Inter Milan in Asia

Ultima Markets has joined Inter Milan as an official regional partner in Asia, expanding its brand through football sponsorship. The move highlights the growing trend of financial firms leveraging sports for visibility.

Source

Wolters Kluwer Launches Cloud Practice Management Platform

Wolters Kluwer rolled out Capego Practice Management, a cloud solution designed for tax and accounting firms. The platform aims to streamline workflows and modernize back-office processes.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a "Source: [Name]" attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.