UBS & Ant International Launch Real-Time Blockchain Payments Network

UBS and Ant International have partnered to roll out a blockchain-based settlement and liquidity platform enabling real-time cross-border payments. The initiative aims to significantly reduce settlement friction for global institutions by combining UBS’s banking network with Ant’s blockchain infrastructure. This collaboration signals a major step toward mainstream adoption of blockchain rails in institutional finance, especially as demand grows for instant, transparent, and compliant cross-border flows. By integrating liquidity management into the real-time system, the platform targets both efficiency and risk reduction for treasurers worldwide. For the fintech sector, this is a landmark example of a traditional bank and a payments giant jointly pushing next-generation infrastructure. It also underscores how blockchain is shifting from experimental to mission-critical in global payments.

Video of the Day

Insight of the Day

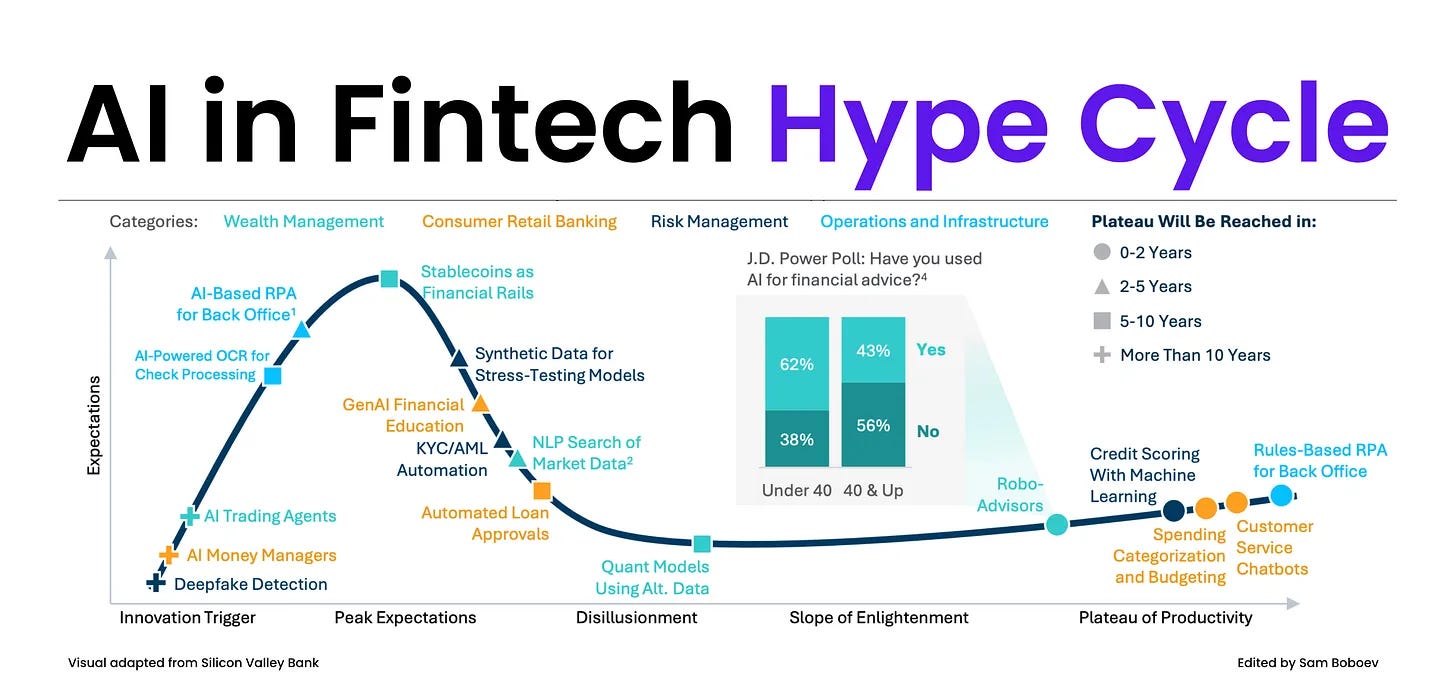

𝗨𝗻𝗱𝗲𝗿𝘀𝘁𝗮𝗱𝗶𝗻𝗴 𝗮𝗻 𝗔𝗜 𝗶𝗻 𝗙𝗶𝗻𝘁𝗲𝗰𝗵 𝗛𝘆𝗽𝗲 𝗖𝘆𝗰𝗹𝗲 𝗯𝘆 Silicon Valley Bank

We all love to imagine a future where personalized AI avatars manage our bills, rebalance our portfolios, and find the best insurance rates for us.

But in fintech, that future is still loading...

Compared to consumer tech or SaaS, financial services face unique headwinds — regulation, trust, and risk. And that’s keeping most AI use cases firmly in “slow burn” mode.

📊 According to Gartner’s AI in Fintech Hype Cycle:

Credit Scoring with Machine Learning, Chatbots, and Rules-Based RPA are already on the Plateau of Productivity — the boring-but-profitable side of the curve.

KYC/AML Automation, Synthetic Data for Stress Testing, and Automated Loan Approvals are in the Slope of Enlightenment — promising but still scaling.

Meanwhile, AI Trading Agents, GenAI Financial Education, and AI-Powered OCR are riding the Peak of Expectations, years away from maturity.

Even consumer trust reflects that lag.

A J.D. Power survey found:

🔹 62% of people under 40 have used AI for financial advice

🔹 Only 43% of those over 40 said the same

Curated News

💳 Payments

JPMorgan Secures New Fintech Data-Sharing Deals

JPMorgan has struck agreements with multiple fintechs to access customer-permissioned financial data via secure APIs. The deals aim to improve transparency, reduce screen scraping, and streamline digital financial services.

Source

Cairo Amman Bank Rolls Out Iris-Based Payouts for Unbanked Workers

The bank is using iris recognition tech to authenticate and disburse payments to workers without bank accounts. This solution boosts inclusion and reduces fraud in cash-heavy environments.

Source

APP Fraud Losses Rise 12% in H1

Authorised push payment fraud continues to escalate, highlighting gaps in consumer protection and authentication. Regulators and banks face renewed pressure to enhance reimbursement rules and real-time detection.

Source

Revolut Partners With Booking.com for Travel Payments Expansion

Revolut has launched a new partnership with Booking.com to streamline travel-related payments and offer exclusive perks to users. The move strengthens its positioning as a global travel-centric financial app.

Source

Ukraine & Mastercard Announce National Digital Partnership

Ukraine and Mastercard are collaborating on a country-wide digital transformation program spanning payments, digital identity, and financial inclusion. It marks one of Mastercard’s most ambitious government partnerships in Eastern Europe.

Source

Ant Group Showcases AI-Powered SME Payment Tools

Ant Group’s chairman highlighted new AI-driven solutions designed to streamline SME payments and cash flow operations. The tools aim to reduce manual processes and enhance financial insights for small businesses.

Source

MoMo Rwanda & TerraPay Simplify International Remittances

The partnership allows Rwandans to receive global money transfers faster and more reliably via MoMo’s mobile wallet. It expands TerraPay’s presence across Africa while boosting financial access.

Source

Yaspa Wins Real-Time Payments Innovation Award

Yaspa was recognized for its advancements in modern payment orchestration at the 2025 Payments Awards. The win underscores the increasing importance of real-time systems in enterprise finance.

Source

Vyntra Launches Real-Time Protection Against Mule Accounts

Vyntra’s new solution blocks fraudulent transactions by identifying mule account activity in real time. The tool targets a growing threat vector as digital fraud becomes more sophisticated.

Source

United Creations Enables Transparent Payroll With IrisGuard

The EyePay® system brings iris-enabled payroll distribution to the Jordanian market, improving transparency and ensuring that wages reach the right individuals. It’s another step toward biometric-driven fintech in the region.

Source

🏦 Banking

Fraud Claims Surge at Singapore Digital Banks

Digital banks in Singapore saw fraud claims rise to $1.9M, reflecting broader global trends in digital fraud exposure. Regulators may push for enhanced authentication standards.

Source

BBVA Integrates Surecomp’s RIVO to Modernize Trade Finance

BBVA is enhancing its trade finance operations with Surecomp’s RIVO platform to digitize and accelerate document handling. The move streamlines corporate banking workflows and improves transparency.

Source

Tietoevry Releases Report on Card Transformation Trends

Tietoevry Banking published insights on how banks are modernizing card platforms, focusing on cloud migration, security, and new user experiences. The report highlights competitive pressure on legacy issuers.

Source

💸 Fintech

Revolut Strengthens Africa Expansion With New Regional Leadership

Revolut is appointing local industry leaders to accelerate its African market rollout. The move underscores Africa’s importance in its global growth strategy.

Source

Paymentology Launches PayCredit for GCC Fintechs

PayCredit offers digital banks in Saudi Arabia and the GCC a fast way to introduce credit products via modular infrastructure. The solution supports the region’s rapid fintech scaling.

Source

Avalara Raises $500M in BlackRock-Led Investment

Avalara secured major financing to accelerate its tax automation expansion globally. The involvement of BlackRock signals strong institutional confidence in regtech growth.

Source

🪙 Crypto

Japan to Reclassify 105 Cryptocurrencies and Cut Taxes

Japan is preparing significant crypto classification reforms and tax reductions to attract Web3 companies. The changes could make Japan one of the most competitive regulatory environments in Asia.

Source

Hong Kong Pilots Tokenized Deposits & Digital Asset Transactions

Hong Kong is launching pilot programs for tokenized deposits and regulated digital asset transactions as part of its virtual asset strategy. The trials aim to position the region as a leader in compliant digital finance infrastructure.

Source

Binance Founder CZ Addresses $4.3B Fine After Pardon

CZ publicly commented on the complexities surrounding the $4.3B penalty following his presidential pardon. The statement highlights ongoing uncertainty in the global regulatory climate for major crypto executives.

Source

📈 WealthTech

eToro Enables 24/5 Trading for All Major US Indices

eToro users can now trade S&P 500 and Nasdaq 100 stocks nearly around the clock, enhancing flexibility for global traders. It reflects rising demand for continuous market access.

Source

LemFi Launches Instant Savings Accounts for UK Immigrants

LemFi introduced savings products that allow immigrants to earn interest instantly and build financial stability. The offering targets underserved communities navigating cross-border financial needs.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.