Visa and Mastercard Reach Landmark Settlement Over Interchange Fees

Visa and Mastercard have agreed to a long-awaited settlement aimed at resolving disputes over interchange fees and merchant choice. The deal is expected to provide merchants with more flexibility in routing transactions and could reshape how card networks compete in the payments landscape. It follows years of regulatory pressure and litigation from merchants challenging the networks’ pricing power. Analysts see this as a major win for retail groups and a potential catalyst for lower transaction costs in the future. The move also signals a broader industry shift toward transparency and competitive fairness in digital payments.

Video of the Day

Insight of the Day

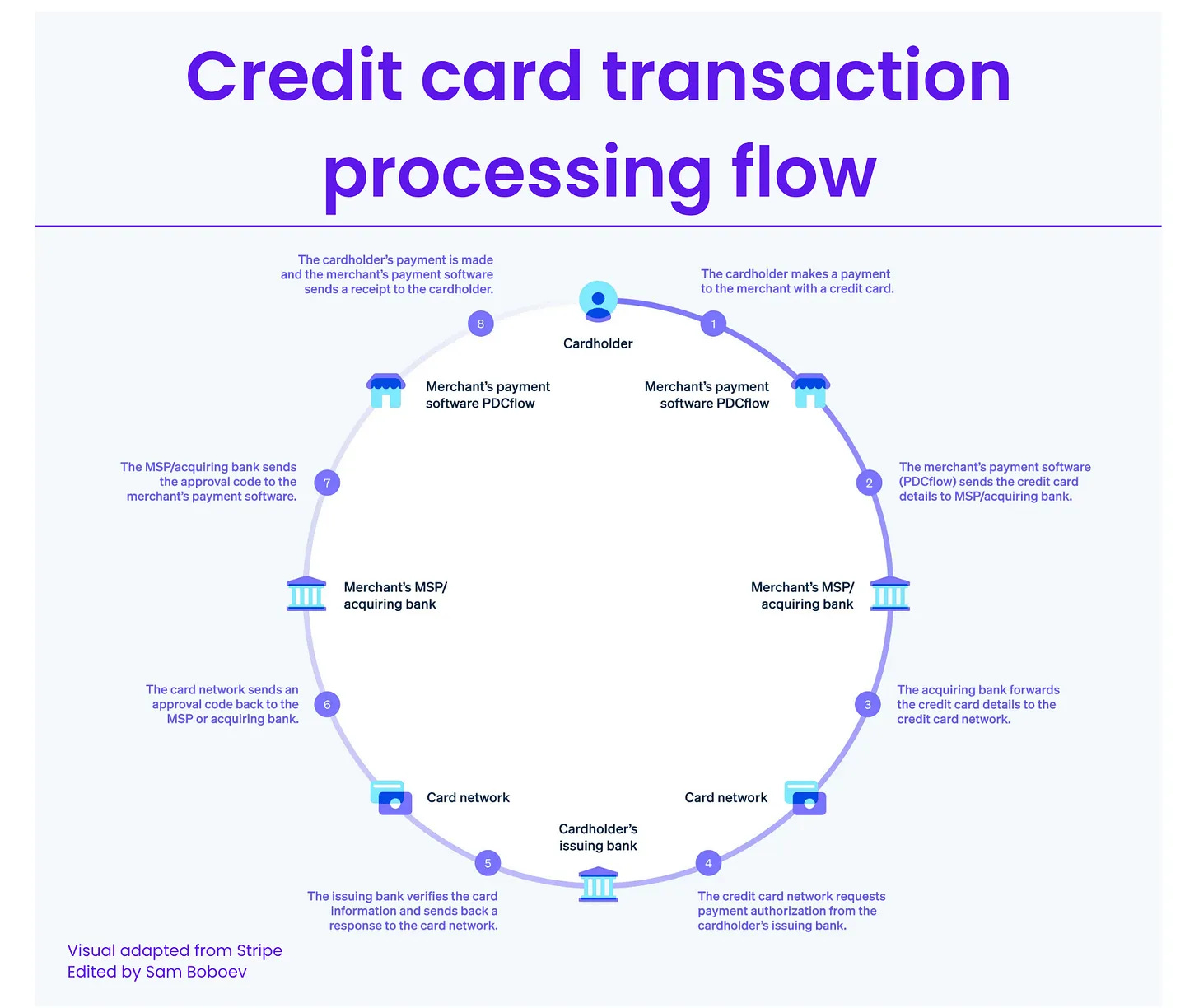

Credit card transaction processing flow by Stripe

Credit card transaction processing varies depending on where a transaction takes place and what type of card is used. For example, an online credit card transaction will be initiated in a different way than an in-person card transaction. Similarly, an in-person transaction will work differently if the credit card is stored in a digital wallet compared to an in-person transaction where the customer uses a physical card.

But even with these smaller variations, the overall credit card transaction process is mostly consistent across different types of transactions. Here’s a simplified overview of how the process works:

1. Initiation

The cardholder provides their credit card information to the business. For in-person transactions, this means swiping, inserting, or tapping their card. For online transactions, this means entering the card details manually or selecting a card from their stored payment methods.

2. Data transmission

The business’s POS system or payment gateway captures the transaction details and securely transmits this information to the credit card processor.

3. Authorization request

The credit card processor forwards the transaction data to the appropriate card network, which then routes the authorization request to the issuing bank.

Curated News

💳 Payments

Citi Expands Token Services for Euro and Multi-Currency Liquidity

Citi has announced the global expansion of its Citi Token Services, adding euro integration and 24/7 liquidity management across multiple currencies. This marks another step in Citi’s push toward blockchain-enabled treasury and cross-border payment innovations for institutional clients.

Source

Edenred Teams Up with WonderDays for Gift Card Distribution

Edenred Payment Solutions is partnering with WonderDays to streamline third-party gift card issuance and management. The collaboration enhances merchant access to corporate and consumer gifting solutions across multiple platforms.

Source

Paystand Strengthens Stablecoin Payments via Bitwage Acquisition

Paystand has acquired Bitwage to bolster its cross-border stablecoin payment infrastructure. The deal expands Paystand’s ability to facilitate faster, blockchain-based payroll and remittance services for businesses.

Source

🏦 Banking

DBS Integrates Generative AI in Banking Operations

Southeast Asia’s largest bank, DBS, has launched a generative AI chatbot to enhance internal workflows and customer engagement. The bank aims to use AI-driven automation to improve productivity and personalized service delivery.

Source

VPBank Modernizes Core Banking with Temenos

Vietnam’s VPBank has adopted Temenos’ cloud-native banking platform in partnership with Systems Limited and Red Hat OpenShift. The upgrade supports faster innovation, scalability, and improved digital customer experiences.

Source

ClearBank Founder Launches New Venture ‘Sporta’

Nick Ogden, founder of ClearBank, has unveiled his latest project, Sporta, targeting new opportunities in embedded finance. The platform aims to bridge sports engagement and financial technology, underscoring Ogden’s continued fintech entrepreneurship.

Source

🪙 Crypto

Bank of England Opens Consultation on Stablecoin Regulation

The Bank of England has initiated a consultation to establish a framework for regulating systemic stablecoins in the UK. The move seeks to ensure financial stability while enabling innovation in digital payments.

Source

Coinbase to Launch Token Offering Platform with Monad Sale

Coinbase is set to debut its new digital token offering platform, starting with the sale of the Monad token. This initiative represents Coinbase’s effort to broaden access to compliant token issuance and trading.

Source

BitMine Stock Rallies After $389M Ethereum Investment

BitMine shares surged after Tom Lee’s investment firm revealed a $389 million purchase in Ethereum. The move signals growing institutional confidence in crypto assets despite market volatility.

Source

Greenidge Settles New York Permit Dispute, Stock Spikes

Bitcoin miner Greenidge Generation has resolved its environmental permit dispute in New York, resulting in a sharp rise in its stock price. The settlement removes a key regulatory hurdle and stabilizes its U.S. mining operations.

Source

💼 Fintech

Ant International and Abdul Latif Partner to Digitize MSME Services

Ant International is teaming up with Saudi Arabia’s Abdul Latif Group to deliver digital financial tools for micro, small, and medium-sized enterprises. The partnership aims to expand financial inclusion and streamline MSME financing in the region.

Source

FintechOS and Finastra Simplify Client Onboarding

FintechOS has joined forces with Finastra to enable smoother digital and in-branch onboarding for banks and credit unions. The integration enhances customer journeys by automating KYC and compliance workflows.

Source

Ex-Google Engineering Head Joins Razorpay

Razorpay has hired a former Google engineering leader to strengthen its product innovation and scalability. The appointment reinforces the fintech’s commitment to advancing India’s digital payments infrastructure.

Source

MAS and Indonesia’s OJK Renew Fintech Partnership

Singapore’s Monetary Authority (MAS) and Indonesia’s OJK have renewed their fintech cooperation to promote cross-border innovation. The partnership focuses on joint sandboxes, digital ID, and open banking integration.

Source

Kapitale Secures $25M Credit Facility for US SMBs

Kapitale has obtained a $25 million credit line to expand funding options for small businesses in the U.S. The fintech plans to use the capital to scale its embedded lending and invoice financing solutions.

Source

📈 WealthTech

Schwab to Acquire Forge Global to Boost Private Markets Access

Charles Schwab is acquiring Forge Global in a deal aimed at expanding access to private market investments. The acquisition enhances Schwab’s alternative investment offerings and appeals to high-net-worth clients seeking diversification.

Source

FIS Launches New Asset Servicing Suite

FIS has introduced an advanced asset servicing management platform to streamline operational workflows. The new suite leverages automation to enhance transparency and efficiency for institutional clients.

Source

📜 Regulation

Bumper Gains FCA Authorization for Consumer Lending

UK-based Bumper has received authorization from the Financial Conduct Authority (FCA) to expand its consumer lending services. This milestone paves the way for broader lending solutions and enhanced compliance standards.

Source

💰 Other

Meta Profits from Fraudulent Ads Exposed

Reports reveal that Meta has earned substantial revenue from fraudulent advertisements running on its platforms. The findings reignite concerns about online ad verification and accountability in digital marketing.

Source

PensionBee Pushes for Faster Pension Transfers

PensionBee’s petition advocating a 10-day pension switch guarantee has reached over 5,000 signatures. The initiative highlights consumer demand for faster, more transparent pension transfer processes.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.