Ripple Commits $25M to Support U.S. Small Businesses and Veterans

Ripple has pledged $25 million to initiatives aimed at strengthening American small businesses and advancing career opportunities for military veterans. The funding will support workforce development, training programs, and entrepreneurship, with a strong focus on economic inclusivity and long-term growth. This move underscores Ripple’s broader strategy of expanding its impact beyond blockchain technology and into social empowerment. The initiative highlights the intersection of fintech and community development, showcasing how financial innovation can drive social good. Ripple’s commitment also reflects a growing trend among fintech firms to balance profit with purpose. The program is expected to deliver both local and national economic benefits, especially in underserved communities.

Insight of the Day

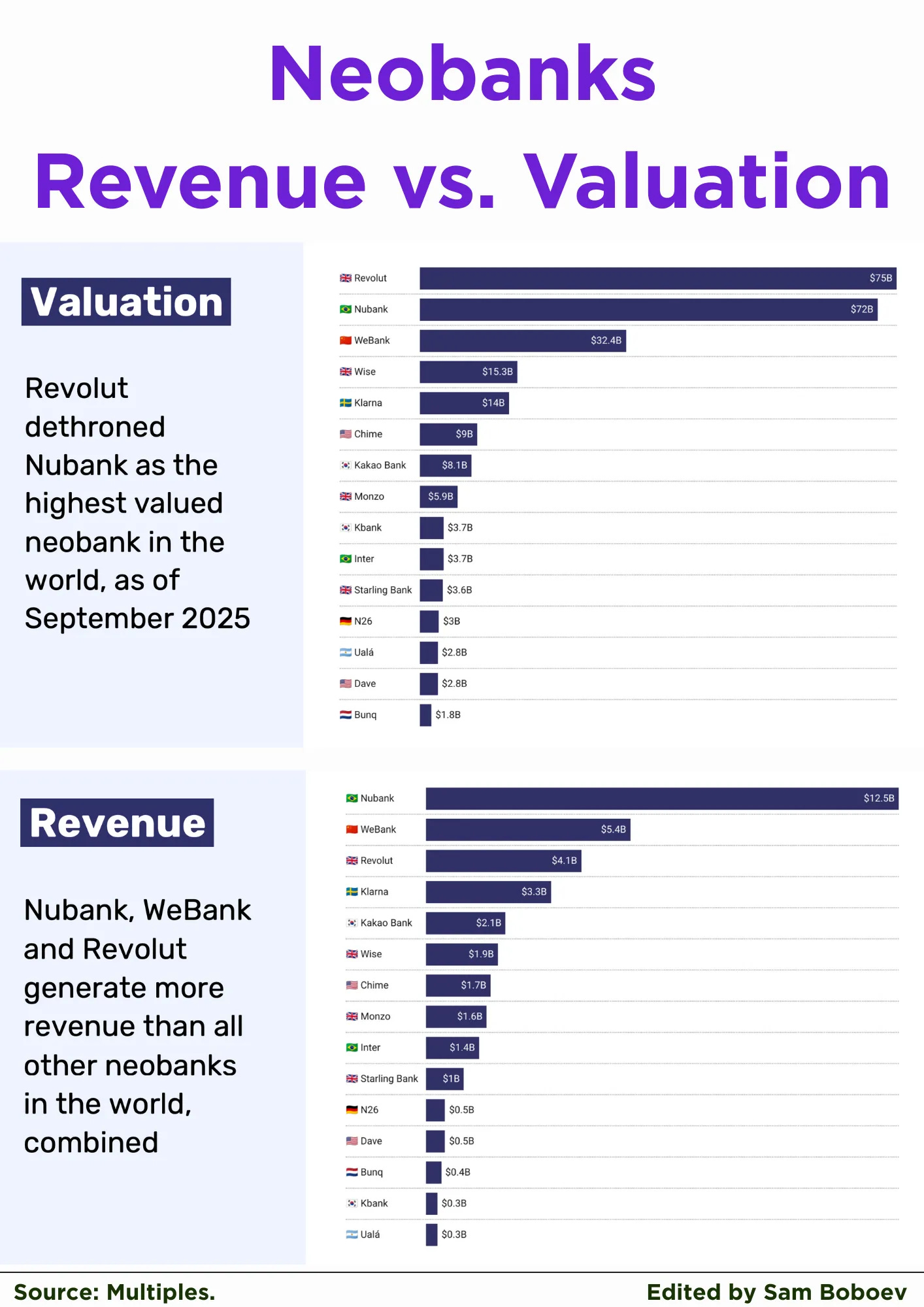

Neobanks 2025: Revenue Titans vs. Valuation Darlings

The big question: will Revolut’s $75B bet pay off—or will Nubank’s raw revenue dominance eventually force investors to reprice what true scale really looks like?

✅ Revenue: Nubank, WeBank, and Revolut Run the Table

The revenue chart makes one thing crystal clear: three players dominate the industry. Nubank ($12.5B), WeBank ($5.4B), and Revolut ($4.1B) collectively generate more than all other neobanks combined.

Behind them, Klarna ($3.3B), Kakao Bank ($2.1B), Wise ($1.9B), and Chime ($1.7B) form a strong second tier. But the gap between Nubank and everyone else is staggering: Brazil’s giant makes nearly 2.5x more than WeBank and three times more than Revolut.

This dominance underscores two truths. First, Nubank’s strategy of scaling in Latin America, where financial services penetration is still relatively low, has unlocked explosive growth. Second, WeBank’s China playbook—digital-first, ecosystem-driven—shows what’s possible when you’re integrated into everyday life. Revolut, meanwhile, has cracked the code in Europe by diversifying into trading, subscriptions, and soon lending at scale.

Everyone else? They’re fighting for relevance. Chime and Monzo hover below $2B, Inter and Starling sit around $1B, while N26, Dave, Bunq, Kbank, and Ualá are stuck below $0.5B.

✅ Valuation: Revolut Takes the Crown

But when we shift from revenue to valuation, the picture flips. Revolut is now the world’s most valuable neobank at $75B, overtaking Nubank ($72B).

That’s a symbolic milestone. Nubank may still out-earn Revolut, but investors clearly believe in the long-term global expansion of the UK-based super-app. Revolut has built a narrative around becoming “the everything app for money” across Europe, the US, and Asia—a story that public markets and private investors are buying into.

WeBank ($32.4B) sits in third, followed by Wise ($15.3B) and Klarna ($14B). Chime ($9B) and Kakao Bank ($8.1B) still hold significant weight, but the valuation drop-off is steep after that. Monzo ($5.9B) leads the next tier, while Starling, Inter, and Kbank hover in the $3–4B range. The once high-flying N26 has slipped to just $3B.

Curated News

💳 Payments

Walmart Business Partners with TreviPay for Pay-by-Invoice

Walmart Business has teamed up with TreviPay to offer B2B customers flexible pay-by-invoice solutions. The move strengthens Walmart’s business services arm, catering to SMBs with more efficient cash flow management tools.

Source

Branch Launches Embedded Worker Payments

Branch unveiled “Branch Embedded,” a solution enabling platforms to offer workers instant and flexible payment options directly within their systems. This boosts financial accessibility and speed for gig and hourly workers.

Source

VoPay Adds Real-Time PayPal & Venmo Payouts

VoPay has expanded its embedded payments offering with real-time PayPal and Venmo payouts. The update enhances speed and convenience for businesses managing digital disbursements.

Source

Proxet Partners with Adyen to Simplify Payments

Proxet has formed a strategic alliance with Adyen to streamline payment experiences for merchants while driving innovation in digital commerce. The partnership emphasizes efficiency and scalability.

Source

🏦 Banking

NatWest May Sell Cushon Pension Unit

NatWest is reportedly in talks to sell Cushon, its workplace pensions provider, as part of its strategic portfolio review. The potential sale highlights ongoing shifts in the bank’s business focus.

Source

Zone & Co Launches Direct Bank Connectivity

Zone & Co introduced direct bank connectivity for its ZoneReconcile solution, enabling businesses to streamline reconciliation processes. The tool strengthens automation in financial operations.

Source

First Fed Bank Debuts Apiture Platform

First Fed Bank has launched Apiture to enhance its digital business banking services. The platform aims to provide customers with a more integrated and modernized banking experience.

Source

Bancolombia Goes Live on MX.3 for Hedge Accounting

Bancolombia has successfully implemented MX.3 for hedge accounting, improving its financial risk management capabilities. The deployment reflects growing adoption of advanced treasury technologies.

Source

💸 Fintech

FintechOS & Tech Mahindra Partner to Modernize Core Systems

FintechOS and Tech Mahindra have joined forces to help financial institutions modernize core systems. The partnership will enable scalability and faster digital transformation for global banks.

Source

Bolt Launches Founder-Focused Growth Program

Bolt has introduced “Activate,” a program designed to accelerate the growth of founders in digital commerce. The initiative provides tailored resources and support for scaling businesses.

Source

Jar Sees 9x Surge in Operating Revenue

Indian fintech Jar reported a ninefold increase in operating revenue, driven by user growth and product expansion. The milestone underscores strong momentum in India’s digital savings and investment sector.

Source

MoneyHero Turns Profitable Despite Revenue Dip

MoneyHero, an Asian fintech comparison platform, posted profitability despite a decline in revenues. The shift demonstrates improved cost management and operational resilience.

Source

Pine Labs Plans $700M IPO in October

Indian fintech Pine Labs is preparing for a $700 million IPO next month. The move positions the company among Asia’s largest upcoming fintech listings.

Source

🪙 Crypto

Kredete Raises $22M for Immigrant Credit and Remittances

Kredete secured $22 million to expand its credit-building services and stablecoin-powered remittances for African immigrants. The startup aims to improve financial inclusion through blockchain-based tools.

Source

Bitget Wallet Adds Pix for Crypto Payments in Brazil

Bitget Wallet has integrated Brazil’s instant payment system Pix, allowing users to make crypto payments more seamlessly. This strengthens the bridge between traditional payments and digital assets.

Source

Asset Managers Favor Centralized Stablecoins

A growing majority of traditional asset managers now prefer centralized stablecoins over decentralized alternatives. The trend reflects a focus on regulatory clarity and risk management.

Source

📊 WealthTech

BLC Chooses LenderAI for Bridge Lending

Business Loan Capital (BLC) has adopted LenderAI to streamline originations in its bridge lending operations. The integration is set to boost efficiency and decision-making speed.

Source

📜 Regulation

MCO Expands Compliance Oversight Tools

MCO has enhanced its compliance solutions to better support financial services firms and banks. The improvements aim to strengthen oversight in an increasingly complex regulatory environment.

Source

📦 Other

SoftBank Vision Fund Cuts 20% of Staff to Bet on AI

SoftBank’s Vision Fund will lay off 20% of its workforce as it doubles down on AI investments. The move signals a strategic pivot to focus heavily on artificial intelligence opportunities.

Source

Viamericas Partners with GCB to Boost Remittances

Viamericas has announced a partnership with GCB to expand and enhance its remittance services. The collaboration aims to provide customers with more efficient and accessible cross-border transfers.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a "Source: [Name]" attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.