U.S. Bank Explores Stablecoin Issuance on the Stellar Network

U.S. Bank is reportedly testing the issuance of a USD-backed stablecoin on the Stellar blockchain, marking one of the most significant moves by a major traditional bank toward blockchain-based settlement. The initiative signals growing institutional confidence in tokenized money and could accelerate bank-backed digital asset adoption across payments and treasury functions. If formalized, this would position U.S. Bank as a leader among legacy institutions exploring blockchain-native rails for faster, programmable finance. The testing phase highlights the increasing convergence between traditional banking infrastructure and public blockchain networks. It also underscores the competitive pressure on banks to modernize settlement capabilities as stablecoins and tokenized cash gain mainstream traction.

Video of the Day

Insight of the Day

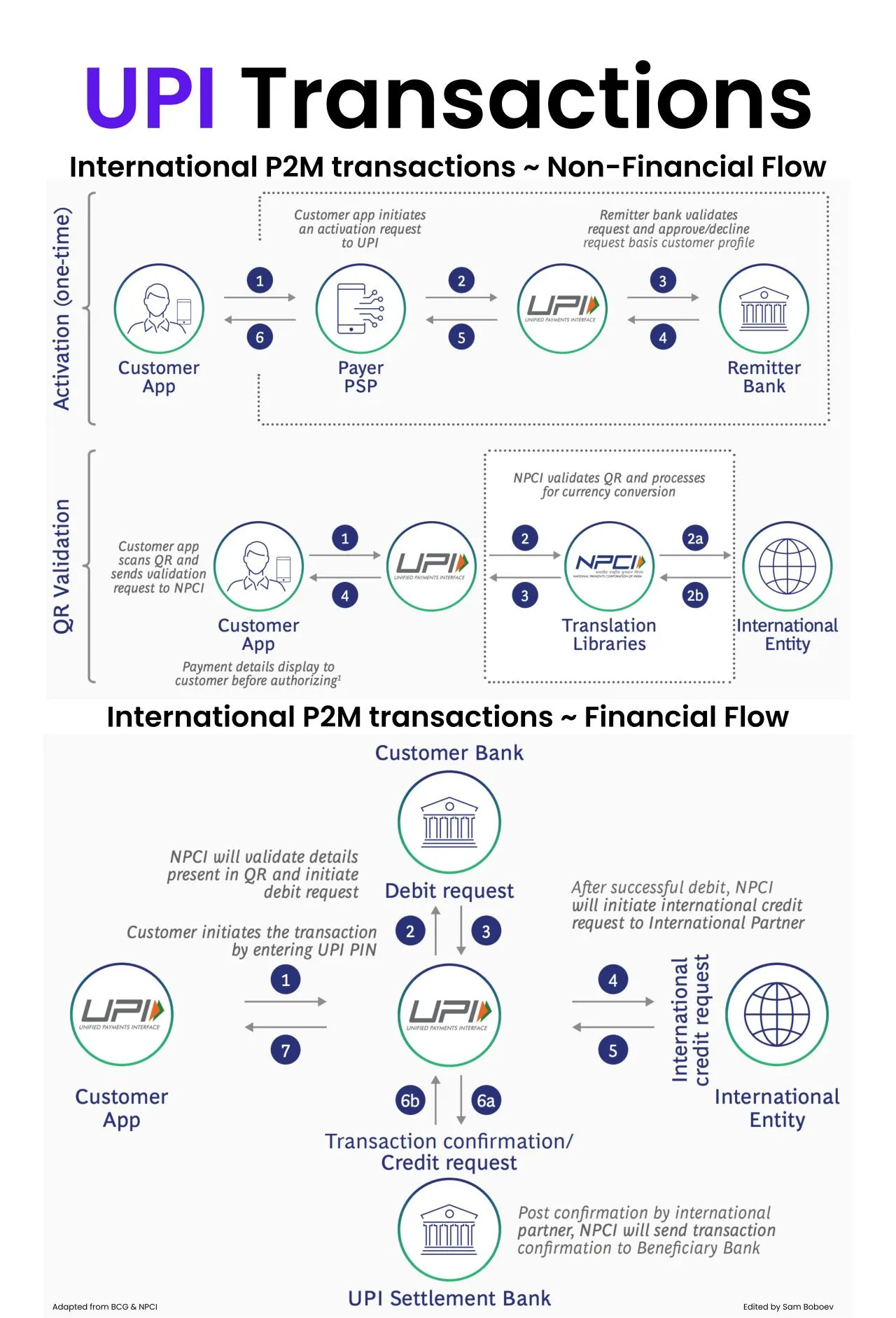

𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐈𝐧𝐭𝐞𝐫𝐧𝐚𝐭𝐢𝐨𝐧𝐚𝐥 𝐏𝟐𝐌 𝐔𝐏𝐈 𝐓𝐫𝐚𝐧𝐬𝐚𝐜𝐭𝐢𝐨𝐧𝐬 𝐛𝐲 𝐁𝐂𝐆 & 𝐍𝐏𝐂𝐈

If global commerce is to truly become “borderless,” payments have to catch up first.

That’s where interoperability — the ability for payment systems across countries to talk to each other — becomes the real unlock.

UPI is showing how it’s done.

India’s Unified Payments Interface (UPI) has already transformed domestic payments. Now, through NIPL (NPCI International), it’s quietly exporting that model to the world — partnering with countries like Singapore, UAE, France, and Mauritius to make real-time cross-border payments as easy as scanning a QR.

𝐋𝐞𝐭’𝐬 𝐛𝐫𝐞𝐚𝐤 𝐝𝐨𝐰𝐧 𝐡𝐨𝐰 𝐭𝐡𝐚𝐭 𝐚𝐜𝐭𝐮𝐚𝐥𝐥𝐲 𝐰𝐨𝐫𝐤𝐬 👇

🔹 𝐆𝐥𝐨𝐛𝐚𝐥𝐥𝐲 𝐢𝐧𝐭𝐞𝐫𝐨𝐩𝐞𝐫𝐚𝐛𝐥𝐞 𝐬𝐲𝐬𝐭𝐞𝐦𝐬 𝐦𝐚𝐤𝐞 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬:

→ Faster: near-instant fund transfers

→ Cheaper: lower fees vs. legacy rails

→ More transparent: with built-in compliance checks

For governments and operators, this also means a unified view of payment flows — making fraud detection and financial inclusion efforts more effective.

🔹 𝐅𝐫𝐨𝐦 𝐈𝐧𝐝𝐢𝐚 𝐭𝐨 𝐭𝐡𝐞 𝐖𝐨𝐫𝐥𝐝

UPI’s international play runs on two key models:

→ P2P Remittances (like UPI–PayNow between India and Singapore)

→ P2M Transactions — when tourists or users pay international merchants via UPI

In Singapore, for instance, a user can pay a local merchant directly with UPI. The experience feels exactly like paying at home — but behind the scenes, a complex real-time flow unfolds.

🔹 𝐓𝐡𝐞 𝐍𝐨𝐧-𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐅𝐥𝐨𝐰 (𝐃𝐚𝐭𝐚 & 𝐕𝐚𝐥𝐢𝐝𝐚𝐭𝐢𝐨𝐧)

1. User scans merchant’s QR code — UPI app recognizes it as an international QR.

2. Merchant and country identifiers are validated through NIPL.

3. International Remittance Partner (IRP) connects UPI to the foreign payment system.

4. Compliance checks are run by a screening bank and NIPL’s Fraud Risk Management (FRM) engine.

All this happens in milliseconds before any money actually moves.

🔹 𝐓𝐡𝐞 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐅𝐥𝐨𝐰 (𝐌𝐨𝐧𝐞𝐲 𝐌𝐨𝐯𝐞𝐦𝐞𝐧𝐭)

Curated News

💳 Payments

Revolut: Brits Struggle to Spot Online Scams

Revolut data reveals that many UK consumers feel unprepared to identify online fraud, despite rising digital-payment usage. The findings underscore the need for enhanced security tools and customer education across fintech platforms.

Source

Vodacom Expands M-Pesa Globally

Vodacom Tanzania has launched a service enabling M-Pesa users to transact internationally with greater ease. The feature allows mobile-money customers to make global payments and card-based transactions, extending M-Pesa’s reach beyond Africa.

Source

RBI Joins European Payments Initiative

India’s RBI has joined the European Payments Initiative (EPI) as an acceptor PSP. The move could enhance interoperability between Indian and European payment infrastructures.

Source

🏦 Banking

FIS Wins BMW Bank Deal for Deposits

BMW Bank has selected FIS to power its deposit-services infrastructure, adopting the tech provider’s cloud-enabled banking platform. The shift modernizes BMW Bank’s core operations and supports future product expansion.

Source

Tandem Launches Portfolio Cash ISA

Tandem Bank has introduced a portfolio cash ISA designed to give savers greater flexibility across multiple savings products. The offering reflects rising demand for higher-yield, easy-to-manage savings tools.

Source

Amazon & Flipkart Expand Consumer Lending

India’s major e-commerce players Amazon and Flipkart are rolling out new loan products targeting retail consumers. These offerings intensify competition with traditional banks on credit distribution.

Source

India Eases Digital Banking Rules

India has relaxed regulations governing digital-banking operations, simplifying licensing and compliance for online-only financial providers. The change is expected to boost innovation and competition in the sector.

Source

💸 Fintech

Erad Secures $125M Credit Line to Scale SME Financing

Saudi fintech Erad has obtained a $125 million credit facility from Jefferies to grow its SME funding operations. The capital boost supports Erad’s expansion across the Middle East’s fast-developing startup ecosystem.

Source

BKN301 Extends Series B to £29M

BKN301 has expanded its Series B round to £29 million, fueling global expansion plans and acquisition opportunities. The company aims to strengthen its cross-border payments and embedded-finance capabilities.

Source

INSURTECH: INSTANDA & Process Factory Team Up

INSTANDA and Process Factory have formed a collaboration designed to help insurers and MGAs in the Nordics innovate faster. The partnership focuses on boosting product development and automation.

Source

🪙 Crypto

Crypto Miners Jump as BTC & ETH Recover

BitMine and other mining-related stocks surged as Bitcoin and Ethereum prices rebounded. The rally reflects renewed optimism ahead of expected market catalysts.

Source

Forecasts Turn Bullish on Bitcoin Hitting $100K

Predictive models and market commentators are increasingly suggesting a potential rebound toward $100K BTC. Sentiment has improved as macro pressures ease and capital flows return to crypto markets.

Source

Philippines Could Unlock $60B Through Tokenization

A new report suggests the Philippines could generate up to $60 billion by 2030 via large-scale asset tokenization. The opportunity spans real estate, government assets, and corporate financing.

Source

📈 WealthTech

Groww Injects $16M Into WealthTech Subsidiary

India’s Groww has invested $16 million into its wealth-management unit to expand product offerings and scale operations. The move strengthens Groww’s position in India’s rapidly growing retail-investment ecosystem.

Source

🏛 Regulation

EU Council & Parliament Tighten Fraud Rules

EU legislators have reached an agreement to enhance fraud-prevention measures and improve transparency across payments. The update reflects rising regulatory pressure on PSPs as fraud cases grow.

Source

EU Watchdog Criticizes Commission Over ‘Urgent’ Proposals

An EU watchdog has accused the European Commission of lacking transparency in the rollout of urgent regulatory proposals. The criticism highlights ongoing tensions around fast-tracked financial-services legislation.

Source

MAS & BoJ Renew Currency Swap Deal

Singapore and Japan have extended their bilateral local-currency swap arrangement through 2028. The agreement strengthens financial cooperation and improves liquidity support mechanisms between the two nations.

Source

🌍 Other

Nairobi & Somalia Exchanges Partner for CX Investment

The Nairobi Securities Exchange and Somalia’s exchange have partnered to advance customer-experience–focused investment initiatives in East Africa. The collaboration aims to bolster regional market development.

Source

CME Restores Trading After Major Outage

CME Group resumed trading after an hours-long systems outage affecting multiple asset classes. The incident highlights the fragility of market-infrastructure systems amid rising trading volumes.

Source

UAE ATMs Now Allow Gold & Silver Purchases

The UAE has rolled out ATMs that allow consumers to buy gold and silver directly from machines. The offering reflects surging regional demand for physical precious metals.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.