Ripple Expands into Wallet Tech with Palisade Acquisition

Ripple has acquired UK-based digital asset and wallet company Palisade, marking a major step in its mission to offer end-to-end blockchain-based financial services. The move strengthens Ripple’s position in the institutional crypto custody and tokenization space, as it continues to diversify beyond remittances. This acquisition could position Ripple as a key infrastructure provider for regulated digital assets, supporting its long-term Web3 and CBDC ambitions. It also signals growing competition in the institutional digital wallet sector, especially as traditional finance embraces blockchain. Ripple’s latest move showcases how legacy fintech players are maturing into full-fledged crypto infrastructure firms.

Video of the Day

Insight of the Day

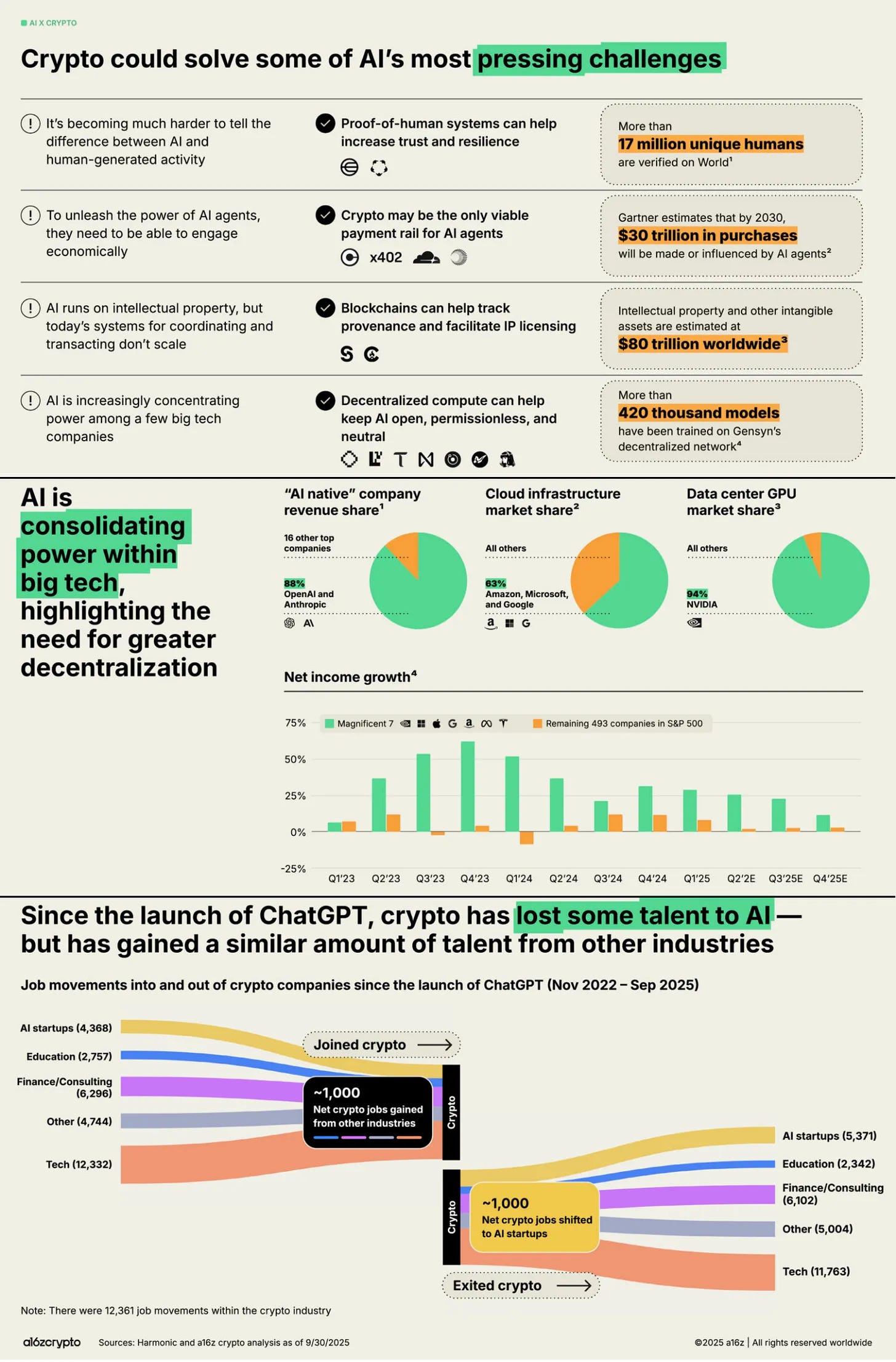

AI and Crypto Are Converging — and It Might Redefine the Internet Itself

The line between human and machine is blurring — fast. AI can write, trade, and even negotiate contracts. But as agents grow more autonomous, the real question becomes: how do they transact, verify, and trust each other in a world without humans in the loop?

That’s where crypto comes in.

At its core, crypto solves the same problems AI will soon face — trust, coordination, and value exchange in digital environments. Today, the internet has no built-in “proof of human” layer, no native payment rail for machines, and no scalable system for tracking ownership of digital work. AI exposes all of these gaps — and blockchain might be the fix.

Take identity. The rise of deepfakes and bots has made it nearly impossible to tell who’s real online. Projects like World, which has verified over 17 million people through biometric proof-of-personhood, could become the foundation of a new “human layer” for the internet. Instead of endless CAPTCHA tests and centralized KYC databases, you could have a privacy-preserving cryptographic proof that you’re, well, you.

Then there’s the economy of AI agents. Analysts like Gartner predict that by 2030, AI agents will control or influence $30 trillion in purchases. But how will these agents pay, receive, and settle microtransactions autonomously? Traditional rails like Visa or SWIFT can’t handle millions of real-time, low-value transactions between machines. Protocols like x402, pioneered by Coinbase, are an early glimpse of what that future could look like — an interoperable crypto standard enabling agents to transact, tip, or trade data with one another, instantly and permissionlessly.

Curated News

💳 Payments

Klarna Expands Debit Card to 15 European Markets

Klarna has partnered with Marqeta to launch its debit card across 15 new European countries, strengthening its footprint beyond its Buy Now, Pay Later core. This move reflects Klarna’s broader push to become a daily payments app rather than a niche credit provider.

Source

Gumtree Rolls Out Wallet-First Payments with Mangopay

Gumtree has integrated Mangopay to enable a wallet-first payment experience, improving transaction security and convenience for marketplace users. The upgrade aligns with the growing shift toward embedded payment ecosystems.

Source

Shopify Partners with payabl to Streamline eCommerce Checkout

Shopify’s new partnership with payabl aims to optimize checkout speed and reduce cart abandonment for merchants. The collaboration underscores the increasing focus on frictionless payment infrastructure in global eCommerce.

Source

🏦 Banking

Starling Bank Signs Deal with Tangerine, Plans 100 New Hires

UK neobank Starling has partnered with Canada’s Tangerine Bank to provide its cloud-native banking software internationally, while expanding its workforce. This marks a major export milestone for UK fintech innovation.

Source

Kuwait Finance House Adopts AI Avatars for Branch Experience

Kuwait Finance House and NCR Atleos are integrating conversational AI avatars into branches to enhance customer engagement and streamline operations. The initiative reflects the region’s rapid adoption of human-like digital banking experiences.

Source

SBS Brings Open Banking to UK Building Societies

SBS has launched open banking capabilities to help UK building societies and smaller banks modernize digital offerings. This development could accelerate innovation among mid-tier financial institutions.

Source

💡 Fintech

AI Fintech Optasia Climbs in JSE Debut, Eyes Asia Growth

AI-powered fintech Optasia saw strong investor interest in its Johannesburg Stock Exchange debut and plans expansion into Asia. Its focus on alternative credit scoring through AI underlines growing demand for inclusive digital finance solutions.

Source

Indian Fintech Zynk Raises $5M for Global Expansion

India’s Zynk secured $5 million to scale its financial automation platform globally, targeting SMEs with smart accounting and expense tools. The funding highlights investor confidence in India’s next-gen SaaS fintech ecosystem.

Source

Spendesk Enters Corporate Travel With Unified Spend Platform

Spendesk has expanded into corporate travel management, integrating booking, payment, and control into its existing spend platform. The move positions it as an all-in-one solution for finance teams managing company expenses.

Source

Alleviate Secures $150M Growth Investment from Sound Point Capital

Alleviate has raised $150 million to scale its lending and debt management platform. The capital will fuel expansion and technology upgrades amid rising investor interest in credit innovation.

Source

🪙 Crypto

EU Foils €600M Crypto Scam

EU authorities have dismantled a massive crypto fraud operation worth €600 million, signaling tighter European oversight on digital assets. The bust highlights the ongoing battle against illicit crypto activity as regulation tightens.

Source

Crypto Market Sees $2B in Liquidations Amid Bitcoin Slump

Over $2 billion in crypto positions were liquidated as Bitcoin fell sharply and Ethereum hit a four-month low. The volatility underscores fragile investor sentiment and tightening liquidity in the digital asset space.

Source

Zcash Gains Momentum on ‘Cypherpunk Principles’

Galaxy Digital highlighted Zcash’s surge as investors look for privacy-focused alternatives to Bitcoin. The renewed interest reflects the ongoing debate around transparency versus privacy in crypto.

Source

Experts Warn Against Bitcoin Overconfidence

Analysts caution that investor overconfidence and lack of innovation could stall Bitcoin’s progress despite institutional adoption. The warning adds nuance to narratives of crypto market maturity.

Source

Singapore Gulf Bank Taps Fireblocks for Digital Asset Infrastructure

Singapore Gulf Bank has partnered with Fireblocks to build its digital asset custody and transfer capabilities. The move reinforces Asia’s growing role in institutional-grade crypto infrastructure.

Source

Chainlink and FTSE Russell Bring Global Indices Onchain

Chainlink is collaborating with FTSE Russell to publish global market indices onchain for the first time using DataLink. The partnership bridges traditional finance data with blockchain accessibility.

Source

💰 WealthTech

Banca Sella Acquires Hype Stake for €85M

Banca Sella has purchased an €85 million stake in digital bank Hype, strengthening its wealth and retail banking ecosystem. The move supports consolidation among Italy’s challenger banks.

Source

⚖️ Regulation & Security

Cifas and Trend Micro Join Forces to Tackle Identity Fraud

Cifas and Trend Micro have announced a partnership to combat online scams and identity theft across the UK. The collaboration aims to combine cybersecurity intelligence with fraud prevention networks.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.