TransUnion Data Breach Exposes 4.4 Million Consumers

TransUnion has confirmed a massive data breach affecting 4.4 million consumers, putting sensitive personal and financial information at risk. The incident underscores growing cybersecurity threats facing credit reporting agencies, which are prime targets due to the volume of data they manage. Regulators are expected to scrutinize TransUnion heavily, with potential penalties, lawsuits, and reputational damage looming. For consumers, the breach raises risks of identity theft and financial fraud, heightening calls for stronger safeguards. This event highlights the urgent need for the financial sector to reinforce digital defenses. It also reignites the debate around how credit bureaus handle and protect consumer data, with transparency and accountability at the forefront.

Insight of the Day

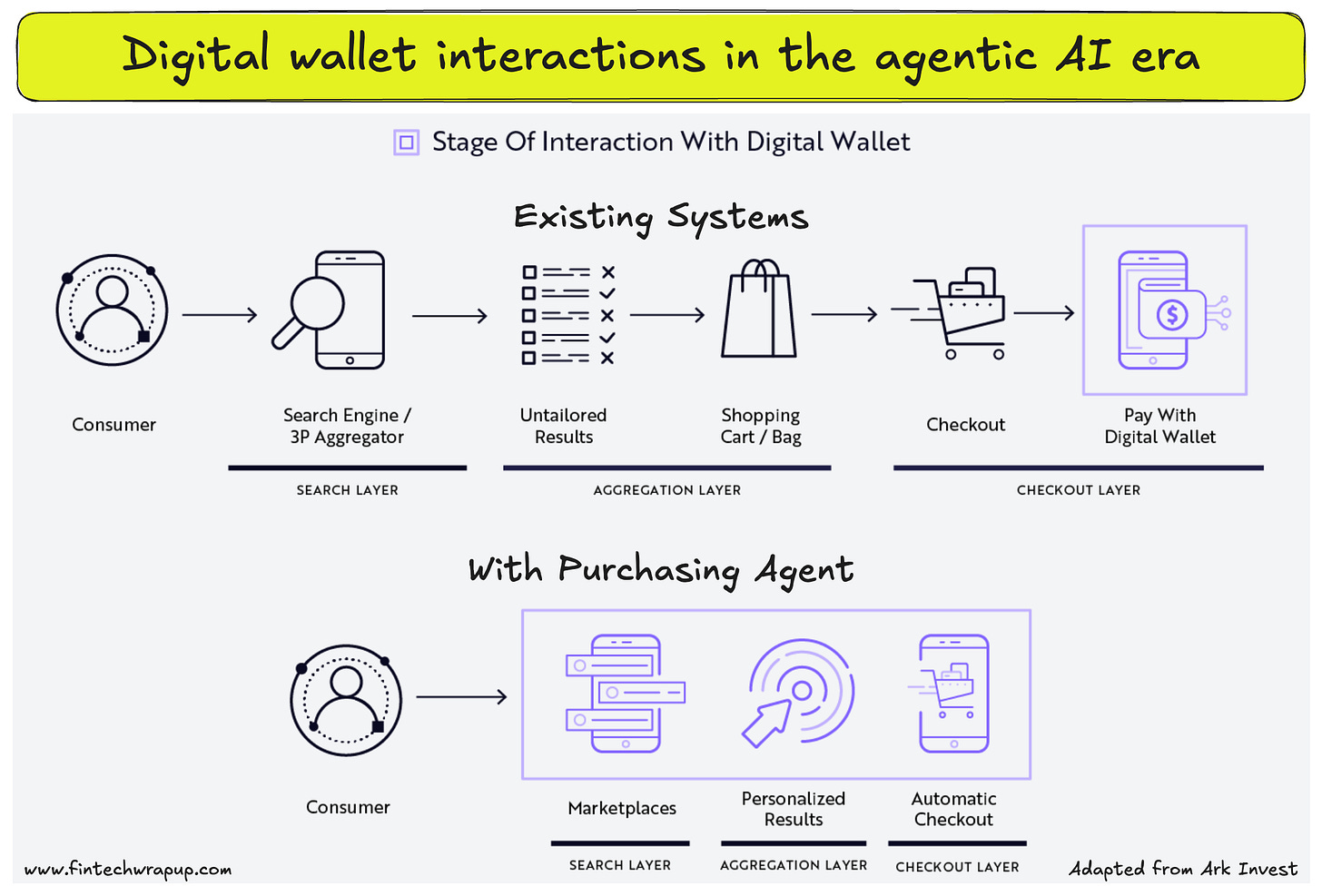

How will digital wallet interaction happen in the agentic AI flow?

As digital wallets increasingly integrate LLM-enabled purchasing agents, consumers are likely to interact with them much earlier in the e-commerce journey.

AI-powered purchasing agents are expected to make one-query purchasing the new industry standard, creating a significant advertising opportunity. For example, Amazon’s “Choice” badges already act as implicit recommenders that boost conversion rates by roughly 25%. One-query purchasing is likely to encourage users to adopt and rely more heavily on purchasing agents for curated suggestions, potentially achieving even higher conversion rates. However, for digital wallets to succeed, sponsors will need to avoid overwhelming consumers with sponsored content and instead build trust by delivering consistently positive experiences.

Curated News

💳 Payments

Mastercard and Infosys Join Forces on Cross-Border Payments

Mastercard has partnered with Infosys to improve cross-border transfers, aiming to make them faster and more affordable. The collaboration will expand access for banks and fintechs, driving efficiency in global payments.

Source

Western Union Enables Transfers via WhatsApp

Western Union now allows users to carry out international transfers and currency exchanges directly on WhatsApp. This move integrates financial services into a widely used messaging app, expanding accessibility for global remittance users.

Source

🏦 Banking

ANZ Staff Learn of Layoffs Through Email Mistake

ANZ inadvertently revealed planned banker layoffs via an automated email, sparking backlash. The incident highlights the reputational risks of poor internal communication during sensitive workforce changes.

Source

Swedbank Strengthens Consumer Finance with Entercard Deal

Swedbank has acquired Barclays’ stake in Entercard, reinforcing its consumer lending position. The acquisition reflects continued consolidation in Europe’s retail banking sector.

Source

TD Bank and CIBC Beat Profit Forecasts

Canadian lenders TD Bank and CIBC posted stronger-than-expected quarterly results, helped by lower loan loss provisions. Their performance underscores resilience in the Canadian banking system despite economic headwinds.

Source

💡 Fintech

Wealthsimple Acquires Fey to Enhance Trading Tools

Wealthsimple has acquired Fey to strengthen its retail trading platform with new features and technology. The deal aligns with its strategy to attract more active investors.

Source

Northmill Earnings Hit Record High on Card and B2B Growth

Northmill reported record results thanks to strong growth in card usage and B2B services. The challenger bank continues to expand beyond traditional retail banking.

Source

Wagely Turns Profitable After $120M in Payouts

Indonesian fintech Wagely has achieved profitability by processing over $120 million in earned wage access payouts. The milestone demonstrates rising demand for financial wellness tools in emerging markets.

Source

TransBnk Raises $25M to Expand Digital Banking Infrastructure

TransBnk has secured $25 million in a funding round led by Bessemer Venture Partners. The capital will accelerate its growth in providing infrastructure solutions for banks and fintechs.

Source

Vergent LMS Launches OmniaCnct Platform for Lenders

Vergent LMS introduced OmniaCnct, a digital platform designed to modernize community lenders. The solution aims to improve efficiency and competitiveness in the digital banking era.

Source

🪙 Crypto

VersaBank Pilots Tokenized Deposits on Multiple Blockchains

VersaBank has launched a U.S. pilot to test tokenized deposits on Algorand, Ethereum, and Stellar. The initiative could reshape how deposits are managed using blockchain technology.

Source

Mo Raises $40M as Stablecoins Attract More VC Capital

Stablecoin startup Mo secured $40 million in Series B funding, signaling strong investor confidence in blockchain-based payments. The raise highlights sustained momentum in the stablecoin sector.

Source

Garanti BBVA Adds Crypto Portfolio to Mobile Banking App

Garanti BBVA now lets customers manage their crypto assets directly within its app. The move deepens integration of digital assets into mainstream financial services.

Source

$YELLOW Token Sale Surpasses $1M on Republic

The $YELLOW token sale successfully closed on Republic, raising over $1 million. The result shows continued appetite for tokenized investment opportunities.

Source

Sygnum and Ledn Launch BTC-Backed Tokenized Private Credit

Sygnum and Ledn finalized a syndicated loan for Bitcoin-backed tokenized private credit. This marks a significant step toward institutional adoption of blockchain-based lending products.

Source

Bitcoin and Solana Rally on Strong U.S. Economic Data

Bitcoin and Solana rose after upbeat U.S. GDP data and Nvidia earnings boosted investor confidence. The gains show how macroeconomic news continues to drive crypto market sentiment.

Source

📊 WealthTech

FusionIQ and Novum Partner to Expand Options Trading Access

FusionIQ and Novum Investment Management teamed up to make options trading more accessible for retail investors. The initiative reflects broader efforts to democratize wealth management tools.

Source

📜 Regulation

FinCEN Flags Chinese Money Laundering Networks

FinCEN has issued an advisory and financial trend analysis warning of large-scale Chinese money laundering activity. It calls on financial institutions to step up monitoring and compliance measures.

Source

Regulatory Penalties for Banks Surge 417% in H1 2025

Global financial institutions saw regulatory penalties jump 417% in the first half of 2025. The spike highlights intensified enforcement against misconduct and compliance failures.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a "Source: [Name]" attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.