Worldpay and OpenAI Partner to Launch AI-Driven Commerce Protocol

Worldpay has announced a groundbreaking partnership with OpenAI to develop the Agentic Commerce Protocol, a platform enabling merchants to embed AI agents directly into digital storefronts. These AI agents will autonomously handle product searches, negotiations, and transactions on behalf of consumers, introducing a new era of “agentic” shopping. The initiative merges fintech infrastructure with advanced AI to streamline digital commerce and enhance personalization. By leveraging OpenAI’s technology, Worldpay aims to create smarter, faster, and more intuitive payment experiences. This partnership positions Worldpay at the forefront of the intersection between AI and payments, pioneering a model that could redefine how merchants and consumers interact. It also highlights how major fintech players are preparing for an autonomous finance future where AI handles entire customer journeys.

Video of the Day

Insight of the Day

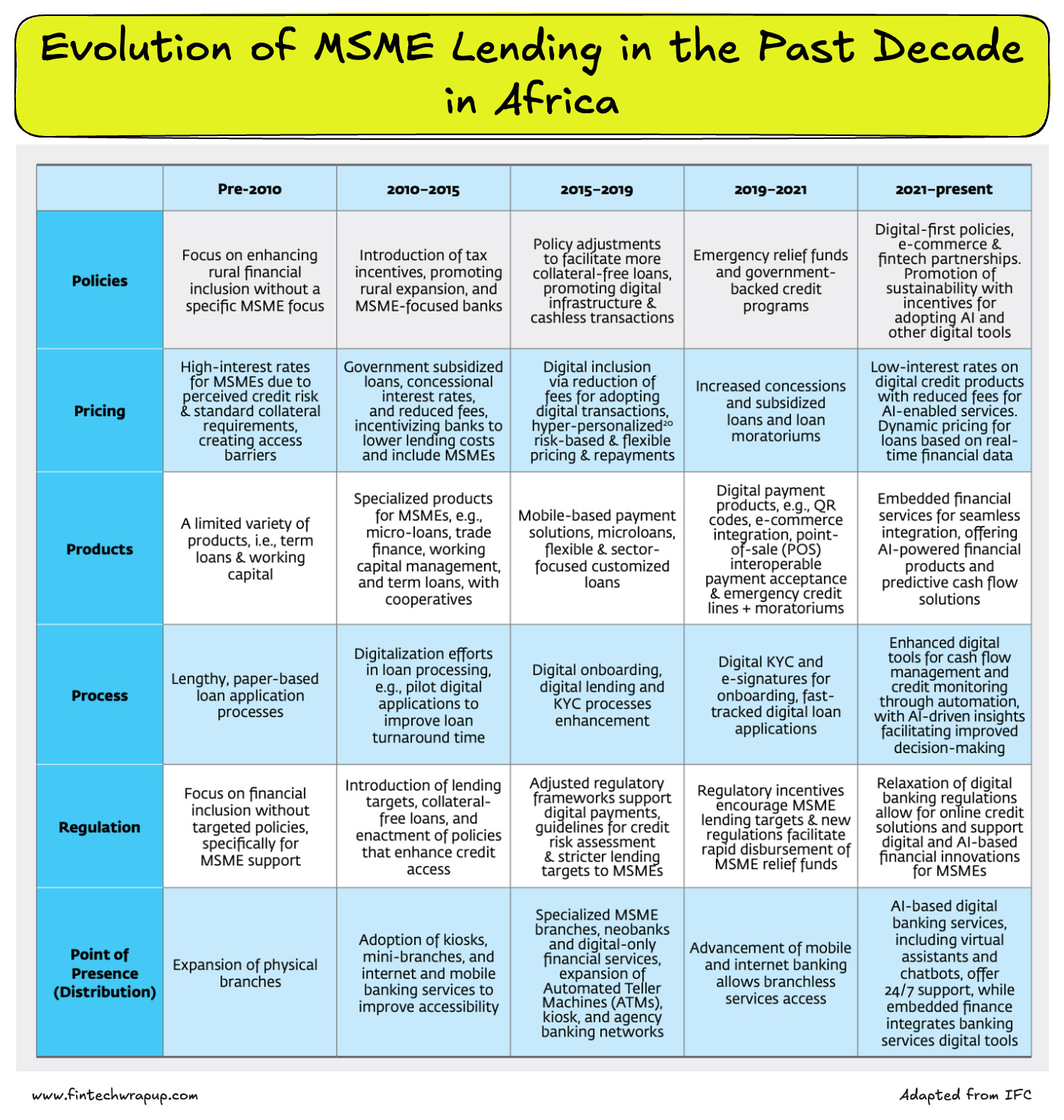

The Evolution of MSME Lending in Africa

The journey of MSME lending over the past decade tells a story of transformation—from manual paperwork and high interest rates to embedded finance and AI-driven credit tools. What began as a focus on rural inclusion has now evolved into a dynamic digital ecosystem redefining how micro, small, and medium enterprises (MSMEs) access finance.

👉 Early Years: Building Access, Not Inclusion (Pre-2010)

In the pre-digital era, MSME financing was tied closely to rural development goals. The policies lacked a specific MSME focus, and loans were often limited to term and working capital credit. Lengthy paper-based processes and high-interest rates reflected the perceived risk of lending to small enterprises. Financial inclusion was more of a slogan than a structured policy goal.

👉 2010–2015: The Push for Accessibility

This period marked the first serious attempt to recognize MSMEs as a distinct segment. Governments introduced tax incentives, rural expansion programs, and MSME-focused banks. Specialized products such as micro-loans and trade finance emerged, supported by concessional interest rates and subsidies. The rise of kiosks, mini-branches, and early digital banking channels expanded reach, while pilot digitalization projects began modernizing loan applications.

👉 2015–2019: The Digital Inflection Point

Digital transformation took center stage. Policies began supporting collateral-free loans and cashless transactions, setting the stage for fintechs to enter the scene. MSMEs started benefiting from lower transaction fees, digital onboarding, and more flexible, personalized loan structures. Mobile-based lending and KYC innovations dramatically shortened processing times, while digital regulatory frameworks began tightening credit assessments. The fintech revolution had officially begun.

Curated News

💳 Payments

PNC Bank and Visa Direct Expand Real-Time Payment Access

PNC Bank has joined forces with Visa Direct to provide faster and more reliable real-time payment capabilities. The integration supports instant fund transfers for both consumers and businesses, advancing the U.S. market’s shift toward immediate payments.

Source

Barclays and Visa Strengthen Partnership to Power Future Payments

Barclays and Visa have extended their partnership to deliver next-generation payment solutions. The collaboration will focus on enhancing digital experiences and developing secure, frictionless transaction capabilities for millions of customers.

Source

Nexi Teams Up with Visa and Mastercard to Support Italian SMEs

Nexi has partnered with Visa and Mastercard to help Italian small businesses adopt advanced digital payment solutions. The initiative aims to boost financial inclusion and accelerate the growth of Italy’s digital economy.

Source

Mint Payments and Travel Network Group Reinvent Travel Industry Payments

Mint Payments has entered into a partnership with The Travel Network Group to modernize payments for UK travel agencies. The collaboration simplifies settlements and enhances transparency across the travel ecosystem.

Source

Report: Digital Payments Could Unlock Billions for UK Consumers

A new report reveals that improving digital payment infrastructure could unlock billions in savings for UK consumers. The findings emphasize the economic potential of paytech innovation in boosting national productivity and consumer welfare.

Source

🏦 Banking

Ubank Introduces Passkeys for Safer, Simpler Online Banking

Ubank has expanded Passkey technology to its online banking services, marking an Australian first. The rollout enhances both convenience and security, replacing passwords with biometric authentication.

Source

HSBC Launches Innovation Banking in Singapore

HSBC has launched its Innovation Banking division in Singapore to serve startups and high-growth tech companies. The expansion reflects HSBC’s strategy to become a global banking partner for the innovation and venture ecosystem.

Source

💸 Fintech

Fintap Secures $86.5M Credit Facility to Drive Growth

Fintap has secured an $86.5 million credit facility to expand its SME financing operations and strengthen its global presence. The funding will support the company’s mission to accelerate access to business capital worldwide.

Source

Anrok Raises $55M to Expand Global Tax Compliance Tech

Tax compliance fintech Anrok has raised $55 million in a Series C round to scale its automated global tax infrastructure. The company plans to use the funds to enhance its SaaS compliance platform and expand internationally.

Source

Qapita Acquires U.S. Fund Administration Firm

Equity management platform Qapita has acquired a U.S. fund administration company to strengthen its private markets offering. The move enhances its cross-border capabilities and expands its presence in the global fintech ecosystem.

Source

🪙 Crypto

DBS and Goldman Sachs Execute First Institutional Crypto Options Trade

DBS and Goldman Sachs have announced the first-ever institutional crypto options trade, marking a major milestone in digital asset derivatives. The deal signals growing institutional adoption and confidence in regulated crypto instruments.

Source

Mastercard in Talks to Acquire Zerohash for $2B

Mastercard is reportedly negotiating to acquire stablecoin infrastructure firm Zerohash for around $2 billion. The move highlights Mastercard’s strategy to bring stablecoin technology and blockchain settlement into its global network.

Source

IBM’s Quantum Leap Raises Bitcoin Encryption Concerns

IBM’s 120-qubit quantum processor, “Cat,” marks a major step forward in computing power and raises fresh concerns about Bitcoin’s encryption resilience. Experts warn this progress could push blockchain developers to prioritize quantum-proof security.

Source

Bitcoin Investment Giant Reaffirms $150K Price Target

A $71 billion Bitcoin investment firm has reiterated its bullish forecast that BTC will hit $150,000 by year-end. The firm cites growing institutional inflows and favorable macroeconomic conditions as key drivers.

Source

ClearBank and Circle Partner to Launch Regulated Stablecoin Payments

UK neobank ClearBank has teamed up with Circle to build a regulated stablecoin payments network. The collaboration leverages Circle’s USDC and ClearBank’s clearing infrastructure to bridge traditional banking with digital assets.

Source

💰 WealthTech

Morgan Stanley to Acquire EquityZen, Expanding Private Market Access

Morgan Stanley plans to acquire EquityZen, a platform that facilitates trading of private company shares. The deal expands Morgan Stanley’s presence in pre-IPO markets and strengthens its alternative investment offerings.

Source

Wealthsimple Raises C$750M at C$10B Valuation

Canadian fintech Wealthsimple has raised C$750 million, boosting its valuation to C$10 billion. The funding reinforces Wealthsimple’s status as one of the most valuable digital wealth platforms globally.

Source

⚖️ Regulation

Formalize Raises €30M to Advance AI-Driven Compliance

Formalize has raised €30 million to expand its AI-based compliance and risk management platform across Europe. The funding will help financial institutions automate regulatory processes and enhance transparency.

Source

Ayan Capital Secures FCA License for Islamic Consumer Finance

Ayan Capital has obtained an FCA credit license and launched its Sharia-compliant digital consumer finance platform. This milestone supports the growing demand for ethical and faith-based financial products in the UK.

Source

🤖 Other

40% of UK Consumers Would Trust AI to Shop for Them

New research from Checkout.com reveals that 40% of UK consumers would let AI agents handle their routine shopping tasks. The study highlights a major cultural shift toward AI-driven consumer automation.

Source

Disclaimer: Payments Wrap Up aggregates publicly available information for informational purposes only. Portions of the content may be reproduced verbatim from the original source, and full credit is provided with a “Source: [Name]” attribution. All copyrights and trademarks remain the property of their respective owners. Payments Wrap Up does not guarantee the accuracy, completeness, or reliability of the aggregated content; these are the responsibility of the original source providers. Links to the original sources may not always be included. For questions or concerns, please contact us at sam.boboev@fintechwrapup.com.