UK Watchdog Clears Global Payments’ $22.7B Worldpay Acquisition

The UK’s Competition and Markets Authority (CMA) has approved Global Payments’ $22.7 billion takeover of Worldpay, removing a major regulatory hurdle for one of the largest payments mergers in recent years. The decision clears the way for Global Payments to integrate Worldpay’s global merchant network and expand its acquiring capabilities. This move solidifies Global Payments’ position as a dominant force in global payment processing, particularly across Europe and North America. The CMA’s approval suggests confidence that the deal won’t harm competition in the payments sector. The merger is expected to create new opportunities for innovation in merchant services and cross-border payments.

Video of the Day

Insight of the Day

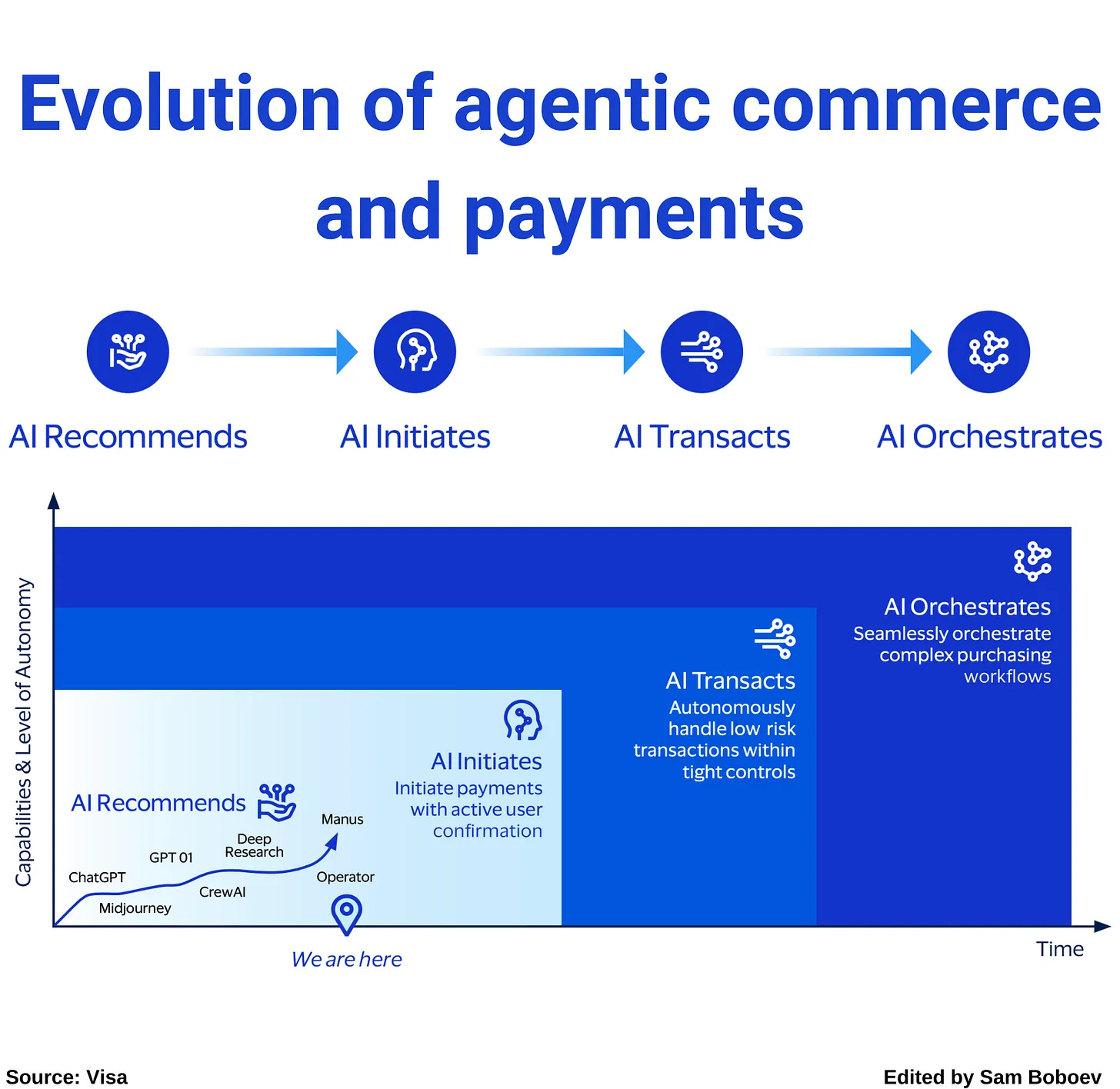

Let’s learn how Visa sees AI-initiated payments evolve

Visa envisions the evolution of agentic payments in four stages — each building on the last, from AI acting as a smart advisor to becoming an autonomous orchestrator of transactions.

1. AI Recommends

This is where we are today. AI tools like ChatGPT serve as intelligent advisors, providing tailored suggestions based on prompts, preferences, and previous interactions. Users ask for purchase ideas or comparisons, and AI offers recommendations — but it doesn’t yet execute payments.

At this stage, AI helps users make smarter spending decisions, identify cost-effective merchants, or choose better delivery options. For instance, OpenAI’s shopping results in ChatGPT display product carousels with prices and direct merchant links. It’s advisory — the user still completes checkout manually.

2. AI Initiates

Here, AI agents begin to take action. They can interact with eCommerce platforms to initiate checkout processes, though users must still confirm and authorise each payment.

This is where OpenAI’s Operator or early browser-based agents come in — simulating user behaviour to perform tasks on their behalf. While still in beta and not fully reliable, these prototypes mark a shift from advice to execution.

This stage also introduces integrations via plugins and APIs, setting the groundwork for what Visa calls Agentic Commerce — the first wave of AI-initiated payments.

3. AI Transacts

In this phase, AI gains conditional autonomy. Agents could complete low-risk, repetitive purchases within predefined limits — like renewing subscriptions, paying for cloud credits, or restocking office supplies.

The system would handle payments end-to-end, provided parameters (amount, merchant type, frequency) are pre-approved. Human oversight remains, but manual steps shrink.

Curated News

💳 Payments

Lloyds Expands ‘Pay by Bank’ to Boost Hospitality Payments

Lloyds has rolled out its Pay by Bank service to the hospitality sector, enabling faster and more secure account-to-account transactions. This move supports merchants by reducing card fees and improving cash flow efficiency.

Source

Gr4vy and Mastercard Partner for Next-Gen Merchant Payments

Cloud payments platform Gr4vy has teamed up with Mastercard to enhance transaction security and speed for merchants. The partnership aims to streamline payment infrastructure and strengthen fraud prevention tools.

Source

Cubic3 Launches AI FleetWallet3 for Smarter Fleet Payments

Cubic3 has unveiled FleetWallet3, an AI-powered platform for fleet operators to manage payments and expenses more efficiently. The system uses predictive analytics to optimize fuel and maintenance costs.

Source

Pay.com.au Debuts International Payments Scheme for SMEs

Australian fintech Pay.com.au has launched a new international payments and rewards program designed for small and medium-sized businesses. The initiative aims to simplify cross-border transactions while offering FX rewards.

Source

MoneyHash and Tabby Bring BNPL to MEA Merchants

MoneyHash has partnered with BNPL provider Tabby to enable flexible payment options for merchants across the Middle East and Africa. The collaboration will expand access to deferred payment methods and enhance regional e-commerce growth.

Source

PayRetailers Unveils AI Platform ‘EON’ to Elevate Merchant Operations

PayRetailers has launched EON, an AI-driven platform designed to improve merchant experience and streamline internal operations. The platform enhances payment efficiency through automation and real-time data insights.

Source

🏦 Banking

Revolut Secures Mexico Banking License, Expanding in Latin America

Revolut has obtained a banking license in Mexico, marking a major step in its Latin American expansion following entries into the US and Brazil. The move positions Revolut to offer full banking services in a fast-growing fintech market.

Source

BNY Releases Community Bank Insights in Annual Survey

BNY has published its second “Voice of Community Banks” report, revealing key insights into digital transformation and lending trends. The survey highlights continued investment in fintech partnerships among smaller banks.

Source

Emirates NBD Launches 4th National Digital Talent Incubator

Emirates NBD has opened the fourth cohort of its National Digital Talent Incubator program to nurture future Emirati fintech leaders. The initiative aligns with the UAE’s national strategy to boost digital and financial innovation.

Source

💰 Fintech

Versana Debuts Cashless Roll Solution in Syndicated Loan Market

Versana has launched the first cashless roll solution for syndicated loans, with J.P. Morgan leading adoption. The innovation simplifies loan settlements, enhancing efficiency and transparency in capital markets.

Source

Investa Returns to Crowdcube Following Record Fundraise

After a successful 2024 campaign, Investa has launched a second crowdfunding round on Crowdcube to accelerate its fintech expansion. The move underscores rising investor confidence in community-driven capital raising.

Source

HV Capital Expands Investment Mandate Across Europe

HV Capital has announced a broader investment focus, supporting startups from seed to late growth stages across Europe. The firm aims to strengthen the continent’s venture ecosystem and support sovereign tech innovation.

Source

🪙 Crypto

Crypto Leaders to Meet US Senators for Regulation Talks

Top crypto executives are set to meet US Senate Democrats to discuss regulatory frameworks for digital assets. The dialogue could shape future legislation balancing innovation with investor protection.

Source

Japan Considers Allowing Banks to Trade Crypto

Japan’s government is reportedly exploring allowing local banks to participate in crypto trading. The proposal could mark a major policy shift, integrating digital assets into traditional financial systems.

Source

Gold-i Enables Institutional Crypto Liquidity Link for Finery Markets

Gold-i has connected Finery Markets and Sage Capital to establish a new OTC crypto liquidity channel for institutions. The integration aims to boost market depth and streamline digital asset trading infrastructure.

Source

Solana Co-Founder Builds Hyperliquid Rival, Invites Open Collaboration

Solana’s co-founder has launched an experimental DeFi trading platform to rival Hyperliquid, openly inviting developers to build upon or “steal” the idea. The project reflects a collaborative ethos within the Web3 space.

Source

BingX Achieves ISO 27001 Certification for Web3 Security

Crypto exchange BingX has earned ISO 27001 certification, reinforcing its commitment to robust cybersecurity and data protection standards. The recognition strengthens BingX’s position as a trusted Web3 platform.

Source

⚖️ Regulation

Canada Establishes New Financial Crime Agency

The Canadian government is setting up a dedicated financial crime agency to enhance enforcement against money laundering and fraud. The initiative reflects global momentum toward stronger financial integrity frameworks.

Source

🌐 Other

Businesses Warned of Rising Nation-State Cyber Attacks

Experts are urging organizations to strengthen cyber defenses amid a surge in nationally significant cyber incidents. The warning comes as geopolitical tensions heighten risks of state-backed digital threats.

Source

AWS Recovers After Major Global Outage

Amazon Web Services has confirmed a return to normal operations following a widespread service disruption. The outage impacted numerous businesses, underlining global dependence on cloud infrastructure.

Source

Indonesia Reports $422M in Scam Losses by October 2025

Indonesia has recorded over $422 million in scam-related losses this year, highlighting escalating cybercrime challenges in Southeast Asia. Authorities are calling for stronger consumer protection measures.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.