Tether Hit by S&P Downgrade Amid Bitcoin Exposure Concerns

S&P has downgraded the stability assessment of Tether’s USDT to “Weak,” citing concerns over the stablecoin’s significant exposure to Bitcoin and other volatile assets. The agency highlighted that this backing structure could challenge USDT’s ability to maintain its peg during periods of market stress. The downgrade raises fresh questions about transparency, reserve composition, and systemic risk in the stablecoin ecosystem. Despite its leading market share, USDT faces renewed scrutiny from institutional participants and regulators. The assessment could accelerate demand for more tightly regulated alternatives, including fiat-backed stablecoins issued by banks or overseen institutions. This marks one of the most consequential credibility challenges Tether has faced in years.

Video of the Day

Insight of the Day

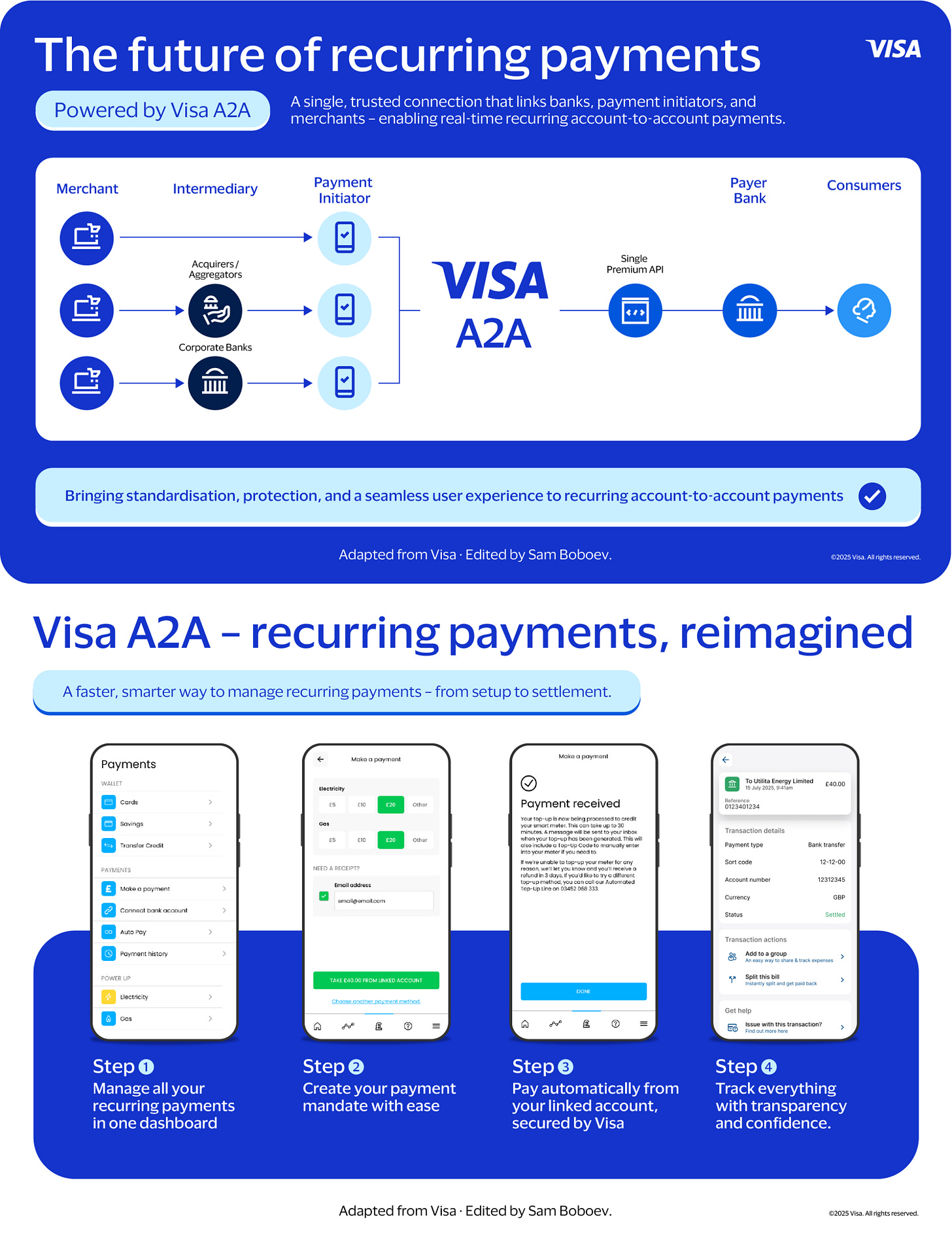

𝐓𝐨𝐝𝐚𝐲, 𝐕𝐢𝐬𝐚, 𝐊𝐫𝐨𝐨 𝐁𝐚𝐧𝐤, 𝐓𝐢𝐧𝐤, 𝐚𝐧𝐝 𝐔𝐭𝐢𝐥𝐢𝐭𝐚 𝐪𝐮𝐢𝐞𝐭𝐥𝐲 𝐦𝐚𝐝𝐞 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐡𝐢𝐬𝐭𝐨𝐫𝐲

They completed the first commercial Variable Recurring Payment (cVRP) powered by Visa A2A - ahead of its rollout across the UK.

If you’ve ever wondered how “smart” recurring payments will work in the open banking world — here’s the explainer 👇

👉 𝗪𝗵𝗮𝘁’𝘀 𝗮 𝗰𝗩𝗥𝗣?

Think of a cVRP as the next evolution of Direct Debits — but powered by open banking.

Instead of giving merchants permanent pull access to your account…

You grant them controlled, variable access (e.g., “you can take my monthly bill, but cap it at £150”).

That means you stay in control — you can set limits, revoke permission anytime, and see every transaction in real time.

👉 𝗛𝗼𝘄 𝗩𝗶𝘀𝗮 𝗔𝟮𝗔 𝗳𝗶𝘁𝘀 𝗶𝗻

The biggest blocker for cVRPs so far? No commercial model. No trustmark. No consumer protection.

Visa A2A fixes that by combining:

✅ Open banking rails (instant payments via Faster Payments)

✅ Card-like protections (dispute resolution + “Secured by Visa” trustmark)

✅ Standardised rules across banks and payment initiators

So you get the speed of open banking with the safety of Visa — something the industry has been waiting for.

👉 𝗛𝗼𝘄 𝘁𝗵𝗲 𝗳𝗶𝗿𝘀𝘁 𝗰𝗩𝗥𝗣 𝘄𝗼𝗿𝗸𝗲𝗱

Here’s what happened in the first transaction 👇

1. Tink initiated the payment request and verified funds.

2. Kroo Bank authenticated the user and approved the transfer, sending the payment in real-time

3. Visa A2A facilitated liability, risk, and dispute frameworks.

4. Utilita Energy (the energy provider) demonstrated how customers connect their bank account to the Utilita app, set up a payment mandate, and how payments are received in real-time.

End result: a real-time, secure, recurring bill payment — no direct debit delay, no surprises.

👉 𝗪𝗵𝘆 𝘁𝗵𝗶𝘀 𝗺𝗮𝘁𝘁𝗲𝗿𝘀

Curated News

💳 Payments

Worldpay Unveils AI-Driven Protocol for Agentic Commerce

Worldpay introduced an AI-powered payment integration protocol designed to support autonomous, machine-to-machine commerce. The system aims to streamline complex payment flows and enable next-generation automated commerce experiences.

Source

Klarna Partners With Lufthansa to Expand Flexible Travel Payments

Klarna and Lufthansa Group are teaming up to offer flexible payment options for travelers across Europe and the U.S. The partnership enhances Klarna’s presence in travel and supports consumers seeking more payment choice at checkout.

Source

Innovative Debt Tech Could Save Brits £17.2bn in Interest

A new debt-consolidation technology promises to dramatically cut unnecessary interest payments for UK consumers. The platform uses smarter repayment optimization to reduce costs for borrowers.

Source

Paysend and JetBlue Launch Remittance Rewards for Dominican Diaspora

Paysend and JetBlue are partnering to reward U.S.-based Dominicans for sending money home. The initiative ties remittances to travel benefits, strengthening engagement between migrant communities and financial services.

Source

Thredd Supports BigPay’s Migration to Next-Gen Card Platform

Thredd successfully migrated BigPay’s card portfolio onto its next-generation issuing platform. The move enhances BigPay’s scalability and supports more advanced payment features.

Source

Omise Launches Autonomous AI-Driven Payment System MCP

Omise introduced Omise MCP, an autonomous payment orchestration platform powered by AI. The solution aims to reduce manual intervention and boost payment performance across markets.

Source

Mastercard Survey Highlights Rising Cyber Threat Concerns in LATAM & Caribbean

A new Mastercard survey reveals growing consumer anxiety around cyber risks in Latin America and the Caribbean. Findings highlight demand for stronger security, fraud prevention, and trustworthy digital payment experiences.

Source

PPRO Enables BLIK Pay Later to Expand Poland’s BNPL Market

PPRO will support BLIK’s new Pay Later service to accelerate BNPL adoption in Poland. The partnership expands consumer choice and strengthens local e-commerce infrastructure.

Source

Juspay and Sabre Partner to Modernize Travel Payments

Juspay and Sabre announced a new partnership to streamline and modernize travel payments through improved orchestration and secure transaction flows. The collaboration aims to reduce friction for airlines and travel merchants.

Source

🏦 Banking

Higala Raises $4M to Accelerate Rural Bank Digitalization in the Philippines

Higala secured $4 million in funding to help rural banks modernize operations through cloud-based core banking and digital tools. The investment supports efforts to boost financial inclusion in underserved regions.

Source

CBA Hires UK Bank’s Data Chief to Lead AI Strategy

Commonwealth Bank of Australia has appointed a former UK banking executive to accelerate its AI transformation. The hire underscores CBA’s push to enhance analytics, automation, and customer intelligence.

Source

Finom Launches Credit Lines for Businesses in Germany

Finom introduced new credit lines aimed at supporting SMEs in Germany. The offering expands access to fast, flexible lending through a digital-first onboarding process.

Source

💼 Fintech

Robinhood Expands Into Prediction Markets With New Exchange

Robinhood is launching a dedicated exchange focused on prediction markets, marking its latest move into alternative trading products. The shift signals broader ambitions beyond traditional brokerage services.

Source

BIS Research Shows AI Agents Excelling in Cash-Management Tasks

New BIS research found that AI agents significantly outperform humans in cash-management simulations. The findings suggest major potential for automation in treasury operations and liquidity management.

Source

RooJai Raises $60M Series C to Scale Digital Insurance in Thailand

RooJai secured $60 million in Series C funding led by Apis Partners to accelerate its digital insurance expansion across Thailand and Southeast Asia. The capital will support product growth and new market entry.

Source

🪙 Crypto

Kraken Launches Crypto-Fiat Debit Card

Kraken introduced a new debit card enabling customers to spend both crypto and fiat seamlessly. The rollout strengthens Kraken’s consumer-facing product suite and bridges digital assets with everyday payments.

Source

Kraken Expands Debit Card Rollout Across UK and EU

Kraken is extending availability of its debit card to more customers throughout the UK and EU. The expansion aims to improve crypto utility and accessibility in mainstream payment environments.

Source

US Bank Runs Stablecoin Pilot on Stellar

US Bank is testing a stablecoin use case on the Stellar blockchain, aiming to streamline interbank settlement processes. The pilot highlights growing institutional exploration of blockchain-based payments.

Source

Bitcoin Nears $90K Again as Risk Sentiment Improves

QCP Capital reports that improving macro risk sentiment is driving Bitcoin’s renewed push toward $90,000. Traders cite lower volatility and demand for high-beta assets as key drivers.

Source

Malicious Chrome Extension Targeted Solana Traders

A rogue Chrome extension siphoned fees from Solana users for months, exploiting browser permissions to intercept transactions. The incident underscores ongoing security risks in crypto retail tooling.

Source

Ripple’s RLUSD Approved for Use Inside Abu Dhabi’s ADGM

Ripple’s new RLUSD fiat-referenced token has been recognized as an accepted instrument within Abu Dhabi’s ADGM financial ecosystem. The approval bolsters Ripple’s position in regulated digital asset markets.

Source

📜 Regulation

Raiffeisen Bank International Joins European Payments Initiative

RBI has joined the European Payments Initiative (EPI) as an Acceptor PSP, supporting the creation of a unified European payment ecosystem. The move helps advance Europe’s push for sovereign, interoperable payment rails.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.