Stripe Makes a $1B Bet on Usage-Based Billing With Metronome Acquisition

Stripe has reportedly acquired usage-based billing startup Metronome for $1B, signaling a major push into SaaS and API-driven billing infrastructure. The move strengthens Stripe’s capabilities in managing complex, consumption-based pricing models increasingly used by AI, cloud, and developer-first companies. By bringing Metronome in-house, Stripe is positioning itself as a core financial operating system for high-growth businesses. The deal highlights how billing has evolved from a back-office function into a strategic fintech differentiator. For fintech and SaaS leaders, this is a clear signal of where platform control and data monetization are heading.

Video of the Day

Insight of the Day

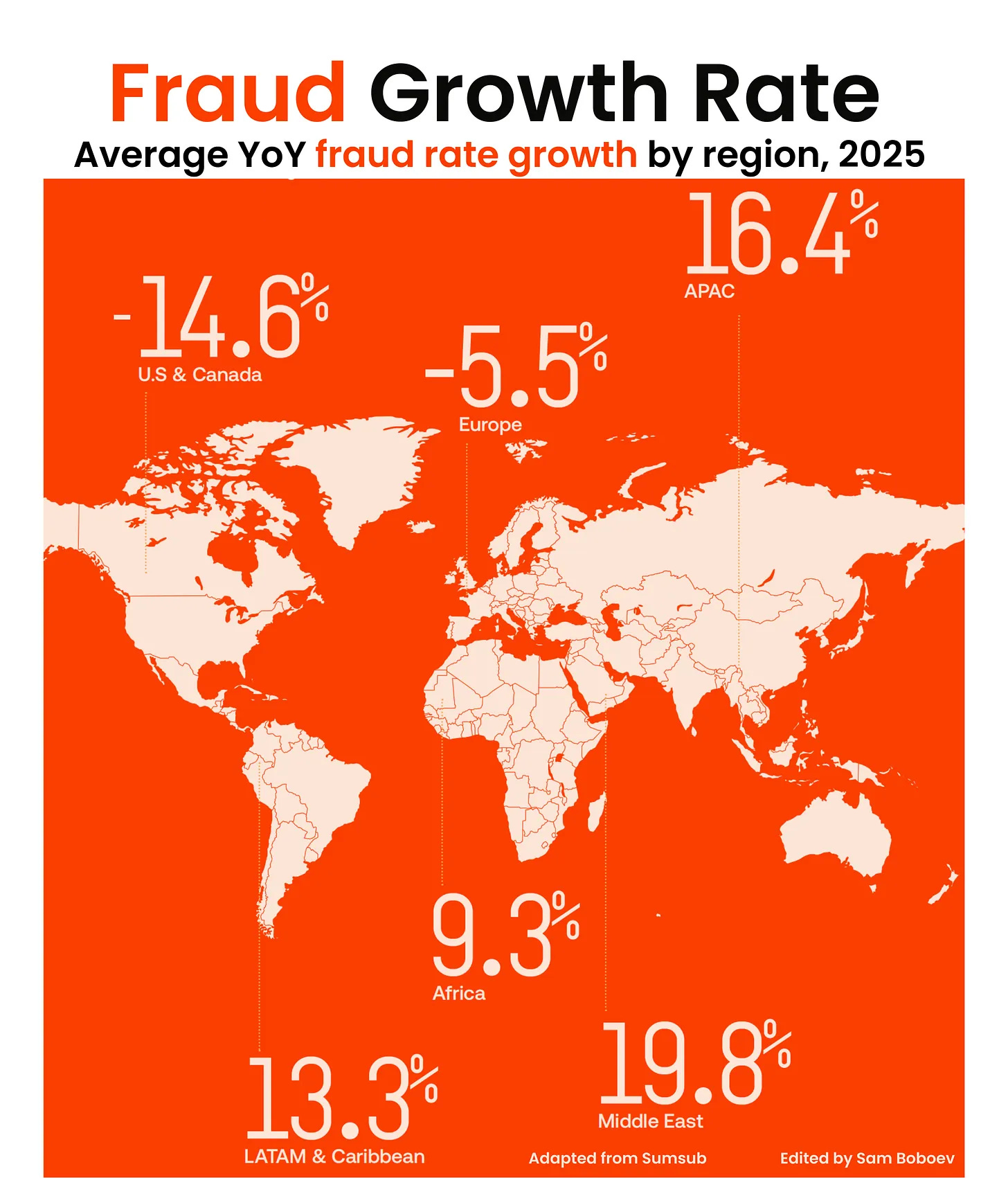

𝐅𝐫𝐚𝐮𝐝 𝐏𝐫𝐞𝐯𝐞𝐧𝐭𝐢𝐨𝐧 𝐏𝐥𝐚𝐲𝐛𝐨𝐨𝐤 𝐟𝐨𝐫 𝟐𝟎𝟐𝟔 𝐛𝐲 𝐒𝐮𝐦𝐬𝐮𝐛

I just finished reviewing Sumsub’s Identity Fraud Report 2025–2026. What they found is a very different fraud landscape than even two years ago and fintech must be aware of these changes.

Sumsub analyzed 4 million+ fraud attempts across 300+ companies and surveyed 1.2K+ end users and 300+ fraud professionals.

Here are the numbers that stood out to me:

👉 𝐓𝐡𝐞 𝐒𝐨𝐩𝐡𝐢𝐬𝐭𝐢𝐜𝐚𝐭𝐢𝐨𝐧 𝐒𝐡𝐢𝐟𝐭: 𝐟𝐞𝐰𝐞𝐫 𝐚𝐭𝐭𝐚𝐜𝐤𝐬, 𝐛𝐮𝐭 𝐞𝐚𝐜𝐡 𝐨𝐧𝐞 𝐢𝐬 𝟏𝟖𝟎% 𝐦𝐨𝐫𝐞 𝐚𝐝𝐯𝐚𝐧𝐜𝐞𝐝

Fraudsters are abandoning low-quality tricks.

→ 180% increase in “sophisticated fraud”

→ 142% YoY growth in synthetic identities

→ 388% surge in duplicate submissions

→ Deepfake-driven selfie mismatches now account for 35.4% of fraud in APAC

→ Forged documents dropped 11% YoY

→ Blacklist violations dropped 50% YoY

So even if fraud percentages remain stable, the impact of each successful attack is much bigger.

👉 𝐀𝐈 𝐢𝐧𝐝𝐮𝐬𝐭𝐫𝐢𝐚𝐥𝐢𝐳𝐞𝐬 𝐟𝐫𝐚𝐮𝐝 — 𝐝𝐨𝐜𝐮𝐦𝐞𝐧𝐭 𝐟𝐨𝐫𝐠𝐞𝐫𝐢𝐞𝐬 𝐚𝐫𝐞 𝐧𝐨𝐰 𝐧𝐞𝐚𝐫-𝐩𝐞𝐫𝐟𝐞𝐜𝐭

Fraudsters have moved from “copy-paste” edits to AI-assisted forgery factories.

The report highlights:

→ Advanced image generation tools now replicate fonts, holograms, and textures at near-human accuracy

→ Deepfakes are used to bypass liveness checks

→ Selfie-to-ID mismatches grew +73% YoY in some regions

👉 𝐃𝐨𝐜𝐮𝐦𝐞𝐧𝐭-𝐟𝐫𝐞𝐞 𝐯𝐞𝐫𝐢𝐟𝐢𝐜𝐚𝐭𝐢𝐨𝐧 𝐢𝐬 𝐞𝐱𝐩𝐥𝐨𝐝𝐢𝐧𝐠 (𝟑𝟑𝟖% 𝐘𝐨𝐘 𝐠𝐫𝐨𝐰𝐭𝐡)

One stat that shocked me:

Document-free verification grew 338% YoY, making it the fastest-growing KYC method globally.

Countries already scaling it:

→ Canada

→ Singapore

→ France

Curated News

💳 Payments

Navro Adds Stablecoin Payments via BVNK Partnership

Navro expanded its payments platform with stablecoin capabilities through BVNK, enabling faster and more cost-efficient cross-border transactions. This move reduces reliance on traditional correspondent banking rails.

Source

First Wero Payment Completed by Belgian Doccle App

Belgian digital wallet Doccle successfully executed Europe’s first Wero payment. The milestone supports efforts to build a pan-European instant payments infrastructure.

Source

Cumbuca Accelerates Access to Brazil’s Payment Initiation Market

Cumbuca launched fast-track payment initiation access aimed at fintechs entering Brazil’s open finance ecosystem. The move lowers operational and regulatory barriers in LATAM.

Source

Thredd Migrates BigPay to Next-Generation Card Platform

Thredd powered the successful migration of BigPay’s card portfolio to its next-gen platform. The upgrade improves scalability, compliance, and speed to market.

Source

Mastercard Launches SME Card With Built-In Cybersecurity

Mastercard introduced an SME-focused card with integrated cybersecurity tools. The product targets growing fraud and security risks faced by small businesses.

Source

🏦 Banking

BBVA Italy Targets One Million Customers by 2026

BBVA Italy is expanding its investment and lending offerings to fuel customer growth. The move reflects intensifying competition among European digital banks.

Source

Lloyds Completes India–UK Digital Letter of Credit

Lloyds executed its first digital letter of credit between India and the UK using WaveBL. This marks progress in digitizing global trade finance.

Source

Propel Holdings Approved to Launch Banking Services

Propel Holdings received regulatory approval to introduce full banking services. The approval enables a shift beyond lending toward a more diversified financial model.

Source

🧠 Fintech

Mastercard Uses Data to Improve Lending Decisions

Mastercard is using its transaction data to help lenders refine credit decisioning. The initiative highlights the growing role of alternative data in underwriting.

Source

Plaid Enhances Transaction Categorization With AI

Plaid rolled out AI-powered transaction categorization to deliver more accurate financial insights. This enhances use cases across personal finance, lending, and fraud prevention.

Source

Treasury Prime Launches AI Marketplace for Bank-Fintech Partnerships

Treasury Prime introduced an AI Marketplace designed to simplify compliant AI adoption for banks and fintechs. The platform aims to accelerate innovation while managing risk.

Source

LSEG Integrates ChatGPT Into Financial Data Platforms

LSEG partnered with OpenAI to integrate ChatGPT into its financial data services. The move reflects rising demand for conversational analytics in capital markets.

Source

🪙 Crypto

Stablecoin Standards Authority Launched by Federal MSBA

The Federal Money Services Business Association launched a Stablecoin Standards Authority to promote industry-led governance. The initiative aims to increase trust and interoperability in stablecoins.

Source

Binance Introduces Junior Crypto Accounts

Binance launched junior accounts with parental oversight features. The move expands crypto adoption while raising regulatory and consumer protection questions.

Source

Are Bitcoin Treasury Strategies Becoming ‘Too Big To Fail’?

A new analysis examines whether large corporate Bitcoin holdings could pose systemic risks. The discussion reflects crypto’s increasing intersection with traditional markets.

Source

📈 WealthTech

Y TREE Highlights the Shift Toward Transparent WealthTech

Y TREE explores how transparency and client-first pricing are reshaping wealth management. Trust and clarity are emerging as key competitive advantages.

Source

⚖️ Regulation

FCA Launches AI Live Testing Initiative

The UK’s Financial Conduct Authority announced the first firms participating in its AI live testing initiative. The program supports responsible AI experimentation in financial services.

Source

Connecticut Orders Fintech and Crypto Platforms to Halt Unlicensed Gambling

Connecticut regulators ordered Kalshi, Robinhood, and Crypto.com to stop offering unlicensed online gambling products. The action highlights increasing scrutiny of fintech innovation at regulatory edges.

Source

🧩 Other

Fintech Provider Marquis Hit by Ransomware Data Breach

Marquis disclosed a ransomware attack affecting dozens of US banks and credit unions. The incident underscores growing cyber risk across shared fintech infrastructure.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.