US Seizes $15B in Bitcoin from Forced-Labour ‘Pig Butchering’ Scam

In a major global sting operation, U.S. authorities have seized more than $15 billion in bitcoin linked to an alleged “pig butchering” scam tied to forced labor networks in Southeast Asia. The scam, which lured victims through social media and dating platforms, involved elaborate crypto investment frauds that funded human trafficking rings. Investigators traced thousands of wallets and coordinated with multiple Asian governments to dismantle key operations. This marks one of the largest-ever digital asset seizures globally. The case underscores how crypto-related crime increasingly intersects with organized exploitation. Regulators are now urging exchanges to tighten KYC and transaction monitoring. The bust is expected to reshape enforcement strategy across crypto and human trafficking investigations.

Insight of the Day

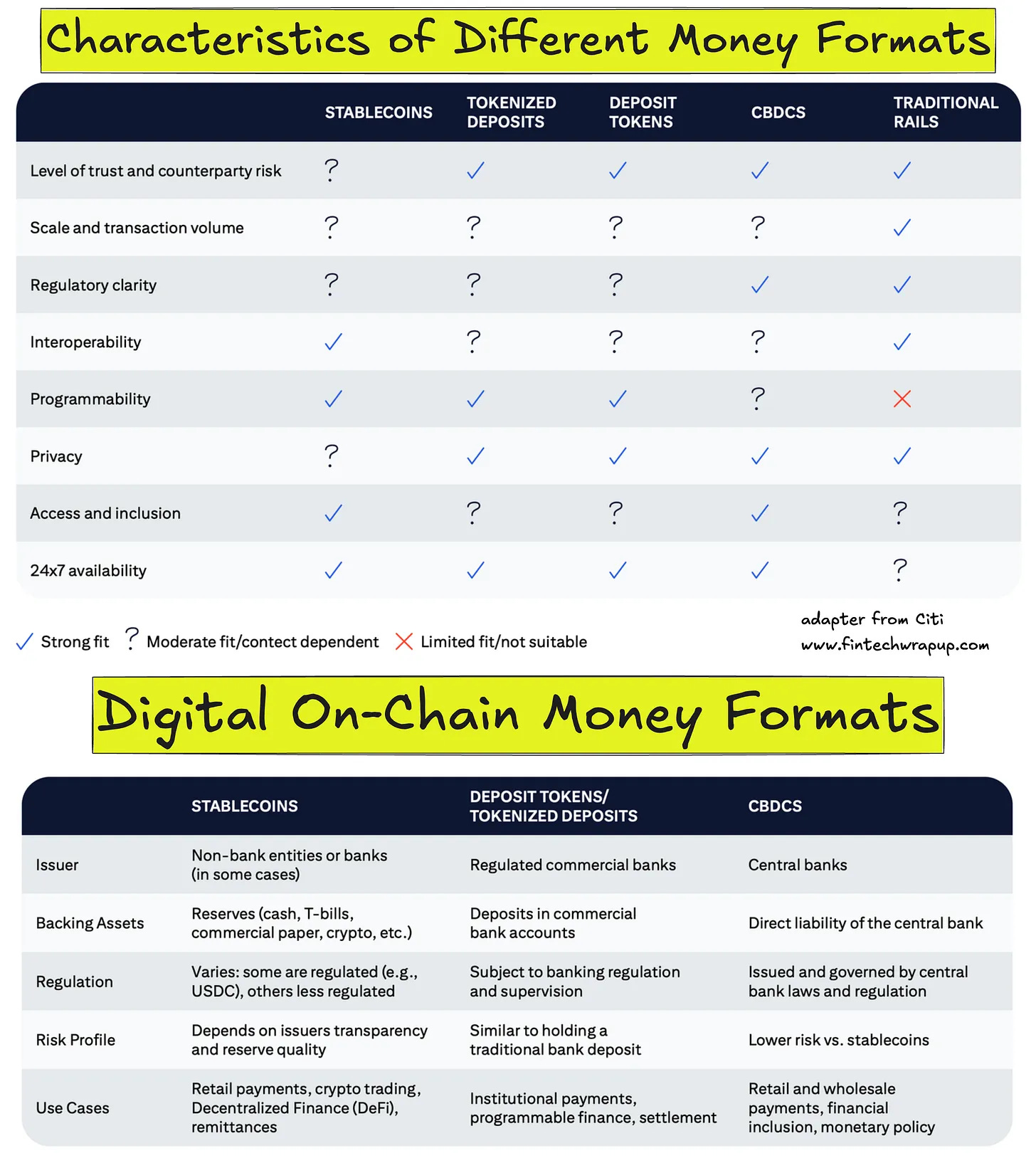

No One Size Fits All - Digital On-Chain Money Formats

Just as some countries build completely new train tracks in parallel to existing systems, or integrate them into existing rails, or chose to focus on different transport modes altogether, so the future of finance will unfold.

A common misconception is that a single digital or blockchain money format will dominate. That this is a race with winners and losers. Or a digital money format war of sorts. VHS versus Betamax, smartphones versus feature phones.

All on-chain money has shared benefits. Just as email is 24x7, instant, borderless, similarly blockchain creates settlement rails for money. Stablecoins or tokenized deposits are fast, cheap, always-on, programmable and easy to access.

Of course, there are many nuances to this discussion. Domestically, for consumers and smaller merchants, real time domestic payments exist in 80+ countries. Cross border, these payment speeds slow. Internet based communication or financial transfers do not slow due to borders.

The digitally native or crypto native firms are running ahead of traditional corporates on stablecoin implementation. However, as we will discuss in detail below, not all corporate treasury operations are set up to operate 24x7, nor do all want such a flexibility

Multiple on-chain money formats will co-exist. Use of a specific format will be dependent on characteristics such as trust, interoperability, and regulatory clarity.

Curated News

💳 Payments

Klarna Debuts Flexible Debit Card and Wallet in the UK

Klarna has launched a new debit card and digital wallet, giving UK users flexible payment options that merge spending and BNPL functionality. The move positions Klarna as a more direct competitor to banks and neobanks, expanding its ecosystem beyond online checkout.

Source

HSBC and Juspay Build Unified Payments Platform

HSBC has partnered with Indian fintech Juspay to develop a unified acquiring platform aimed at simplifying merchant payments. The collaboration enhances HSBC’s digital capabilities and deepens its presence in India’s fast-evolving payment infrastructure.

Source

SpotOn and Visa Direct Speed Up Tipped Employee Payouts

SpotOn and Visa Direct have teamed up to enable near-instant payouts for tipped workers. The integration reduces payroll delays and enhances liquidity for service industry employees.

Source

Flywire Integrates with Workday Student

Flywire has integrated its cross-border payments solution with Workday Student, streamlining education payments for universities and international students. The move simplifies tuition payment processes and boosts transparency in higher-education finance.

Source

Mastercard: 91% of Jamaican SMEs Say Digital Payments Boosted Growth

A Mastercard survey found that 91% of Jamaican SMEs using digital payments reported measurable business growth. The data highlights digital adoption as a key driver of inclusion and resilience in emerging markets.

Source

🏦 Banking

SBS Warns Banking Regulation and Inclusion Are Non-Negotiable

Speaking on the evolving face of banking, SBS emphasized that both regulation and financial inclusion are essential pillars of trust. The firm warned against prioritizing tech innovation over consumer protection and accessibility.

Source

UBS Appoints Daniele Magazzeni as Chief AI Officer

UBS has named AI expert Daniele Magazzeni as its first Chief AI Officer, signaling a deep commitment to responsible and scalable AI integration across banking operations. The move underscores AI’s growing strategic importance in financial services.

Source

💰 Fintech

Ripple Acquires GTreasury for $1B to Target Corporate Clients

Ripple has agreed to acquire GTreasury for $1 billion to expand into corporate treasury and liquidity management. The deal positions Ripple to offer blockchain-based treasury services to global enterprises.

Source

Deel Valued at $17B After $300M Fundraise

Global HR fintech Deel has raised $300 million in new funding, boosting its valuation to $17 billion. The capital will fuel expansion into benefits and compliance solutions for distributed workforces.

Source

Plata Raises $250M, Hits $3.1B Valuation

Mexican fintech Plata secured $250 million in new funding, valuing the company at $3.1 billion. The firm plans to accelerate credit access and digital lending in underserved Latin American markets.

Source

FIS Launches ‘Smart Basket’ for Real-Time Purchase Intelligence

FIS has unveiled “Smart Basket,” a new feature that provides real-time data and insights during shopping. The innovation aims to merge analytics and payments for a more intelligent retail experience.

Source

Thredd Powers ANNA Money’s Super-App in Australia

Thredd has partnered with ANNA Money to power its new business super-app in Australia, enabling faster onboarding and smarter cash flow tools for small businesses.

Source

Apollo Leads $65M Investment in Glow Services

Apollo has led a $65 million round in Glow Services, a U.S.-based phone financing startup. The investment underscores growing investor interest in embedded finance models.

Source

Affirm Expands BNPL Reach with Fanatics and FreshBooks

Affirm is expanding its BNPL network through partnerships with Fanatics and FreshBooks, extending installment options across retail and SaaS platforms. This expansion strengthens Affirm’s multi-sector positioning in consumer finance.

Source

🪙 Crypto

Euronet Partners with Fireblocks for Cross-Border Stablecoin Payments

Euronet has chosen Fireblocks to enable secure stablecoin-based cross-border transactions. The collaboration enhances speed, transparency, and settlement efficiency in international payments.

Source

MoonPay Launches ‘MoonPay Commerce’ for Global Crypto Payments

MoonPay has introduced a new commerce platform allowing businesses to accept crypto payments globally. The launch reflects rising merchant demand for blockchain-based payment alternatives.

Source

Cantor May Net $25B if Tether Reaches $500B Valuation

Reports suggest that Cantor Fitzgerald could earn as much as $25 billion if Tether’s valuation hits $500 billion. The potential windfall highlights the growing interconnection between traditional finance and stablecoin ecosystems.

Source

Currency.com Secures 32nd U.S. Money Transmitter License

Crypto trading platform Currency.com has obtained its 32nd U.S. state money transmitter license, advancing its nationwide expansion. The milestone strengthens its regulatory compliance footprint in the U.S. market.

Source

📊 WealthTech

Webull Adds Corporate Bond Trading

Webull has expanded into fixed-income trading with the launch of corporate bond products. The addition diversifies Webull’s investment offerings and appeals to a broader investor base.

Source

⚖️ Regulation

CUBE Acquires Kodex AI to Build Unified Compliance Platform

Regtech firm CUBE has acquired Berlin-based Kodex AI to create an integrated compliance and risk management system. The move combines AI and regulatory automation to strengthen enterprise compliance frameworks.

Source

📂 Other

Expense Reports: One of the Most Stressful Work Tasks

A survey revealed that nearly a quarter of UK employees find disputing an expense claim more stressful than most work tasks, second only to asking for a pay rise. The findings underscore ongoing frustrations with outdated expense management systems.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.