Visa Unveils AI-Powered Commercial Payments Hub

Visa has launched its new VCS Hub, an AI-driven platform designed to modernize commercial payments. The hub integrates advanced data analytics and automation to optimize payment flows for enterprises, with a focus on efficiency, fraud reduction, and improved cash management. By embedding AI into core processes, Visa aims to help businesses streamline cross-border transactions and unlock smarter liquidity management. The move underscores a broader trend of financial giants embedding AI to gain a competitive edge in B2B payments. Visa’s new platform could also serve as a model for corporate treasury solutions globally. Analysts see this as a step toward reshaping the $120 trillion commercial payments market.

Insight of the Day

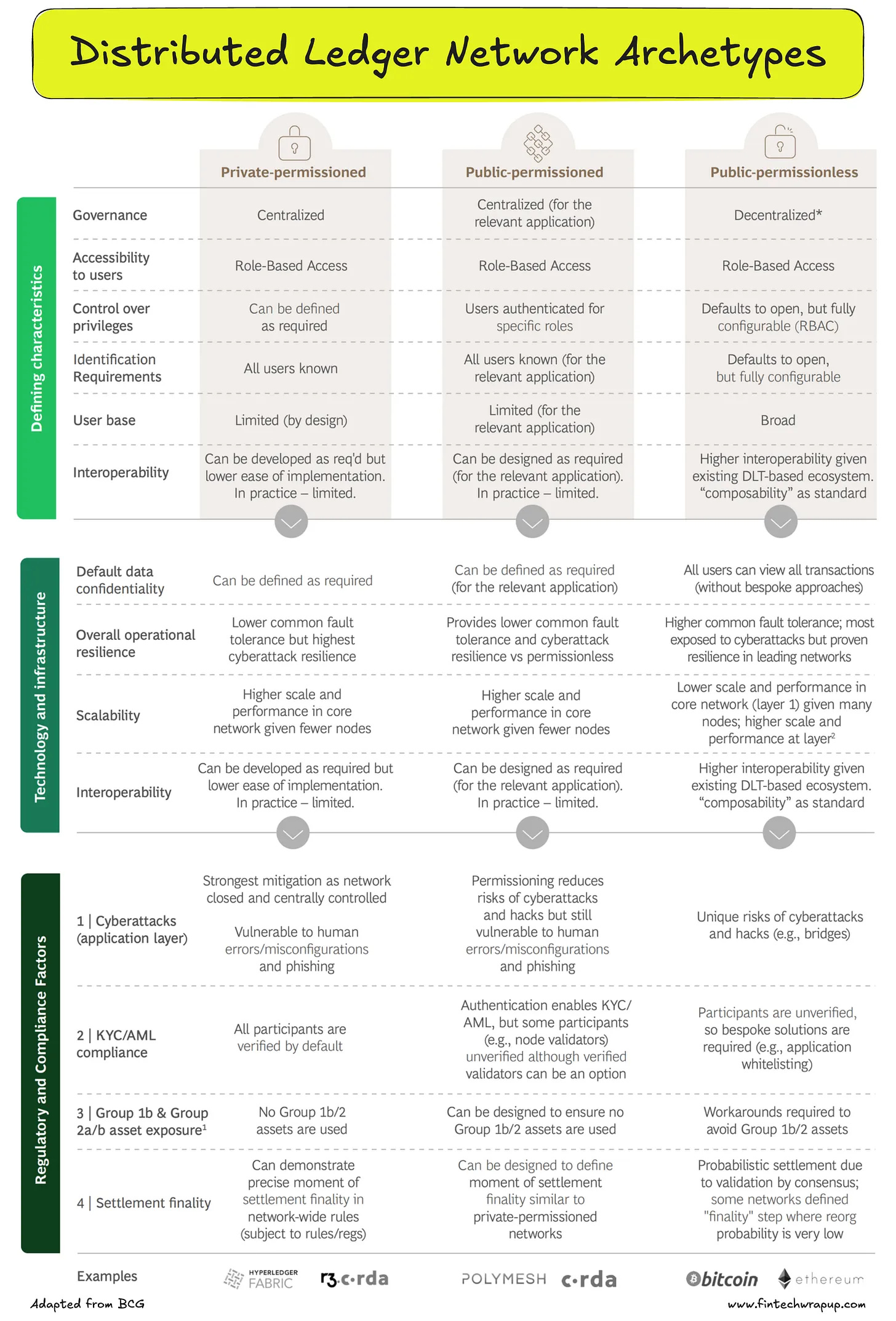

Making Sense of Distributed Ledger Network Archetypes

Distributed Ledger Technology (DLT) is powering change across finance, supply chains, and digital identity. But not all networks are the same. Broadly, they fall into three categories: private-permissioned, public-permissioned, and public-permissionless. Each comes with trade-offs in governance, infrastructure, and compliance.

🔹 Defining Characteristics

Private-permissioned networks are centralized, closed, and role-based, with all participants verified. They restrict the user base by design and focus on security and compliance. Public-permissioned models remain centralized for specific applications but allow broader authenticated access. Public-permissionless systems—like Bitcoin and Ethereum—are decentralized, open, and highly interoperable.

Privileges and identity differ too. Private and public-permissioned models define roles and require known users, while permissionless defaults to open participation, though configurable via RBAC.

🔹 Technology and Infrastructure

Data confidentiality is flexible in private and permissioned systems, while permissionless defaults to transparency (all transactions visible unless privacy layers are added). Fault tolerance flips: permissionless networks show the strongest resilience but face higher cyber risks. Permissioned systems balance fault tolerance with fewer nodes. Private systems, though more efficient, have the lowest resilience.

Scalability favors private and permissioned models: higher throughput with fewer nodes. Permissionless networks scale globally but struggle with core performance. Their strength lies in interoperability and composability across ecosystems.

Curated News

💳 Payments

Santander’s Zinia Expands BNPL to Amazon Spain

Santander’s Zinia will now offer installment payment options to Amazon customers in Spain, deepening its footprint in e-commerce. This partnership highlights BNPL’s growing role in mainstream retail and enhances customer flexibility at checkout.

Source

Solaris and ACI Join Forces on Unified Payments

Solaris has partnered with ACI Worldwide to unify payment processing across multiple channels. The collaboration aims to simplify payment infrastructure for banks and fintechs while boosting speed and security.

Source

Oracle Secures Swift Compatibility for Payments 2025

Oracle has announced its payments application is now Swift-compatible, ensuring institutions can meet the 2025 global standards. This positions Oracle as a reliable infrastructure provider for banks upgrading their systems.

Source

Temenos Launches AI-Powered Payments Platform

At Sibos 2025, Temenos introduced a new AI-driven solution for payments and account management. The platform aims to reduce operational costs and enhance transaction efficiency for banks worldwide.

Source

Yaspa Showcases Intelligent Payments in US Expansion

UK-based Yaspa will present its intelligent payments platform at G2E as it accelerates into the US market. The expansion underscores strong global demand for advanced, AI-powered paytech solutions.

Source

🏦 Banking

Citi Pioneers 24/7 USD Clearing with Token Services

Citi has achieved an industry-first by integrating its Citi Token Services with 24/7 USD clearing, enabling real-time cross-border payments and liquidity management. This breakthrough could reshape global transaction settlement.

Source

Deutsche Bank Executes First Euro Blockchain Transaction

Deutsche Bank has conducted its first euro-denominated transaction on blockchain. The move signals progress toward blockchain adoption in mainstream banking and could pave the way for faster, transparent settlements.

Source

Barclays and CGI Reinvent Trade Finance

Barclays has teamed up with CGI to launch a new digital pathway for trade finance. The solution aims to modernize traditional processes, reducing inefficiencies in international trade transactions.

Source

SNB and ECB Explore Instant Payments Link

The Swiss National Bank and European Central Bank are testing the interlinking of their instant payment systems. This initiative could lead to faster, seamless cross-border payments across Europe.

Source

💡 Fintech

Fiserv Acquires StoneCastle Cash Management

Fiserv has signed a deal to acquire StoneCastle Cash Management, enhancing its cash optimization and liquidity services for institutional clients. The acquisition strengthens Fiserv’s fintech ecosystem in treasury solutions.

Source

Worldpay Rolls Out Embedded Finance Engine

Worldpay has launched a unified embedded finance engine, designed to integrate lending, payments, and financial services for merchants. This move reflects the growing trend of finance embedded directly into digital platforms.

Source

Light Raises $30M to Build AI-Native Finance Platform

Light secured $30 million in Series A funding to replace legacy finance systems with its AI-native platform. The company plans to accelerate adoption among banks and enterprises seeking next-gen infrastructure.

Source

Chubb and Endeavor Form Global Growth Partnership

Chubb has partnered with Endeavor to support entrepreneurs and drive economic growth in emerging markets. The collaboration will combine insurance solutions with entrepreneurship initiatives.

Source

Simply Asset Finance Hits £150m Milestone

Simply Asset Finance has reached £150 million in funding in Scotland and opened a new Glasgow office. The milestone highlights rising demand for alternative finance solutions for SMEs.

Source

🪙 Crypto

SWIFT Joins Blockchain with Consensys Prototype

SWIFT is collaborating with Consensys on an onchain prototype, with 30 banks exploring 24/7 blockchain-based settlement. This could revolutionize global clearing and settlement processes.

Source

📊 WealthTech

FS Giants Test Blockchain and AI for $58B Corporate Actions

Leading financial services firms are piloting blockchain and AI to address inefficiencies in corporate actions, an area costing the industry $58 billion annually. The initiative seeks to improve transparency, reduce errors, and lower costs.

Source

📜 Regulation

Sibos 2025 Sets Agenda on AI, CBDCs, and Tokenization

Sibos 2025 will spotlight AI, quantum computing, CBDCs, tokenized assets, and stablecoins. The event reflects regulators’ and institutions’ growing focus on balancing innovation with financial stability.

Source

🌐 Other

Murex Strikes AWS Deal for Managed Services Expansion

Murex has announced a global multi-year partnership with AWS to scale its managed services program. The collaboration will accelerate cloud adoption for capital markets clients.

Source

Duco Launches Next-Gen AI Automation at Sibos

Duco introduced its latest AI automation platform at Sibos, aiming to enhance reconciliation and data management across financial institutions. The tool promises major efficiency gains in operational processes.

Source

Financial Crime 360 to Spotlight Fraud and Cybersecurity

Europe’s leading financial crime event, Financial Crime 360, will gather experts on fraud, cybercrime, and AML. The conference will focus on building stronger defenses against evolving threats.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.