Wise Expands into Africa to Power Cheaper Cross-Border Payments

Wise is entering key African markets as it looks to tap into one of the world’s fastest-growing regions for cross-border payments and remittances. The move aims to reduce costs and friction for individuals and businesses moving money in and out of the continent. This expansion signals growing fintech confidence in Africa’s digital payments infrastructure and long-term growth potential. For a LinkedIn fintech audience, it highlights how global players are prioritizing emerging markets to drive the next wave of user growth.

Video of the Day

Insight of the Day

The Agentic AI Era in Banking

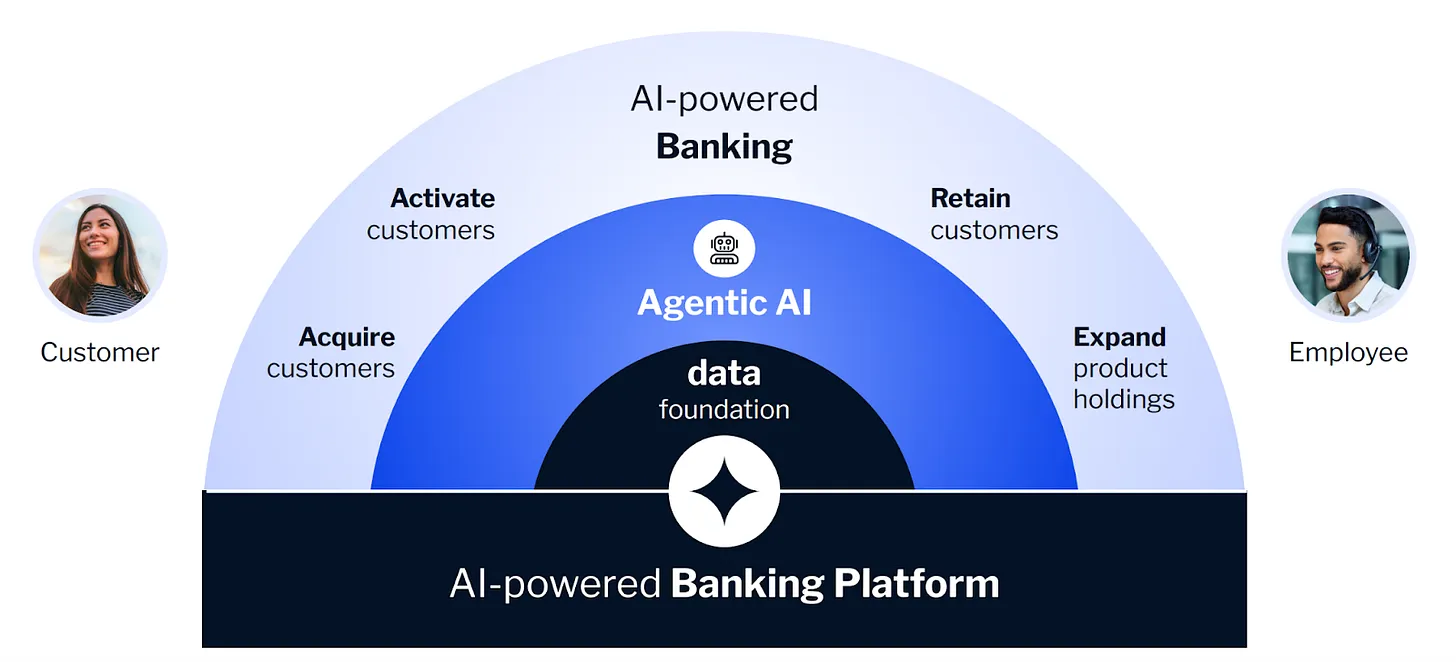

I’ll be blunt: who isn’t a little weary of the AI hype in banking? I watched Backbase’s Engage 2025 event in London to gain insights into AI’s role in the banking sector and what Backbase is developing. During the keynote address, CEO Jouk Pleiter asked the audience, “Who’s a little bit tired of all the AI hype?” Numerous hands were raised in agreement. Despite the skepticism, he and others in the industry firmly believe that this wave of AI could be more significant than the internet itself.

Why the gap? Partly because early efforts were siloed experiments, a fancy pilot here, a chatbot there that never touched the bank’s core operations. It’s been easy for executives to label projects as “AI” in presentations without truly scaling them. As Pleiter noted, we’ve seen the internet wave, then the mobile wave, and “we’re now in this AI-inside wave”, which is all about embedding AI into every aspect of banking. This means not just having AI as a side project in areas like fraud detection or marketing, but integrating it throughout marketing, sales, service, operations, compliance, and essentially every function. The next five years in banking will be defined by this infusion of AI into the fabric of how banks work. The promise is huge: imagine AI powering everything behind the scenes, turning banks into truly intelligent organizations. But to get there, banks must move beyond “AI lab” mode and bring AI into production at scale. How? That brings us to the new kid on the block: Agentic AI.

Curated News

💳 Payments

Sokin Raises $50M to Scale Cross-Border Payments

Cross-border payments fintech Sokin has secured $50 million in new funding to accelerate global expansion. The round underlines continued investor appetite for B2B and international payments infrastructure despite a tougher funding climate.

Source

Ant International Boosts Merchant Efficiency with Antom Copilot

Ant International has enhanced its Antom Copilot, adding AI-driven features to help merchants manage payments more efficiently. The upgrade reflects how AI is being embedded directly into merchant workflows to reduce operational complexity.

Source

Amazon and Visa Team Up on Agentic Payment Tools

Amazon and Visa are collaborating on agentic AI tools designed to automate and optimize payment-related tasks. The partnership signals how big tech and card networks are converging around AI-driven commerce experiences.

Source

Paymentology Outlines How to Launch Card Programs in Saudi Arabia

Paymentology has published a roadmap for launching card programs in Saudi Arabia. It highlights regulatory, infrastructure, and localization considerations for fintechs eyeing the Kingdom’s fast-growing payments market.

Source

Bank of Ireland Sees Contactless Surge as ATM Use Falls

Bank of Ireland reports continued growth in contactless payments alongside declining ATM usage. The trend reinforces the structural shift toward cashless consumer behavior across Europe.

Source

Clara Secures $70M Debt to Fuel LatAm Payments Growth

Clara has raised $70 million in debt financing to expand its payment products in Mexico and Colombia. The deal shows how alternative financing is supporting fintech scale in Latin America.

Source

Mastercard Gateway Gains SAMA Certification

Mastercard Gateway has obtained SAMA certification for Saudi Arabia’s new e-commerce payments interface. This approval strengthens Mastercard’s position in one of the Middle East’s most strategically important payments markets.

Source

🏦 Banking

HSBC Partners with Mistral to Roll Out GenAI Across the Bank

HSBC has partnered with Mistral AI to deploy generative AI tools across its global operations. The initiative highlights how large banks are accelerating enterprise-wide AI adoption to boost productivity and innovation.

Source

India Relaxes Rules for Digital Banking Operations

India has eased regulations around digital banking, lowering barriers for innovation and expansion. The move is expected to boost competition and accelerate digital-first banking models.

Source

Santander Uses Fake AI Ads to Warn Customers About Scams

Santander launched AI-generated fake social media ads to educate consumers about rising fraud risks. The campaign reflects banks’ growing use of creative tech to build financial awareness and trust.

Source

NatWest Backs Bourn to Support SME Working Capital

NatWest Group has taken a minority stake in Bourn, a fintech focused on SME working capital solutions. The investment highlights banks partnering with fintechs to better serve small businesses.

Source

🪙 Crypto

Crypto ETFs Rebound After Rough Month

Bitcoin, Ethereum, and XRP ETFs have bounced back after a difficult period for crypto investment funds. The recovery suggests continued institutional interest despite ongoing market volatility.

Source

China Signals Renewed Crypto Crackdown

China is reportedly considering a fresh crackdown on crypto amid rising speculative trading. The move underscores persistent regulatory uncertainty across major markets.

Source

Singapore Crypto Founder Sued for $60.5M

The founder of a Singapore-based crypto platform faces a $60.5 million lawsuit over alleged fraud. The case highlights intensifying legal and regulatory pressure in the crypto sector.

Source

Bitcoin Strategy Firm Builds $1.44B Cash Reserve

A major Bitcoin-focused firm has established a $1.44 billion USD reserve, while still leaving the door open to selling BTC. The move reflects more sophisticated treasury and risk management strategies in crypto firms.

Source

Zama Plans First Sealed-Bid Auction for Its Token

Zama is preparing a first-ever sealed bid auction for its native token. The approach aims to introduce a more structured and transparent token distribution mechanism.

Source

📊 WealthTech

FCA Pushes for Greater Transparency in ESG Ratings

The UK’s FCA is targeting improved transparency in ESG ratings through proposed changes. The move could reshape how asset managers and investors assess sustainability claims.

Source

⚙️ Fintech

Bolt Launches Bolt ID to Tackle Synthetic Fraud

Bolt has introduced Bolt ID to address the growing $35 billion synthetic fraud problem. The product aims to strengthen digital identity and trust in online transactions.

Source

GNOMI Launches AI-Driven ‘Finance Mode’ for Market Intelligence

GNOMI has launched a new Finance Mode offering real-time earnings calls and generative market intelligence. The platform targets professionals seeking faster, AI-powered insights.

Source

📦 Other

Shopping Scams Cost Indonesia $666.6M in 2025

Shopping scams have cost Indonesian consumers an estimated $666.6 million this year. The figures highlight the urgent need for stronger fraud prevention across e-commerce and payments.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.