SoFi Launches Fully Reserved Stablecoin to Power Institutional Finance

SoFi has unveiled a fully reserved U.S. dollar-backed stablecoin designed to support banks, fintechs, and enterprise partners across payments, settlements, and treasury use cases. The stablecoin is structured to be fully collateralized, addressing long-standing concerns around transparency and risk in digital assets. SoFi positions the offering as infrastructure-grade, targeting regulated financial institutions rather than retail crypto users. The move signals SoFi’s strategic expansion beyond consumer finance into core financial plumbing. It also reflects growing institutional demand for compliant stablecoin solutions amid accelerating tokenization trends. By entering this space, SoFi aims to compete with incumbents while leveraging its regulated status. The launch underscores how stablecoins are increasingly viewed as a foundational layer for modern financial services rather than speculative instruments.

Video of the Day

Insight of the Day

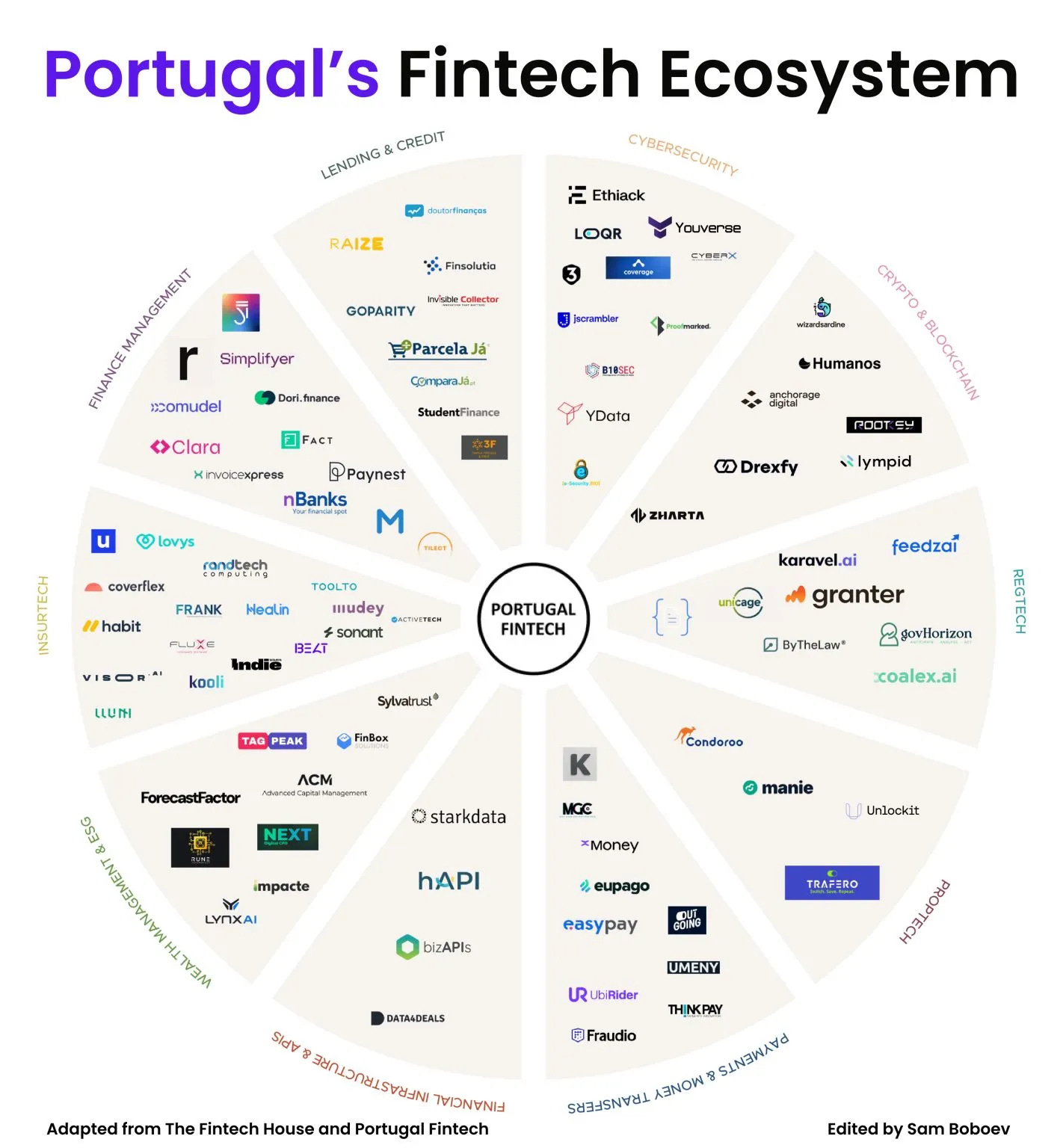

𝐏𝐨𝐫𝐭𝐮𝐠𝐚𝐥 𝐅𝐢𝐧𝐭𝐞𝐜𝐡 𝐄𝐜𝐨𝐬𝐲𝐬𝐭𝐞𝐦 𝟐𝟎𝟐𝟓

Portugal’s fintech ecosystem surprised me. Here is how I now think about it.

When I first started looking at Portugal, I expected a small market with limited fintech activity. But the more time I spent studying its founders, talent, and product culture, the more I realised this ecosystem is stronger and more ambitious than people assume.

So here is a simple breakdown of how Portugal’s fintech ecosystem works and how to make the most of it if you are building or scaling a fintech product today.

→ 𝐒𝐭𝐚𝐫𝐭 𝐰𝐢𝐭𝐡 𝐭𝐡𝐞 𝐭𝐚𝐥𝐞𝐧𝐭 𝐩𝐨𝐨𝐥

Portugal produces some of the best engineering and product talent in Europe. Years of tech relocation from companies like Revolut, Stripe, Klarna, and others created a deep bench of operators who understand scale. That matters because the strongest fintech products in Portugal tend to be built by engineers and product people, not traditional bankers.

→ 𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝 𝐭𝐡𝐞 𝐋𝐢𝐬𝐛𝐨𝐧 𝐯𝐬 𝐏𝐨𝐫𝐭𝐨 𝐝𝐲𝐧𝐚𝐦𝐢𝐜

Lisbon acts as the commercial hub. Porto acts as the technical centre of gravity. If you map where teams sit, you see this pattern everywhere. It gives Portugal a rare mix of creativity and engineering depth.

→ 𝐓𝐡𝐞 𝐞𝐜𝐨𝐬𝐲𝐬𝐭𝐞𝐦 𝐩𝐮𝐬𝐡𝐞𝐬 𝐬𝐭𝐚𝐫𝐭𝐮𝐩𝐬 𝐭𝐨 𝐭𝐡𝐢𝐧𝐤 𝐠𝐥𝐨𝐛𝐚𝐥 𝐟𝐫𝐨𝐦 𝐝𝐚𝐲 𝐨𝐧𝐞

Portugal is not large enough to sustain consumer fintechs at scale. That is why many of the best companies here build global B2B products in payments, fraud, compliance, treasury automation, and embedded finance. You can see that global-first mindset in their product design and pricing.

→ 𝐓𝐡𝐞 𝐫𝐞𝐠𝐮𝐥𝐚𝐭𝐨𝐫𝐲 𝐞𝐧𝐯𝐢𝐫𝐨𝐧𝐦𝐞𝐧𝐭 𝐡𝐞𝐥𝐩𝐬 𝐦𝐨𝐫𝐞 𝐭𝐡𝐚𝐧 𝐩𝐞𝐨𝐩𝐥𝐞 𝐭𝐡𝐢𝐧𝐤

Portugal is not trying to copy the UK. It focuses on something more practical: lowering friction for formation, hiring, and operating. For early-stage teams, that matters more than loud regulatory frameworks.

→ 𝐓𝐡𝐞 𝐜𝐨𝐦𝐦𝐮𝐧𝐢𝐭𝐲 𝐢𝐬 𝐬𝐦𝐚𝐥𝐥 𝐛𝐮𝐭 𝐡𝐢𝐠𝐡𝐥𝐲 𝐜𝐨𝐧𝐧𝐞𝐜𝐭𝐞𝐝

Every ecosystem has its own energy. In Portugal, you see fast collaboration, quick intros, and a strong link between founders and global operators who moved there. This creates a tight feedback loop for product development and partnerships.

𝐇𝐨𝐰 𝐭𝐨 𝐚𝐩𝐩𝐫𝐨𝐚𝐜𝐡 𝐏𝐨𝐫𝐭𝐮𝐠𝐚𝐥 𝐢𝐟 𝐲𝐨𝐮 𝐚𝐫𝐞 𝐢𝐧 𝐟𝐢𝐧𝐭𝐞𝐜𝐡

→ If you are a founder, treat it like a launchpad for global fintech.

→ If you are hiring, treat it like a high quality talent market that is still undervalued.

→ If you are an investor, treat it as an ecosystem that consistently punches above its weight.

→ If you are a fintech expanding into Europe, treat it as a strategic base for building cost-efficient, high quality teams.

My takeaway is simple. Portugal is not trying to win attention. It is building quietly, steadily, and with strong fundamentals.

Curated News

💳 Payments

Nodu Raises $1.45M to Modernize Europe’s Payment Rails with Stablecoins

Nodu secured $1.45 million in funding to upgrade European payment infrastructure using stablecoins. The company aims to reduce cross-border friction and settlement delays as demand for digital currency-based payments grows.

Source

KPay Partners with Amigo to Digitize Hong Kong Taxi Payments

KPay announced a digital payments partnership with Hong Kong taxi fleet operator Amigo. The collaboration expands cashless payment adoption in everyday transportation and strengthens KPay’s merchant footprint.

Source

Visa and Aldar Launch Voice-Enabled Agentic Payments

Visa and Aldar introduced voice-enabled agentic payments, allowing transactions to be initiated via AI-powered voice commands. The initiative highlights how AI interfaces are reshaping consumer payment experiences.

Source

Moneyhash and Mastercard Expand Merchant Payment Solutions

Moneyhash partnered with Mastercard to broaden access to merchant-focused payment tools. The collaboration aims to improve authorization rates and payment performance across the Middle East and beyond.

Source

Crypto.com Partners with DBS to Enhance Payment Services

Crypto.com teamed up with DBS to strengthen its payment offerings in Asia-Pacific. The partnership signals deeper collaboration between crypto platforms and traditional banks.

Source

🏦 Banking

Mercury Applies for OCC National Bank Charter

Mercury has applied for a national bank charter from the OCC to better serve startups and builders. Approval would allow Mercury to offer banking services directly rather than through partner banks.

Source

Thread Bancorp Raises $30.5M in Fresh Capital

Thread Bancorp raised $30.5 million to support growth and technology investment. The funding highlights continued investor interest in modern banking infrastructure providers.

Source

🚀 Fintech

Superbank Hits $1.6B Valuation After IPO Debut

Digital lender Superbank reached a $1.6 billion market capitalization following its IPO. The strong debut reflects investor appetite for profitable, tech-driven banking models.

Source

Akamai and Visa Team Up to Secure AI Agent Transactions

Akamai and Visa are collaborating to secure AI-driven commerce through a Trusted Agent Protocol. The partnership focuses on safeguarding automated transactions for merchants.

Source

🪙 Crypto

North Korean Hackers Steal $2B in Crypto, Report Finds

A report claims North Korean hackers have stolen approximately $2 billion in crypto assets. The findings underscore persistent security and geopolitical risks in digital asset markets.

Source

Bitcoin Could Reach $1.4M by 2035, Analysts Say

Analysts predict Bitcoin could rise to $1.4 million by 2035 under optimistic adoption scenarios. The forecast highlights continued long-term bullish sentiment despite market volatility.

Source

Ripple Expands Institutional Trading Partnership with TJM

Ripple expanded its partnership with TJM to improve institutional trade execution and clearing services. The move strengthens Ripple’s presence in professional financial markets.

Source

INXY Reports Rising Stablecoin Adoption Across Industries

INXY Payments reported increased stablecoin usage across multiple sectors. The trend points to stablecoins gaining traction beyond crypto-native applications.

Source

📊 WealthTech

Cache Surpasses $1B in Assets Under Management

Cache announced it has surpassed $1 billion in assets under management. The milestone reflects strong demand for digital-first investment platforms.

Source

⚖️ Regulation

Fed Seeks Feedback on Limited Payment Accounts

The U.S. Federal Reserve is soliciting feedback on offering limited payment accounts to certain firms. The proposal could reshape access to central bank infrastructure.

Source

FCA to Allow Flexible Contactless Payment Limits

The UK FCA plans to allow banks more flexibility in setting contactless payment limits starting March 2026. The change aims to balance convenience with fraud prevention.

Source

🧩 Other

European Payment Fraud Rate Remains Stable

New data shows Europe’s payment fraud rate has remained steady despite rising transaction volumes. This suggests fraud controls are keeping pace with digital payment growth.

Source

EuroCTP Named EU Consolidated Tape Provider

ESMA has selected EuroCTP as the consolidated tape provider for EU shares and ETFs. The decision is a key step toward greater market transparency in Europe.

Source

Bank of England Governor Warns AI Will Displace Jobs

The Bank of England governor warned that AI is likely to displace jobs across the economy. The comments highlight growing policy focus on workforce disruption from automation.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.