Robinhood Launches Private Market Fund for Retail Investors

Robinhood has unveiled a new fund that gives retail investors access to private market opportunities, traditionally reserved for institutional players. This move marks a major step toward democratizing alternative investments, opening up exposure to startups, growth equity, and other private assets. By lowering entry barriers, Robinhood aims to expand diversification options for everyday investors and tap into rising demand for non-public markets. While it offers new opportunities, the fund may also raise concerns about liquidity and risk exposure. Still, this initiative could reshape wealth management for retail audiences by blurring the line between public and private market access.

Insight of the Day

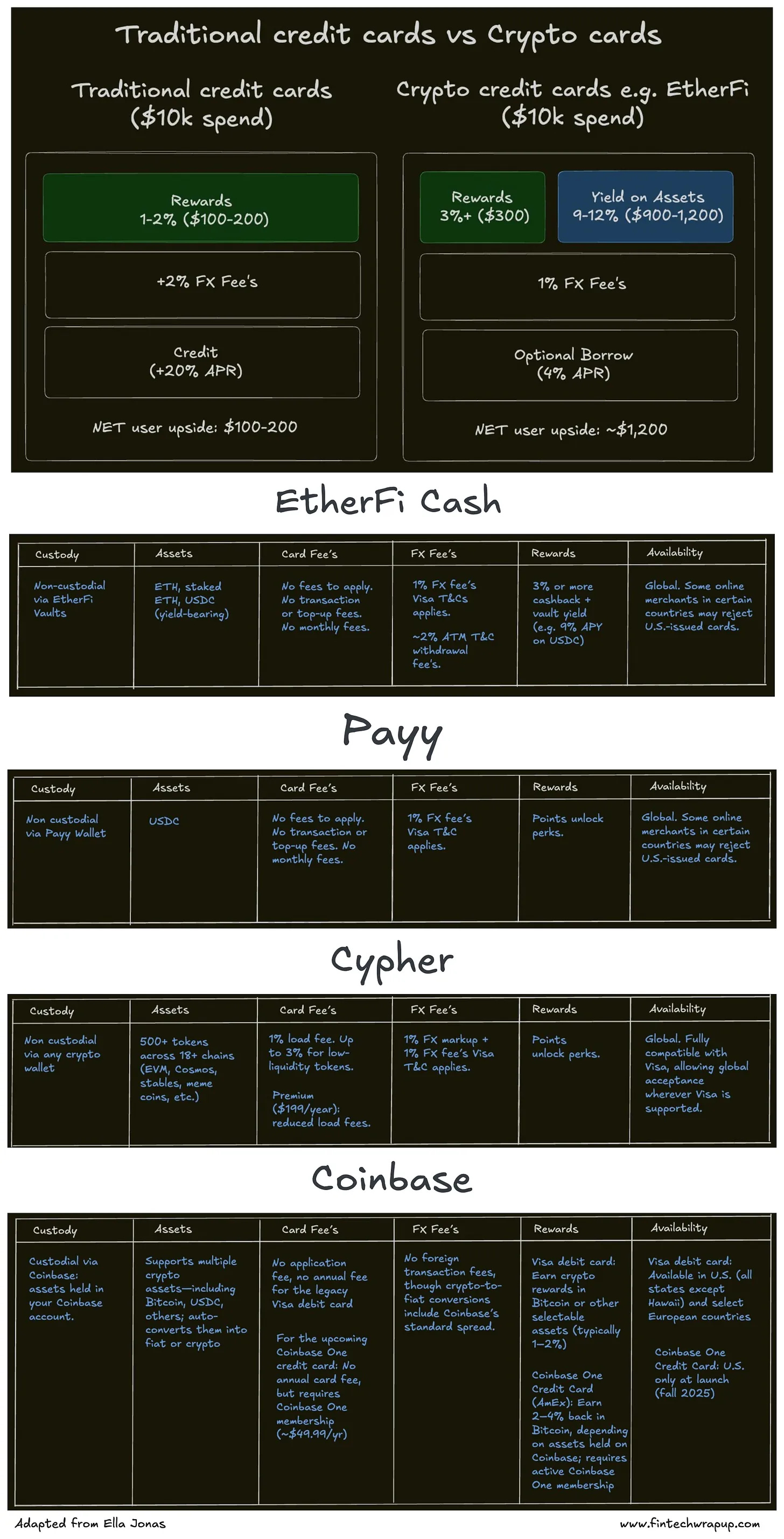

Crypto Card Comparison (2025)

Most “crypto cards” are just prepaid cards with crypto branding: you complete KYC, move your coins to a custodian and earn a token trickle. Real differentiation comes from how they handle custody, yield and fees. Four cards illustrate the spectrum.

🔹 EtherFi Cash

EtherFi Cash plugs into an EtherFi vault instead of a bank. When you deposit USDC or ETH, those assets keep working: stablecoins earn 9–12% APY and ETH keeps staking. You spend directly from the vault and earn at least 3% cashback. A $10 k USDC deposit yields roughly $900–1 200 in interest and about $300 more in cashback if you churn the balance. There are no top‑up or idle‑balance fees. An optional borrow mode lets you draw credit at ~4% APR against your vault; if you repay within the billing cycle, the vault yield and cashback more than cover the cost. It’s designed for disciplined users comfortable with DeFi.

🔹 PAYY

PAYY is a self‑custodial Visa card that spends USDC anywhere Visa is accepted while using zero‑knowledge proofs to keep spending private. Unlike other cards, which link every swipe to your KYC identity and wallet forever, PAYY breaks the chain. The trade‑off is gamified access: you must earn 100 000 Payy Points (by holding stables or referrals) to unlock the physical card, and the program offers neither yield nor cashback. It functions more like a privacy membership than an economic product.

🔹 Cypher

Cypher acts as an “everything wallet”: it supports 500+ tokens across 18 blockchains, integrates with Apple Pay and Google Pay, and offers bill pay and family controls. You can spend any token anywhere Visa is accepted. Standard pricing includes ~1% fees to load or convert and 3% at ATMs; a $199/yr Premium subscription removes FX fees, lowers other costs and raises daily limits to $200 k. If your portfolio spans EVM tokens, Cosmos assets, stables and meme coins, Cypher makes them one tap away from coffee. With a CYPR token launch planned, early users will receive an airdrop and future swipes and referrals earn CYPR, making rewards grow over time.

Curated News

💳 Payments

Pega Introduces AI-Powered Payment Exception Resolution

Pega launched a payment exceptions and investigations solution with native agentic AI, designed to reduce costs and speed up resolution times for banks and payment processors. The tool aims to streamline back-office processes, improving efficiency and customer experience.

Source

Klarna Adds Flexible Payments to Apple Pay In-Store

Klarna is bringing its flexible installment options to Apple Pay for in-store purchases, enhancing convenience for shoppers. The move further embeds buy-now-pay-later (BNPL) services into mainstream retail payments.

Source

TreviPay Powers Walmart’s Pay By Invoice Offering

TreviPay will enable Walmart Business customers to use Pay By Invoice, offering extended payment terms to small and medium-sized businesses. The partnership supports cash flow flexibility and positions Walmart as a stronger B2B platform.

Source

areeba Brings Google Pay to Lebanon

Lebanese payment processor areeba partnered with Entrust to launch Google Pay enablement, making it the first provider to do so in the country. The development expands digital wallet adoption in the region.

Source

Zelle Hits $600B in Payments for H1 2025

Zelle processed over two billion transactions worth nearly $600 billion in the first half of 2025, marking record highs. The numbers highlight growing adoption of peer-to-peer and small-business payments in the U.S.

Source

Marqeta Research: Demand Rising for Smarter Payment Platforms

New research from Marqeta shows consumers and SMBs are increasingly pushing for intelligent financial solutions, creating growth opportunities for modern payment platforms. This underscores the demand for seamless, flexible financial services.

Source

🏦 Banking

U.S. Bank Joins CLSSettlement

CLS announced that U.S. Bank has joined its CLSSettlement service, a global FX settlement platform. The move strengthens cross-border payment stability and reduces settlement risk.

Source

Libya’s National Union Bank Partners With Network International

Libya’s National Union Bank has selected Network International to modernize its digital payments infrastructure. The collaboration aims to accelerate digital transformation in the country’s banking sector.

Source

📊 Fintech

SEON Raises $80M for AI Compliance Expansion

Fraud prevention firm SEON secured $80 million to scale its AI-driven compliance and fraud detection platform. The funding will help the company expand globally amid rising regulatory demands.

Source

WorkFusion Raises $45M for AI in Financial Crime

WorkFusion raised $45 million to expand its agentic AI tools focused on financial crime compliance. The funding highlights investor confidence in AI-driven risk management.

Source

Saudi Fintech Spare Secures $5M Pre-Series A

Saudi fintech Spare closed a $5 million pre-Series A round to scale its financial services offerings. The funding signals growing investor interest in the Middle East’s fintech ecosystem.

Source

Payhawk Introduces Four Enterprise AI Agents

Payhawk launched four enterprise-ready AI agents designed to transform spend management for businesses. The tools promise automation and efficiency in expense tracking and payments.

Source

BaseKit and Mastercard Boost MSME Digital Inclusion

BaseKit partnered with Mastercard to drive digital inclusion for micro, small, and medium enterprises (MSMEs). The collaboration focuses on equipping businesses with modern financial tools.

Source

Iris Finance Raises $6.2M for AI CFO Platform

Iris Finance raised $6.2 million to grow its AI-native CFO platform tailored for consumer packaged goods (CPG) brands. The funding will fuel product development and market expansion.

Source

Money20/20 Middle East Opens in Riyadh

The Money20/20 Middle East event launched in Riyadh with major fintech announcements expected to reshape the sector. The gathering highlights the region’s growing role in global fintech.

Source

🪙 Crypto

Santander’s Openbank Launches Crypto Trading in Germany

Santander’s digital bank Openbank has rolled out crypto trading services in Germany, allowing customers to buy and sell digital assets. The launch strengthens crypto’s integration into mainstream banking.

Source

Transak and MetaMask Enable Stablecoin Onramping

Transak partnered with MetaMask to provide 1:1 stablecoin onramping with named IBANs, improving fiat-to-crypto conversions. This move enhances usability for individuals and businesses adopting digital assets.

Source

Thomson Reuters Teams With Ledgible on Crypto Tax

Thomson Reuters partnered with Ledgible to simplify digital asset tax reporting for businesses. The collaboration aims to reduce complexity and compliance burdens in crypto accounting.

Source

📈 WealthTech

Brits Eye ChatGPT for Tax Returns

A new survey reveals that over half of Brits plan to use ChatGPT to complete their tax returns. While appealing for speed and cost savings, the trend raises concerns about accuracy and compliance risks.

Source

⚖️ Regulation

HSBC Deploys AI Platform for Client Experience

HSBC has rolled out a new AI platform aimed at enhancing client services while ensuring regulatory compliance. The system underscores the growing use of AI in banking operations.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a "Source: [Name]" attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.