Samsung Brings Coinbase Access to 75M Wallet Users in Major Crypto Expansion

Samsung has deepened its push into digital assets by integrating Coinbase access for 75 million Samsung Wallet users worldwide. This collaboration allows seamless crypto trading and management directly from users’ devices, marking a milestone in mainstream blockchain adoption. The move bridges traditional tech and decentralized finance, positioning Samsung as a global leader in consumer crypto accessibility. It could accelerate mass adoption by bringing crypto tools to millions of non-crypto-native users. Analysts see this as a turning point that validates digital assets’ place in everyday finance and mobile ecosystems. The partnership also signals growing convergence between tech giants and established crypto infrastructure providers.

Insight of the Day

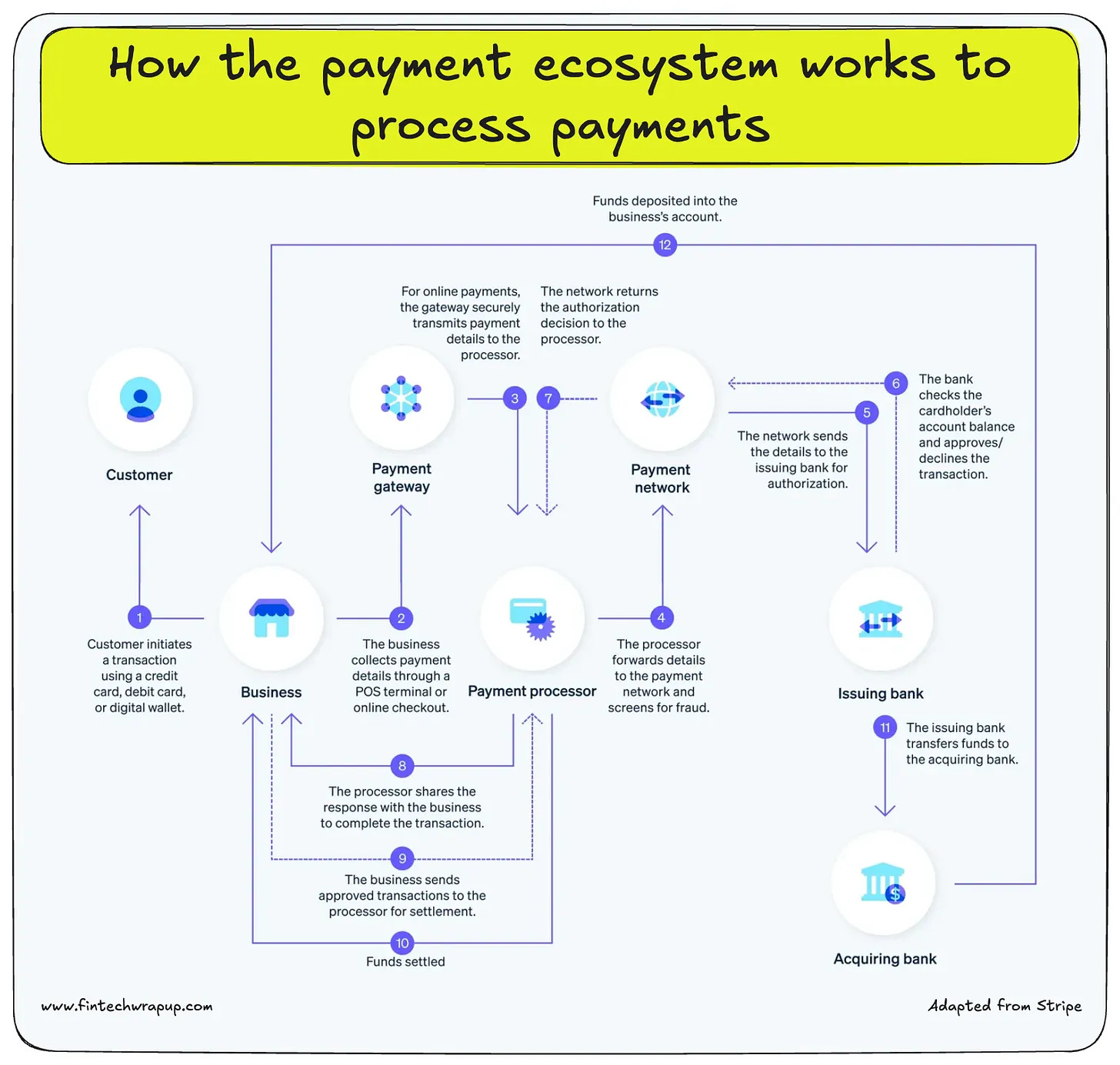

How the payment ecosystem works to process payments

The payment processing ecosystem is a complex web of relationships between players who work together to enable seamless and secure transactions. As the term “ecosystem” suggests, there are interconnected relationships and functions at play. Here’s an overview of how these stakeholders interact during payment processing:

🔹 Customer: The process begins when the customer decides to make a purchase using a payment method such as a credit card, debit card, or digital wallet.

🔹 Business: The customer presents their payment method to the business, either by swiping, dipping, or tapping their card at a physical POS terminal, entering their card details online, or using a digital wallet.

🔹 Payment gateway: In online transactions, the payment gateway securely transmits the payment information from the business’s website or app to the payment processor.

🔹 Payment processor: The payment processor receives the transaction details and forwards them to the relevant payment network (Visa, Mastercard, American Express, etc.) for authorization. The processor also checks for potential fraud and compliance with security standards.

🔹 Payment network: The payment network receives the transaction details from the payment processor and routes them to the issuing bank for authorization.

🔹 Issuing bank: The issuing bank checks the transaction details, such as the cardholder’s account balance. Based on this information, the issuing bank either approves or declines the transaction and sends the decision back to the payment network.

Curated News

💳 Payments

Checkout.com Wins Georgia Banking Charter to Expand in the US

Checkout.com has secured a Georgia banking charter, positioning itself to compete directly with US enterprise digital payment providers. The milestone enables the company to expand its payment rails and offer deeper integration for American businesses.

Source

PayDo Introduces US IBAN via SWIFT

PayDo has launched a US IBAN through the SWIFT network, allowing users to receive and send USD payments globally with enhanced compliance and speed. This marks a significant step for cross-border payment accessibility in the fintech sector.

Source

Payabl Joins Wero, Supporting Europe’s Digital Wallet Push

Payabl has partnered with Wero to advance Europe’s initiative for a sovereign digital wallet and account-to-account payments system. The move aligns with the EU’s ambition to enhance financial autonomy and reduce reliance on non-European payment giants.

Source

Square Powers Growth for London’s JMHG Group

Square is fueling digital innovation across London’s hospitality sector through its partnership with The JMHG Group. The collaboration focuses on modern payment solutions that streamline operations and boost customer experiences.

Source

🏦 Banking

MVB Bank Partners with Aeropay on Pay-by-Bank Solutions

MVB Bank has teamed up with Aeropay to bring pay-by-bank capabilities to its customers, reducing transaction costs and improving payment efficiency. This partnership underscores the growing shift toward direct account payments.

Source

Net-Zero Banking Alliance Votes to Shut Down

The Mark Carney-founded Net-Zero Banking Alliance is closing after internal divisions on climate commitments. The dissolution highlights the challenges of aligning global banks on sustainability targets amid shifting regulatory expectations.

Source

💡 Fintech

ECB Partners with Italian Tech Firms to Build Digital Euro Infrastructure

The European Central Bank has chosen Almaviva and Fabrick to develop the digital euro app and its core infrastructure. The collaboration marks a major milestone in Europe’s digital currency journey and aims to enhance financial sovereignty and innovation.

Source

Thought Machine Raises £45M Despite Growing Losses

Core banking tech firm Thought Machine secured £45 million in funding as it continues to scale globally, even while reporting higher losses. The capital will help strengthen its platform amid intense competition in the fintech infrastructure space.

Source

Teylor Secures €150M Facility from Fasanara for Factoring Expansion

Swiss fintech Teylor has landed €150 million from Fasanara Capital to grow its European factoring business. The financing will help the firm meet SME demand for alternative credit solutions.

Source

Kanastra Raises $30M to Build Brazil’s Private Credit Infrastructure

Brazilian fintech Kanastra raised $30 million in Series B funding led by F-Prime to enhance private credit infrastructure. The company aims to digitize and scale lending in Latin America’s fast-growing credit market.

Source

Zeller Expands to the UK in First Overseas Move

Australian fintech Zeller has entered the UK market, marking its first international expansion. The company aims to bring its integrated payments and financial management tools to small businesses across Britain.

Source

Yavrio Named Among CNBC’s Top UK Fintechs 2025

Open banking startup Yavrio has been listed among CNBC’s top UK fintechs, recognizing its leadership in enterprise financial automation. The accolade underscores its growing role in open finance innovation.

Source

Remitee Raises $20M to Power Embedded Remittance

Argentina-based Remitee secured $20 million to scale its embedded remittance platform, simplifying cross-border transfers for digital platforms. The funding highlights the growing market for integrated payment experiences.

Source

🪙 Crypto

Crypto Wallet Adoption Skews Toward Affluent Users

A new report shows crypto wallet adoption is increasingly dominated by affluent investors, signaling a decline in mass-market engagement. The findings challenge the early narrative of crypto as a tool for universal financial freedom.

Source

Binance Launches Blockchain 100 Award

Binance has introduced the Blockchain 100 Award to recognize top innovators shaping the blockchain ecosystem. The initiative aims to encourage talent and boost credibility in the evolving crypto industry.

Source

US Bitcoin ETFs Record $3.2B in Weekly Inflows

Bitcoin ETFs in the US have recorded $3.2 billion in inflows — their second-largest week ever. The surge signals renewed investor confidence amid macroeconomic uncertainty.

Source

LayerZero Powers Cross-Chain Stablecoin Interoperability for Quantoz

LayerZero has enabled cross-chain functionality for Quantoz’s EURQ and USDQ stablecoins. This upgrade enhances liquidity and interoperability across blockchain ecosystems.

Source

💰 WealthTech

Chip Raises £6M from Channel 4 Ventures

Wealth app Chip has secured £6 million from Channel 4’s VC arm to scale its AI-driven investment tools. The funding will fuel product innovation and user growth in the digital savings space.

Source

⚙️ Other / AI

Snowflake Launches Cortex AI for Financial Services

Snowflake has unveiled Cortex AI, a scalable AI platform built for financial services firms. The solution enables secure data sharing, analytics, and predictive modeling across enterprise systems.

Source

SEI Announces Strategic Partnership with Graphene

SEI has formed a partnership with Graphene to enhance its digital infrastructure and investment capabilities. The collaboration aims to advance data-driven innovation in wealth and asset management.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.