Revolut Launches Fee-Free Fiat-to-Stablecoin Conversions

Revolut has unveiled a new feature allowing users to convert fiat currencies into stablecoins without fees, marking a bold move into digital assets. This initiative positions the neobank as a bridge between traditional finance and crypto, offering users seamless access to stablecoins like USDC and USDT. It’s part of Revolut’s broader strategy to expand its crypto offerings and enhance cross-border payment flexibility. The launch reflects growing consumer demand for low-cost, borderless financial tools. By eliminating conversion fees, Revolut strengthens its competitive edge against both banks and crypto-native platforms. This move could significantly accelerate mainstream stablecoin adoption among everyday users.

Video of the Day

Insight of the Day

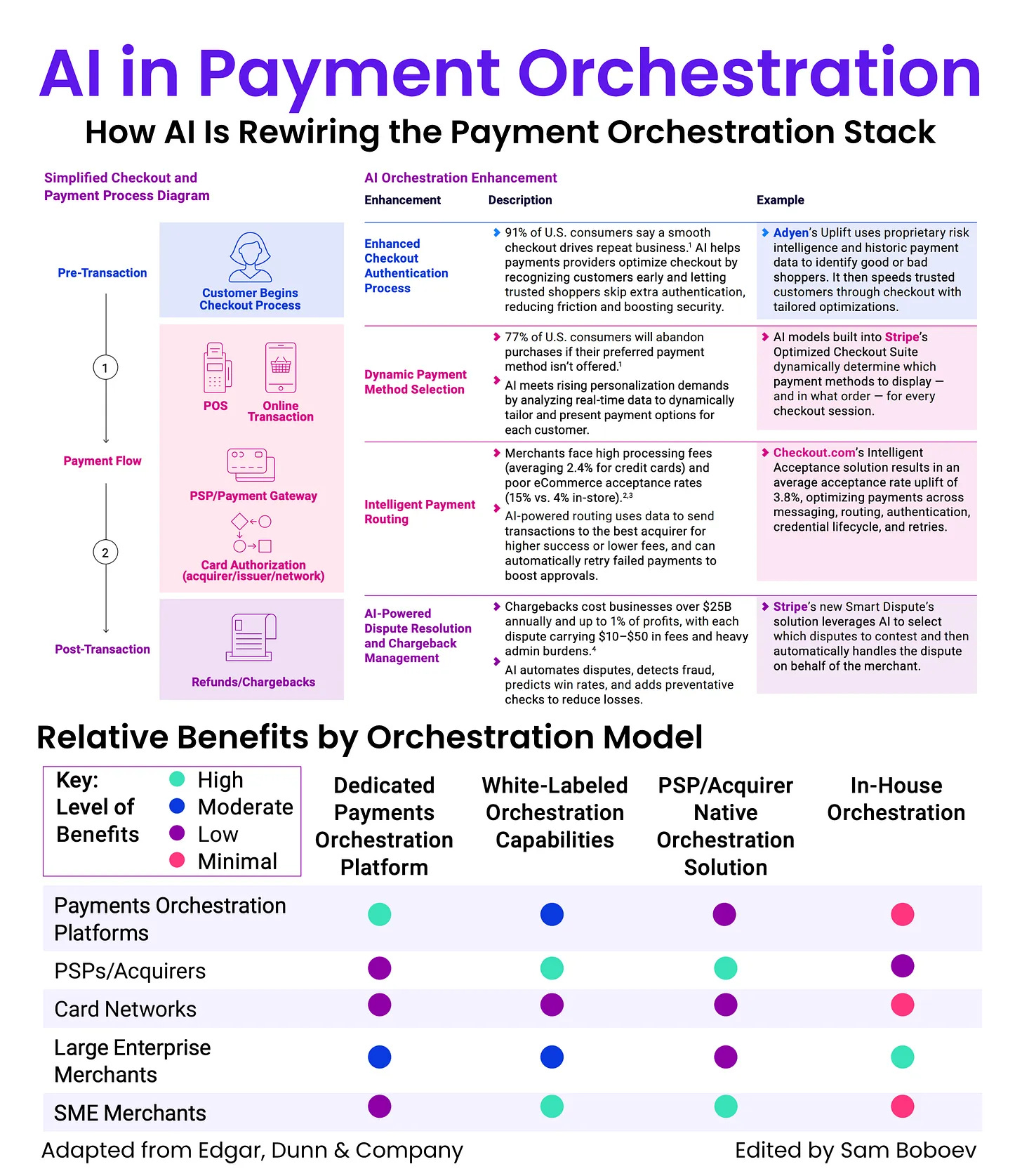

𝐇𝐨𝐰 𝐀𝐈 𝐈𝐬 𝐑𝐞𝐰𝐢𝐫𝐢𝐧𝐠 𝐭𝐡𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧 𝐒𝐭𝐚𝐜𝐤

AI is quietly transforming how payments move, route, and resolve behind the scenes.

Here’s how it’s reshaping the flow from checkout to chargeback 👇

✅ 1. Smarter Checkout Authentication

91% of U.S. consumers say a seamless checkout keeps them coming back.

AI helps PSPs and acquirers recognize trusted shoppers early, skip redundant authentication, and cut friction — all while boosting security.

→ Example: Adyen’s Uplift tailors checkout flows using real-time risk signals.

✅ 2. Dynamic Payment Method Selection

77% of customers abandon carts if their preferred payment method isn’t shown.

AI now personalizes payment options in real time, adapting to user behavior and context.

→ Example: Stripe’s Optimized Checkout Suite uses AI to decide which methods to display — and in what order.

✅ 3. Intelligent Payment Routing

Processing fees remain steep and acceptance rates vary.

AI-powered routing analyzes transaction data to send each payment to the acquirer most likely to approve it — and can automatically retry failures.

→ Example: Checkout com’s Intelligent Acceptance boosts average success rates by ~3.8%.

Curated News

💳 Payments

Block Enables Global Bitcoin Payments for 4 Million Merchants

Block has rolled out a global Bitcoin payments option for its merchant network, allowing businesses to accept BTC worldwide with no transaction fees until 2027. The feature enhances crypto payment accessibility and underlines Block’s push to make Bitcoin a mainstream payment method.

Source

Spreedly Expands to Brazil’s $378B E-Commerce Market via Pix

Spreedly is integrating with Brazil’s Pix payment network, tapping into one of the fastest-growing digital payment ecosystems. The move opens access to Brazil’s booming $378 billion e-commerce market, offering global merchants faster and more localized payment options.

Source

Ravelin Warns of Rising Payment Friction During Peak Season

Fraud-prevention platform Ravelin reports a decline in frictionless payment approvals during peak sales periods, putting holiday revenues at risk. The firm calls for smarter fraud models to balance risk and customer experience.

Source

OpenPayd Expands European Payment Capabilities

OpenPayd has added new domestic virtual IBANs and payment rails across Europe, strengthening its embedded finance infrastructure. The update enables faster, more localized payments for fintechs and digital businesses operating in the region.

Source

🏦 Banking

Smart Data Group Unveils Blueprint for Open Banking’s Future

The Smart Data Group has released a roadmap outlining how open banking can evolve into open data ecosystems. The blueprint emphasizes interoperability, consumer control, and innovation across financial services.

Source

Starling and Small Business Britain Partner to Empower Women Entrepreneurs

Starling Bank and Small Business Britain have teamed up to boost female entrepreneurship through financial education and access to resources. The initiative aims to close gender gaps in business financing.

Source

59% of UK SMEs Abandon Loan Applications Midway

A new report reveals that over half of UK small business founders abandon loan applications due to complexity and delays. The findings highlight a persistent gap in SME access to finance and digital lending solutions.

Source

💰 Fintech

Saudi Fintech Lean Eyes IPO After Strategic Expansion

Saudi fintech startup Lean is reportedly exploring acquisition and partnership opportunities ahead of a planned IPO. The company aims to position itself as a regional leader in financial infrastructure and data connectivity.

Source

Pine Labs’ $440M IPO Fully Subscribed

Payments and merchant platform Pine Labs saw strong investor demand, with its $440 million IPO fully subscribed on the final day. The result reflects sustained global interest in India’s fintech ecosystem.

Source

WAMID Launches Newswire for Real-Time Financial Updates

Saudi data provider WAMID has launched “WAMID Newswire,” a new service delivering real-time financial news to local and global markets. The platform strengthens financial transparency and investor access to timely data.

Source

Hexaware Deepens Google Cloud Partnership for Insurance Solutions

Hexaware is expanding its collaboration with Google Cloud to launch AI-driven insurance solutions. The partnership aims to accelerate digital transformation and enhance risk analytics across insurers.

Source

🪙 Crypto

Coinbase Launches Savings Account Offering 3.75% Interest in the UK

Coinbase has introduced a new crypto-linked savings product for UK users, offering 3.75% APY to rival traditional bank savings rates. The move reflects a growing overlap between DeFi yields and regulated banking.

Source

Standard Chartered Backs Stablecoin Credit Card in Singapore

Standard Chartered and DCS are teaming up to support Singapore’s first stablecoin-backed credit card. The partnership could redefine digital asset payments in one of Asia’s leading fintech hubs.

Source

Robinhood Joins $68M Round for Crypto Trading Protocol Lighter

Robinhood has participated in a $68 million funding round for Lighter, a decentralized crypto trading protocol. The investment signals Robinhood’s growing interest in Web3 infrastructure and non-custodial trading.

Source

Coins.ph Tests Peso Stablecoin on Arc Blockchain

Philippines-based exchange Coins.ph is exploring the Arc blockchain for its peso-backed stablecoin initiative. The project could enhance remittances and local digital payments through faster, cheaper settlements.

Source

Canary XRP ETF Set to Begin Trading After SEC Filing

Canary’s XRP exchange-traded fund is expected to start trading this week, following SEC approval. It marks another step toward the mainstream acceptance of XRP-based investment products.

Source

📈 WealthTech

Schwab to Acquire Forge Global, Expanding Private Markets Access

Charles Schwab is acquiring Forge Global to strengthen its private market investment platform. The move gives Schwab clients greater access to pre-IPO and alternative assets.

Source

⚖️ Regulation

IOSCO Warns Tokenization Poses New Market Risks

The International Organization of Securities Commissions (IOSCO) has warned that financial tokenization introduces new forms of systemic risk. The report urges regulators to address data integrity, custody, and valuation concerns.

Source

🌍 Other

BNP Paribas Uses AI to Accelerate ESG Assessments

BNP Paribas has adopted AI tools to automate and speed up ESG evaluations across its investment operations. The bank aims to improve transparency and compliance amid rising regulatory scrutiny on sustainability.

Source

EIB Expands Global Green Finance Access Tool

The European Investment Bank (EIB) Group has extended its digital platform that streamlines access to green financing. The tool supports global sustainability projects through improved data sharing and project tracking.

Source

BMLL Powers Data Calibration for European Consolidated Tape

BMLL has been selected by EuroCTP to provide data calibration services for Europe’s consolidated tape initiative. The partnership will enhance market transparency and data quality across the region’s trading venues.

Source

Creators Drive Next Wave of Commerce, Report Finds

A new report highlights how “business-savvy creators” are reshaping digital commerce through direct monetization and brand partnerships. The trend underscores the convergence of content creation and fintech innovation.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.