SEC Tightens Oversight on Tokenized Stocks and Synthetic Equity

The U.S. Securities and Exchange Commission has clarified its stance on tokenized stocks, signaling stricter scrutiny of platforms offering blockchain-based equity exposure. The guidance draws a clear line between compliant, regulated tokenized securities and so-called “synthetic” equity products that may bypass investor protections. By reinforcing disclosure, custody, and registration expectations, the SEC is aiming to curb regulatory arbitrage in crypto-linked capital markets. This move raises compliance costs for issuers but provides greater legal certainty for institutions exploring tokenization. It also signals that tokenized finance will be regulated firmly within existing securities frameworks, rather than treated as a loophole. For fintechs and exchanges, the message is clear: innovation is welcome, but only within established regulatory guardrails.

Video of the Day

Insight of the Day

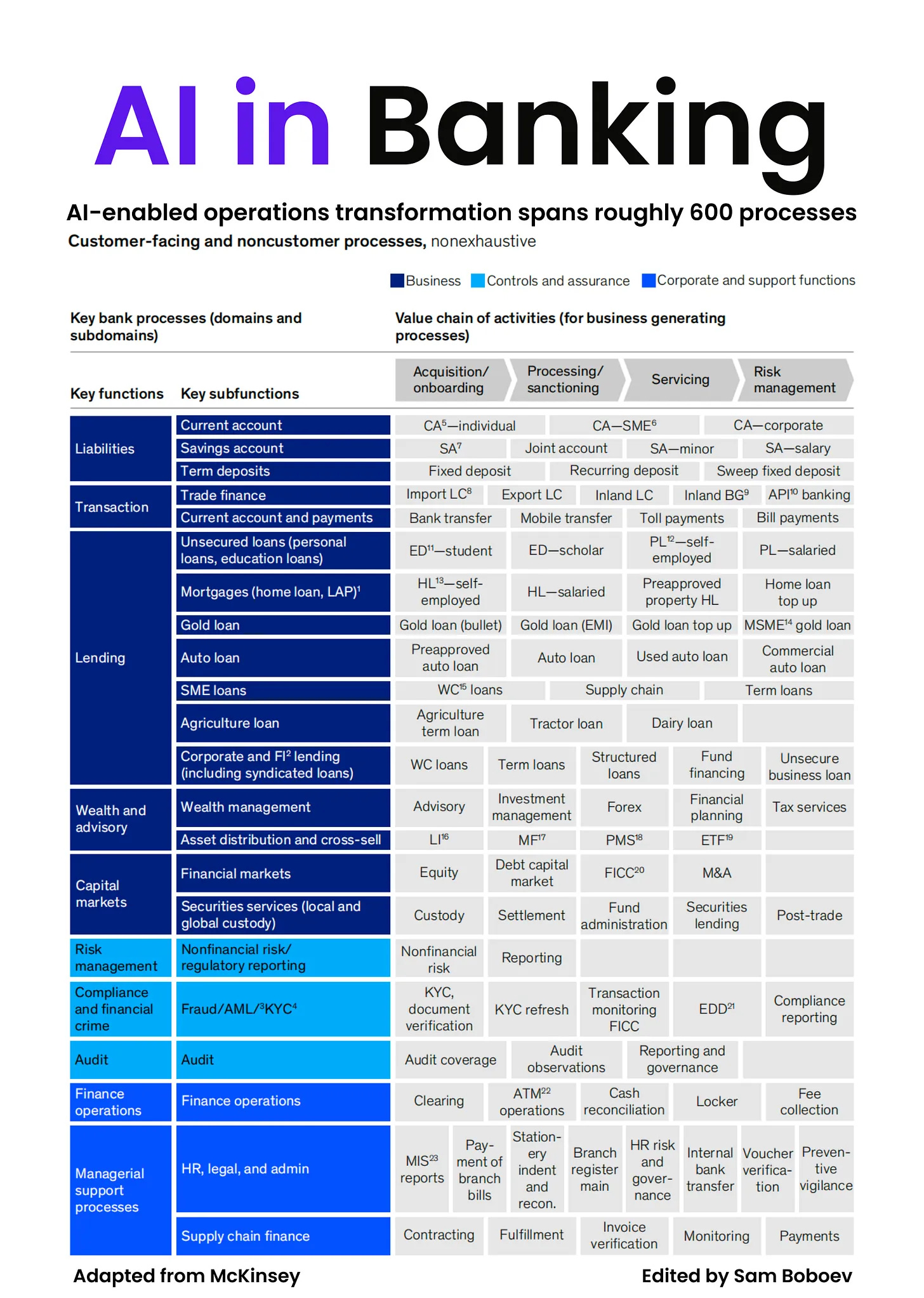

𝐖𝐡𝐲 𝐀𝐈 𝐅𝐚𝐢𝐥𝐬 𝐢𝐧 𝐁𝐚𝐧𝐤𝐬

Most banks do not fail with AI because the models are weak. They fail because the work is mis-specified.

Look at the actual operating surface of a bank. Hundreds of processes across deposits, payments, lending, wealth, markets, risk, compliance, finance, and support. Each process decomposes into the same four stages: onboarding, processing, servicing, risk. Each stage reuses the same decisions under different names.

KYC is not one thing. It appears in account opening, loan origination, trade finance, corporate onboarding, and periodic reviews. Credit assessment is not a lending function. It shows up in overdrafts, cards, SME facilities, structured loans, and collections. Reconciliation is not a finance task. It exists in payments, custody, ATM ops, securities, and internal transfers.

____

Banks keep automating these as if they are unique.

That is why AI initiatives stall. Teams deploy models inside products instead of extracting the decision logic into shared services. The same eligibility rules, risk thresholds, and exception handling are rebuilt dozens of times. Governance breaks because no one owns decisions end to end.

____

Agentic AI becomes useful only when decisions are separated from workflows.

Atomic agents should own stable decision primitives: identity confidence, sanctions risk, credit appetite, pricing bands, servicing next-best-action, exception severity. Orchestration agents then compose these primitives across onboarding, transaction processing, servicing, and risk.

____

This is not theoretical. It directly changes cost, risk, and speed.

Upstream identity confidence reduces downstream fraud handling. Shared credit logic reduces overrides and post-approval remediation. Early exception classification reduces service center load and audit findings. Reusable decision agents eliminate model sprawl.

The outcome is not “AI transformation.” It is fewer handoffs, fewer reconciliations, fewer controls added after the fact.

If AI does not change how decisions are owned, reused, and orchestrated across the value chain, it will never move bank-level economics.

Curated News

💳 Payments

UAE Central Bank Trials Facial and Palm Biometric Payments

The UAE central bank has launched a regional first by piloting facial and palm biometric payments. The initiative aims to reduce fraud and friction in everyday transactions while laying the groundwork for next-generation digital payments infrastructure.

Source

SUNRATE Builds Global Acquiring Capability

SUNRATE has acquired an experienced payments team to accelerate the launch of its global acquiring services. The move strengthens its end-to-end payments offering and positions the firm to better serve multinational merchants.

Source

Viva.com Expands BLIK Payments to In-Store Checkout

Viva.com has extended BLIK code payments to in-store checkout across Poland using tap-on-any-device technology. The rollout unifies online and offline payments, improving convenience for merchants and consumers alike.

Source

🏦 Banking

Lloyds Deepens AI Investment After Proving Value

Lloyds Banking Group plans to expand its use of AI after quantifying the financial returns from existing deployments. The bank sees AI as a core driver of efficiency, risk management, and customer experience.

Source

Santander Reshapes Branch Network for the Future

Santander has announced further changes to its UK branch network as part of its digital transformation strategy. The shift reflects evolving customer behavior and a growing focus on digital-first banking services.

Source

Standard Chartered Applies AI to Transaction Banking

Standard Chartered is embedding AI into transaction banking services to improve efficiency and client outcomes. The initiative targets faster processing, smarter insights, and enhanced corporate banking capabilities.

Source

HSBC Partners with Sage on Digital Tax Compliance

HSBC has teamed up with Sage to help businesses prepare for incoming digital tax rules. The collaboration integrates banking and accounting tools to simplify compliance for SMEs.

Source

🪙 Crypto

UAE Gets Its First Central Bank-Registered Stablecoin

Universal has launched the UAE’s first stablecoin registered with the central bank. The move signals growing regulatory acceptance of stablecoins in the region and supports institutional crypto adoption.

Source

Bybit Adds Bank Accounts as It Eyes U.S. Expansion

Crypto exchange Bybit plans to offer fiat bank accounts with IBAN access, according to Bloomberg. The move blurs the line between exchanges and traditional banks while supporting global expansion ambitions.

Source

Ethereum Prepares New Standard for AI Agents

Ethereum developers are preparing to roll out a new standard for AI agents on the network. The update could accelerate experimentation at the intersection of blockchain and artificial intelligence.

Source

Tether Plans Gold Allocation

Tether is considering allocating up to 15% of its portfolio to gold. The move aims to diversify reserves and reinforce confidence in the stablecoin’s backing.

Source

Gemini Launches Zcash Rewards Credit Card

Gemini has introduced a credit card that pays rewards in ZEC. The product blends traditional consumer finance with privacy-focused crypto incentives.

Source

📊 WealthTech

WealthAI Secures $1M Pre-Seed Funding

WealthAI has raised $1 million in pre-seed funding from Fuel Ventures and Founders Factory. The startup is building AI-driven tools to help wealth managers scale advice and improve client outcomes.

Source

Gold’s Rally Sparks Pension Debate

With gold prices surging, PensionBee has weighed in on whether savers should add gold to their pensions. The commentary highlights diversification benefits alongside volatility risks.

Source

⚖️ Regulation

FCA Launches Pop-Up ATM to Warn Against Investment Scams

The UK’s FCA has unveiled a pop-up ATM designed to educate consumers about investment scams. The campaign uses real-world engagement to raise awareness and prevent fraud losses.

Source

🧠 Fintech

ThetaRay Unveils Agentic AI for AML Investigations

ThetaRay has launched “Ray,” an AI-driven investigation suite designed to speed up and standardize AML investigations. The platform promises greater consistency and reduced compliance costs for institutions.

Source

NICE Actimize Launches Unified Fraud Insights Network

NICE Actimize has introduced a new Insights Network to enhance proactive fraud and financial crime prevention. The platform connects data and intelligence across institutions to improve detection accuracy.

Source

📌 Other

Mastercard Launches UK FinTech Sponsor Accreditation

Mastercard has rolled out an accreditation program for UK fintech sponsors. The initiative aims to raise standards and trust across the payments ecosystem.

Source

Volt and ClearBank Expand Merchant Account Capabilities

Volt has partnered with ClearBank to deliver next-generation merchant account services across the UK and Europe. The collaboration strengthens real-time payments and cash-management capabilities.

Source

Movitz and J.P. Morgan’s Kinexys Tackle Payee Verification

Movitz and Kinexys by J.P. Morgan are bringing global payee verification services to banks worldwide. The solution aims to reduce payment fraud and operational risk.

Source

iplicit Appoints VP Finance to Support Growth

iplicit has appointed a new VP of Finance as it targets continued growth and future investment. The hire supports the firm’s scaling ambitions in the finance software market.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.