Ripple’s GTreasury Acquires Solvexia to Strengthen Enterprise Financial Automation

Ripple’s GTreasury has acquired Solvexia, a financial automation and data orchestration platform, to expand its enterprise treasury and compliance capabilities. The move strengthens Ripple’s push beyond crypto payments into end-to-end financial operations, including reporting, controls, and automation. By integrating Solvexia, GTreasury aims to serve large corporates and financial institutions with more sophisticated tooling. This acquisition signals Ripple’s broader ambition to become a core fintech infrastructure provider. It also highlights growing convergence between crypto-native firms and traditional financial automation platforms. For fintech leaders, it underscores M&A momentum in enterprise finance tech.

Video of the Day

Insight of the Day

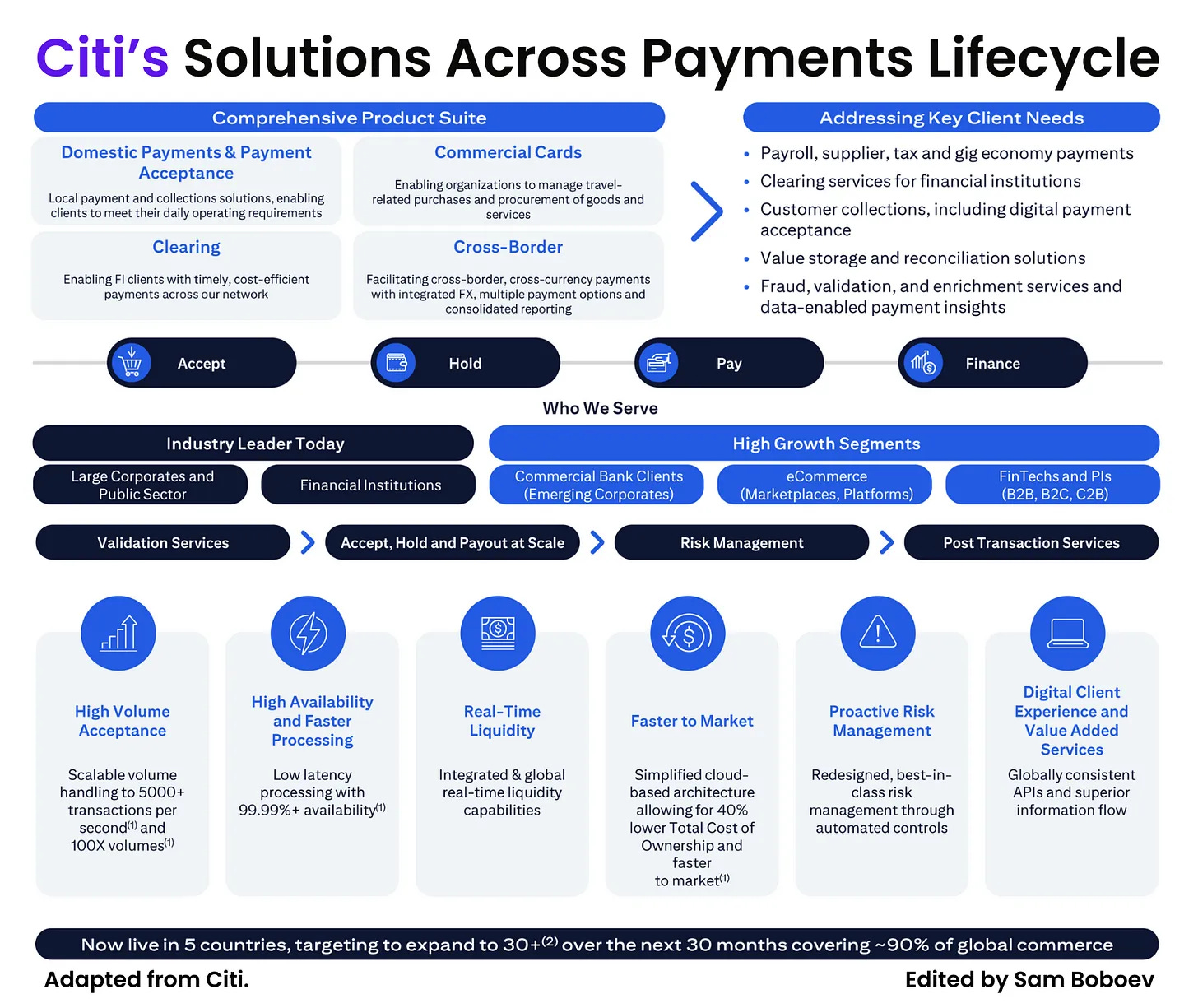

𝐇𝐨𝐰 𝐂𝐢𝐭𝐢 𝐂𝐨𝐯𝐞𝐫𝐬 𝐭𝐡𝐞 𝐄𝐧𝐭𝐢𝐫𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐋𝐢𝐟𝐞𝐜𝐲𝐜𝐥𝐞

One thing Citi does exceptionally well is treating payments as a lifecycle, not a single transaction.

When you look closely at Citi Payments, you see a tightly integrated stack that spans Accept → Hold → Pay → Finance, all within one global network.

Here is how it actually works.

🔹 𝐀𝐜𝐜𝐞𝐩𝐭

This is where money enters the system.

Citi supports both consumer and B2B collection use cases across markets:

• Online checkout and D2C payments via Spring by Citi

• Domestic receivables like ACH and instant debit

• Cross-border receivables for global merchants

• Card acceptance and pay-by-bank flows

The key point is scale. Citi operates local payment rails in 90+ countries, so acceptance is multi-domestic by design, not bolted on later.

🔹 𝐇𝐨𝐥𝐝

This is the part many people underestimate.

Once funds are collected, Citi focuses heavily on liquidity control and reconciliation:

• Real-time liquidity visibility

• Virtual accounts for fund segregation

• Payer ID and reference data for reconciliation

• Target balancing and cash concentration

This layer is what allows enterprises and platforms to operate at scale without losing control of cash, especially in marketplace and eCommerce models.

🔹 𝐇𝐨𝐥𝐝

This is where Citi’s global network really shows its strength.

Citi supports outbound payments across multiple rails and speeds:

• Domestic payments via ACH and wires

• Cross-border payments with embedded FX

• Instant payments and real-time payouts

• Wallet payouts and commercial cards

This enables global payouts for sellers, gig workers, suppliers, and partners, all from the same infrastructure.

🔹 𝐅𝐢𝐧𝐚𝐧𝐜𝐞

Payments do not stop at movement of money.

Citi extends into financing directly within the payment flow:

• Supplier finance

• Seller financing

• BNPL partnerships

• Commercial cards linked to liquidity

This is where payments turn into a revenue and margin lever, not just an operational function.

______

Citi is not positioning payments as a product. It is positioning payments as core financial infrastructure.

The same stack supports:

• Corporates managing global cash

• Banks accessing USD clearing and instant payments

• eCommerce platforms scaling payouts

• Fintechs building end-to-end money movement

And payments already account for roughly 74% of Citi’s services revenue, growing at double-digit CAGR, which explains why so much investment is going into this area.

Curated News

💳 Payments

Sterling Bank Taps Thunes to Boost Cross-Border Payments for Nigerian Expats

Sterling Bank has joined Thunes’ Direct Global Network to improve international money transfers for Nigerian expatriates. The partnership promises faster settlement, broader reach, and improved transparency. It reflects continued innovation in cross-border payments targeting diaspora communities.

Source

PayPal Ads Unveils Transaction Graph Insights for Commerce Advertising

PayPal Ads has launched new transaction graph insights and measurement tools to help merchants improve ad performance. By leveraging payment data, advertisers can better understand conversion and ROI. This move deepens PayPal’s role at the intersection of payments, data, and digital commerce.

Source

🏦 Banking

Ajman Bank Completes Core Banking Upgrade in Digital Transformation Push

Ajman Bank has completed a major core banking system upgrade as part of its technology transformation. The new platform improves scalability, security, and product agility. This reflects a broader regional trend of banks modernising legacy infrastructure.

Source

Iute Wins Ukrainian State Tender to Build a Digital Bank

Iute has secured a state tender in Ukraine to develop a new digital bank. The project highlights public-sector support for fintech-led banking innovation. It also positions Iute as a key player in Eastern Europe’s digital finance ecosystem.

Source

🧠 Fintech

Pluto Launches AI Lending Platform for Private Market Liquidity

Pluto has introduced an AI-powered lending platform designed to unlock liquidity in private markets. The solution aims to improve credit assessment and access to capital for underserved asset classes. It signals growing use of AI in alternative finance.

Source

CredAble and Citi Partner to Digitise Trade Finance and E-Invoicing

CredAble and Citi announced a global technology partnership to digitise trade finance workflows and e-invoice validation. The collaboration targets efficiency, transparency, and fraud reduction in corporate finance. It highlights banks’ increasing reliance on fintech partners for digitisation.

Source

UK Consumers Rank Fraud Prevention as Top AI Priority in Finance

A new study shows UK consumers want AI in financial services to focus primarily on fraud prevention in 2026. Trust and security outweigh personalization and automation. The findings underline rising expectations for AI-driven protection.

Source

🪙 Crypto

US Crypto Market Rules May Be Delayed Until 2029

US crypto market regulations could be postponed until 2029, according to policy discussions. The delay may prolong regulatory uncertainty for crypto firms and investors. It highlights ongoing tension between innovation and oversight.

Source

Bitcoin Builds Momentum as Traders Await Confirmation

Bitcoin is gaining momentum as traders look for confirmation of a sustained uptrend. Market sentiment is cautiously optimistic amid improving technical indicators. The move reflects renewed interest after recent volatility.

Source

Maine Secures $1.9M Settlement With Bitcoin ATM Operator

Maine has reached a $1.9 million settlement with a Bitcoin ATM operator over scam-related losses. The case highlights growing regulatory scrutiny of crypto ATMs. Consumer protection is becoming a central theme in crypto enforcement.

Source

Solana Memecoin Frenzy Drives PumpSwap Volume to $1.2B

A surge in Solana-based memecoin trading pushed PumpSwap’s volume to a record $1.2 billion. The spike underscores retail-driven speculation and high on-chain activity. It also highlights Solana’s growing role in crypto trading ecosystems.

Source

📈 WealthTech

Strategy Reports $17.4B Unrealised Loss in Q4

Strategy disclosed a $17.4 billion unrealised loss in Q4, reflecting market volatility. The figures highlight the risks associated with large balance-sheet exposures. It serves as a reminder of macro sensitivity in investment-heavy firms.

Source

Japan’s Metaplanet Shares Jump 10.7%

Shares of Japan’s Metaplanet surged 10.7% following positive market developments. The rally reflects renewed investor confidence. It underscores volatility and momentum-driven movements in Asian markets.

Source

⚖️ Regulation

Singapore Jails Two Over Wirecard-Linked Account Falsification

Singapore courts jailed two individuals for falsifying accounts connected to the Wirecard scandal. The case reinforces authorities’ tough stance on financial misconduct. It also shows long-tail enforcement from historic fintech failures.

Source

📌 Other

Cash Withdrawals Rise for Fourth Consecutive Year in the UK

Cash usage and withdrawals rose for the fourth year in a row as consumers continue valuing physical money. The trend challenges assumptions of a fully cashless society. It has implications for banks, ATMs, and payment infrastructure planning.

Source

Updraft Launches First TV Ad in Omnichannel Brand Push

Updraft has launched its first-ever TV advertising campaign as part of a broader omnichannel strategy. The campaign highlights how consumer debt accumulates through everyday digital spending. It signals fintechs’ growing investment in mass-market brand building.

Source

Cred App Appoints Matt Trueman as CEO to Drive Expansion

Next-generation credit platform Cred has appointed Matt Trueman as CEO. The leadership change aims to accelerate growth and market expansion. Executive hires continue to be a key signal of fintech scaling ambitions.

Source

Capitolis Names Roy Saadon Head of Market Development

Capitolis has appointed Roy Saadon as head of market development and portfolio optimisation. The role focuses on expanding client engagement and optimising capital efficiency. It reflects continued talent movement in market infrastructure fintech.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.