Wall Street Bets on FinTechs Reinventing Lending, Credit and Payments

Investor confidence in fintechs is surging as Wall Street backs companies transforming lending, credit, and payments. With traditional banks under pressure, fintechs are leveraging AI, embedded finance, and new business models to scale faster and capture underserved markets. IPO activity is expected to rise as these firms prove profitability while expanding globally. The trend underscores a structural shift in financial services, where digital-first firms challenge incumbents with speed, personalization, and lower costs. Analysts say fintechs are no longer just disruptors but vital players in reshaping the financial ecosystem. This shift also suggests a more competitive IPO pipeline in 2026.

Insight of the Day

Let's learn how Ramp grew from corporate cards to $1B revenue

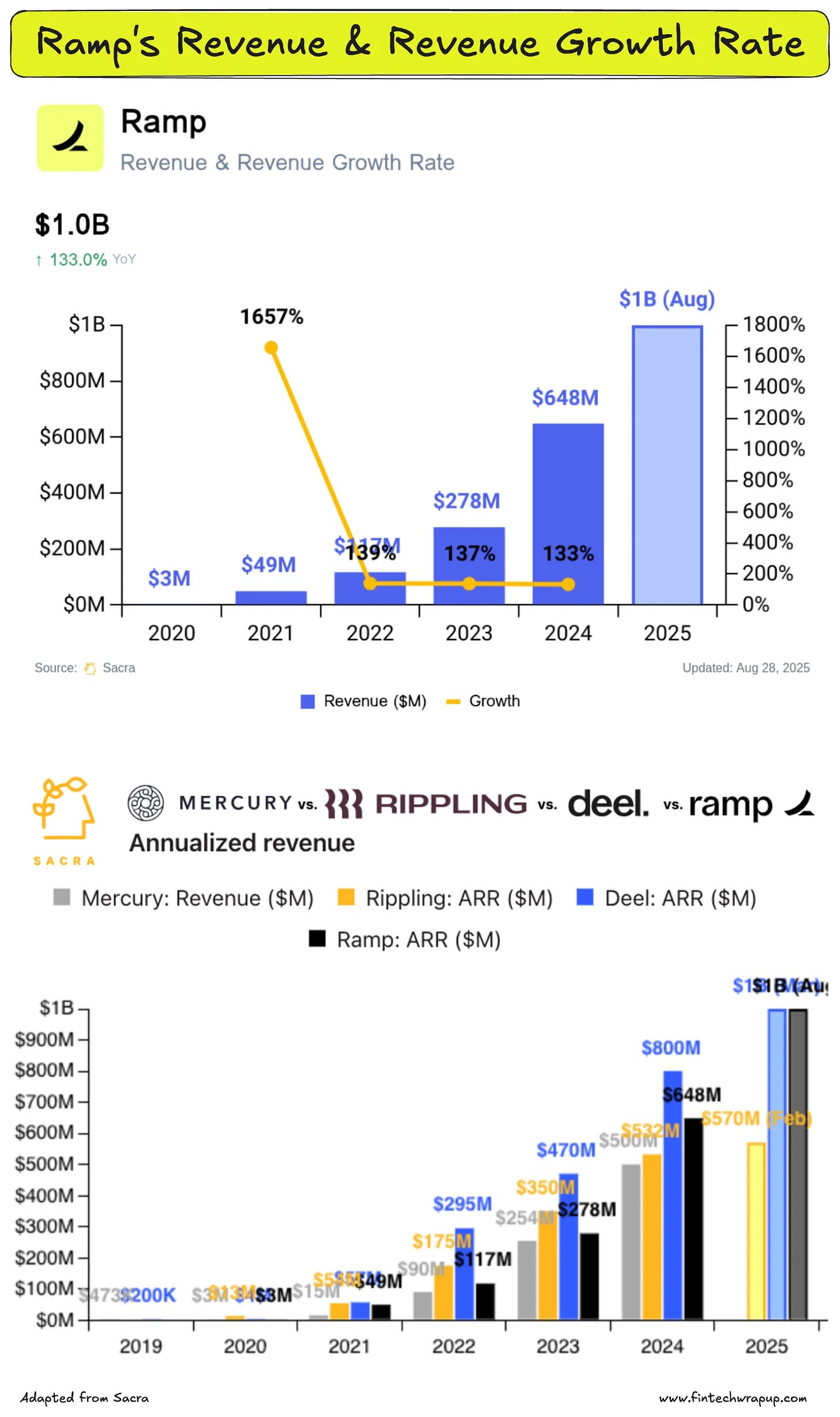

Growing over 100% YoY from $50M to hundreds of millions in revenue, Ramp has become one of fintech’s fastest-growing players. Sacra estimates Ramp hit $1B in annualized revenue in August 2025, up 110% YoY, driven by its multiproduct strategy and strong attach rates—from cards to bill pay, procurement, travel, and treasury. This expansion has fueled Ramp’s move upmarket into the enterprise.

✅ Ramp’s trajectory

Founded in 2019, Ramp launched with a free corporate card offering 1.5% cashback, powered by API-based issuing via Marqeta and Stripe. By automating expense management, it enabled organizations to distribute cards widely while keeping spend under control. Within ten months (Dec 2020), Ramp hit $200M in annualized TPV and $8M in revenue. Today, Sacra estimates Ramp processes $16B TPV and $327M revenue (+98% YoY), on track for $381M by year-end. For comparison, Brex is at ~$500M revenue (+50% YoY) on $20B TPV.

By August 2025, Ramp surpassed $1B in annualized revenue (vs. $476M in Aug 2024), raising $500M at a $22.5B valuation (~22.5x multiple). Competitors include Brex ($357M revenue in 2024, +12% YoY), Deel ($1B revenue in Mar 2025, +70% YoY), Rippling ($570M ARR in Feb 2025, +52% YoY), and Mercury ($500M in 2024, +97% YoY).

✅ Why Ramp is scaling so fast

Its 2x+ YoY growth comes from layering products on top of cards & expense management (2019): bill pay (2021), procurement and travel (2024), and treasury (2025). This shifted its revenue mix from mostly interchange (~1.6% of TPV) to a blend of interchange, SaaS (Ramp Plus at $15/user/month), financing revenue (bill pay), FX and wire fees, affiliate fees (travel), and interest on deposits (treasury). The multiproduct approach also enables Ramp to compete directly in the enterprise space.

Curated News

💳 Payments

Visa Expands Payments Infrastructure in Saudi Arabia

Visa has launched a locally hosted acceptance platform in Saudi Arabia, strengthening its commitment to the region’s payments modernization. The move enhances transaction speed, security, and compliance for merchants and consumers.

Source

MoonPay Acquires Meso to Build Global Payments Network

MoonPay acquired Meso to accelerate its evolution from a crypto service provider into a broader global payments network. The deal expands its user base and infrastructure for seamless cross-border transfers.

Source

PayPal Reinvents Peer-to-Peer Payments

PayPal unveiled a new P2P experience, enabling instant, flexible, and more global money transfers. The update aims to make PayPal the go-to app for universal payments.

Source

DailyPay Adds Frontline Communications Tools

DailyPay integrated new communication features to strengthen its positioning as the primary financial app for hourly workers. This expansion builds engagement and enhances user loyalty.

Source

🏦 Banking

Starling Invests $50M to Expand Engine into Americas

Starling Bank will invest $50 million to bring its SaaS banking platform, Engine, to the Americas. The expansion will be led by former J.P. Morgan executive Jody Bhagat.

Source

Swift Deploys AI Blueprint for Cross-Border Fraud Prevention

Swift introduced an AI-powered framework that enables global banks to collaborate more effectively against fraud in real time. The initiative promises faster detection and stronger defenses in international transactions.

Source

💡 Fintech

SumUp Eyes IPO Next Year

UK-based SumUp is preparing for a public listing in 2026 as it seeks to scale its payments and merchant services. The IPO would mark a milestone for European fintechs amid renewed investor appetite.

Source

Trade Republic Enters Poland Amid Price War

German fintech Trade Republic expanded into Poland, intensifying its competition with XTB in retail investing. The move highlights Europe’s escalating brokerage price wars.

Source

Chest Launches Pension-Savings App for Gen Z

UK fintech Chest launched an app that converts everyday spending into pension savings through cashback. The product targets Gen Z and millennials struggling to save for retirement.

Source

Dotfile Unveils AI Agent for KYB Compliance

Dotfile launched “Autonomy,” a self-decisioning AI agent that automates Know Your Business (KYB) compliance checks. This innovation could reduce onboarding times and strengthen fraud defenses for fintechs.

Source

Azentio Rolls Out Next-Gen Loan Origination

Azentio introduced a new loan origination platform designed to boost speed and personalization for SMEs and corporates. The solution aims to streamline credit delivery in competitive lending markets.

Source

Tot Secures €7M to Boost SME Growth

Spanish fintech Tot raised €7 million to scale its financial services for SMEs. The funds will be used for product expansion and market entry.

Source

🪙 Crypto

BoE’s Stablecoin Cap Plan Faces Industry Pushback

The Bank of England’s proposal to cap stablecoin holdings has drawn criticism from crypto firms, which argue it could stifle adoption. Regulators, however, see the cap as a safeguard against systemic risks.

Source

France Opposes EU Crypto Licence Passporting

France signaled it may block plans for crypto license “passporting” across the EU, citing concerns over regulatory arbitrage. The move could delay Europe’s unified crypto framework.

Source

Chainlink Launches EU-Regulated On-Chain Exchange 21X

Chainlink introduced 21X, the first EU-regulated on-chain exchange for tokenized securities. The launch marks a milestone in bridging traditional finance with blockchain infrastructure.

Source

📈 WealthTech

Trade Republic Moves Into Wealth Management

Trade Republic expanded from brokerage into wealth management, launching access to private markets with investments starting from just €1. Strategic partnerships with Apollo and EQT back the move.

Source

Robinhood Plans Retail Venture Fund Access

Robinhood is preparing to let retail investors participate in venture funds, traditionally reserved for institutions. The move could democratize access to private market opportunities.

Source

Investa Launches Zero-Commission Options Trading in UK

Investa introduced the UK’s first zero-commission options trading app. The platform aims to make derivatives more accessible to retail investors.

Source

LSEG Debuts Digital Platform for Private Funds

The London Stock Exchange Group launched a digital infrastructure platform for private funds, completing its first transaction. This innovation seeks to bring efficiency and transparency to private markets.

Source

Finastra Enhances Fusion Invest for Annuities

Finastra upgraded its Fusion Invest solution to better serve the annuities market. The update supports asset managers in optimizing investment strategies for long-term products.

Source

⚖️ Regulation

APIs Emerging as Prime Cybercrime Target

Over 40,000 API-related security incidents were recorded in H1 2025, highlighting the growing risks tied to financial data exchanges. Regulators and firms are urged to bolster defenses.

Source

📊 Other

Younger Consumers Shunning Life Insurance

A report shows consumers under 40 are increasingly delaying or skipping life insurance as they postpone milestones like marriage and parenthood. The trend signals long-term shifts in protection product demand.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a "Source: [Name]" attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.