US Regulators Clear the Way for Banks to Issue Stablecoins

The US Commodity Futures Trading Commission (CFTC) has changed its rules to allow national trust banks to issue stablecoins, marking a major shift in how digital assets can be integrated into the regulated financial system. The move lowers barriers for banks to enter stablecoin issuance while providing stronger regulatory clarity. It could accelerate institutional adoption of stablecoins for payments, settlement, and tokenized finance. The decision also signals growing acceptance of blockchain-based money within traditional finance. For fintechs and crypto firms, it opens the door to deeper partnerships with banks. Overall, this is a pivotal step toward mainstream, regulated digital currencies in the US.

Video of the Day

Insight of the Day

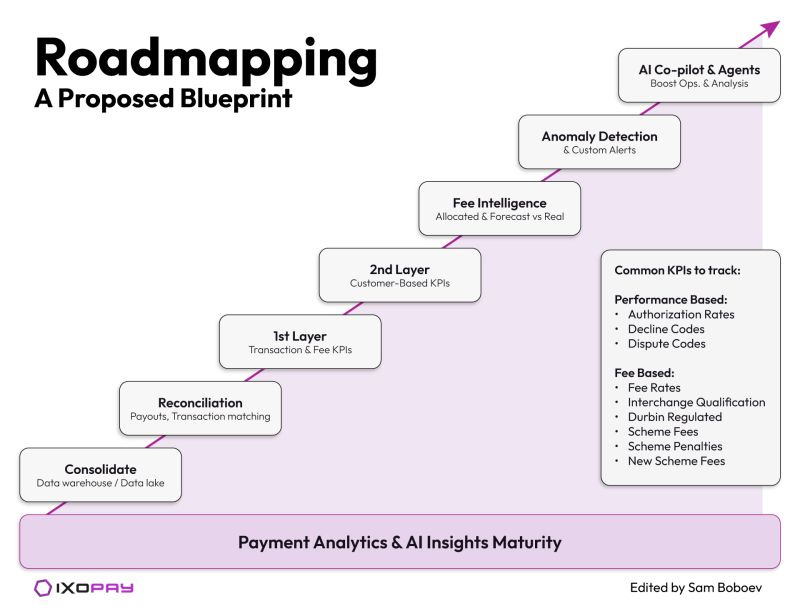

Why Most Payment Data Fails to Drive Decisions (and How Teams Fix It Over Time)

Many payments teams spend hours reconciling data across gateways and providers, yet still struggle to explain basic changes—like why authorization rates dipped last week or why fees rose in one region.

This isn’t a data shortage problem. It’s a fragmentation problem

In multi-provider environments, each gateway, acquirer, wallet, and fraud tool produces reports in different formats, with different response codes and timelines. The result: a lot of information but limited clarity.

____

The reality of modern payment operations

For most enterprise merchants, payment data typically looks like this:

- Hundreds of columns of transaction data across providers

- Different schemas, error codes, and reporting cadences

- A single transaction involving six or more stakeholders

- Manual reconciliation consuming time meant for optimization

This makes it hard to move from reporting what happened to understanding why it happened.

____

Where AI fits (and where it doesn’t)

AI is increasingly applied to payments—not as a shortcut, but as a scaling layer once fundamentals are in place.

Used thoughtfully, AI can help:

- Normalize data across gateways and acquirers into a consistent operational view

- Surface anomalies earlier, such as routing failures or unexpected fee increases

- Answer operational questions faster, reducing multi-hour investigations

____

Payments intelligence is a maturity path

Most teams don’t jump straight to AI. They progress through stages:

1. Centralizing payment data

2. Improving reconciliation and consistency

3. Adding performance and cost analytics

4. Introducing anomaly detection

5. Enabling AI-driven insights and automation

It’s a staircase, not a leap. Where you start matters less than having a clear path forward.

____

What this unlocks over time

As payment data matures, teams can:

- Track authorization rates, routing, and fees across providers in near real time

- Detect performance and cost risks before they impact revenue

- Translate fragmented KPIs into clear, decision-ready insights

For most payment leaders, the real question isn’t whether to improve payment data maturity—it’s which bottleneck to tackle first.

So, what’s one payments data bottleneck you’d fix tomorrow if you could?

Curated News

💳 Payments

European Wallet Leaders Unite to Build Sovereign Payments Network

Bancomat, Bizum, EPI, SIBS, and Vipps MobilePay have signed an MoU to accelerate a pan-European payment solution. The collaboration aims to reduce reliance on non-European card schemes and strengthen regional payments sovereignty.

Source

Nexus Global Payments Names Technical Operator

Nexus Global Payments has appointed a technical operator to support cross-border instant payments infrastructure. The move advances interoperability between domestic payment systems.

Source

Adyen and Uber Deepen Global Payments Partnership

Adyen and Uber are expanding their partnership to support new markets and launch Uber kiosks. The deal highlights how embedded payments continue to scale across global platforms.

Source

Xpeng and Antom Launch EV Charging Payments in Hong Kong

Xpeng and Antom have introduced an integrated EV charging payment service in Hong Kong. The service simplifies charging payments and reflects the convergence of mobility and fintech.

Source

Lüt and Safe Harbor Partner on Compliant Cannabis Payments

Lüt has partnered with Safe Harbor to expand compliant closed-loop payments for cannabis and specialty merchants. The deal addresses long-standing payment access challenges in regulated industries.

Source

🏦 Banking

India’s NSE Board Approves Long-Awaited IPO Plan

India’s National Stock Exchange has approved plans to move forward with an IPO. The decision revives one of India’s most anticipated listings after years of regulatory delays.

Source

NatWest Acquires Evelyn Partners, Announces £750m Buyback

NatWest Group is acquiring wealth manager Evelyn Partners while launching a £750m share buyback. The move strengthens NatWest’s wealth offering and signals confidence in its capital position.

Source

Finora Bank Triples Loan Book to €90.2m

Finora Bank more than tripled its net loan portfolio in 2025. The growth highlights strong demand for alternative and digital-first banking models.

Source

Monzo Wrongly Denied Fraud Refunds, Watchdog Finds

Monzo was found to have wrongly denied refunds to thousands of fraud and scam victims. The case underscores increasing regulatory scrutiny of banks’ fraud-handling processes.

Source

Revolut Hits 1M Customers in Australia Without Licence

Revolut has surpassed one million customers in Australia despite lacking a local banking licence. The milestone shows the power of fintech-led customer acquisition.

Source

💡 Fintech

US Financial Institutions Lead Global AI Adoption

US financial institutions are outpacing global peers in AI adoption, according to new research. AI is increasingly used across risk, customer service, and operations.

Source

Square Adds Conversational AI Assistant for Merchants

Square has launched a conversational AI assistant across its business platform. The tool aims to help merchants manage operations more efficiently.

Source

Cleo Returns to the UK With AI Money Management

Cleo has relaunched its AI-powered personal finance app in the UK. The move reflects renewed competition in consumer-facing fintech.

Source

Bound Raises $24.5m Series A for FX Risk Management

FX risk management fintech Bound has secured $24.5m in Series A funding. The capital will support product expansion and international growth.

Source

🪙 Crypto

Gemini Exits UK, EU, and Australia Amid Downturn

Crypto exchange Gemini is retrenching and exiting several international markets. The move reflects broader consolidation during the crypto downturn.

Source

Bitcoin Funds See $264m Weekly Outflows

Bitcoin investment funds shed $264m last week, though altcoins showed signs of recovery. The data points to shifting investor sentiment.

Source

Fintechs Back Fed Payments Account for Crypto Access

Several fintechs are supporting a proposed Fed payments account that could open rails to crypto firms. The initiative could reshape crypto access to core banking infrastructure.

Source

Cango Sells $305m in Bitcoin to Fund AI Pivot

Bitcoin miner Cango has sold over $300m worth of BTC to pivot toward AI. The move highlights diversification pressures facing miners.

Source

MrBeast Buys Banking App, Sparks Crypto Speculation

YouTube star MrBeast has acquired a banking app, raising questions about potential crypto features. The deal underscores the growing overlap between creators and fintech.

Source

📜 Regulation

Tokenovate Joins Bank of England Synchronisation Lab

Tokenovate has joined the Bank of England’s Synchronisation Lab alongside major industry players. The initiative explores tokenized assets and synchronized settlement.

Source

📊 WealthTech

Experian Launches High-Yield Digital Savings Account

Experian has introduced a new high-yield digital savings account. The launch expands its role beyond credit data into consumer financial products.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.