Tether Launches New US Dollar Stablecoin

Tether has unveiled a new U.S. dollar-backed stablecoin, marking a significant expansion of its product suite. The move comes as demand for digital dollars continues to grow, particularly in emerging markets where stablecoins are increasingly used for payments, savings, and remittances. The launch positions Tether to compete more directly with Circle’s USDC and PayPal’s PYUSD, while reinforcing its dominance in the global stablecoin market. The firm emphasizes compliance and transparency, aiming to strengthen trust among institutional and retail users alike. Analysts see this as part of a broader shift where stablecoins become mainstream financial tools, potentially reshaping global payment rails. If widely adopted, Tether’s new offering could accelerate stablecoin integration into both fintech platforms and traditional banking ecosystems.

Insight of the Day

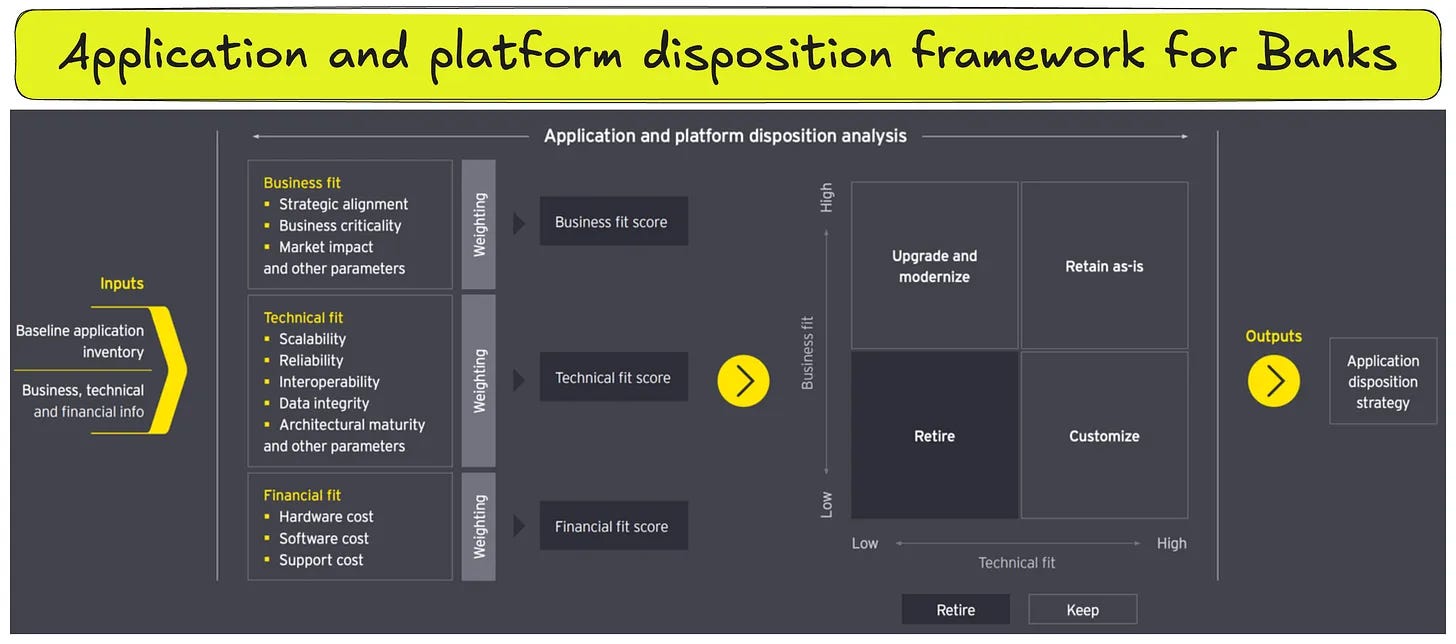

Application and Platform Disposition Framework for Banks

Mergers and acquisitions are exciting on paper—but inside a bank’s tech stack, they can look more like a game of Jenga. Which applications should stay? Which should be retired? Which need expensive modernization? That’s where the Application and Platform Disposition Framework steps in.

This framework helps banks decide which software applications and platforms to keep, upgrade, customize, or retire. It’s especially useful for those pursuing a best-of-breed integration strategy, where mixing and matching platforms without careful planning can lead to chaos, duplicated costs, and disconnected systems.

👉 The Three Dimensions That Matter

The framework works by scoring applications against business fit, technical fit, and financial fit—because not every system that’s technically sound is strategically valuable, and not every mission-critical tool is cost-effective.

🔹 Business fit considers whether the application aligns with strategy, supports critical operations, and contributes to market impact.

🔹 Technical fit looks at scalability, reliability, interoperability, data integrity, and architectural maturity.

🔹 Financial fit weighs the total cost of ownership: hardware, software, and support.

Curated News

💳 Payments

Remitly Expands with New Membership Tier

Remitly introduced a membership program alongside broader product offerings to deepen customer engagement and loyalty. The move strengthens its competitive position in the cross-border payments market.

Source

China–Indonesia Launch Cross-Border QR Payments Pilot

China and Indonesia have initiated a pilot linking QR code payment systems, enabling seamless retail transactions between the two countries. The project aims to boost cross-border trade and tourism with simpler payment interoperability.

Source

Global Payments Rolls Out Enterprise POS Solution

Global Payments launched Genius™ for Enterprise, a point-of-sale platform designed for large businesses. It promises better integration, scalability, and efficiency for retail and hospitality operators.

Source

UPS and Amex Partner on Logistics-Payments Integration

UPS and American Express announced a partnership to merge logistics and payments, streamlining how businesses manage supply chains and cash flow. The collaboration could improve efficiency for merchants handling cross-border commerce.

Source

OatFi & GigSafe Launch Early Pay for Gig Workers

OatFi and GigSafe have teamed up to offer early wage access to contingent workers. The initiative aims to improve financial flexibility for freelancers and gig economy professionals.

Source

🏦 Banking

Zelle Owner Explores Stablecoin for Banks

Early Warning Services, owner of Zelle, is considering a stablecoin product for U.S. retail banks. This could give traditional banks a foothold in the fast-growing stablecoin payments sector.

Source

Aven Raises $110M to Build ‘Machine Banking’ for Homeowners

Aven secured $110M in Series E funding at a $2.2B valuation to develop its AI-powered “machine banking” platform. The solution is tailored for homeowners seeking smarter credit and financial tools.

Source

Pathward & Oportun Extend Lending Partnership

Pathward and Oportun have renewed their collaboration to expand affordable credit access. The partnership focuses on serving underbanked communities with responsible lending products.

Source

BIMBANK Deploys SmartVista Fraud Management

BIMBANK in Mauritania adopted BPC’s SmartVista Enterprise Fraud Management solution. The upgrade strengthens its position as a leader in real-time fraud protection in the region.

Source

💰 WealthTech

Children’s ISA Moves 126K Accounts with WealthOS

Children’s ISA has migrated 126,000 accounts from Embark to Quai Digital, leveraging WealthOS’s infrastructure. The transition highlights growing reliance on cloud-native platforms in wealth management.

Source

🪙 Crypto

MoonTags Enables Instant Crypto Transfers

MoonTags launched a service allowing users to send any cryptocurrency to anyone instantly, simplifying digital asset transfers. The solution aims to reduce barriers to crypto adoption for everyday payments.

Source

WisdomTree Debuts Tokenized Private Credit Fund

WisdomTree has launched a blockchain-based tokenized fund giving investors exposure to private credit. The move reflects rising institutional interest in tokenized real-world assets.

Source

Winklevoss Twins Predict $1M Bitcoin as Gemini Goes Public

The Winklevoss twins forecast Bitcoin could reach $1 million while announcing Gemini’s public listing. Their bold prediction underscores optimism around crypto’s long-term potential.

Source

Dogecoin & BNB Surge as Bitcoin, Ethereum Rally

Dogecoin and Binance Coin saw price gains alongside Bitcoin and Ethereum, which hit monthly highs. The rally signals renewed investor appetite for crypto assets.

Source

📊 Fintech

Eloquent AI Raises $7.4M Seed Round

Eloquent AI secured $7.4M in seed funding to expand its fintech automation tools. The startup plans to scale operations and enhance its AI-driven product suite.

Source

SIX & swissSPTC Advance T+1 Settlement Transition

SIX and swissSPTC are collaborating to accelerate the move to a T+1 settlement cycle in Switzerland and Liechtenstein. The shift aims to boost efficiency and reduce risk in securities markets.

Source

EBANX Integrates Capitec Pay for Cross-Border E-Commerce

EBANX has integrated with Capitec Pay to expand open banking payments in South Africa. This enhances cross-border e-commerce accessibility for merchants and consumers.

Source

Citi Adds FIX API with Bloomberg BSKT for ETFs

Citi has enabled FIX API connectivity with Bloomberg’s BSKT tool to simplify ETF services. The upgrade improves automation and efficiency in institutional trading.

Source

📑 Other

InsureMO & Appian Partner on Underwriting Tech

InsureMO and Appian have joined forces to modernize underwriting for U.S. specialty insurance. Their collaboration leverages automation to streamline risk assessment and policy issuance.

Source

Crane VC Launches $135M APAC AI Fund

Venture firm Crane has launched a $135M fund focused on AI startups in Asia-Pacific. The move underscores rising investor appetite for AI-driven innovation in fintech and beyond.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a "Source: [Name]" attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.