Robinhood CEO: Tokenisation Is an Unstoppable Freight Train

Robinhood CEO Vlad Tenev described tokenisation as an “unstoppable freight train,” signaling how blockchain and digital assets will reshape financial markets. He argued that tokenised securities will democratize access to investment opportunities and transform infrastructure efficiency. This aligns with broader industry momentum, as major institutions explore blockchain for clearing, settlement, and asset issuance. Tenev emphasized that resistance to tokenisation will fade as adoption accelerates, drawing parallels with previous technological shifts in finance. The statement reflects Robinhood’s broader strategy to stay ahead in digital assets. It also underscores the rising convergence of traditional finance and crypto-native innovation.

Insight of the Day

Proliferation of payment systems is increasing the threat ‘surface’

In a multipolar world, payments systems are growing more complex, with new national, transnational, and global rails emerging. These include entirely new forms such as stablecoins and CBDCs (e.g., the digital euro), as well as the linking of domestic instant payment rails (as in India, Malaysia, and Singapore, where payments can start on one system and end on another). This expansion is likely to continue as governments push for sovereignty and operators seek resilience.

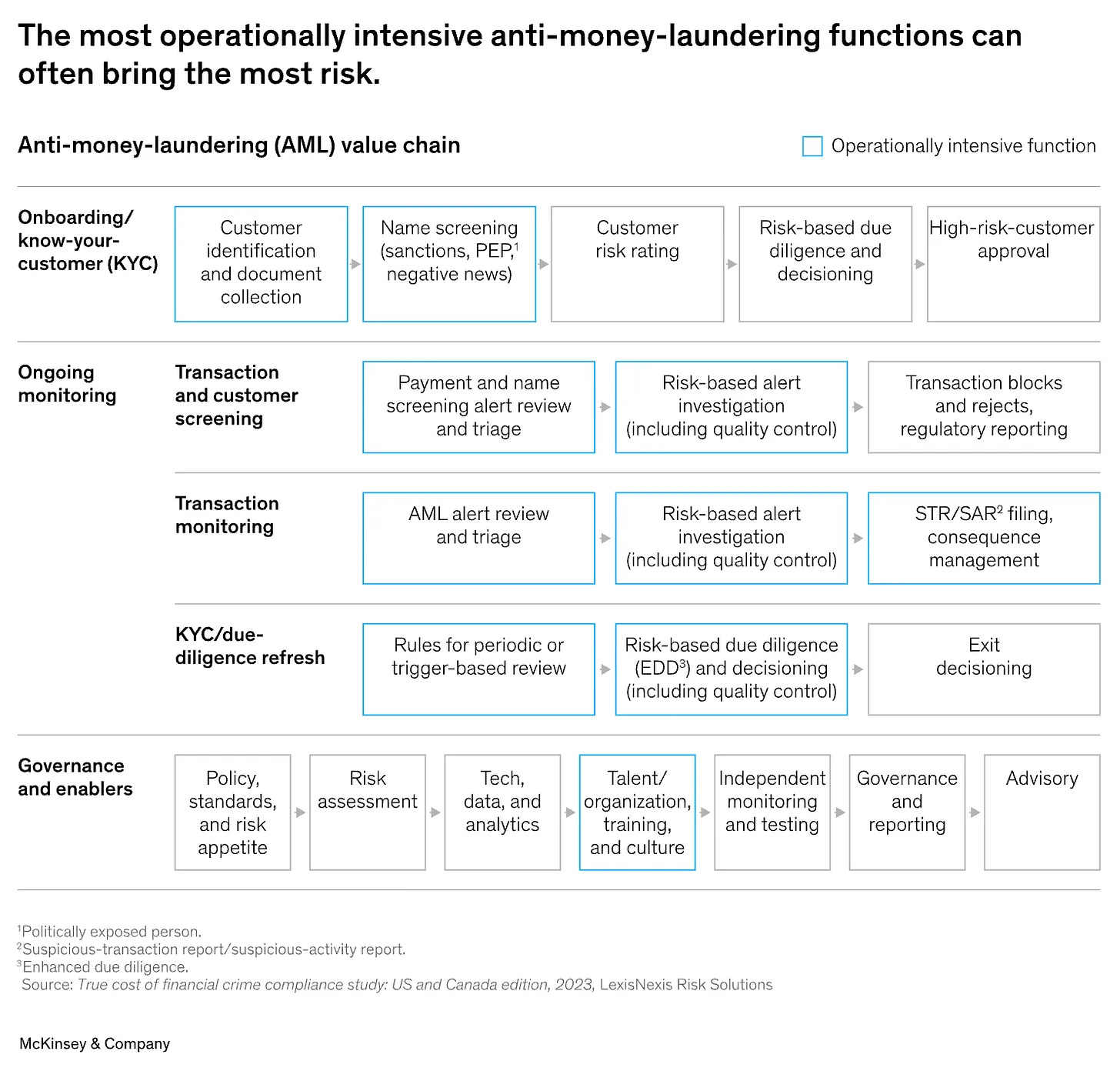

Some authorities are also diversifying currency usage—such as China’s interest in paying for Saudi oil in renminbi—to reduce reliance on external systems. Yet, as new schemes arise, traditional protections like AML or fraud controls may lag. Systems built for a single domestic rail must now confront a far broader set of risks.

Going forward, financial institutions must integrate rail-agnostic risk controls and monitoring to ensure security across offerings. Drawing from proven methods—such as AML checks on wires or fraud controls on cards—can maintain trust, safeguard compliance, and protect against vulnerabilities in new technologies.

👉 Navigating payments risk in 2025

To manage evolving risks, banks and providers should adopt a proactive stance built on five imperatives:

🔹 Embrace appropriate risk. Taking risk on customers can unlock revenue. Just as advanced credit models manage risk while optimizing outcomes, strong payments risk management reduces friction and creates advantage.

Curated News

💳 Payments

Synchrony Acquires Versatile to Strengthen POS Credit Offerings

Synchrony has acquired Versatile to expand its point-of-sale credit solutions, aiming to compete more aggressively in embedded finance. The move bolsters its retail partnerships and strengthens its footprint in consumer lending at checkout.

Source

Remitee Raises $20M for Embedded Remittance

Remittance startup Remitee secured $20 million to expand its embedded payments infrastructure. The funding will accelerate its mission to make international money transfers more seamless within partner platforms.

Source

Triple-A Adds iPiD Verification to Boost Stablecoin Payments

Triple-A integrated iPiD’s verification service to improve accuracy and trust in stablecoin transactions. This enhancement comes as stablecoin payments gain traction in cross-border commerce.

Source

Evertec Expands in Brazil With Tecnobank Stake

Evertec finalized its acquisition of a controlling stake in Tecnobank, expanding its payment and financial product offerings in Brazil. The deal underscores the growing importance of Latin America’s digital payments sector.

Source

I&M Bank Introduces Tanzania’s First World Elite Debit and Multi-Currency Prepaid Cards

I&M Bank has launched Tanzania’s first Mastercard World Elite debit card along with a multi-currency prepaid card, powered by OpenWay’s Way4 platform. The move aims to enhance cross-border financial access for Tanzanian customers.

Source

🏦 Banking

nCino Launches AI Mortgage Tools to Streamline Lending

Cloud banking provider nCino introduced AI-driven mortgage solutions designed to speed up loan processing and improve customer experience. The tools aim to modernize how banks handle mortgage workflows.

Source

Sibos 2025: Banks Urged to Be Modern, Not Modernised

At Sibos 2025, speakers warned that banks must fundamentally transform rather than just digitize legacy processes. They stressed that modernization should mean reinvention, not superficial upgrades.

Source

💡 Fintech

Baselane Secures $34M to Expand AI Offerings

Property-focused fintech Baselane raised $34 million to enhance its AI-powered financial tools. The funding will drive innovation in landlord banking and cash-flow management.

Source

Carta Acquires Accelex to Enhance Data Automation

Carta announced the acquisition of Accelex to provide AI-powered data automation and transparency for capital allocators. The move strengthens Carta’s position as a key infrastructure player in private markets.

Source

Brazil’s Kanastra Raises $30M for Private Credit Growth

Brazilian fintech Kanastra secured $30 million to expand its private credit platform. The company plans to scale operations amid growing investor appetite for alternative lending.

Source

Teylor Lands €150M from Fasanara Capital

Swiss fintech Teylor raised €150 million in funding from Fasanara Capital. The financing will support SME lending expansion across Europe.

Source

LSEG Opens Private Market Trading to Crowdfunding Investors

The London Stock Exchange Group announced it will allow crowdfunding investors access to private market trading. The initiative aims to expand liquidity and investor participation in private assets.

Source

🪙 Crypto

Sibos 2025: DeFi Expected to Reshape Financial Ecosystem

Experts at Sibos 2025 highlighted that decentralized finance (DeFi) is on track to transform the global financial system. They emphasized opportunities for efficiency but warned of regulatory and stability challenges.

Source

💰 WealthTech

Public Unveils Fully Customisable Direct Indexing

Public introduced a new direct indexing product that allows investors to tailor portfolios to their specific needs. The move reflects growing demand for personalization in wealth management.

Source

Wealth App Chip Raises £6M from Channel 4 Ventures

UK-based wealth app Chip secured £6 million from Channel 4’s venture arm. The funds will support its growth in automated savings and investment services.

Source

⚖️ Regulation & Compliance

ECB Picks AI Startup Feedzai to Safeguard Digital Euro

The European Central Bank selected AI firm Feedzai to help detect and prevent fraud in its upcoming digital euro system. The move highlights the critical role of AI in securing central bank digital currencies.

Source

iDenfy Expands Compliance Toolkit With Criminal Background Checks

iDenfy introduced a new compliance feature offering automated criminal background checks. This enhancement strengthens KYC and AML capabilities for financial institutions.

Source

📊 Other

Adyen: Australians Lost $1,700 Each to Fraud in 2025

Adyen reported that Australians lost an average of $1,700 each to fraud this year, worsened by AI-driven scams and seasonal risks. The findings highlight growing security concerns in digital commerce.

Source

Scottish Company Data Platform Launched to Boost Investment

A new Scottish company data platform was unveiled to improve transparency and attract investment. It aims to provide investors with better access to corporate information.

Source

Diebold Nixdorf’s Brian Gallipeau Recognized as Industry Leader

Diebold Nixdorf executive Brian Gallipeau was named one of 2025’s top “Future of Field Service Stand Out 50” leaders. The recognition highlights his contributions to fintech operations and customer service innovation.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.