Stripe Brings Embedded Payments to Microsoft Copilot

Stripe is powering a new in-chat purchasing experience within Microsoft Copilot, allowing users to complete transactions directly inside an AI-driven workflow. This marks a significant step toward fully embedded, conversational commerce where payments are no longer a separate checkout step. By integrating payments into productivity tools, Stripe and Microsoft are redefining how businesses monetize AI assistants. The move highlights the growing convergence of fintech, AI, and enterprise software. It also positions Stripe at the center of emerging “agentic commerce” use cases. For fintech audiences, this partnership signals where the next wave of payments innovation is heading.

Video of the Day

Insight of the Day

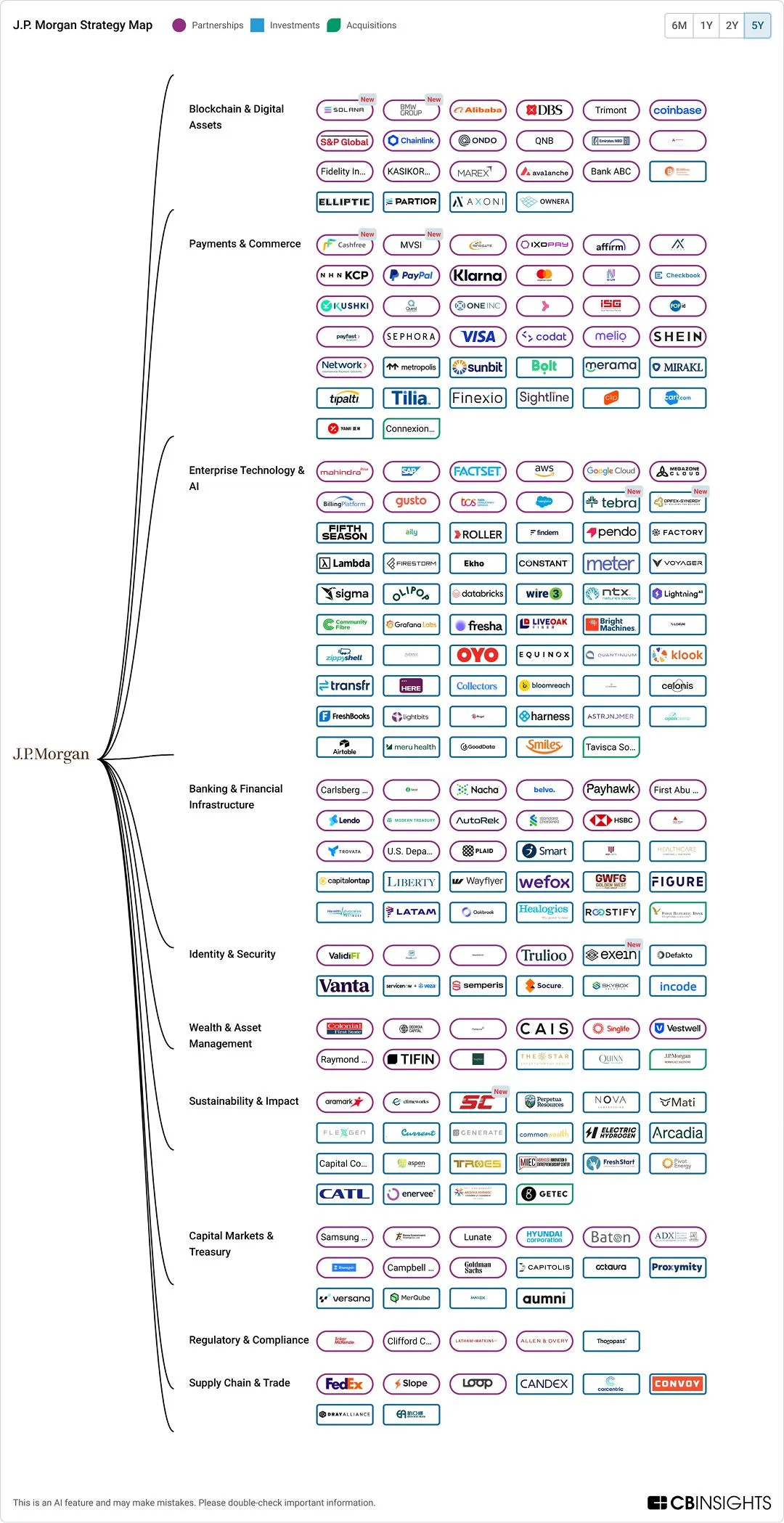

𝐉𝐏𝐌𝐨𝐫𝐠𝐚𝐧 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐲 𝐁𝐫𝐞𝐚𝐤𝐝𝐨𝐰𝐧

I look at this JPMorgan strategy map as a blueprint for how a Tier-1 bank approaches innovation.

At the highest level, the strategy is about integration rather than disruption. JPMorgan does not outsource core capabilities. It selectively partners, invests, or acquires where technology strengthens its existing balance sheet, regulatory position, and distribution.

🔹 Blockchain and Digital Assets

JPMorgan treats blockchain as financial infrastructure. The focus is on settlement, custody, tokenization, data integrity, and market efficiency. This is not a speculative crypto strategy. It is about reducing friction in capital markets, payments, and asset servicing where JPMorgan already has scale.

🔹 Payments and Commerce

This is one of the densest parts of the map because payments sit at the center of customer relationships. Cards, wallets, BNPL, merchant tools, and cross-border flows create distribution, data, and stickiness. Payments are not just a product. They are an access layer to the rest of the bank.

🔹 Enterprise Technology and AI

This section reflects how JPMorgan scales internally. Cloud infrastructure, data platforms, developer tools, observability, and AI are used to improve risk management, compliance, pricing, and operational efficiency. The priority is not flashy consumer AI. It is industrial-grade systems that allow a regulated institution to move faster without increasing risk.

🔹 Banking and Financial Infrastructure

This is the foundation. Core banking, treasury, reconciliation, liquidity, and settlement systems are where long-term defensibility is built. These systems are deeply embedded, costly to replace, and critical to regulatory compliance. Control here ensures resilience and margin stability.

🔹 Identity and Security

This category highlights a key advantage banks have over fintechs. Identity, fraud, KYC, AML, and internal controls are treated as strategic capabilities, not compliance overhead. JPMorgan invests heavily here because regulation compounds in favor of institutions that can operationalize it well.

🔹 Wealth and Asset Management

Once trust, custody, and infrastructure are in place, wealth management becomes a natural extension. Advisory tools, portfolio management, alternatives, and data platforms allow JPMorgan to monetize long-term client relationships across market cycles.

🔹 Capital Markets and Treasury

This is JPMorgan’s core engine. Trading, clearing, funding, and risk management benefit from every other layer on the map. Payments, data, identity, and infrastructure ultimately feed into stronger capital markets operations.

🔹 Regulatory and Compliance

Regulation is treated as infrastructure. Legal, reporting, and compliance tooling reduces execution risk and protects the franchise. This is an area where scale and experience create a durable moat.

Curated News

💳 Payments

Paychex and PayPal Expand Direct Deposit Alternatives

Paychex and PayPal have partnered to offer PayPal-powered payout options inside Paychex Flex Perks. The move provides employees with faster access to wages and greater flexibility beyond traditional bank deposits.

Source

FreshTunes Expands Payment Options for Artists

Music distribution platform FreshTunes has added new payout methods to support artists globally. The update improves accessibility and speed of payments for creators operating across multiple markets.

Source

Mastercard Study Highlights SME Benefits of Digital Payments

A Mastercard study found that 92% of SMEs accepting digital payments save both time and money. The findings reinforce the operational and cost advantages driving continued digital payment adoption.

Source

🏦 Banking

J.P. Morgan’s Kinexys to Integrate Deposit Tokens With Canton

Kinexys by J.P. Morgan will integrate its deposit token with the Canton blockchain. The initiative aims to enable regulated, interoperable tokenised deposits for institutional use cases.

Source

BNY Launches Tokenized Deposits for Institutions

BNY has debuted tokenized deposit offerings targeting institutions and digital-native firms. The move underscores growing bank adoption of tokenisation within regulated frameworks.

Source

🪙 Crypto

Ripple Secures UK EMI Licence and Crypto Registration

Ripple has obtained an Electronic Money Institution licence and crypto registration in the UK. The approval strengthens its regulatory standing and supports expansion of payment and crypto services in Europe.

Source

Rain Raises $250m to Scale Stablecoin Infrastructure

Stablecoin platform Rain has raised $250 million to accelerate global expansion. The funding highlights strong investor appetite for compliant, payments-focused stablecoin providers.

Source

Polygon Jumps on New Stablecoin Framework

Polygon’s token rose 13% after developers unveiled a new stablecoin framework. The announcement signals renewed focus on infrastructure to support enterprise-grade stablecoin issuance.

Source

Indonesia Approves ICEx as Second Crypto Exchange

Indonesia has approved ICEx as its second licensed crypto exchange, backed by $70 million in funding. The move strengthens regulatory oversight while expanding domestic crypto market infrastructure.

Source

Indonesia’s Crypto Trading Hits $28.6bn in 2025

Crypto trading volumes in Indonesia reached $28.6 billion in 2025, according to regulator OJK. The figures highlight strong retail participation despite tighter regulatory controls.

Source

Truebit Suffers $26m Exploit

Truebit lost $26 million in an exploit targeting older DeFi protocols. The incident underscores persistent security risks in legacy smart contracts.

Source

Zodia Custody Adds Support for AUDM Stablecoin

Zodia Custody has added custody support for the AUDM stablecoin. The move expands institutional-grade infrastructure for fiat-backed digital assets.

Source

Bitget Wallet Expands Tokenized U.S. Stocks Offering

Bitget Wallet has doubled its onchain equity offering with Ondo to more than 200 tokenized U.S. stocks. The expansion reflects growing demand for blockchain-based access to traditional assets.

Source

📊 Fintech

Ant International and Google Launch AI Commerce Protocol

Ant International and Google have introduced a new AI-driven commerce protocol. The initiative aims to standardise how AI agents transact and interact across digital ecosystems.

Source

HabitTrade Raises Nearly $10m to Expand Globally

HabitTrade has secured nearly $10 million in Series A funding to fuel international growth. The round supports product development and market expansion.

Source

ITRS Acquires IP-Label to Expand Digital Monitoring

ITRS has acquired IP-Label to strengthen its digital experience monitoring capabilities in Europe. The deal enhances its observability offering for financial services clients.

Source

💼 WealthTech

PensionBee Warns of Growing Retirement Expectation Gap

PensionBee is urging action to address the widening gap between retirement expectations and reality. The firm highlights the need for better engagement and financial planning tools.

Source

🧩 Other

Majesco Completes Vitech Acquisition

Majesco has closed its acquisition of Vitech to advance cloud and AI-native solutions for insurance and pensions. The deal strengthens its position in core systems modernisation.

Source

Levene Energy Secures $64m Facility From Afreximbank

Levene Energy has secured a $64 million facility from Afreximbank to acquire a strategic stake in Axxela Limited. The financing supports energy infrastructure expansion across Africa.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.