United Fintech Acquires Trade Ledger to Bolster AI’s Banking Presence

United Fintech has acquired Trade Ledger, a digital lending platform, to expand its presence in AI-driven banking infrastructure. The acquisition strengthens United Fintech’s goal of building a comprehensive suite of digital tools for financial institutions. By combining Trade Ledger’s advanced credit decisioning capabilities with United Fintech’s ecosystem, the move aims to streamline commercial lending and improve data-driven insights for banks worldwide. It’s a strong signal of continued consolidation in the fintech infrastructure space, highlighting the central role of AI in reshaping institutional finance.

Video of the Day

Insight of the Day

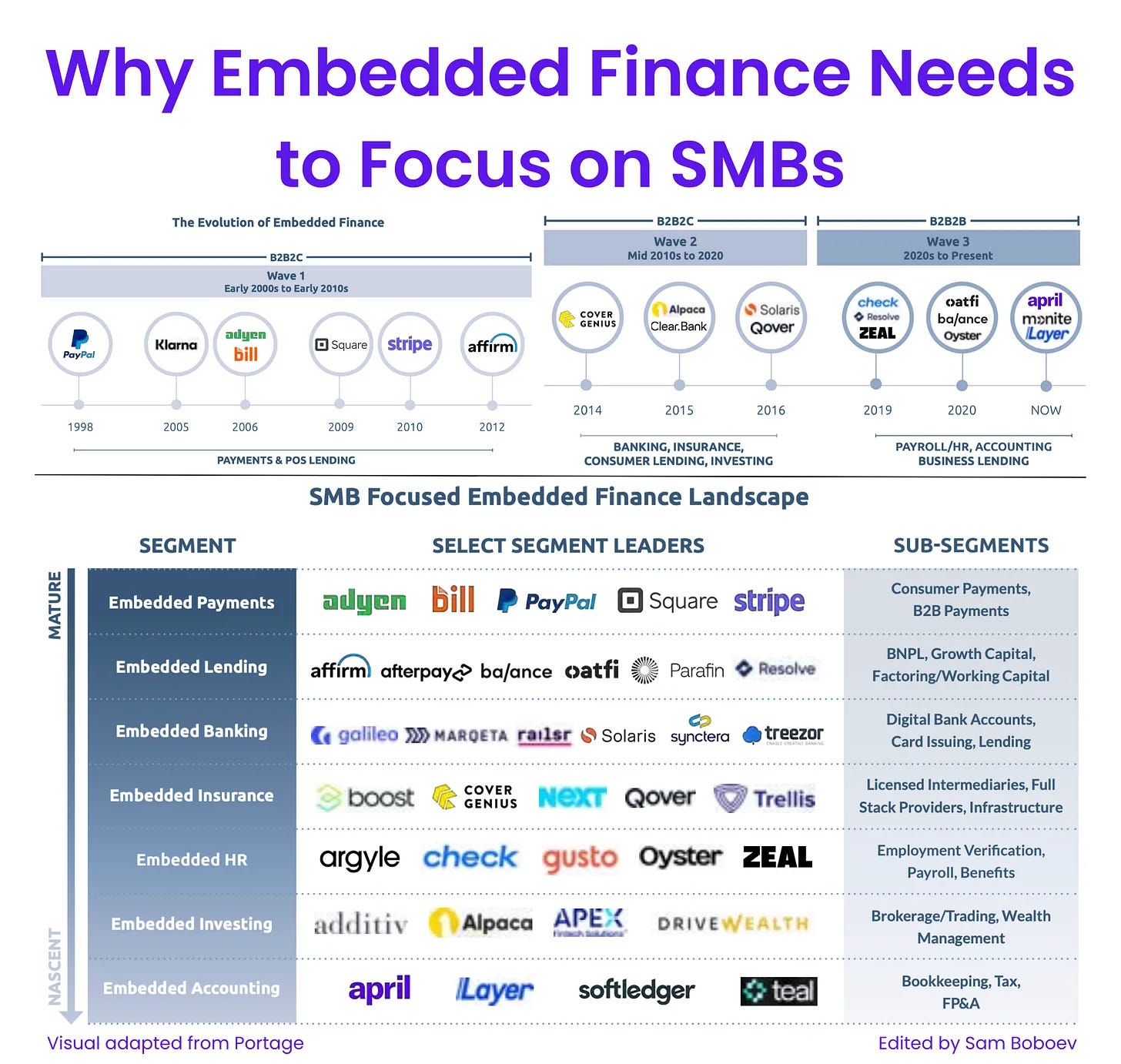

Why Embedded Finance providers must focus on SMBs

Let’s break it down!

SMBs make up over 90% of businesses globally and drive 40% of U.S. GDP, yet remain largely underserved. For embedded finance providers, that gap represents the next trillion-dollar opportunity.

1. The third wave is all about SMBs

According to Portage’s Next Wave of Embedded Finance (2025) report, the third wave of embedded finance is shifting focus from consumers to businesses — particularly SMBs. Only 40% of SMBs are satisfied with their current banking providers, and half are unhappy with lending solutions. Nearly one-third complain about the lack of customization, and 25% say they’d switch providers for more transparent pricing. Most tellingly, half of SMBs are open to buying financial services directly from non-financial platforms, such as accounting or SaaS tools.

2. Distribution is already built-in

Vertical SaaS platforms, accounting tools, and marketplaces are where SMBs live — and that’s where embedded finance can thrive. More than 35% of SMBs say they would buy financial services through vertical SaaS, and over 25% would do so via accounting or e-commerce platforms. These systems already hold rich operational and transaction data — the lifeblood for embedded underwriting, credit scoring, and contextual product delivery.

3. Payments show the blueprint

As noted in the Portage report, fintech solutions already dominate payments in U.S. e-commerce, and payments now make up a significant share of revenue for leading software companies like Toast, Shopify, and Intuit QuickBooks. According to a Flagship Advisory Partners survey, every software platform that offers embedded finance today also provides payment acceptance services.

Curated News

💳 Payments

US Bank Launches Split Card for Auto-Installment Payments

US Bank introduced its Split Card, allowing customers to automatically divide larger purchases into manageable installments at checkout. The innovation reflects growing consumer demand for built-in “Buy Now, Pay Later” options within traditional banking channels.

Source

Stripe and NEC Partner on Face Recognition Payments

Stripe and NEC are collaborating to enable biometric payments through Stripe Terminal, using NEC’s facial recognition technology. The partnership aims to enhance payment security and frictionless in-person checkout experiences.

Source

Interac Launches Konek to Broaden Online Payment Options

Canadian payments giant Interac has launched Konek, a platform to expand digital payment acceptance for merchants. The move underscores Interac’s push to diversify beyond traditional debit rails and boost domestic e-commerce capabilities.

Source

Worldline and Deliverect Expand Partnership for Smart Kiosks

Worldline and Deliverect have deepened their collaboration to deploy smart self-ordering kiosks across the UK. The integration enhances efficiency and personalization in retail and hospitality payments.

Source

Click to Pay Reduces Abandonment Rates Across Europe

Ecommpay reports significant decreases in cart abandonment after integrating Click to Pay across its merchant network in the UK and Europe. The feature simplifies checkout and boosts conversion rates for online retailers.

Source

🏦 Banking

Major Banks Unite to Support Financial Inclusion Initiatives

UK banks have launched a new financial inclusion strategy to assist people experiencing homelessness. The effort focuses on providing accessible financial products and pathways back into the banking system.

Source

TSB Warns of Rising Purchase Fraud Ahead of Holidays

TSB has issued an alert over a sharp rise in purchase fraud cases as the festive shopping season begins. The bank is calling on social media firms to increase fraud prevention measures on their platforms.

Source

💡 Fintech

Zest AI Secures Strategic Investment in Oversubscribed Round

Zest AI closed a heavily oversubscribed funding round with investment from key customers, reinforcing demand for its machine learning-based credit underwriting tools. The raise highlights financial institutions’ growing trust in explainable AI for lending decisions.

Source

Expensify Launches Hybrid “Contextual” AI Expense Agent

Expensify unveiled a new AI-driven agent that automates and contextualizes expense reporting. The tool combines generative AI and machine learning to reduce manual input and streamline financial workflows for businesses.

Source

Butter Payments Appoints New CTO to Accelerate Growth

Butter Payments named Sonali Sambhus as Chief Technology Officer to lead innovation and scaling efforts. Sambhus will oversee the company’s push to enhance its platform for frictionless recurring payments.

Source

Tide and YouLend Expand Embedded SME Financing to Germany

Tide and YouLend are extending their embedded finance partnership into Germany, offering SMEs faster access to working capital. The expansion supports Europe’s growing embedded lending ecosystem.

Source

🪙 Crypto

Bitcoin and Ethereum ETFs See $2.6B in Outflows

Crypto ETFs tracking Bitcoin and Ethereum lost $2.6 billion in assets over the past week, reflecting investor caution amid market volatility. The trend could influence liquidity and price movements across digital asset markets.

Source

Robinhood’s Crypto Revenue Surges 300% in Q3

Robinhood’s Q3 results beat analyst forecasts, driven by a 300% surge in crypto trading revenue. The growth underscores retail investors’ renewed appetite for digital assets.

Source

Standard Chartered Expands Digital Asset Offerings

Standard Chartered unveiled a robust pipeline of digital asset products at Hong Kong Fintech Week 2025. The bank is deepening its commitment to institutional crypto services and tokenized assets.

Source

📊 WealthTech

PensionBee Partners with Adclear to Bring AI to Marketing Compliance

PensionBee announced a partnership with Adclear to integrate AI tools for marketing compliance monitoring. The collaboration will help the online pension provider ensure regulatory adherence across UK and US campaigns.

Source

⚖️ Regulation

Treasury to Examine AI’s Role in Financial Services

The UK Treasury has launched a review into how AI can enhance financial services, focusing on responsible innovation and consumer protection. The findings will inform future regulatory frameworks for AI deployment in finance.

Source

Canadian Budget Prioritizes Payments, Stablecoins, and Open Banking

Canada’s federal budget places significant emphasis on developing policies for payments modernization, stablecoin regulation, and open banking frameworks. The strategy signals the country’s commitment to fostering fintech innovation while ensuring oversight.

Source

🌐 Other

SoftBank and OpenAI Announce Joint AI Venture

SoftBank and OpenAI are forming a joint venture to deliver AI solutions across industries, including finance. The collaboration underscores Big Tech’s growing focus on vertical AI applications for enterprise use.

Source

SoftBank Reports $22.1B in H1 Revenue

SoftBank announced $22.1 billion in revenue for the first half of fiscal 2025, reflecting recovery in its tech investment portfolio. The results may signal renewed confidence in AI and fintech-related investments.

Source

Europe’s Largest Ticketing Platform Adds Wero Wallet

Europe’s biggest online ticketing platform has integrated the Wero Wallet to expand digital payment options for event-goers. The move enhances convenience and positions Wero as a serious contender in Europe’s payments ecosystem.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.