Revolut Launches “Street Mode” to Protect Users From Transfer Muggings

Revolut has introduced Street Mode, a new safety feature that allows users to quickly delay or block outgoing transfers if they feel threatened. The tool addresses a growing real-world risk tied to instant payments, where criminals coerce victims into making immediate transfers. By adding a friction layer at moments of distress, Revolut is reframing payments security beyond cyber fraud to include physical-world threats. The launch highlights how fintechs are evolving faster than traditional banks in user-centric safety design. It also sets a new benchmark for how instant payments can coexist with consumer protection.

Video of the Day

Insight of the Day

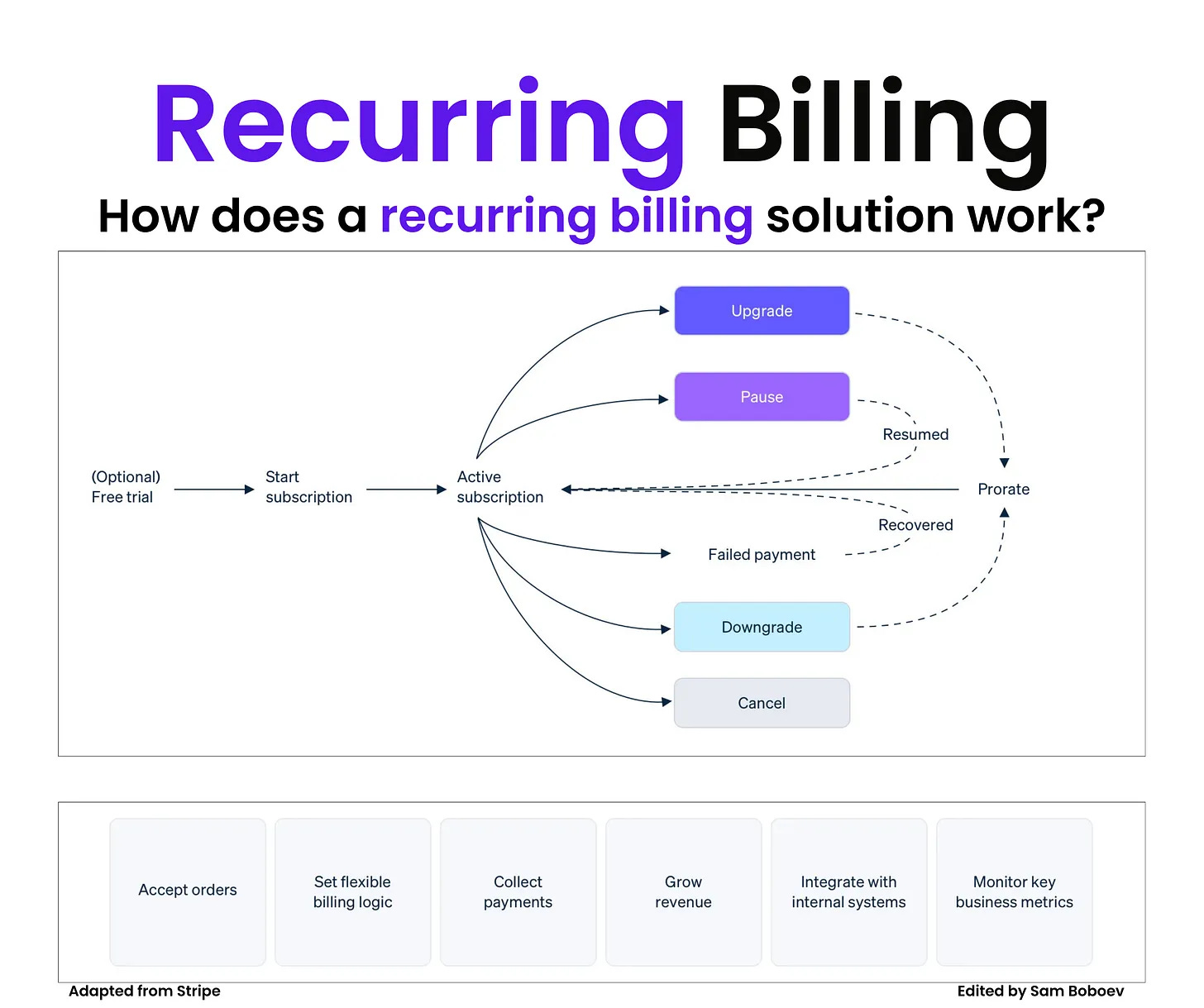

𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐡𝐨𝐰 𝐚 𝐫𝐞𝐜𝐮𝐫𝐫𝐢𝐧𝐠 𝐛𝐢𝐥𝐥𝐢𝐧𝐠 𝐬𝐨𝐥𝐮𝐭𝐢𝐨𝐧 𝐚𝐜𝐭𝐮𝐚𝐥𝐥𝐲 𝐰𝐨𝐫𝐤𝐬

I’ve been thinking about this a lot as Fintech Wrap Up continues to grow — because my own newsletter runs on recurring subscriptions. And the more you scale, the more you realize recurring billing is not “set it and forget it”. It’s a real system, and here’s how it works.

𝟏. 𝐈𝐭 𝐚𝐜𝐜𝐞𝐩𝐭𝐬 𝐨𝐫𝐝𝐞𝐫𝐬 𝐚𝐧𝐲𝐰𝐡𝐞𝐫𝐞 𝐲𝐨𝐮𝐫 𝐜𝐮𝐬𝐭𝐨𝐦𝐞𝐫𝐬 𝐛𝐮𝐲

A billing system plugs directly into your purchase flow.

Customers can subscribe via mobile, web checkout, or even an invoice. If you have a sales team, they can create subscriptions manually from a dashboard. If you’re self-serve, the system auto-generates the subscription through an API the moment someone checks out.

The key is flexibility: fixed plans, custom quotes, recurring invoices, or hybrid motions as you scale.

𝟐. 𝐈𝐭 𝐥𝐞𝐭𝐬 𝐲𝐨𝐮 𝐬𝐞𝐭 𝐟𝐥𝐞𝐱𝐢𝐛𝐥𝐞 𝐛𝐢𝐥𝐥𝐢𝐧𝐠 𝐥𝐨𝐠𝐢𝐜

Pricing never stays static. Your billing system needs to adapt as your product grows.

It should support:

• usage-based pricing

• tiered pricing

• location-based pricing

• free trials and promotions

• introductory discounts

• subscription schedules

• pausing or resuming plans

𝟑. 𝐈𝐭 𝐜𝐨𝐥𝐥𝐞𝐜𝐭𝐬 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐬𝐞𝐚𝐦𝐥𝐞𝐬𝐬𝐥𝐲

Customers expect familiar and frictionless payment methods.

Beyond credit cards, a billing solution should support:

• ACH debit and bank transfers

• digital wallets

• checks

• local payment methods and currencies

𝟒. 𝐈𝐭 𝐡𝐞𝐥𝐩𝐬 𝐲𝐨𝐮 𝐠𝐫𝐨𝐰 𝐫𝐞𝐯𝐞𝐧𝐮𝐞 (𝐚𝐧𝐝 𝐫𝐞𝐝𝐮𝐜𝐞 𝐜𝐡𝐮𝐫𝐧)

Curated News

💳 Payments

Nuvei Scales Global Payments With Microsoft Partnership

Nuvei expanded its partnership with Microsoft to support more than 10,000 transactions per second. The move reinforces Nuvei’s ambitions to serve large global platforms with enterprise-grade payments infrastructure.

Source

Klarna Brings Tap to Pay In-Store Across 14 Markets

Klarna launched Tap to Pay for in-store purchases across 14 markets, extending its brand beyond e-commerce. This signals Klarna’s push to become an everyday payments player, not just a BNPL provider.

Source

Vietnam and China Launch Cross-Border QR Payments

Vietnam and China introduced cross-border QR payments, allowing consumers to pay seamlessly across borders. The initiative highlights Asia’s rapid progress on regional payment interoperability.

Source

Checkout.com Posts Strong Black Friday & Cyber Monday Growth

Checkout.com processed more than $5.2bn over Black Friday and Cyber Monday, delivering 62% year-on-year growth. The results underline continued strength in global e-commerce spending.

Source

Fraud Prevention Tops UK Payments Priorities

New research shows fraud prevention is the top priority for UK consumers when it comes to payments. The findings increase pressure on banks and fintechs to invest further in real-time fraud controls.

Source

Santander UK Calls for Consumer-First Payments Strategy

Santander UK urged the industry to put consumers first as fraud concerns rise. The message reinforces trust and safety as critical differentiators in modern payments.

Source

Visa Supports New EU Digital Wallet Projects

Visa announced support for upcoming EU digital wallet initiatives. This positions Visa as a key infrastructure partner as Europe accelerates digital identity and wallet adoption.

Source

🏦 Banking

Propel Holdings Approved to Launch Banking Services

Propel Holdings received regulatory approval to roll out full banking services. The approval allows the fintech to deepen its offering and compete more directly with traditional banks.

Source

VPBank Securities Files for $2.4B IPO

VPBank Securities filed for an IPO valuing the firm at $2.4bn. The move highlights growing capital markets activity in Vietnam’s financial sector.

Source

💸 Fintech

Hatch Bank and Thrive Partner on Home Improvement POS Financing

Hatch Bank teamed up with Thrive to offer point-of-sale financing for home improvement projects. The partnership expands embedded finance options for contractors and consumers.

Source

Razorpay Cleared to Offer Cross-Border Payments

Razorpay received approval to launch cross-border payments from India. This strengthens its position as Indian merchants increasingly sell globally.

Source

🪙 Crypto

European Banks Push Ahead With a Euro Stablecoin

Major European banks, including BNP Paribas and ING, are moving forward with plans for a euro-denominated stablecoin. The initiative signals traditional banks entering the on-chain money race to counter dollar-based stablecoins.

Source

Kraken to Acquire Tokenization Platform Backed Finance

Kraken plans to acquire tokenization firm Backed Finance as it expands beyond pure crypto trading. The deal reflects growing interest in regulated, tokenized real-world assets.

Source

Zepz Launches Stablecoin-Linked Visa Card

Zepz unveiled a stablecoin-linked Visa card for its Sendwave wallet. The product bridges crypto balances with everyday spending and remittances.

Source

Bank of America Signals 4% Crypto Allocation for Wealth Clients

A report suggests Bank of America is open to crypto allocations of up to 4% in wealth portfolios. The stance reflects growing institutional acceptance of digital assets.

Source

Taurus and Everstake Expand Institutional Staking

Taurus partnered with Everstake to scale institutional staking globally. The collaboration targets rising demand for compliant yield in crypto markets.

Source

xpate Joins Visa Ramp Provider Program

xpate joined Visa’s ramp provider program to connect crypto and fiat payments more seamlessly. This move lowers friction for businesses operating across both ecosystems.

Source

📊 WealthTech

Nevis Raises $35M to Build AI for Wealth Management

Nevis secured $35m to develop AI-driven tools for wealth managers. The round highlights strong investor appetite for automation in advisory services.

Source

Zocks and eMoney Deepen AI-Powered Integration

Zocks and eMoney launched an enhanced integration using AI-powered document intelligence. The update aims to reduce manual workflows for financial advisors.

Source

⚖️ Regulation

US State Attorneys General Launch BNPL Inquiry

US state attorneys general opened an investigation into Buy Now, Pay Later practices. The probe raises fresh regulatory risks for BNPL providers.

Source

🏛️ Other

Deutsche Börse Makes $5.5B Bid for Allfunds

Deutsche Börse submitted a $5.5bn bid for fund platform Allfunds. The move underscores continued consolidation in market infrastructure and data services.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.