Visa Launches Stablecoin Payout Pilot to Accelerate Payments for Creators and Gig Workers

Visa has announced a major leap forward in digital payments with the launch of its stablecoin payout pilot, aimed at transforming how creators, freelancers, and gig workers access their earnings worldwide. Through its Visa Direct platform, the initiative enables real-time payouts in USDC stablecoin, combining the speed of blockchain settlement with the reliability and compliance of Visa’s global network. This move bridges traditional finance with Web3 infrastructure, offering near-instant payments that bypass the delays and costs of conventional banking rails.

The pilot directly addresses a major challenge in the global gig economy — slow, high-fee cross-border transactions — by allowing workers to receive funds in minutes rather than days. Beyond faster payments, it expands access to the financial system for unbanked or underbanked users in emerging markets, helping democratize digital earnings. The initiative also underscores Visa’s strategic shift toward tokenized money and programmable payments, showing how stablecoins can power real-world financial use cases at scale. As stablecoin regulation matures and blockchain infrastructure strengthens, Visa’s pilot positions the company at the forefront of digital asset integration in mainstream finance. It’s a bold step toward a more inclusive, efficient, and borderless payment ecosystem.

Video of the Day

Insight of the Day

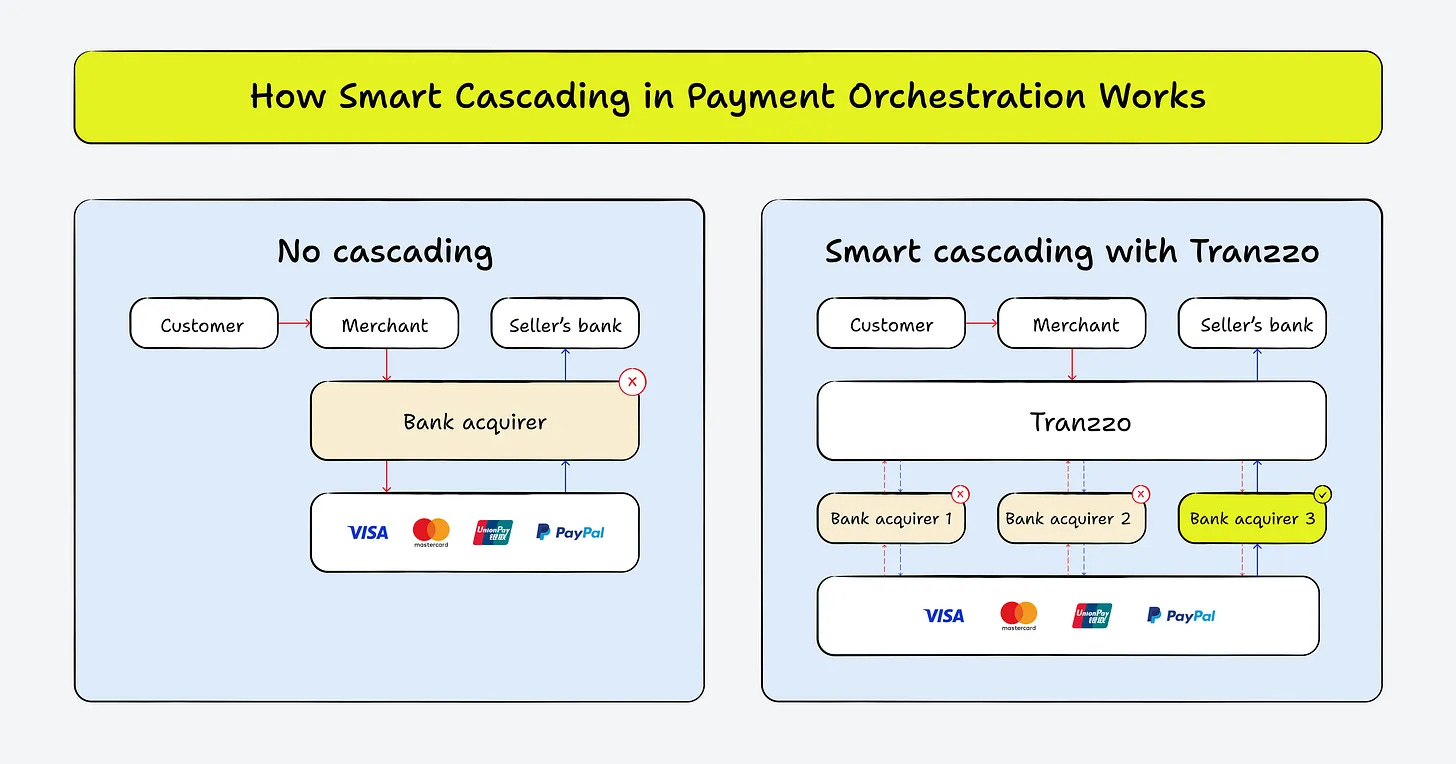

How Smart Cascading in Payment Orchestration Works - Explained by Tranzzo

When a user clicks “Pay,” dozens of systems spring into action — acquirers, gateways, fraud, and authentication tools. Payment orchestration conducts it all, with cascading as its secret rhythm.

👉 What is Cascading in Payment Orchestration?

At its core, cascading in payment orchestration refers to the sequential routing of transactions through multiple payment service providers (PSPs) or acquiring banks based on a predefined set of rules, without creating a new transaction. This means the user sees a single, seamless payment attempt, even if the system executes multiple retries behind the scenes.

This method stands in contrast to traditional payment systems that follow a fixed, predetermined path, lacking flexibility.

Here’s how it works in practice: a transaction is initially routed to a primary terminal. If that terminal responds with a decline due to a soft error, such as a limit being exceeded or a network timeout, the system automatically reroutes the same transaction to another terminal in the configuration. If the second terminal successfully processes the payment, the transaction completes — the user never notices the internal retry. If all configured fallback terminals fail, the transaction is finalized with a failure status.

Smart cascading also takes 3DS authentication into account. The orchestration service can use both non-3DS and 3DS terminals. If the rerouted attempt is processed through a 3DS terminal, the user will repeat the verification. Proper configuration ensures that fallback attempts avoid unnecessary repeated challenges and maintain the flow’s reliability.

Curated News

💳 Payments

Mastercard to Eliminate Passwords and Card Numbers in APAC by 2030

Mastercard plans to make online shopping password-free and number-free across Asia Pacific by 2030, introducing biometric and tokenized verification for enhanced security and convenience. The initiative supports Mastercard’s vision of frictionless, secure commerce.

Source

Blik Tests First Cross-Border P2P Transfer Between Portugal and Spain

Poland’s Blik has successfully conducted its first test of cross-border P2P payments between Portugal and Spain. The move marks a milestone in its European expansion, signaling a future of real-time, low-cost transfers across the continent.

Source

Visa’s Scan to Pay Goes Live Across Asia Pacific

Visa’s “Scan to Pay” QR payments system has launched across millions of merchants in Asia Pacific, bringing a new level of convenience and inclusivity to the digital payments ecosystem. It enables consumers to pay securely using any smartphone camera.

Source

TransferMate Gains U.S. Virgin Islands License

Global B2B payments firm TransferMate has secured a payments license in the U.S. Virgin Islands, further expanding its regulated footprint across North America and the Caribbean. The license strengthens its position as a leader in compliant cross-border payments.

Source

HitPay and Yuno Partner to Simplify Global Payment Access

Singapore-based HitPay has teamed up with Yuno to streamline local payment acceptance for global merchants. The collaboration enhances payment reach across emerging markets by integrating regional payment methods.

Source

One Inc Modernizes Insurance Payments with ClaimsPay®

One Inc’s ClaimsPay® is powering Mutual Benefit Group’s modernization of insurance payments, improving disbursement efficiency and customer satisfaction. The update reflects ongoing digitization within the insurance payments ecosystem.

Source

🏦 Banking

Constantinople Chooses Paymentology for Banking-as-a-Service Expansion

Constantinople has selected Paymentology to power its Banking-as-a-Service platform, enabling rapid and compliant financial product launches. The partnership supports scalable card issuing and embedded finance capabilities.

Source

Eurobank, EY & Microsoft Partner on Agentic AI in Banking

Eurobank and Fairfax Digital have teamed up with EY and Microsoft to launch a new initiative using agentic AI to boost productivity and customer experience in banking operations. The project explores AI co-pilot use cases for frontline staff.

Source

Creditinfo and NOTO Expand AML and Fraud Controls for Banks

Creditinfo has partnered with NOTO to deliver modern fraud prevention and AML tools to banks, fintechs, and lenders worldwide. The collaboration enhances real-time risk management and regulatory compliance.

Source

💰 Fintech

FNZ Secures Second Major Cash Injection

FNZ has obtained a fresh round of funding following strong institutional backing. The investment supports continued innovation in wealth infrastructure and long-term expansion across global markets.

Source

FNZ Raises $650 Million to Accelerate Growth

FNZ has raised US$650 million from existing institutional shareholders to support its long-term strategy in wealth management technology. The capital will fund R&D, partnerships, and new market entries.

Source

Ant International and Xiaomi Develop Iris Authentication Glasses

Ant International and Xiaomi have unveiled iris-scanning smart glasses that enable secure, hands-free payments and identity verification. The innovation could revolutionize biometric authentication for financial transactions.

Source

Paydown App Helps Borrowers Escape Credit Card Debt

New fintech app Paydown is designed to help users “break up with credit cards” by consolidating balances and automating repayments. The platform aims to promote financial wellness through personalized debt management.

Source

🪙 Crypto

Coinbase Cancels $2B BVNK Stablecoin Acquisition

Coinbase has abandoned its planned $2 billion acquisition of BVNK, a London-based stablecoin infrastructure firm. The move raises questions about Coinbase’s long-term stablecoin strategy amid evolving market and regulatory dynamics.

Source

JPMorgan Launches Dollar Deposit Token on Coinbase’s Base

JPMorgan is bringing a USD deposit token to Coinbase’s Base network, marking a major step in the convergence of traditional finance and blockchain infrastructure. The initiative reflects growing institutional interest in blockchain settlement.

Source

Calastone Integrates Tokenized Platform with Polygon

UK-based Calastone has integrated its tokenized fund platform with Polygon, enabling faster and cheaper fund transactions on-chain. The move signifies the asset management sector’s growing shift toward blockchain interoperability.

Source

Japan’s Startale Unveils Super-App on Sony’s Soneium Blockchain

Startale has launched a super-app for Sony’s Soneium blockchain, combining payments, NFTs, and digital identity services. The app is positioned to drive mass Web3 adoption in Japan through Sony’s ecosystem.

Source

Bitcoin Traders Brace for U.S. Inflation Data

Crypto traders are closely watching upcoming U.S. inflation numbers, expecting them to influence Bitcoin’s short-term price direction. The release could impact liquidity and investor sentiment across digital assets.

Source

📈 WealthTech

Middle East Investment Platform Launches Robo-Advisor

A new robo-advisor has debuted in the Middle East, offering automated investment guidance to regional users. The platform expands access to digital wealth management and reflects the sector’s growing maturity.

Source

🧠 Regulation & AI

UK and Singapore Regulators Collaborate on AI in Finance

Regulators from the UK and Singapore have announced plans to jointly advance AI innovation in financial services. The collaboration will establish frameworks for responsible AI deployment in banking and fintech.

Source

Banks and Insurers Deploy AI Agents for Fraud Detection

A Capgemini report reveals that banks and insurers are deploying AI agents to fight fraud, process applications, and improve efficiency. The trend also raises the need for new supervisory roles to oversee AI systems responsibly.

Source

🛡️ Other

Chubb Unveils AI-Powered Embedded Insurance Engine

Chubb has launched an AI-driven embedded insurance engine that allows partners to integrate customized coverage directly into digital platforms. The solution represents the next evolution in personalized, context-aware insurance.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.