Visa Expands Stablecoin Payments Across CEMEA with Aquanow Partnership

Visa has partnered with Aquanow to enable stablecoin settlement across the Central and Eastern Europe, Middle East, and Africa (CEMEA) region. The initiative allows financial institutions and fintechs to settle transactions using blockchain-based stablecoins, improving speed and reducing cross-border payment costs. This move signals Visa’s growing confidence in regulated crypto infrastructure as part of mainstream payments. It also highlights rising institutional demand for always-on, programmable settlement rails. By targeting CEMEA, Visa is addressing regions where cross-border payments are often slow and expensive. The partnership strengthens Visa’s role as a bridge between traditional finance and digital assets. Overall, this marks another step toward real-world adoption of stablecoins in global payments.

Video of the Day

Insight of the Day

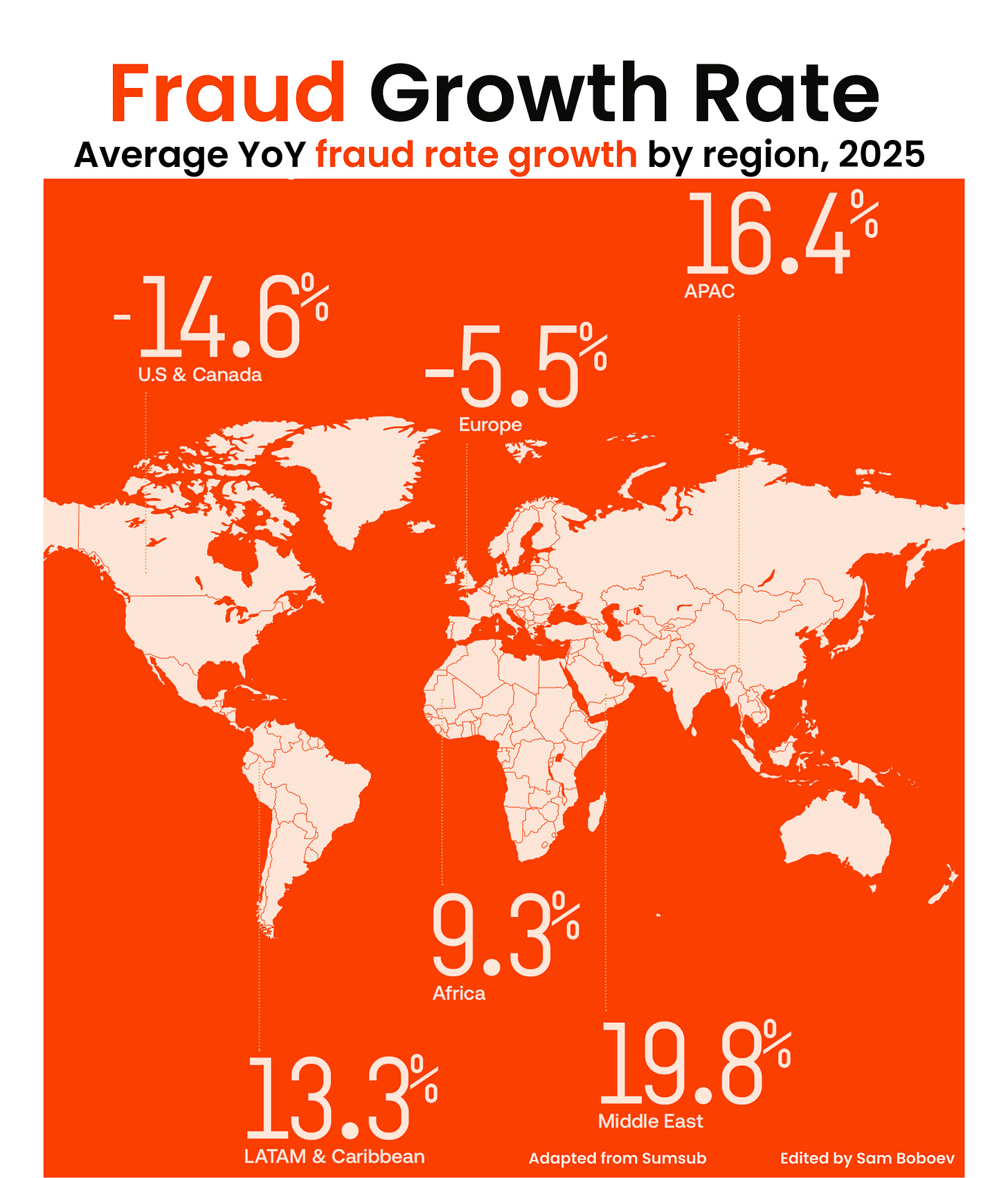

𝐅𝐫𝐚𝐮𝐝 𝐏𝐫𝐞𝐯𝐞𝐧𝐭𝐢𝐨𝐧 𝐏𝐥𝐚𝐲𝐛𝐨𝐨𝐤 𝐟𝐨𝐫 𝟐𝟎𝟐𝟔 𝐛𝐲 𝐒𝐮𝐦𝐬𝐮𝐛

I just finished reviewing Sumsub’s Identity Fraud Report 2025–2026. What they found is a very different fraud landscape than even two years ago and fintech must be aware of these changes.

Download the full report here: https://lnkd.in/dKTQ-B5A

Sumsub analyzed 4 million+ fraud attempts across 300+ companies and surveyed 1.2K+ end users and 300+ fraud professionals.

Here are the numbers that stood out to me:

👉 𝐓𝐡𝐞 𝐒𝐨𝐩𝐡𝐢𝐬𝐭𝐢𝐜𝐚𝐭𝐢𝐨𝐧 𝐒𝐡𝐢𝐟𝐭: 𝐟𝐞𝐰𝐞𝐫 𝐚𝐭𝐭𝐚𝐜𝐤𝐬, 𝐛𝐮𝐭 𝐞𝐚𝐜𝐡 𝐨𝐧𝐞 𝐢𝐬 𝟏𝟖𝟎% 𝐦𝐨𝐫𝐞 𝐚𝐝𝐯𝐚𝐧𝐜𝐞𝐝

Fraudsters are abandoning low-quality tricks.

→ 180% increase in “sophisticated fraud”

→ 142% YoY growth in synthetic identities

→ 388% surge in duplicate submissions

→ Deepfake-driven selfie mismatches now account for 35.4% of fraud in APAC

→ Forged documents dropped 11% YoY

→ Blacklist violations dropped 50% YoY

So even if fraud percentages remain stable, the impact of each successful attack is much bigger.

👉 𝐀𝐈 𝐢𝐧𝐝𝐮𝐬𝐭𝐫𝐢𝐚𝐥𝐢𝐳𝐞𝐬 𝐟𝐫𝐚𝐮𝐝 — 𝐝𝐨𝐜𝐮𝐦𝐞𝐧𝐭 𝐟𝐨𝐫𝐠𝐞𝐫𝐢𝐞𝐬 𝐚𝐫𝐞 𝐧𝐨𝐰 𝐧𝐞𝐚𝐫-𝐩𝐞𝐫𝐟𝐞𝐜𝐭

Fraudsters have moved from “copy-paste” edits to AI-assisted forgery factories.

The report highlights:

→ Advanced image generation tools now replicate fonts, holograms, and textures at near-human accuracy

→ Deepfakes are used to bypass liveness checks

→ Selfie-to-ID mismatches grew +73% YoY in some regions

👉 𝐃𝐨𝐜𝐮𝐦𝐞𝐧𝐭-𝐟𝐫𝐞𝐞 𝐯𝐞𝐫𝐢𝐟𝐢𝐜𝐚𝐭𝐢𝐨𝐧 𝐢𝐬 𝐞𝐱𝐩𝐥𝐨𝐝𝐢𝐧𝐠 (𝟑𝟑𝟖% 𝐘𝐨𝐘 𝐠𝐫𝐨𝐰𝐭𝐡)

One stat that shocked me:

Document-free verification grew 338% YoY, making it the fastest-growing KYC method globally.

Countries already scaling it:

→ Canada

→ Singapore

→ France

By connecting directly to government registries, Non-Doc Verification eliminates the main attack vector (fake documents).

👉 𝐒𝐲𝐧𝐭𝐡𝐞𝐭𝐢𝐜 𝐢𝐝𝐞𝐧𝐭𝐢𝐭𝐢𝐞𝐬 𝐚𝐫𝐞 𝐫𝐞𝐩𝐥𝐚𝐜𝐢𝐧𝐠 𝐬𝐭𝐨𝐥𝐞𝐧 𝐈𝐃𝐬

Traditional stolen data is being replaced by AI-generated personal details.

Key numbers:

→ Synthetic personal data is up +142% YoY

→ Now 15.7% of all fraud cases

→ Deepfake + synthetic combos rising rapidly

👉 𝐅𝐫𝐚𝐮𝐝𝐬𝐭𝐞𝐫𝐬 𝐚𝐫𝐞 𝐛𝐞𝐜𝐨𝐦𝐢𝐧𝐠 𝐩𝐞𝐫𝐬𝐢𝐬𝐭𝐞𝐧𝐭: “𝐚𝐭𝐭𝐚𝐜𝐤 𝐮𝐧𝐭𝐢𝐥 𝐭𝐡𝐞𝐲 𝐠𝐞𝐭 𝐢𝐧”

The report shows fraudsters don’t give up after one try.

- Duplicate submissions → +388% YoY

- Liveness bypass attempts → major rise

- Bot-driven attacks affecting 37% of companies

- Card testing impacting 46%

- Identity theft experienced by 73% of APAC companies

Persistence is now a core fraud tactic. This means more:

→ rate limiting

→ device fingerprinting

→ behavioral analytics

Here’s my fraud-prevention checklist:

- Multi-layer verification across onboarding and post-KYC

- AI-driven anomaly detection

- Behavioral analytics (typing, navigation flow)

- Government-verified identity data where available

- Unified fraud + compliance stack

Curated News

💳 Payments

Buy Now, Pay Later Becomes Essential for Merchant POS

Buy now, pay later is shifting from an optional add-on to a core requirement for merchant point-of-sale systems. As consumer budgets remain stretched, merchants increasingly rely on BNPL to boost conversion and basket size.

Source

PayPal and Perplexity Launch Instant Buy Ahead of Black Friday

PayPal and AI search firm Perplexity have launched “Instant Buy,” enabling shoppers to purchase products directly from search results. The feature aims to reduce friction during peak shopping periods like Black Friday.

Source

Monex Canada Adds Mass Payments to Monex Pay

Monex Canada has expanded Monex Pay with a new mass payments capability. The update enables businesses to send large volumes of payments efficiently, supporting payroll and supplier use cases.

Source

Smarter POS and Faster Payments for Peak Sales Season

Merchants are upgrading POS systems and adopting faster payments to handle peak-season demand. The changes help improve checkout speed, reduce outages, and enhance customer experience.

Source

Thredd Enables Visa Cloud Connect Globally

Thredd has signed a global agreement to enable Visa Cloud Connect. The move simplifies secure connectivity for issuers and fintechs, accelerating card program launches worldwide.

Source

PayMe by HSBC Migrates to AWS

PayMe by HSBC has migrated to Amazon Web Services to support scalability and faster innovation. The move strengthens Hong Kong’s digital payments infrastructure.

Source

🏦 Banking

Crypto Finance Group Completes Bank-Led Digital Asset Pilot

Crypto Finance Group and several banks have completed a pilot focused on digital asset infrastructure. The project highlights growing collaboration between traditional banks and crypto-native firms.

Source

Tuum Extends Core Banking Partnership with Multitude Bank

Tuum has secured a long-term extension of its partnership with Multitude Bank. The agreement supports continued innovation and scalability for digital banking services.

Source

💼 Fintech

FE fundinfo Acquires Finscape

FE fundinfo has acquired Finscape to strengthen its fund data and analytics capabilities. The deal enhances its offering for asset managers and distributors.

Source

Ant International and Ho Chi Minh City Plan Fintech Hub

Ant International is partnering with Ho Chi Minh City to build a regional fintech hub. The initiative aims to support startups and accelerate digital finance innovation in Vietnam.

Source

Disseqt AI, HCLTech and Microsoft Push Agentic Finance

Disseqt AI has teamed up with HCLTech and Microsoft to develop agentic AI solutions for finance. The collaboration focuses on automating complex financial workflows.

Source

Malaysia Ecommerce Revenue Hits $226.7B

Malaysia’s ecommerce revenue has reached $226.7 billion, reflecting rapid digital adoption. Growth is boosting demand for embedded finance and payment services.

Source

🪙 Crypto

Deutsche Börse and AllUnity Partner on European Stablecoins

Deutsche Börse Group and AllUnity are partnering to expand stablecoin adoption in Europe. The move supports regulated digital settlement for financial markets.

Source

KakaoBank Begins Development of Won-Pegged Stablecoin

KakaoBank has started work on a won-backed stablecoin. The project highlights growing interest among Asian banks in blockchain-based payments.

Source

Paxos Acquires Fordefi for $100M+

Paxos has acquired Fordefi for over $100 million to expand its DeFi custody capabilities. The deal strengthens Paxos’ institutional crypto infrastructure offering.

Source

US Bank Tests Stablecoin on Stellar

US Bank is piloting a stablecoin on the Stellar network. The test reflects increasing experimentation by major banks with blockchain settlement rails.

Source

Bitcoin Options Traders Watch for a Market Bottom

Bitcoin options traders are tracking key signals to identify a potential market low. The analysis reflects cautious sentiment amid ongoing volatility.

Source

📈 WealthTech

ING Launches Round-Up Investing Feature

ING has introduced a round-up-and-invest feature in its Dutch app. The tool helps users invest spare change automatically, encouraging long-term saving.

Source

⚖️ Regulation

FCA Unveils Stablecoin Regulatory Sandbox

A UK regulator has outlined its crypto strategy, including plans for a stablecoin sandbox. The move aims to balance innovation with consumer protection.

Source

Australian Scam-Sharing Network Reduces Financial Crime

Australia’s scam-sharing network is helping institutions better detect and prevent fraud. Collaboration across firms is showing early positive results.

Source

🏷️ Other

Mastercard Launches Access Pass for Personalized Perks

Mastercard has introduced Access Pass to help partners deliver tailored experiences and rewards. The initiative strengthens consumer engagement beyond payments.

Source

Kraken Pushes “Krak” as a Bank Alternative

Kraken is expanding its offering with a cashback debit card, salary deposits, and high-yield vaults. The move positions the exchange as a full-service financial platform.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.