Walmart’s OnePay Expands Into Mobile Plans

Walmart’s fintech arm, OnePay, has entered the mobile phone market, offering customers bundled mobile plans alongside its financial services. This strategic move deepens Walmart’s ecosystem, positioning OnePay as more than just a payments and banking player. By integrating telecom services, Walmart strengthens customer stickiness and opens new revenue channels. The initiative could set a precedent for other retailers exploring fintech–telecom convergence. With its massive retail footprint, Walmart is well placed to cross-sell services and accelerate adoption. The expansion underscores the trend of fintechs evolving into multi-service platforms that integrate daily consumer needs.

Insight of the Day

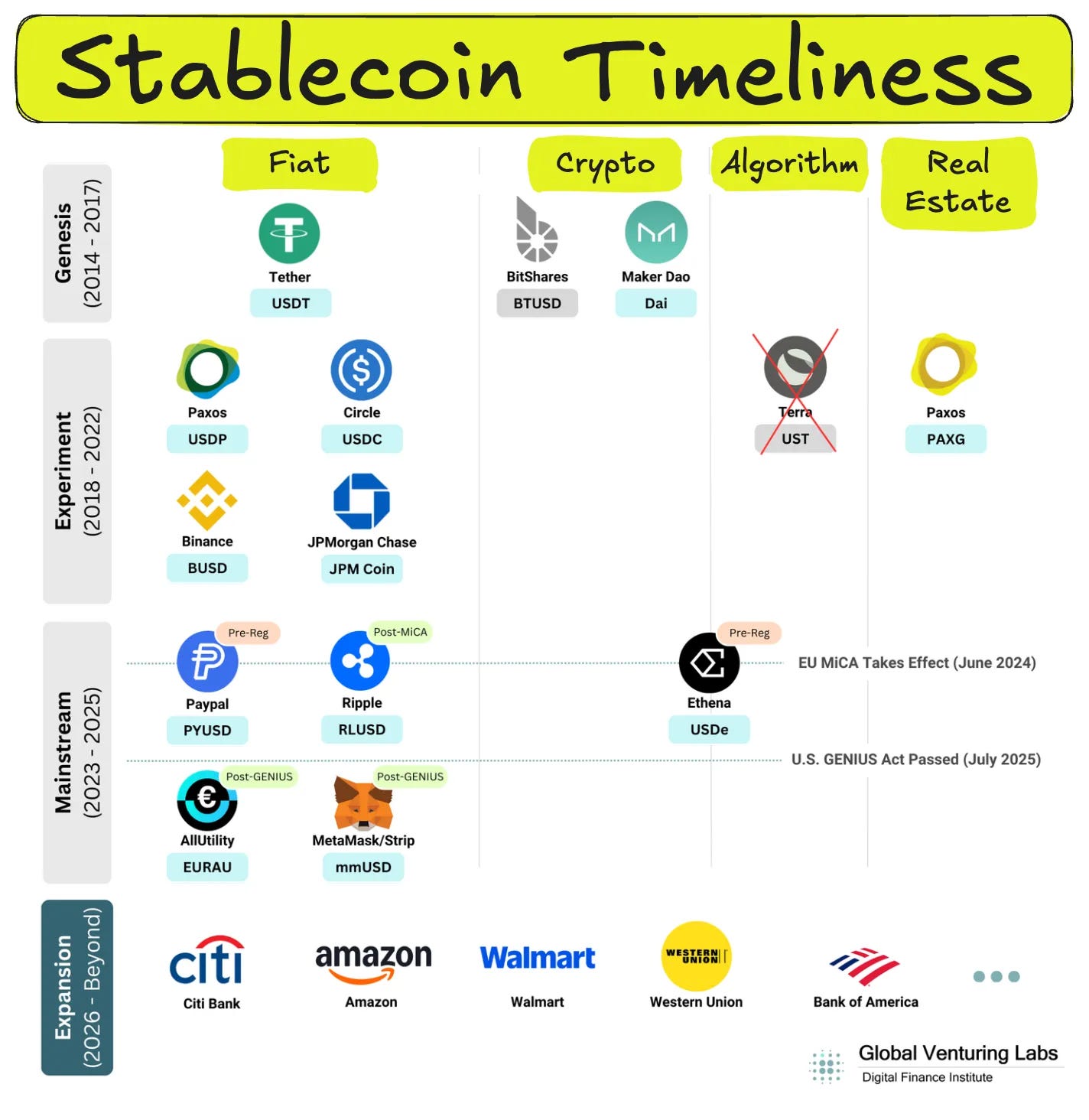

Stablecoins Timeline

1. The Genesis Era (2014-2017): Solving Crypto’s Native Problems

The first stablecoins emerged in 2014 to address problems within the crypto ecosystem, where traders needed a stable asset to transact without constantly converting back into traditional fiat currency. BitShares pioneered the first crypto-collateralized stablecoin (BITUSD), while Tether (USDT) introduced the fiat-backed model that soon became a critical liquidity bridge for exchanges. Later, MakerDAO (DAI) built upon the decentralized approach with an over-collateralized crypto-backed design.

2. The Experiment Era (2018-2022): Refining Models and Testing Boundaries

As the crypto market grew, a new wave of issuers entered to refine existing models and experiment with new ones. Regulated financial institutions like Paxos (USDP) and Circle (USDC) launched compliant, audited stablecoins to attract institutional capital, with Paxos even tokenizing real-world assets like gold (PAXG). At the same time, major banks like JPMorgan Chase built private stablecoins (JPM Coin) for internal settlements.

The motivations became more diverse and business-focused, shifting to goals like monetizing trust, improving corporate efficiency, and controlling a platform’s ecosystem, as seen with Binance’s BUSD. This era’s ambitious search for new models also led to the rise and catastrophic fall of the algorithmic stablecoin Terra (UST), which served as a stark warning about risk and marked a pivotal end to the period of unchecked experimentation.

Curated News

💳 Payments

Stripe Unveils Tempo: A Stablecoin Payments Blockchain

Stripe has launched Tempo, a blockchain network dedicated to stablecoin payments. The move highlights growing demand for faster, regulated cross-border payment solutions and puts Stripe in direct competition with crypto-native firms.

Source

Mastercard & Qlub Modernize GCC Hospitality Payments

Mastercard has partnered with Qlub to digitize payments in the Gulf hospitality sector. The collaboration targets seamless dining payments, reducing friction for consumers and restaurants alike.

Source

AEON Pay Launches Crypto Scan-to-Pay in Brazil

AEON Pay has introduced a crypto scan-to-pay feature using Brazil’s PIX QR code system. This integration merges mainstream payment rails with crypto, boosting digital currency usability in everyday transactions.

Source

🏦 Banking

Equipifi Adds BNPL to Jack Henry’s Core Banking

Equipifi has integrated its BNPL offering into Jack Henry’s SilverLake platform, allowing banks to deliver installment lending within core banking systems. This enables community banks to better compete with fintech BNPL providers.

Source

ebankIT Unveils AI Transactional Banking Assistant

ebankIT is set to launch a next-gen AI banking assistant at FinovateFall 2025. Powered by agentic AI, the tool aims to improve customer service and transactional efficiency in digital banking.

Source

💸 Fintech

Lead Raises $70M to Power Fintech-Focused Banking

Lead, a bank dedicated to fintech companies, secured $70 million in new funding. The capital will help scale its specialized banking services, catering to the needs of rapidly growing fintech startups.

Source

Spinwheel Gains Citi Ventures Backing

Spinwheel has secured investment from Citi Ventures to accelerate its consumer credit ecosystem. The funding will fuel product development aimed at reshaping debt management and credit optimization.

Source

Chargebacks911 & cside Partner for Next-Gen Merchant Security

Chargebacks911 has teamed up with cside to strengthen chargeback protection and client-side security for merchants. The partnership seeks to enhance fraud prevention and reduce losses for global retailers.

Source

🪙 Crypto

Gemini Expands in Europe With Derivatives & Staking

Gemini has launched crypto derivatives and ETH/SOL staking services across Europe. The expansion strengthens its global footprint and offers European investors more diversified crypto products.

Source

1Money Secures 34 U.S. Money Transmitter Licenses

Stablecoin processor 1Money has obtained 34 U.S. licenses, clearing regulatory hurdles to scale its payment network. This positions it as a major competitor in regulated stablecoin infrastructure.

Source

Taiwan VC Firm to Launch $1B Bitcoin Fund

A Taiwan-based venture capital firm plans to raise $1 billion for a Bitcoin-focused fund supporting Asian treasuries. The initiative could significantly boost institutional adoption of Bitcoin in the region.

Source

Elliptic Powers Risk Intelligence for BVNK Layer1

Elliptic is providing compliance and risk intelligence to BVNK’s Layer1 platform, enabling large-scale stablecoin payments and trading. This collaboration highlights the growing need for robust AML tools in crypto infrastructure.

Source

📈 WealthTech

Citi Wealth’s $80B Mandate Shifts Toward BlackRock

Citi Wealth has allocated an $80 billion mandate to BlackRock, marking a shift in institutional wealth management strategies. The move could reshape competitive dynamics in the global asset management space.

Source

Pave Finance Raises $14M for AI WealthTech

Pave Finance, an AI-driven personalized wealth management startup, raised $14 million in an oversubscribed seed round. The funds will accelerate product development and client acquisition.

Source

Pointsville Raises Series A for Asset Digitization

Pointsville secured Series A funding led by Valor Capital Group to expand asset digitization and real-world asset tokenization. The raise highlights growing investor demand for tokenized investment platforms.

Source

📜 Regulation

BoE & BIS Collaborate on ISO 20022 Data Platform

The Bank of England and BIS are developing a platform to enhance ISO 20022 data usage in payments. The initiative aims to improve cross-border efficiency and compliance in the evolving global financial system.

Source

LSEG Agrees to Share Data Centre Rooftop After FCA Probe

The London Stock Exchange Group will open access to its data centre rooftop following a competition investigation by the FCA. The move addresses regulatory concerns about fair market infrastructure access.

Source

🧩 Other

Tangram & INSTANDA Launch Guard Insurance Product

Tangram has partnered with INSTANDA to release a new security guard insurance solution. The product demonstrates growing demand for specialized insurance in the gig and contract work sector.

Source

Elysian Raises $6M to Reinvent Insurance Claims With AI

Elysian secured $6 million in seed funding to develop its AI-native insurance claims platform. The company aims to streamline claims processing and reduce costs for insurers.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a "Source: [Name]" attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.