Swift to Build a Shared Ledger for Digital Assets

Swift has announced plans to develop a shared ledger designed to enable seamless interoperability between traditional financial institutions and digital asset networks. The initiative aims to reduce fragmentation in tokenized assets, central bank digital currencies, and stablecoins by providing a trusted, standardized infrastructure. By leveraging Swift’s global reach, the project could accelerate institutional adoption of digital assets while maintaining regulatory alignment. This move signals Swift’s intent to remain central to global financial plumbing as markets transition toward tokenization. It also underscores growing momentum around shared ledgers as a bridge between legacy finance and blockchain-based systems.

Video of the Day

Insight of the Day

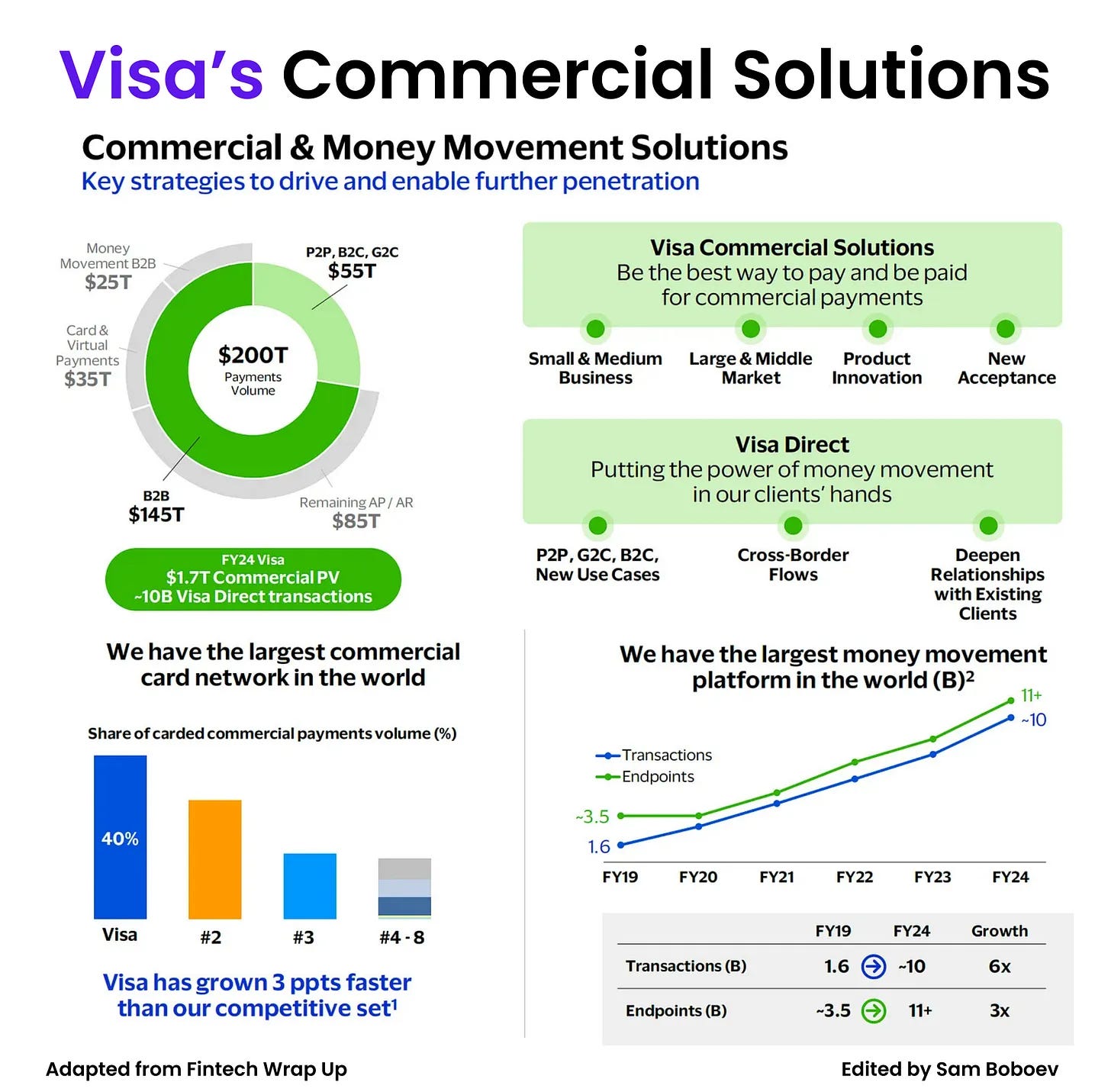

𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐕𝐢𝐬𝐚’𝐬 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐢𝐚𝐥 & 𝐌𝐨𝐧𝐞𝐲 𝐌𝐨𝐯𝐞𝐦𝐞𝐧𝐭 𝐒𝐨𝐥𝐮𝐭𝐢𝐨𝐧𝐬

Most people still think of Visa as a consumer card company. That mental model is outdated.

The real growth engine today sits in Commercial & Money Movement Solutions, Visa’s business focused on payment flows outside traditional consumer-to-merchant card swipes. This includes B2B payments, person-to-person transfers, business payouts, and government flows.

According to Chris Newkirk, President of CMS, the CMS strategy is built on two platforms. Visa Commercial Solutions targets B2B use cases such as payables, procurement, travel and expense, employee spend, and public sector payments. Visa Direct focuses on money movement at scale, covering P2P transfers, gig economy payouts, insurance disbursements, remittances, and selected B2B flows that move funds between accounts.

The addressable market here is massive. Visa estimates roughly $200 trillion in annual volume across these non-consumer flows, split between $55 trillion in money movement and $145 trillion in B2B payments.

This is not just a long-term bet. Since 2021, CMS revenues have grown at a 22 percent compound annual rate. In fiscal 2024 alone, Visa processed $1.7 trillion in commercial card volume and nearly 10 billion Visa Direct transactions. And yet, Visa still describes its penetration of this market as minimal.

The focus is deliberate. Within B2B, Visa is targeting about $60 trillion of flows where it can monetize effectively. Around $25 trillion comes from cross-border B2B payments, supported by capabilities such as Currencycloud and Visa B2B Connect. Another $35 trillion comes from domestic and cardable B2B spend, including procurement, travel, and contractor payments. These segments account for roughly 80 percent of the revenue opportunity in B2B payments.

The results are starting to show. Visa now holds around 40% global share in commercial cards and continues to gain ground. Visa Direct has become the largest money movement platform globally by transaction count, volume, and endpoints.

Cards built Visa’s network. Commercial payments and money movement are what will define its next phase of growth.

Curated News

💳 Payments

Visa, Mastercard and Revolut Lose UK Court Case on Cross-Border Fees

A UK court ruled against Visa, Mastercard, and Revolut in their challenge to proposed caps on cross-border interchange fees. The decision strengthens regulatory oversight of card payment costs and could lead to lower fees for merchants. It also reinforces policymakers’ willingness to intervene in dominant payment networks.

Source

Visa’s Crypto Chief Sees Stablecoin Payment Volumes Growing

Visa’s head of crypto says stablecoin-based payments are gaining traction, driven by faster settlement and lower costs. The company expects increased usage across cross-border and B2B payments. This highlights stablecoins’ expanding role in mainstream payment flows.

Source

Stinker Stores Boosts Employee Retention With DailyPay

Stinker Stores reported a 45% improvement in employee tenure after rolling out DailyPay’s earned wage access solution. The initiative gives workers faster access to wages, improving financial wellness. The case underscores how fintech tools can directly impact workforce stability.

Source

🏦 Banking

Standard Chartered Completes Digital Bank Guarantee via Komgo

Standard Chartered executed its first digital bank guarantee transaction using ICC and Swift API standards through Komgo. The deal demonstrates how standardized APIs can streamline trade finance processes. It marks a step toward faster, paperless guarantees for corporates.

Source

Iute Group Approved to Launch a Digital Bank in Ukraine

Iute Group has received regulatory approval to establish a digital bank in Ukraine. The move expands digital banking access in a market undergoing rapid financial modernization. It also reflects regulators’ openness to fintech-led banking models.

Source

💼 Fintech

Lingfeng Capital Prepares New Digital Venture Fund

Lingfeng Capital is launching a new Digital Venture Fund focused on technology-driven financial services. The fund aims to back early-stage fintech and digital infrastructure companies. This signals continued investor appetite for fintech innovation despite tighter markets.

Source

Feedzai and Matrix USA Partner on AI Fraud Detection

Feedzai has partnered with Matrix USA to enhance AI-driven fraud detection capabilities. The collaboration focuses on improving real-time monitoring and financial crime prevention. It highlights growing demand for advanced analytics in combating fraud.

Source

Allianz Trade Launches Social2Social Specialty Credit Offering

Allianz Trade introduced Social2Social, a specialty credit solution supporting projects with positive social impact. The initiative combines risk management with sustainability objectives. It reflects the rising intersection of fintech, credit, and ESG priorities.

Source

Kikin Financial Secures $20M Debt Facility

Kikin Financial announced a $20 million debt facility to support the growth of its UK operations. The funding will be used to expand lending capacity and scale its business. This highlights continued capital availability for non-bank lenders.

Source

🪙 Crypto

Ripple and LMAX Group Announce Strategic Partnership

LMAX Group and Ripple have formed a partnership to strengthen institutional digital asset trading. The collaboration focuses on liquidity and infrastructure for Ripple’s ecosystem. It underscores Ripple’s push into institutional markets.

Source

Ripple Injects $150M Into LMAX to Support RLUSD Stablecoin

Ripple invested $150 million into LMAX to promote adoption of its RLUSD stablecoin among institutions. The funding aims to enhance liquidity and trading capabilities. This move highlights Ripple’s aggressive strategy in the stablecoin race.

Source

LSEG Deploys Digital Settlement Service DiSH

LSEG has launched its Digital Settlement Service, DiSH, to enable blockchain-based settlement of tokenized assets. The service aims to reduce settlement risk and improve efficiency. It signals traditional market infrastructure embracing DLT.

Source

Chainlink, Cardano and Stellar Futures to Trade on CME

CME announced futures trading for Chainlink, Cardano, and Stellar starting next month. The launch expands institutional access to major crypto assets. It further legitimizes crypto derivatives in regulated markets.

Source

MetaMask Adds Tron Support

MetaMask has added support for the Tron network following earlier expansions to Bitcoin and Solana. The update broadens user access to multiple blockchain ecosystems within a single wallet. It reflects growing demand for multi-chain interoperability.

Source

DeadLock Ransomware Uses Polygon Smart Contracts

Researchers found that DeadLock ransomware is leveraging Polygon smart contracts to evade detection. The tactic complicates tracking and takedown efforts by authorities. It highlights evolving cybercrime risks within blockchain ecosystems.

Source

Pakistan Reportedly Partners on Dollar Stablecoin Project

Pakistan is reportedly exploring a partnership with Trump-backed World Liberty Financial on a dollar-linked stablecoin. The initiative could support cross-border payments and remittances. It signals growing sovereign interest in stablecoin infrastructure.

Source

📜 Regulation

FCA Opens Applications for Stablecoin Sprint

The UK’s Financial Conduct Authority has opened applications for a stablecoin “sprint” program. The initiative is designed to help firms test use cases under regulatory supervision. It reflects the FCA’s proactive approach to shaping stablecoin oversight.

Source

📊 WealthTech

Prudential and HSBC Back WeLab’s $220M Series D

Prudential and HSBC joined a $220 million Series D round for Hong Kong-based digital bank WeLab. The funding will support regional expansion and product development. It highlights strong institutional backing for digital wealth and banking platforms.

Source

📂 Other

Cosegic Acquires FINTRAIL to Boost Financial Crime Expertise

Cosegic has acquired FINTRAIL to strengthen its financial crime and compliance capabilities. The deal expands advisory services for regulated financial institutions. It reflects rising demand for specialized AML and compliance expertise.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.