Wealthsimple Data Breach Exposes Customer Information

Wealthsimple has confirmed a data breach that compromised sensitive customer details, raising serious concerns about security in the fast-growing WealthTech sector. The incident highlights the vulnerability of digital-first financial platforms as they scale rapidly. Customers affected may face increased risks of fraud and identity theft, putting pressure on the firm to strengthen defenses. Regulators are also likely to scrutinize Wealthsimple’s practices, given its growing footprint in the North American market. The breach could dent customer trust at a time when digital wealth management is seeing record adoption. Wealthsimple has pledged to improve safeguards and is working with authorities to contain the fallout.

Insight of the Day

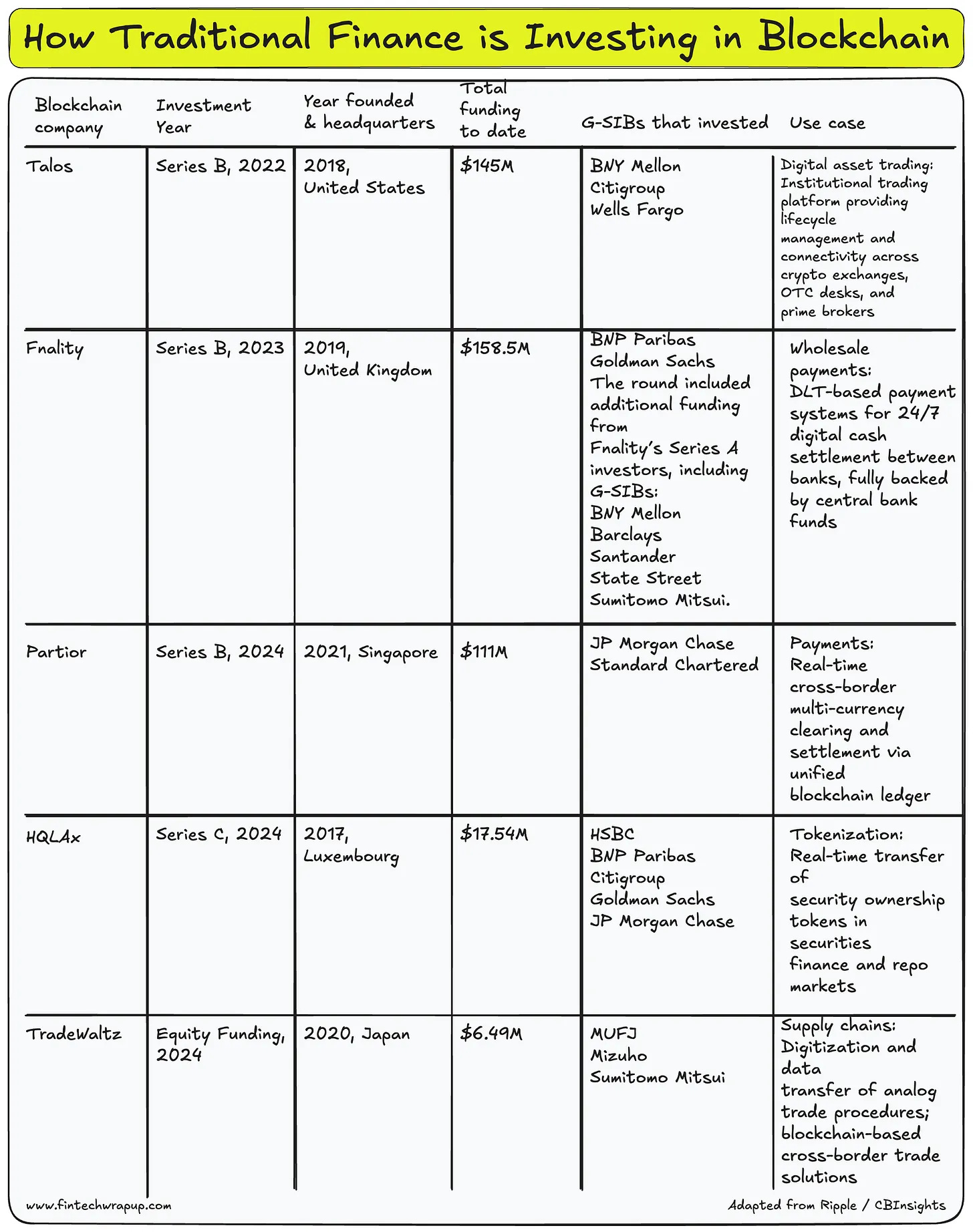

How Traditional Finance is Investing in Blockchain

Financial institutions are finding multiple ways to integrate blockchain and digital assets—ranging from offering crypto-enabled payments and custody services to tokenizing assets like bonds, equities, and mutual funds. One of the key choices is “build vs. buy”: developing in-house capabilities or partnering with, investing in, or acquiring a provider.

Between 2020–2024, more than $100B was invested in blockchain firms across 10,000+ deals, including 219 mega-rounds ($100M+). Most investments went to U.S. companies, followed by Singapore, Canada, and the UK, showing early but globally scattered adoption.

✅ Banks Step In

Banks made 345 blockchain investments from 2020–2024, largely in early-stage rounds (seed and Series A). For traditionally conservative investors, this signals alignment with long-term strategies. Banks also joined 33 mega-rounds, focused on institutional infrastructure (27%), payments (24%), and digital asset custody (21%). U.S. and Japanese banks led activity, with SBI Group, Goldman Sachs, and Thailand’s SCB 10X among the most active.

👉 Notable deals include:

🔹 CloudWalk (Brazil): $313M from Banco Itaú (May 2024) and $444M from BTG Pactual and Banco Safra (Dec 2023) to expand blockchain-enabled merchant payments.

🔹Solaris (Germany): $104M led by SBI Group (Mar 2024). Solaris pioneered Germany’s first digital asset trading venue and regulated security token offering. SBI later acquired a majority stake.

🔹NYDIG (U.S.): $1B round (2021) from MassMutual, New York Life, and Morgan Stanley to expand its bitcoin platform. Morgan Stanley, already the first U.S. bank to offer bitcoin fund access, later rolled out bitcoin ETFs with BlackRock and Fidelity after SEC approval.

Curated News

💳 Payments

Green Dot Partners With Stripe for Network Expansion

Green Dot has added Stripe as a network partner, enhancing its payments infrastructure and reach. This partnership will enable smoother integrations for merchants and broaden Green Dot’s role in embedded finance.

Source

Aiwyn Acquires QuickFee’s U.S. Payments Arm

Aiwyn has acquired QuickFee’s U.S. payments business and introduced a pay-later solution, expanding its product suite for professional services firms. The move strengthens its foothold in the growing B2B payments and financing market.

Source

IXOPAY Integrates J.P. Morgan Payments

IXOPAY has integrated J.P. Morgan Payments, boosting global connectivity for merchants. The deal allows clients to access broader settlement options and simplifies international payment flows.

Source

Nuvei and Early Warning Deliver Paze Checkout

Nuvei has partnered with Early Warning Services to launch Paze℠, an online checkout solution designed to compete with major wallets. It promises faster, more secure transactions for consumers and merchants.

Source

TransferMate Expands With Brazilian Real Support

TransferMate now enables businesses to pay, receive, and hold funds in Brazilian Real. The move strengthens its local accounts offering and supports clients expanding into Latin America.

Source

Alacriti and Early Warning Extend Zelle Reach

Alacriti has partnered with Early Warning to expand the reach of Zelle, improving real-time payment accessibility for financial institutions and their customers.

Source

🏦 Banking

UniCredit Taps BNP Paribas and FNZ for Services Revamp

UniCredit is collaborating with BNP Paribas and FNZ to overhaul its securities services business. The partnership aims to modernize offerings and improve efficiency across markets.

Source

Snappi Becomes First Greek Neobank Licensed by ECB

Snappi has received a license from the European Central Bank and is launching nationwide in Greece. It marks a milestone as the first Greek neobank to secure ECB approval.

Source

Ireland’s An Post Launches Super App

Ireland’s An Post has launched a new app to compete with Revolut and other digital challengers. The platform consolidates payments, transfers, and financial services to capture tech-savvy users.

Source

Allica Cuts Asset Finance Rates

UK-based Allica Bank has lowered asset finance rates to encourage leasing activity among SMEs. The move reflects growing competition in small business lending.

Source

🪙 Crypto

Vietnam Pushes Blockchain Amid Foreign Crypto Limits

Vietnam is promoting domestic blockchain development while tightening restrictions on foreign crypto services. The government’s dual approach aims to foster innovation while maintaining regulatory control.

Source

CoinShares Plans $1.2B U.S. SPAC Deal

CoinShares is pursuing a $1.2 billion SPAC deal to list on Nasdaq, accelerating its U.S. expansion strategy. The move positions it among the largest European crypto firms eyeing U.S. markets.

Source

Eightco Stock Soars 3000% on Worldcoin Strategy

Eightco shares skyrocketed after the company revealed a Worldcoin treasury strategy and BitMine investment. The surge underscores investor appetite for bold crypto-linked plays.

Source

💹 WealthTech

Webull Expands Into EU With Dutch Launch

Webull has launched its retail investment platform in the Netherlands, marking its entry into the European Union. The rollout reflects its ambition to challenge established brokers across Europe.

Source

📊 Fintech

Payhawk Quadruples Revenue in Two Years

Payhawk reported IFRS revenue quadrupling in the past two years, with annual recurring revenue up 78%. The strong performance underscores the growing demand for spend management platforms.

Source

eToro Eyes Bigger Acquisitions for Global Growth

eToro is planning larger acquisitions to fuel its global expansion strategy. The move reflects intensifying competition among multi-asset trading platforms.

Source

NCR Atleos Ranks #5 in IDC Fintech Rankings

NCR Atleos secured the #5 spot in the IDC Fintech Rankings, highlighting its strong position in the sector. The recognition reinforces its influence in digital banking and payments solutions.

Source

📜 Regulation & Security

Entrust and Mastercard Enhance Fraud Defense

Entrust and Mastercard are collaborating on intelligent fraud defense solutions to strengthen account onboarding security. The initiative addresses rising fraud threats in digital finance.

Source

Naq Raises €6M to Secure NHS Digital Systems

Naq has raised €6 million to support cybersecurity for the UK’s National Health Service digital transformation. The funding highlights growing investment in regulated digital infrastructure.

Source

🌍 Other

SGInnovate Leads $1.5M Seed in Greenitio

SGInnovate has led a $1.5 million seed round in Greenitio, a biopolymer startup. The deal reflects Singapore’s continued push into deeptech and sustainable innovation.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a "Source: [Name]" attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.

Scary part is that fintechs build trust on convenience, but one breach like this makes you wonder if the tradeoff is worth it. We’ve already seen traditional institutions hit too — Carter Credit Union (https://mydatabreachattorney.com/case/carter-credit-union-data-breach/) recently reported a data breach that exposed highly sensitive customer info. It feels like no corner of finance is safe right now.