Revolut Pledges £3B UK Investment

Revolut has announced a £3 billion investment plan in the UK, underscoring its commitment to becoming a dominant player in the domestic and global financial services industry. The investment will be directed toward expanding its product suite, scaling infrastructure, and boosting hiring in its London hub. This move comes as Revolut seeks to cement its reputation as one of Europe’s most valuable fintechs, while navigating regulatory pressures. The announcement also strengthens the UK’s fintech ecosystem at a time when global competition for financial innovation is intensifying. For Revolut, this marks both a growth milestone and a bid to reassure stakeholders about its long-term vision. The investment highlights a shift from rapid expansion to deeper market consolidation, especially in a highly competitive landscape.

Insight of the Day

What is Model Context Protocol (MCP)?

We have seen major fintech companies such as Visa, Stripe, Paypal, Coinbase, and others launching their MCP servers. But have you ever thought what MCP is?

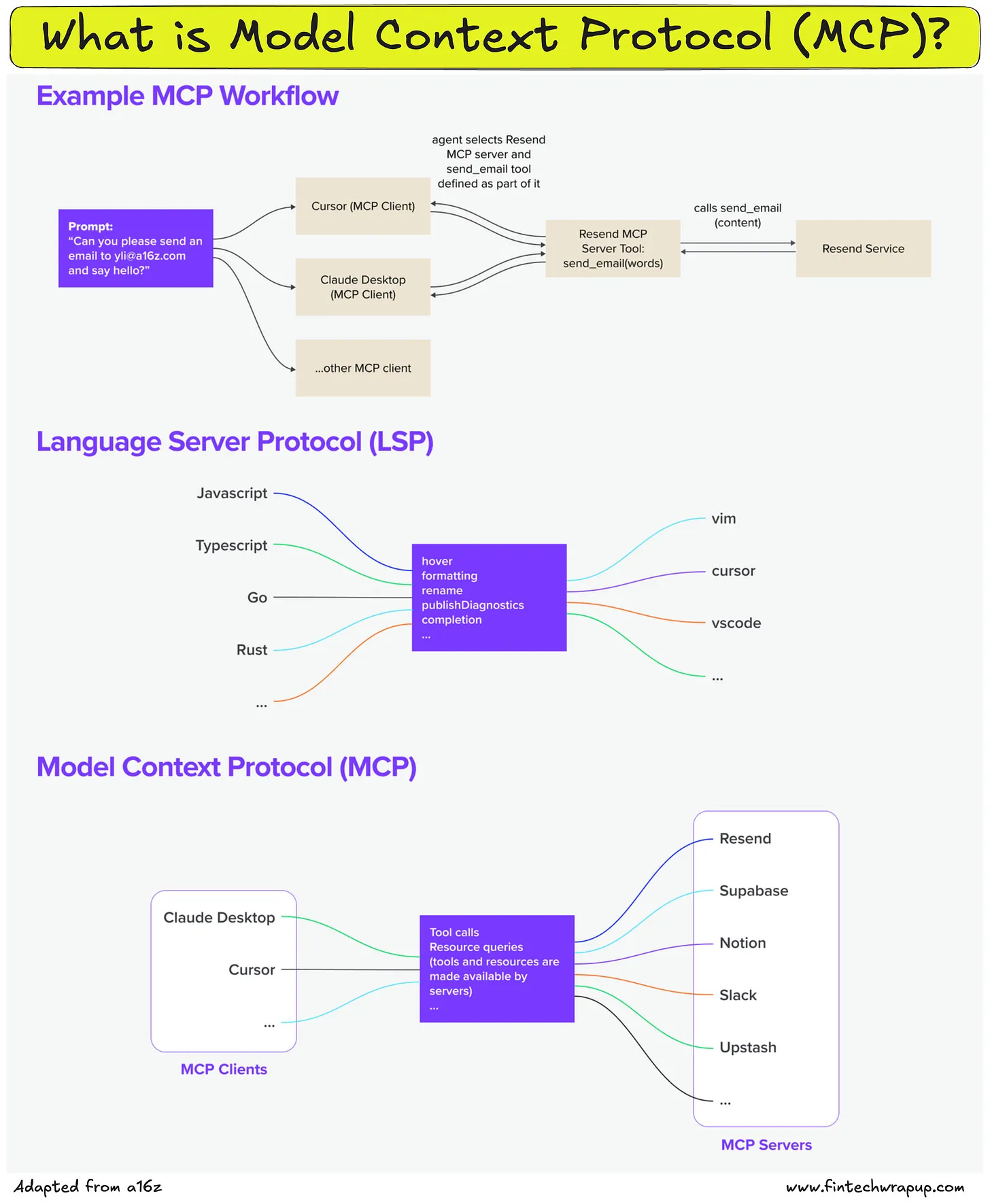

MCP is an open protocol that allows systems to provide context to AI models in a manner that’s generalizable across integrations. The protocol defines how the AI model can call external tools, fetch data, and interact with services. As a concrete example, below is how the Resend MCP server works with multiple MCP clients.

The idea is not new; MCP took inspiration from the LSP (Language Server Protocol). In LSP, when a user types in an editor, the client queries the language server to autocomplete suggestions or diagnostics.

Where MCP extends beyond LSP is in its agent-centric execution model: LSP is mostly reactive (responding to requests from an IDE based on user input), whereas MCP is designed to support autonomous AI workflows. Based on the context, AI agents can decide which tools to use, in what order, and how to chain them together to accomplish a task. MCP also introduced human-in-the-loop capabilities for humans to provide additional data and approve execution.

Curated News

💳 Payments

Apple Expands Tap to Pay on iPhone Across Europe

Apple has launched Tap to Pay on iPhone in five new European countries, enabling merchants to accept contactless payments directly on their devices. This move strengthens Apple’s role in the payments space and provides small businesses with a cost-effective way to process transactions.

Source

TrustPay Rebrands as Finby and Gains New License

TrustPay has rebranded as Finby and expanded its regulatory reach by securing an additional license. The change reflects a broader strategic shift to position itself as a more versatile payments provider in the global market.

Source

OneBill Launches AI Revenue Assurance Tool

OneBill introduced RevAssure360, an AI-powered platform designed to detect, prevent, and predict revenue leakage. The tool aims to help payment providers and enterprises strengthen their financial resilience and compliance.

Source

🏦 Banking

Finastra Debuts Modern ACH Solution

Finastra has rolled out a modern ACH platform to give banks a future-proof alternative for handling payments. The solution is designed to enhance efficiency and compliance while meeting evolving customer demands.

Source

💡 Fintech

Pillar Raises €3.2M for Construction Finance Management

Berlin-based Pillar secured €3.2 million to digitize financial management for construction firms. The startup aims to streamline processes and reduce inefficiencies in one of the world’s most fragmented industries.

Source

CommBank’s x15ventures Partners with Triple Bubble

Commonwealth Bank’s venture arm x15ventures signed a deal with fintech fund Triple Bubble. The partnership is set to accelerate investment in early-stage startups, particularly within Australia’s financial services ecosystem.

Source

Circuit & Chisel Secures $19.2M for Growth

Circuit & Chisel, a fintech startup, raised $19.2 million to expand its platform and fuel product innovation. The funding round reflects strong investor appetite for niche fintech solutions.

Source

Reap Teams Up with Flagright for AML Expansion

Reap partnered with Flagright to implement real-time transaction monitoring and AML compliance tools. The collaboration will support Reap’s international expansion while strengthening regulatory safeguards.

Source

🪙 Crypto

Ripple Stablecoin Powers Tokenized Fund Off-Ramps

Ripple’s stablecoin has been adopted as an off-ramp solution for tokenized funds from BlackRock and VanEck. This marks a significant step in linking traditional asset management with blockchain infrastructure.

Source

Morgan Stanley to Enable Crypto Trading via E*Trade

Morgan Stanley will soon offer crypto trading through E*Trade after investing in infrastructure provider ZeroHash. The move signals deeper integration of digital assets into mainstream brokerage services.

Source

Fold Launches Bitcoin Rewards Credit Card

Fold, with support from Visa and Stripe, has introduced a Bitcoin rewards credit card. The product blends traditional credit offerings with crypto incentives, targeting mainstream adoption.

Source

Shield Raises $5M to Scale Crypto Payments

Shield secured $5 million in seed funding to expand its crypto payments platform for global trade. The company aims to streamline cross-border commerce with blockchain-based infrastructure.

Source

Bitget Wallet Distributes 270K BGB in Airdrop

Bitget Wallet hosted the Morph Unity Airdrop, distributing over 270,000 BGB tokens to its users. The campaign underscores the wallet’s growing role in community-driven crypto adoption.

Source

HK’s OSL Acquires Licensed Indonesian Crypto Exchange

Hong Kong-based OSL has acquired Koinsayang, a licensed crypto exchange in Indonesia. The deal expands OSL’s presence in Southeast Asia and strengthens regulatory-compliant market entry.

Source

📊 WealthTech

PensionBee Calls for Bold UK Pension Reforms

PensionBee urged the UK Pensions Commission to introduce bold reforms to improve retirement outcomes for millions of savers. The move highlights growing pressure on policymakers to modernize pension frameworks.

Source

📜 Regulation

Deutsche Börse Uses Social Media for Market Surveillance

Deutsche Börse has expanded its surveillance systems to include social media data. This innovation aims to detect potential manipulation and ensure fairer markets.

Source

🤝 Other

Visa and Intella Launch Arabic AI for Banks

Visa partnered with Intella to develop an Arabic-language conversational AI platform for financial institutions. The tool is expected to improve customer engagement and accessibility in the Middle East.

Source

Mastercard Unveils Global Reach Partner Program

Mastercard announced a Global Reach Partner Program to accelerate customer expansion initiatives worldwide. The program is designed to enhance collaboration and drive growth across new markets.

Source

BVI Finance Promotes Digital Asset Structuring in Asia

BVI Finance will engage with Asia’s digital asset leaders at Token2049 Singapore to showcase structuring opportunities for global growth. The initiative aims to position the British Virgin Islands as a hub for digital finance innovation.

Source

GO Markets Partners with Acuity for Trading Signals

GO Markets has teamed up with Acuity Trading to launch a new signal service. The partnership is designed to enhance trading strategies for retail and professional clients alike.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.